INSIGHT

Asia’s undeniable recovery

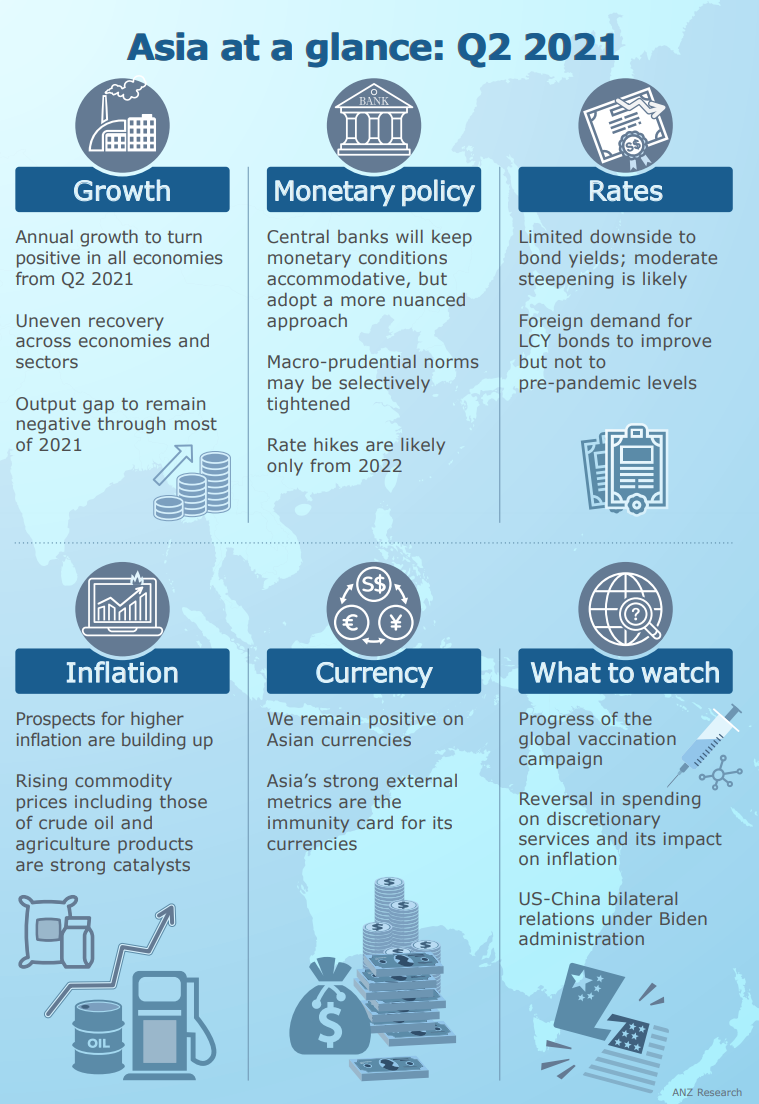

Asia’s recovery is undeniable. As the region moves quickly into the next phase of the cycle, ANZ Research expects annual growth in a number of critical economies to turn positive from the next quarter.

There is a case for genuine optimism in the region, with little evidence the tech cycle will fade any time soon. The improving pace of vaccine roll-outs portends further opening of the services sector. Strong growth conditions in Mainland China and the US will further boost exports.

Still, the pace of recovery has become asynchronous across the region, with two distinct growth camps emerging.

The lagging growth camp comprises Indonesia, Malaysia, the Philippines and Thailand. During the first months of 2021, these economies not only saw a flat-lining in manufacturing PMIs but also a slow relaxation of movement controls, which dampened domestic activity. In addition, Thailand’s recovery continues to be handicapped by the stalled tourism sector.

The leading camp, which fortunately is a larger group, is now experiencing a more decisive upturn. Within this camp, Mainland China’s rebound is the most broad-based. Its exports for the first two months of the year surged 60 per cent in the year to date, compared with a fall of 17.2 per cent in 2020.

Consumer appetite also remains solid. Online spending, express deliveries, box office revenues and local tours received a strong boost during the Lunar New Year period. Elsewhere, the recovery in Taiwan and Vietnam has similar attributes to that of Mainland China, but at a slower pace. In India and South Korea, the sectoral breadth of the recovery is narrower.

This uneven pace of recovery across economies and sectors is set to prevail, but the outlook for the region as a whole is decisively turning for the better.

Rebound

ANZ Research sees GDP growth in Asia rebounding to 7.9 per cent in 2021 from a flat performance in 2020. Expect a moderation to 5.4 per cent in 2022.

However, the 2021 numbers for the region as a whole are skewed by stellar growth of 8.8 per cent and 10 per cent in China and India, respectively. On an ex-China and India basis, 2021 GDP growth is forecast to be more moderate at 4.6 per cent.

ANZ Research believes even with these growth rates, output gaps are unlikely to close in most economies. There are also substantial intra-economy differences.

Headline inflation for Asia is forecast at 2 per cent in 2021, somewhat lower than in 2020. However, this aggregate is skewed by China whose consumer price inflation is set to ease to 1.5 per cent, from 2.5 per cent in 2020.

China’s inflation is likely to be more pressing at the producer price level. In all the other economies except India, ANZ Research forecasts inflation to be higher than in 2020.

India should see milder inflation of 5.1 per cent compared with 6.2 per cent in 2020 but even so, it will be closer to the upper bound of the official target range.

Pro-growth

The policy mix remains pro-growth. Announced budget deficits for 2021 remain high by historical levels, with the bulk of the reduction from the previous year coming from higher tax collections rather than expenditure cuts.

In some economies, the projected 2021 composition of spending is also more skewed towards development/capital spending, which has a larger multiplier on overall growth.

Fiscal policy has in fact become structurally expansionary, with some governments even extending the timeline for consolidation of public finances.

Monetary policy in the region should also remain accommodative in aggregate, but become more nuanced than in 2020. Although conventional easing has now concluded, ANZ Research does not expect any central bank to start raising policy rates until 2022.

ANZ Research maintains this view even against the backdrop of rising inflation risks and the ongoing volatility in US Treasuries. Quantitative measures to support government borrowing programmes and credit flow to SMEs should remain in play. However, their magnitude is likely to be more moderate than in 2020.

Apart from simply a smaller requirement as the recovery gains traction, quantitative easing is elevating financial stability risks or has misaligned the overall interest rate structure. These concerns call for a more-nuanced approach rather than the wholesale liquidity injections seen in 2020.

In this sense, monetary policy is likely to take a backseat to its fiscal counterpart. The problem of misaligned interest rates is perhaps starkest in India. Short-term money market rates have periodically fallen below the policy rate corridor while long-term bond yields that are critical to government finances have been rising.

The need to manage financial stability risks is becoming more pressing in some economies, thereby warranting tighter macroprudential norms.

China is predictably at the forefront of this exercise with a clear focus on stabilising the macro leverage ratio. There is a distinct concern rising leverage is the basis for asset bubbles, including that in the equities and property sector.

Nuanced

Even with this nuanced monetary policy backdrop, ANZ Research does not expect central banks to mechanically respond to higher inflation, even though several developments portend it.

A likely confluence of positive developments make a compelling case for inflation to rebound. These include a full re-opening of the services sector that could in turn catalyse employment and wages; the unwinding of forced and precautionary savings; accelerating money supply; and higher commodity prices.

However, the timing, extent and longevity remains unclear. Moreover, apart from India and the Philippines, inflation in the other economies is currently far from worrying levels.

The preference of central banks will be to first ensure that output gaps are closed. This approach is likely to be similar to that of the US Federal Reserve which has explicitly stated it will tolerate higher inflation for a period of time.

Yield curves in the region are not pricing in the risk of inflation and therefore can materially steepen should it fructify. This rise will not upend the growth recovery, but rather become a source of financial market volatility.

Neither is monetary policy likely to succumb to higher US bond yields. The formal normalisation of monetary policy will be a more persuasive development in the reaction function of Asian central banks. In ANZ Research’s view, the capacity to withstand higher yields on US bonds is now higher than during the 2013 taper tantrum.

Apart from Indonesia, all Asian economies are running current account surpluses. The adverse impact of higher oil prices should be attenuated by a slower recovery in non-oil imports. Various external reserve adequacy metrics have also strengthened over the course of 2020.

Overall, the region’s external health is distinctly superior to that in 2013 when both India and Indonesia found a spot in the infamous ‘fragile five’ club. ANZ Research believes current volatility in financial markets has more to do with the speed of adjustment in US bond yields than the level itself.

The pace of recovery will be uneven across economies but we are clearly past the worst. The risks to inflation are to the upside but even so, rate hikes will come about only in 2022.

Sanjay Mathur is ANZ Chief Economist, Southeast Asia

This is an edited version of a piece that appeared in the latest Asia Economic Outlook. Registered clients can click HERE to access the full report.

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.