INSIGHT

How is digitisation disrupting the workplace?

Download the PDF

Alan Huse, Head of Transaction Banking, Australia and Papua New Guinea, ANZ | September, 2017

________

Regardless of industry, the digitisation of commerce is dominating conversations about the future of business. This was made clear at our recent events in Sydney, which featured insights from a guest speaker from the MIT Center for Information Systems Research (CISR), Dr Kristine Dery.

MIT CISR is a Research Centre in the Sloan School of Management at the Massachusetts Institute of Technology that looks at the challenges faced by large, global and information-intensive organisations.

CISR research in 2015 showed that board members at large companies believed that on average 35% of their revenue would be under threat in the next five years due to digital disruption1. By now it might be an even larger proportion: while executives recognise that digital disruption has the potential to seriously test them, the problem is that most do not necessarily know where those threats are going to come from, or what their industries will look like in five years’ time.

It’s not just business models: the focus of Dr Dery’s presentation was how digital technology is also affecting the employee experience. As digitisation leads to the automation of the simplest tasks, work is going to become more complicated and organisations need to equip themselves — and the people that work for them — for this change. By doing so, the rewards could include greater innovation and increased profitability.

New, nimble and a threat

Companies have always had to tackle the challenges of technological change, from the introduction of the assembly line to the rise of computers. But that disruption is even more dramatic and harder to ignore because it now includes companies entering established markets that are ‘born digital’ and as a result are much more nimble, Dr. Dery explained.

“They don’t have the legacy of old technology, they don’t have the legacy of culture and they don’t have the legacy of systems.”

As a starting point, Dr. Dery highlighted two ways MIT CISR thinks technology is disrupting organisations’ relationships with their customers.

The first is by shifting consumer patterns from buying products and services to purchasing solutions. Take the example of American financial services company USAA. The company realised that people don’t buy just car insurance: they first have to buy a car. So now USAA offers an integrated service that helps customers find the vehicle of their choice, finance the purchase, and insure the car all on one USAA Auto-Circle mobile App. They have since expanded this strategy to other insurance products, with the result being that their sales approach is now centred around life events.

Closer to home, superannuation technology services firm SuperChoice Services realised that payments take up a large amount of payroll officers’ time even though it accounts for a small fraction of their overall responsibilities. In response, the company has set up a non-super payments platform that helps payroll officers organise other employee benefits, such as paying gym memberships.

The second way technology impacts established businesses is by getting in between companies and their customers. Online platforms such as Amazon — which is expected to launch in Australia later this year — and Google now act as middlemen, meaning traditional businesses no longer get the insights into customers they used to.

A striking example of this is China’s WeChat. More than just a way to stay in contact, the social media app took just three years to dominate China’s payments market and now has a 40-50% share. This is part of a dramatic shift in consumer behaviour that sees around 92% of people in China now using digital wallets, followed by cash with credit cards coming in a distant third2.

Prioritising employee experience

The result of this increased digitisation is that life is going to get a lot more complicated for employees, Dr. Dery said.

“The more integrated services become and the more digitised we become means the easy tasks get taken away. What’s going to be left is a much more complex world of work.”

In response, firms should focus as much time on employee experience (EX) as customer experience (CX), according to Dr. Dery.

First, companies need to recognise that EX is distinct from employee well-being. Having a great office space will not help increase EX if employees are faced with speedbumps that stop them doing their jobs efficiently.

However, the EX fix is far from simple. Companies need to focus on two levels of activity: reducing work complexity and building a digital culture. Big, old companies are built on being great at command and control and digital requires them to re-organise and, if necessary, restructure their business to make it easier for staff to collaborate and share ideas. This includes empowering employees to engage and challenge people above them in the organisation — and management needs to be responsive to those ideas.

This was the approach adopted by DBS Bank, Singapore. This traditional bank has been transformed over the last 5 years from a bank known for being slow and conservative to one that is now at the forefront of digital innovation. In 2016, they were awarded the World's Best Digital Bank. Central to that transformation was the focus on building an Employee Experience that would make DBS fit for a new digital business model. This very hierarchical, traditional bank shifted the boundaries between business silos and between people by deploying a range of on-line platforms and enterprise social networks (ESN). In this way the leaders at DBS raised the voices of all employees — regardless of position, location, skill base or experience — to initiate or engage with corporate conversations to innovate around both customer and employee experiences. By implementing measurable links between the digital experience for customers with that of employees, DBS, have transformed their business by digitising as many work practices as possible, increasing digital skills across the enterprise, and empowering their people to build new ways of working for digital.

Dr. Dery pointed out that good EX also means making sure employees have the technological tools in place to navigate the complexity of the modern workplace.

For example, if a customer service operative needs to toggle between multiple windows on a single screen to solve a problem because a company does not have an integrated system, the experience is bad for the employee as well as the customer, and consequently bad for business.

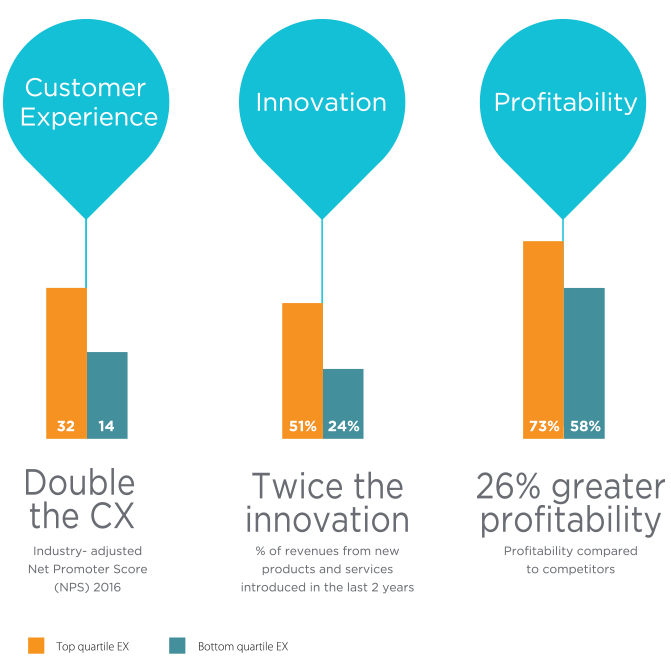

Certainly, this employee-focused approach is worth the effort: investment in EX has been shown to have a direct and positive impact on business value. When it ranked 280 large companies by EX, research from MIT CISR found the top 25% had double the customer satisfaction, twice the innovation and 26% greater profitability than competitors3.

Positioned for success

The insights from the event revolved round a simple message: digital disruption offers huge opportunities, but it does require a change in approach.

While efforts to improve customer experience should remain a priority, they should not be viewed as separate from the needs of the workforce. Rather, by providing staff with the skills and technology to navigate a more digital workplace, not only will companies foster a progressive approach to employee experience, but they will ensure they are well positioned to thrive in today’s ever-changing commercial environment.

In the words of Dr. Dery, this is the most exciting time for anybody who has worked in the business arena.

1 Thriving in an Increasingly Digital Ecosystem

2 Source: Presentation by Dr. Kristine Dery,“The digitisation of commerce – impact on you & your business”

3 Ibid

FEATURED ARTICLES

insight

Digging Deep: Mining the Next Big Data Frontier

The future of the natural resources industry is increasingly looking like science fiction: very soon resources firms big and small will be able to quickly locate value deep in the earth thanks to lightning-fast, algorithm-based analysis of electromagnetic data

insight

Distributed Ledger Technology and Bank Guarantees for Commercial Property Leasing

In an ecosystem where three parties participate in the creation, management and expiry of a common instrument, blockchain can provide the optimal solution

research

Demographic Time Bomb? Time to Question Conventional Wisdom

Ageing populations combined with rising automation have conventionally been omens of economic slowdown. Here are 5 reasons not to panic.