Insight

How to Close The $1.5 Trillion Trade Finance Gap

Download the PDF

Mark Harding, Head of Financial Institutions South Asia, ME & India, ANZ

Michael Lim, Head of Transaction Banking, Financial Institutions, ANZ

Damian Kwok, Head of Trade Portfolio Management and Head of Trade and Supply Chain, AU, NZ and Pacific, ANZ

Adesh Sarup, Head of Transaction Banking, North Asia, ANZ

________

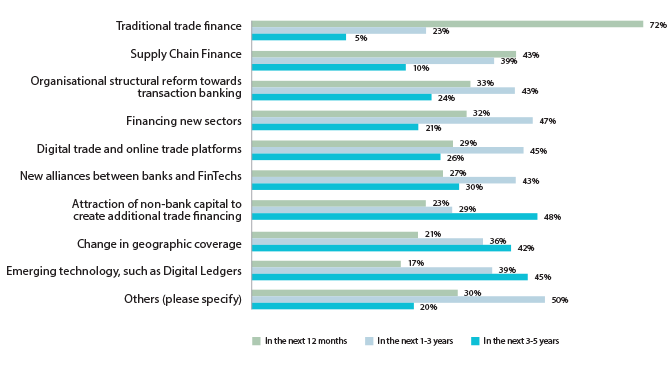

A RECENT ICC STUDY SHOWS CLOSING THE TRADE FINANCE GAP BY ATTRACTING MORE NON-BANK CAPITAL WILL BE THE MOST PRESSING TRADE- RELATED ISSUE IN THE NEXT 3-5 YEARS.

Simply put, trade is fundamental to international economic growth and development: It results in capital and labour being allocated to sectors and nations that enjoy a comparative advantage; it can boost investment, which has a range of benefits; and it helps firms to generate economies of scale, and countries to earn foreign exchange.

Countless studies have also shown the role trade plays in lifting communities out of poverty. A recent ADB study, for instance, concluded that a 10 percent increase in trade finance would see an additional 1 percent of workers employed.1

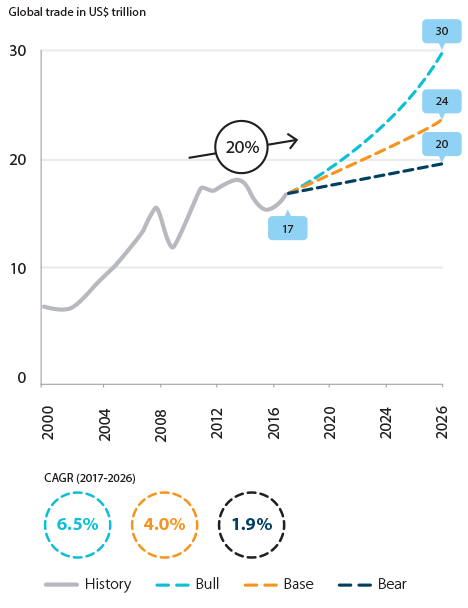

But in recent years, global bodies such as the U.N., the World Bank and the World Economic Forum have completed studies that reveal a $1.5 trillion trade finance gap on merchandise trade of about $17 trillion.2 This divide between what banks are prepared to provide and what borrowers need is impeding the ability of trade to fully support international economic growth.

There is widespread agreement that closing this gap is essential for global trade to flourish in the coming years, and growing acceptance that this can only be achieved by harnessing non-bank capital.

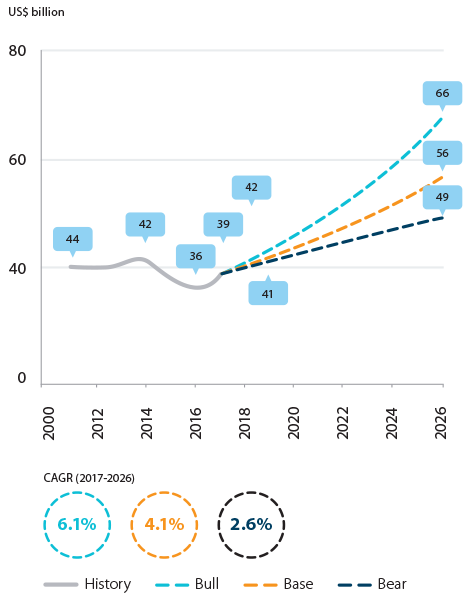

At the same time, adequate trade financing will mitigate risks in the international trading system and help the smooth flow of goods across borders. This is absolutely critical, as global trade flows are expected to grow 4% per year between 2017-2026, and trade finance revenues could grow by 4.1% over the same period, as illustrated in the graphs below.

To date, though, closing the gap has proven complex. For a start, banks are the key players in providing trade finance, yet the decade following the global financial crisis has seen them weather a range of issues including greater capital constraints, which have affected its provision.

There are the following structural challenges too:

International trade remains a largely paper-based and operationally intensive activity. Consequently, facilitating and financing trade transactions requires organisations to maintain cumbersome operational structures that can support that type of business.

Traditional financiers continue to face challenges such as regulatory constraints – which are sometimes counterproductive and effectively widen the gap3 - as well as non-profitable markets. At the same time, the ADB study showed the trade finance gap affects emerging economies more than developed economies, and micro-, small- and medium-sized enterprises more than large firms.4

The distribution of trade risk is archaic, which further exacerbates the problem. Trade risk is largely sold on a transactional basis due to the differing regulatory treatments associated with portfolio techniques such as synthetic securitisations which only some banks are able to utilise.

Trade assets are by nature short term. Accordingly, investors need continually to replenish their asset pool, which adds to the already high level of manual administrative burdens.

Although banks will play a key role in trade finance moving forward, the need for new investors is acute. Any solution needs investment from, for example, funds, insurers and private equity. However, the challenge for these entities is that they lack the systems and operational capability of the banks.

_________________________________________________________________________________________________________

MEANWHILE, SUPPLY CHAINS ARE ALSO EVOLVING, CONVERGING AND BECOMING MORE INTEGRATED. THAT MEANS BANKS CANNOT PROVIDE TRADE FINANCE TO JUST ONE PLAYER IN THE SUPPLY CHAIN WITHOUT ADDRESSING ITS ECO-SYSTEM OF SUPPLIER AND OFF-TAKERS.

_________________________________________________________________________________________________________

Given the above, the goal is to evolve from programmatic or transactional solutions to the building of an efficient and transparent market. What the market needs is a digital solution that enables new investors to purchase risk either via a seamless digital platform or as a portfolio, and removes the need for them to establish material operational capabilities.

I. PROBLEMS ADDRESSED

Trade finance is the lifeblood that makes businesses thrive in our communities, and it is imperative that the finance community works together to support the growing requirements. In order to meet this aspiration, it is paramount that banks seize the opportunity of using digital technology to raise trade finance to the forefront as a highly attractive asset class. This will allow the market to harness the capacity of new, alternative investors.

One potential solution is the TFD Initiative, a collective effort launched on a trial basis in April 2019 with the support of – among others – more than a dozen banks (including ANZ).

Hope for a solution is strong given that the participants in the TFD Initiative collectively agree that attracting non- bank capital won’t be easy due to the following pain points:

• Investors have other options such as the equity and bond markets that are transparent and technologically advanced, and which provide a more satisfying investor experience.

• Securitising trade assets across different jurisdictions can be complicated and regulatory treatment inconsistent for banks – which is a further barrier.

• Current trade instruments are short-term - less than a year - which means yields are difficult to predict. Typically, investors want certainty on yield and tenor, both of which they can lock in with existing bond or loan products.

That said, the initiative’s launch is propitious: it comes at a time of rapid progress in digitising trade – a process that has in part been driven by collaboration across the financial services industry to create distributed ledger solutions, and in part by the building of digital trading platforms by regulators in places like Singapore (the Networked Trade Platform (NTP) – that country’s trade information management platform) and Hong Kong (eTradeConnect, a trade finance platform).

ANZ is involved with both NTP and eTradeConnect, as well as with CCRManager, which provides trade-linked financial solutions. And in Australia we are pioneering the use of distributed ledger technology to underpin trade finance guarantees.

Of course, there are alternatives to the TFD Initiative, as illustrated in the chart below. But to date, the TFD Initiative is the platform that most aggressively addresses the urgent need to close the financing gap via non-bank investors.

II. THE TFD INITIATIVE IN DETAIL

Until now, there has not been a common platform to connect all players – corporates, banks and investors – across regional markets in the trade financing ecosystem. The TFD Initiative brings the opportunity to build a market that will provide benefits across the value chain.

It aims to deploy digital platforms that aggregate the data behind each participating bank’s trade finance deals and make them available for sale to investors.

Doing so provides an efficient, streamlined distribution of trade finance assets that can bring greater liquidity to the trade finance space, including from non-bank investors that have a different risk appetite compared to traditional banks. We believe this will help to close some of that $1.5 trillion trade finance gap, by allowing banks to build a market for distribution so that freed-up capital can be redeployed into new financing.

So How Does It Work?

The banks, which will still be the originators, put the assets on the platform. Then, using machine learning algorithms , the platform identifies and packages those assets against eligible investors or against criteria that investors have determined they require.

Once it has determined a match between two parties, it pushes that into a structure the investor needs.

This process also creates opportunities for intermediaries to warehouse and build portfolios from multiple sources to distribute as investment instruments.

For their part, non-bank investors can parse the data to a granular level to determine the type of assets they want to purchase – whether by tenor profile, jurisdiction, the underlying goods being financed, potential yield or any number of a range of possibilities.

For example, should a potential investor be interested in, say, cotton trades from India with a 120-day tenor and a 1.5 percent annualised yield, they could search for trade finance assets that match those criteria.

III. MULTIPLE BENEFITS

The benefits for seekers of trade finance are clear: The TFD Initiative will open up the pool of interested providers once the network is established and non-bank investors begin to engage and originate assets from it. It’s also likely that investors will make reverse enquiries -- i.e. some investors might ask the banks for certain risk exposures that the banks might not be prepared to offer. Perhaps a non-bank provider would step into that gap themselves knowing they have a means to recycle their capital when needed.

The initiative also brings advantages to banks, not least in terms of greater efficiencies and in helping to reduce capital constraints. And it brings non-bank investors exposure to assets from different parts of the world, allowing them to balance lower-risk against higher-risk asset classes to build a more blended yield return.

The initiative currently deploys a standalone, scalable platform, but in time it will plug directly into investors’ and banks’ systems, further driving demand and supply efficiencies. In short, the TFD Initiative is a development whose time has come. Why? Because trade digitisation is gaining momentum via collaboration between government and banking consortiums, which will ultimately feed a digital distribution network even more efficiently.

In addition, the initiative will provide seekers of capital with new financing options, and offer providers of capital an efficient new asset class.

And lastly, the initiative overcomes the legacy perception that the documentation that underlies trade finance makes it onerous to distribute the risk – versus distributing the risk on, say, a syndicated loan. To date, trade finance hasn’t lent itself well to a syndication structure, though that is changing. With time, those perceptions will change too.

In the end, the level of interdependency and integration in trade supply chains today demands trade financing solutions that cater to not just one component, but to the entire eco-system. While fully digitising trade will take time and is likely only possible in the medium-term,5 the evolution of trade distribution to a “market build” digital model supports this objective perfectly.

A Risk of Disintermediation?

Will the initiative see banks disintermediated? The short answer is no.

Why? Firstly, because it is the banks themselves that feed assets into the platform.

Secondly, many investors rely on banks to source high-quality assets for them, and want to remain as pure financial investors.

Thirdly, banks understand the assets, their clients and the market better than most investors.

The TFD Initiative won’t change the fact that each party will do what it’s best-suited to do. But it will enhance the focus on each party playing to its strengths by removing duplication and creating one single eco-system for all participants.

The initiative will also create a robust secondary market to help trade, boost business and support global communities.

1. 2017 Trade Finance Gaps, Growth and Jobs Survey, ADB (September 2017). See: https://www.adb.org/sites/default/files/publication/359631/adb-briefs-83.pdf

2. World Trade Statistical Review 2018, World Trade Organization (2018). See: https://www.wto.org/english/res_e/statis_e/wts2018_e/wts2018_e.pdf

3. ICC Global Survey 2018: Securing Future Growth. See: https://iccwbo.org/publication/global-survey-2018-securing-future-growth/

4. 2017 Trade Finance Gaps, Growth and Jobs Survey, ADB, ibid.

5. https://iccwbo.org/publication/global-survey-2018-securing-future-growth/