INSIGHT

Cash Management Realities in a Basel III World

Download the PDF

Mark Harding, Head of Financial Institutions Group, Southeast Asia, India and Middle East, ANZ

Philippe Jaccard, Head of Liquidity & Balance Sheet Management, Transaction Banking, ANZ | March, 2017

________

By now it’s clear 2017 has ushered in a new era of geopolitical and economic uncertainty shaped by a protectionist posture in the U.S. and an unstable outlook in post-Brexit Europe.

In this context, global banks not only face the task of thriving in an era of muted growth, they also must contend with volatile markets, disruption from new fintech firms, and above all, a raft of new regulations; all of which aim to safeguard the integrity of the global financial system following the financial crisis.

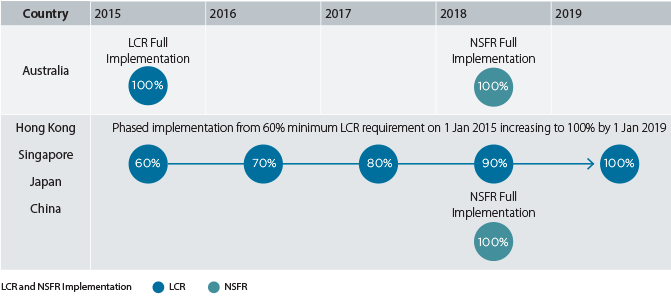

In Asia, banks are now tasked with adopting Basel III rules for Liquidity Coverage Ratios (LCR) and Net Stable Funding Ratios (NSFR), with compliance expected in many jurisdictions by 2019. These rules will affect how Asia’s banks treat funding such as customer deposits, especially deposits from other financial institutions – potentially driving down yields for the region’s banks, insurers, fund managers and pension funds.

But there are useful lessons to be gained from Down Under: Australia is ahead of the game on Basel III adoption, having embraced the new LCR rules since 2015. Given that head start, Australia’s banks have actively developed deposit solutions that aim to help financial institution clients strike a balance between competing liquidity requirements and yield objectives.

Regulatory changes: The fine print

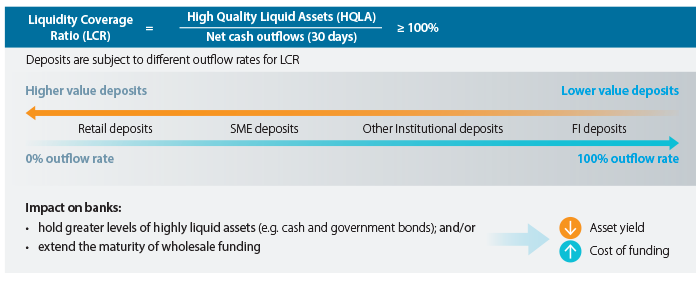

Under Basel III’s LCR requirements, banks around the world now have to pass a 30-day liquidity stress test. Specifically, in our home market, Australian banks must hold Australian Prudential Regulation Authority (APRA) compliant High Quality Liquid Assets (HQLA) to support the expected liability run-off over a 30-day period.

In embracing LCR requirements, banks have two levers at their disposal: holding the requisite volume of HQLA and managing outflows and inflows. The HQLA lever tends to be dilutive to bank returns given the low yields associated with qualifying HQLA. Thus, banks are increasingly focused on managing the outflow lever by re-designing certain funding options like deposits, to meet regulatory requirements.

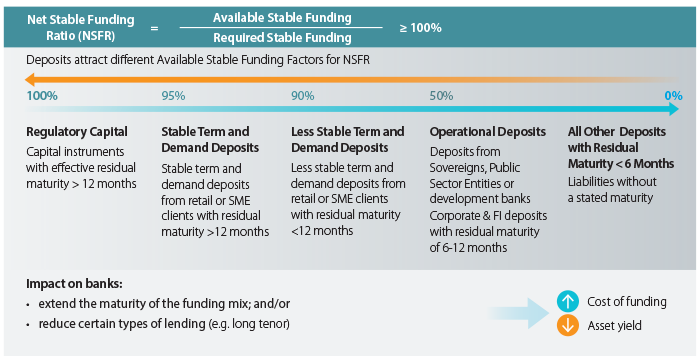

On top of that, from January 1st 2018, a range of bank regulators in the Asia-Pacific region, including APRA, the Hong Kong Monetary Authority (HKMA), the Monetary Authority of Singapore (MAS) and regulators in other jurisdictions, will implement the NSFR rules. These rules require banks to hold more term funding to match assets with longer maturities, an obligation that aims to provide greater balance sheet stability. At the same time, banks’ off-balance sheet activities will also require supporting term funding.

In summary, banks across Asia-Pacific will likely hold more government bonds in each jurisdiction. Singapore banks might have to hold higher volumes of Singapore government bonds, while Hong Kong banks may have to hold Hong Kong government bonds or potentially, government bonds from the U.S. This will have a negative impact on bank returns due to the required shift into such low-yielding assets.

FIGURE 2

LCR Overview

FIGURE 3

NSFR Overview

From Australia to Asia

Luckily, Australia’s early stage adoption of Basel III regulations will benefit Asian markets looking for models of best practice as they integrate the new standards into their own operating models.

APRA was the first regulator globally to fully adopt the new rules without a long period of transition. Implementation by MAS, HKMA and other Asian regulators, however, has been staggered over a longer time frame. This means local banks in Asia currently assign different values to deposits from financial institutions relative to Australian banks. That will inevitably change in the near future, as many jurisdictions in Asia seem prepared to apply the Basel standards as formulated.

The biggest differences across markets will be how regulators define HQLA and the liability run-off rates for LCR. To that end, regulators in various Asian jurisdictions are customising their formulas to make sure they reflect the accessible liquid assets and the types of liabilities common in their respective markets.

In recent years banks could get away with paying zero – or at least very low interest – on their cash accounts. That seems poised to change. Asia’s banks will have no choice but to offer new solutions, while Asia’s money managers will be obliged to manage their cash allocations more actively, to extract value from changing bank deposit structures. They will likely also have to diversify cash holdings across a portfolio of highly rated institutions.

The hunt for yield goes on

Of crucial importance to banks’ financial institution clients is the fact that banks will continue to price deposit solutions according to Basel III liquidity and stability benefits. On that basis, it’s now a fact of life that Basel III liquidity requirements create a preference for deposits from retail, SME and non-financial corporate customers. This will squeeze returns on financial institutions’ deposits at a time when yields in many markets are already at historic lows – despite recent rate hikes in the U.S.

Put simply, banks place greater value on retail and non-financial institution corporate deposits because those deposits have greater liquidity and stable funding benefits from a regulatory perspective when compared to deposits from financial institutions and short-term deposits. Traditional at-call deposits from financial institutions can no longer be used to support LCR, which in turn may result in excess cash invested in very short-term financial instruments or cash that is left with central banks at very low yield. Sometimes this cash even has a negative yield - hence these deposits are no longer as attractive to banks.

Even so, new offerings from banks that operate where the rules have already been implemented are giving financial institution treasurers, CIOs and money managers a range of options to find the appropriate balance between liquidity and yield objectives.

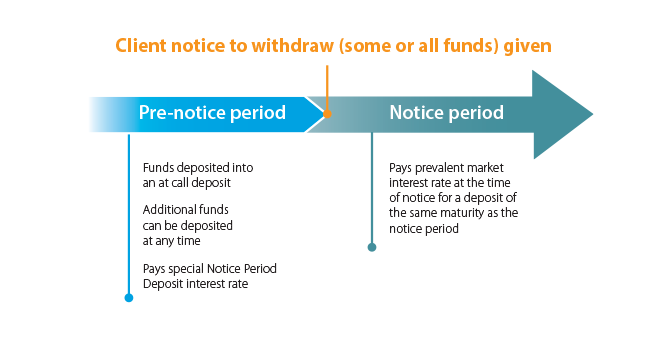

In Australia under APRA’s rules, these offerings are designed to meet Basel III LCR and NSFR requirements, making such offerings valuable to the bank, while they also potentially provide more yield to the depositor. The most basic solution is a notice period deposit that achieves superior interest rates to at-call and short-to-medium term deposits during the pre-notice period, and market rates during the notice period. Other bespoke solutions have been developed to suit the needs of money managers who are mandated to invest in highly liquid instruments (<30 days) and for clients that manage money for retail clients.

FIGURE 4

Notice Period Deposite

Forging ahead

To be sure, in the years ahead Asia’s portfolio managers will have to work harder to manage against their benchmarks, and banks will have to ensure compliance with Basel III requirements while also finding a way to continuously serve their clients’ best interests.

As the new LCR and NSFR rules come into effect in Asia, Australia’s experience with early Basel III adoption offers useful lessons in terms of deposit and cash management solutions that may help Asia’s financial institutions better manage their yield and liquidity objectives in a Basel III world.

RELATED INSIGHTS AND RESEARCH

insight

Cross-border Transactions in a 'Post-global' World - No Need to Panic

For the many businesses in australia and new zealand whose operations depend on the unimpeded flow of transactions and capital across international borders, it’s a difficult time to be optimistic.

insight

Crossing Borders: Navigating the New Reality of International Business

Globalisation has redefined how businesses operate, enabling them to reach more customers, improve efficiency and ultimately become more profitable. However, in an increasingly complex world, the benefits that have been delivered by globalisation can no longer be taken for granted.

insight

Coming soon — NPP, a Game-Changer for Australian Financial Institutions?

A guide to how Australia’s anticipated New Payments Platform will benefit banks and insurance companies.