FINANCIAL INSTITUTIONS GROUP NEWSLETTER

PREPARING FOR CHANGE: KEY CONSIDERATIONS FOR A SMOOTH LIBOR TRANSITION

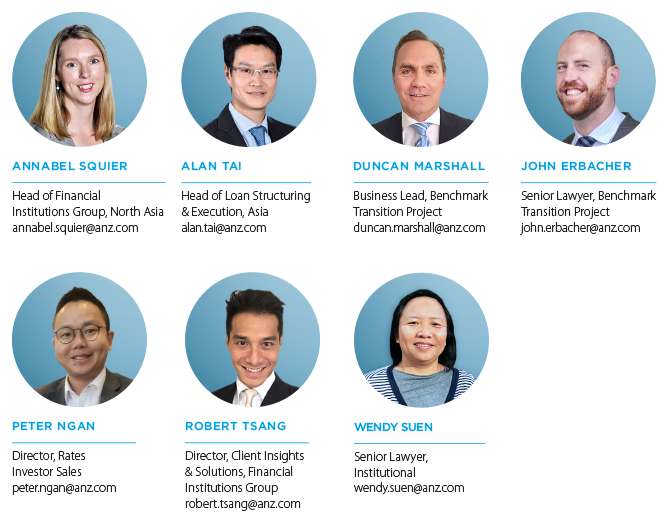

Annabel Squier (Head of Financial Institutions Group, North Asia )

Alan Tai (Head of Loan Structuring & Execution, Asia)

Duncan Marshall (Business Lead, Benchmark Transition Project)

John Erbacher (Senior Lawyer, Benchmark Transition Project)

Peter Ngan (Director, Rates Investor Sales)

Robert Tsang (Director, Client Insights & Solutions, Financial Institutions Group)

Wendy Suen (Senior Lawyer, Institutional)

February 2021

Download the PDF

_______________________________________________________________________________________________________________

THE MOVE AWAY FROM THE LONDON INTERBANK OFFERED RATE, WHICH IS SET TO BE DISCONTINUED AFTER END-2021, IS PROVING A COMPLEX AND ONEROUS UNDERTAKING. PREPARATION AND ENGAGEMENT WILL BE KEY IN NAVIGATING THE CHALLENGES AHEAD.

_______________________________________________________________________________________________________________

The official announcement by the UK Financial Conduct Authority of the discontinuation of the London Interbank Offered Rate (LIBOR) after end-2021 is currently expected to be made in the early part of 2021. Despite the myriad challenges of transitioning from LIBOR, there has not been significant movement in the marketplace so far.

Part of the reason for the hold-up was the delayed release by the International Swaps and Derivatives Association (ISDA) of Supplement 70 to the 2006 ISDA Definitions, which provides fallbacks for new transactions involving floating-rate options on 10 currencies from January 25, 2021. ISDA also published an IBOR Fallbacks Protocol for legacy transactions using the floating-rate options

contained in the Supplement. Counterparties can opt to amend their legacy transactions by either adhering to the Protocol or through bilateral amendment, which add the same fallbacks as contained in the Protocol.

As per an ISDA announcement on 25 January 2021, more than 12,000 entities across nearly 80 jurisdictions have so far adhered to the Protocol, which still remains open for adherence.

What all this means is, as Duncan Marshall, Business Lead, Benchmark Transition Project at ANZ, noted: “2021 is going to be a very big year in terms of active transitioning, which is being compressed into a smaller and smaller time frame.”

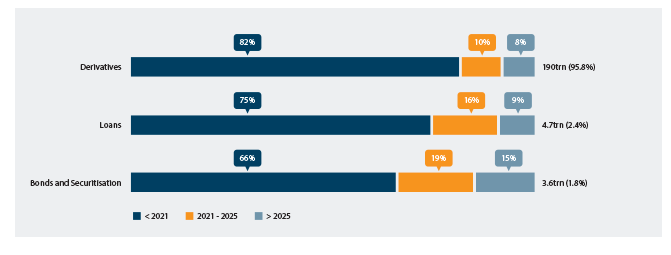

SPECIFIC ASSET CLASS CHALLENGES

LIBOR underpins more than USD400 trillion worth of contracts for loans, bonds, derivatives and other financial instruments. Amending all those contracts, especially with respect to loans, is a complex and onerous undertaking, stressed John Erbacher, Senior Lawyer at ANZ’s Benchmark Transition Project.

“The actual legal amendments are very material. It’s not just deleting a word and replacing it. There are a whole bunch of pain points involved in transitioning, which, ultimately, because there’s no market consensus, the parties have to thrash out between each other.”

The bottom line is that deals that mature beyond the end of 2021 must be based on risk-free rates (RFRs) rather than LIBOR. Existing deals will need to be amended to accommodate this. But despite their looming demise, LIBOR and IBOR rates “remain more attractive in many respects for a lot of parties,” added Erbacher. Further, there is a lot of ongoing discussion about producing forward-looking term rates derived from RFRs for a number of currencies, “which is, generally speaking, a more compelling proposition for borrowers because it looks and smells and feels a lot like what they are used to.”

FIGURE 1:

Legacy USD LIBOR Contracts - Volumes & Maturity

Source: ARRC Second Report dated March 2018; Notes: 1) Data are gross notional exposures as of year-end 2016. 2) The figures for loans do not include undrawn lines; retail mortgage maturity estimated based on historical pre-payment rates.

Another challenging category is trade products, which often involve discounts “that need to be calculated with an interest rate upfront and are obviously not compatible with an overnight in arrears compounded rate,” pointed out Marshall. The trade products category is largely adopting a wait-and-see approach in the hopes of moving straight to a new forward-looking term rate, rather than implement interim provisions.

Moreover, a lack of liquidity is holding up the development of term rates, noted Wendy Suen, Senior Lawyer at ANZ. “Without people actually transacting in the replacement RFRs, you don’t get liquidity, so it becomes very circular in that sense. It is almost as if someone has to break that circuit so that liquidity in RFRs can develop.”

SOME RELIEF IN SIGHT

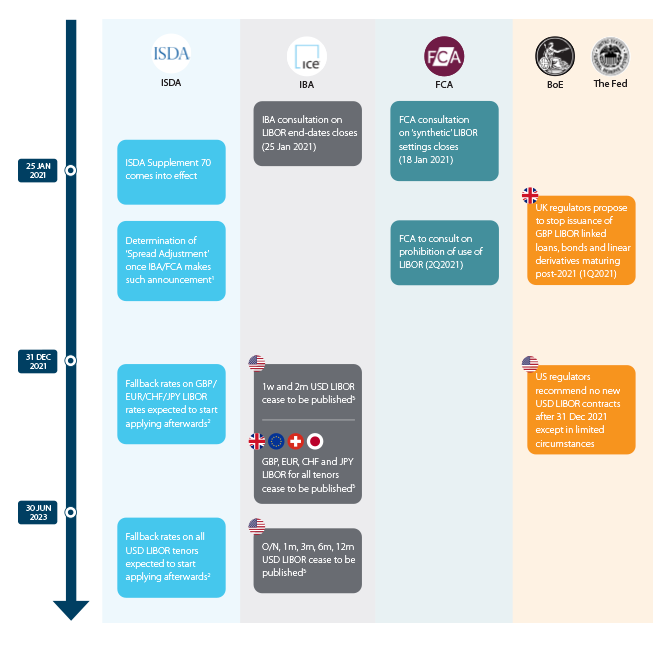

Replacing “the most important number in the world” was bound to prove more difficult than expected. The announcement on 30 November 2020 by the ICE Benchmark Administration of the extension of most US dollar LIBOR tenors through June 2023 has provided some relief, allowing the focus in 2021 to be on non-US dollar LIBOR currencies.

FIGURE 2:

LIBOR Transition Timeline

Source: ISDA, IBA, FCA, BOE, ARRC; Notes: 1) ‘Spread Adjustment’ based on 5yr median difference between LIBOR and RFR will be fixed on the day IBA, FCA or regulators announce a ‘Cessation Event’; 2) Subject to IBA consultation concluding as intended and no contrary announcements from regulators in the interim; 3) Proposed end-dates for various LIBOR settings as per the IBA consultation.

However, this raises the question of what happens to cross-currency swaps as the US dollar LIBOR continues on but other currency LIBORs switch to a fallback at end-2021. “Firms need to assess their exposures, fallbacks and triggers for each of those products, so they understand the various outcomes they face under different announcements by regulators,” said Marshall.

The decision to adhere to the ISDA Supplement and Protocol or instead use bilateral arrangements to add fallbacks to legacy swap transactions comes down to individual needs and preferences. A lot of operational and systems impacts need to be considered, with due diligence, risk assessment and contingency planning in relation to third-party data and system providers constituting essential steps prior to transitioning.

In many cases, adherence to the ISDA Fallbacks Protocol, which were developed on the basis of extensive industry consultation and feedback, provides a convenient way to prepare for transition. “There’s overwhelming support for the current fallback methodology. Coming up with an alternative that would be even better is highly unlikely, in our view,” explained Suen.

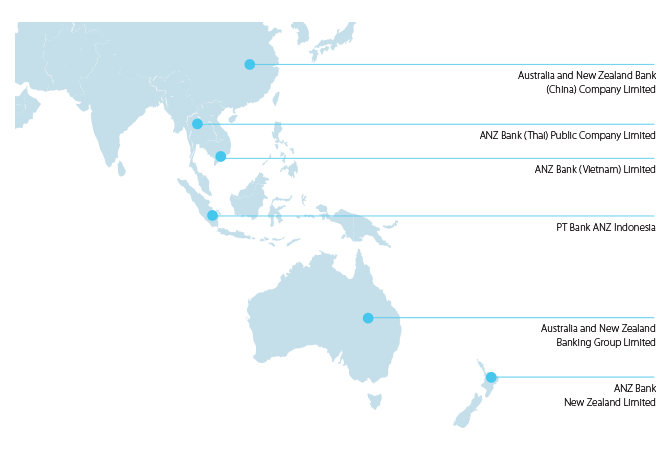

FIGURE 3:

ANZ Entities Adhering to the ISDA Protocol

FIGURE 4:

ISDA Protocol and Supplement - Amended Floating Rate Options

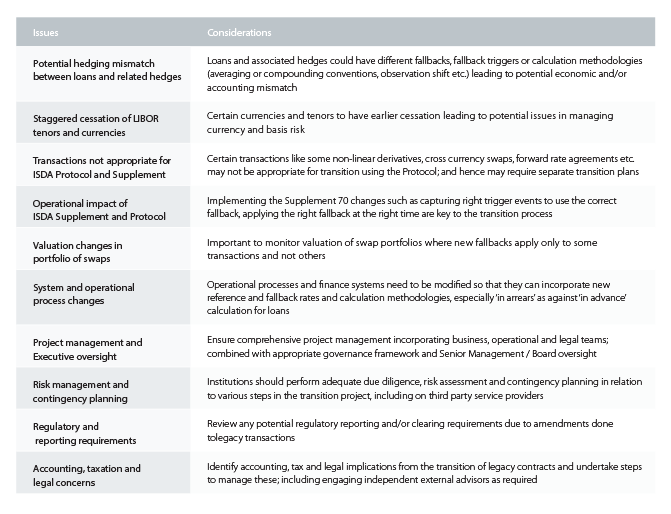

Still, several issues remain. Among these are a potential hedging mismatch between loans and related hedges, the effect of staggered cessation of LIBOR tenors and LIBOR currencies, and the impact of valuation changes in a portfolio of swaps where new fallbacks apply to some transactions and not others. There are also several transactions that are not appropriate for the Protocol and Supplement, including non-linear transactions such as caps and floors, cross-currency swaps and forward-rate agreements.

It would generally be prudent to find alternative arrangements for such transactions early. “And there are some products which may not even work with overnight compounding in- arrears RFRs,” added Marshall. “You may end up deciding to tear up the trade and settle up ahead of the cessation event.”

FIGURE 5:

Key Issues and Considerations

BANKS LEADING LIBOR TRANSITION

Banks are unsurprisingly taking a more proactive role in transitioning, given the significant technology and system development they need to complete ahead of the switch. “System changes always take longer than you think,” said Marshall. The challenge is compounded by the lack of established market conventions, meaning it is often unclear what to build for. “Banks have to build for every variety in case the market goes in a certain direction.” Given the possibility of product fragmentation, flexibility in systems and processes is paramount.

“GIVEN THE LEADING POSITION OF BANKS IN THE TRANSITION, NON-BANK FINANCIAL INSTITUTIONS TEND TO EXPECT THEIR BANK RELATIONSHIPS TO ADVISE THEM ON THE NEXT STEPS IN TERMS OF TRANSITIONING THEIR EXISTING OUTSTANDING CONTRACTUAL EXPOSURES. HOWEVER, GIVEN STRICT BANK COMPLIANCE REQUIREMENTS ON CONDUCT RISK, WE CAN ONLY PROVIDE THE VARIOUS TRANSITION OPTIONS AVAILABLE FOR THEIR OWN INDEPENDENT CONSIDERATIONS.” - ANNABEL SQUIER, HEAD OF NORTH ASIA FINANCIAL INSTITUTIONS GROUP AT ANZ.

In contrast to banks, corporates in the Asia Pacific region are by and large taking a wait-and-see approach, observed Alan Tai, Head of Loan Structuring & Execution, Asia at ANZ. It is also worth noting that there is a great deal of variance across the region in the pace of transition. Based on financial press coverage in recent months, corporates in Singapore, in particular, seem to be more active in entering into RFR loan transactions than corporates in other Asian jurisdictions, but these transactions are primarily on a bilateral basis. RFR loan transactions are expected to pick up rapidly towards mid 2021 as more financial institutions become system ready to offer RFR loan products and there’s more consensus on the market conventions.

There is also considerable divergence between individual Asian countries. Singapore has already established its fallback and new reference rate, while other countries like India are still going through that process and trying to establish what their new benchmark rate will be.

PREPARATION AND ENGAGEMENT ARE KEY

Much uncertainty remains. However, there’s a growing consensus that there is no better alternative and it’s best to be proactive than reactive, observed Peter Ngan, Director, Rates Investor Sales at ANZ.

The best course of action is, reasoned Marshall, to “make sure you have your house in order.” This involves understanding your exposures, fallbacks, new interest rate calculations and what varieties there are. It also behooves organisations to understand their preferences and decide whether it is necessary to have a perfect hedge or an effective hedge would suffice. And of course, it is important to understand what triggers the fallbacks, what basis risks might arise, and then monitor market developments closely.

There are risks associated with transitioning too late, but also with being too early. Staying abreast of market developments is therefore imperative.

“As market conventions start becoming established, there will be a big switch in liquidity at some point out of LIBOR into the new RFRs. Being prepared means you can transition at an optimal time, at a time of your choosing,” added Marshall.

And an important part of that preparation involves appraising board members and management of the challenges ahead.

“Engage your senior management and engage your senior stakeholders. They need to understand what’s going on. Don’t underestimate how hard this is going to be,” concluded Suen.

AUTHORS AND CONTACTS

This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.