NHFIC issues benchmark social bond for housing in Aus

The success of a recent social bond from Australia’s National Housing Finance and Investment Corporation (NHFIC) is the latest sign of growing interest in the community housing sector.

The industry is quickly developing as a standalone asset class and capital markets are playing a key role channeling capital into the sector.

NHFIC is an independent Australian government entity that provides loans to eligible community housing providers to increase the supply of social and affordable housing.

The 12-year bond - the largest by an Australian issuer – at $A562 million was oversubscribed by around three times by both domestic and international investors.

“There is good investor appetite for quality assets that fund the community housing sector helping vulnerable Australians stay in accommodation,” Director of Debt Capital Markets at ANZ, Andrew Brown said. ANZ was joint-lead manager with UBS and Westpac for the bond.

The success of the latest NHFIC social bond shows the financial sector has an important role to play in mobilising capital to fund community housing, according to Caryn Kakas, Head of Housing Strategy at ANZ.

“The challenge to improving meaningful supply of affordable housing requires a collaborative approach from the public, private and non-profit sectors,” she said.

ANZ is committed to increasing the availability of suitable and affordable housing options for all Australians and New Zealanders, including the supply of homes to buy and rent, as well as access to safe accommodation.

The bank has a $A50 billion commitment by 2025 to fund and facilitate sustainable solutions for customers including initiatives to help improve environmental sustainability, increase access to affordable housing and promote financial wellbeing.

“THE CHALLENGE TO IMPROVING MEANINGFUL SUPPLY OF AFFORDABLE HOUSING REQUIRES A COLLABORATIVE APPROACH FROM THE PUBLIC, PRIVATE AND NON-PROFIT SECTORS.”

- CARYN KAKAS

Emerging asset class

The latest bond by NHFIC is its third in less than 18 months making the agency the largest issuer of social bonds in Australia with around $A1.2 billion.

The strong reception from investors shows the sector emerging as a standalone asset class.

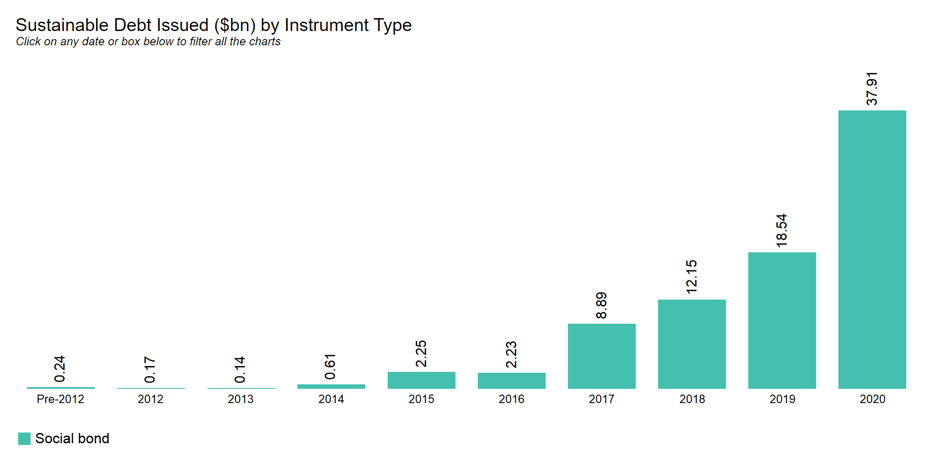

Source: Bloomberg New Energy Finance

“The NHFIC bonds are further evidence of Australia’s community housing sector emerging as a new investment asset class, NHFIC CEO Nathan Dal Bon said in a release.

Proceeds from the 12-year social bond will go towards 10 community housing providers across New South Wales, South Australia, Tasmania and Victoria to develop 2,742 properties including 781 new dwellings.

Social bonds rising

The COVD-9 pandemic has spurred the growth of social bonds as governments, multi-lateral organisations and the private sector raise capital to manage the health and socio-economic impact of the crisis.

“Social bonds address a particular issue that affects a community and are tied to a purpose to achieve positive socio-economic outcomes,” Tessa Dann, Director – Sustainable Finance at ANZ said.

The total volume of social bonds issued in the first half of 2020 alone has hit around $US38 billion, dwarfing the $US18.5 billion in issuance for all of 2019 according to data from Bloomberg New Energy Finance.

Ratings agency S&P believes social bonds will emerge as the fastest growing segment of the sustainable debt market in 2020. The anticipated growth of social bonds is in sharp contrast to issuance in the rest of the global fixed income market which S&P expects to decline.

“The impact of the COVID-19 pandemic has accelerated the use of social bonds as a format for investors to direct capital towards helping support communities in responding to the fallout,” Dann said.

Sharon Klyne is Associate Director, Communications at ANZ Institutional

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.