FEBRUARY 2021 CORPORATE FINANCE INSIGHTS

LEVERAGED AND ACQUISITION FINANCE, ASIA

The year 2020 – A TALE OF TWO HALVES

_______________________________________________________________________________________________________________

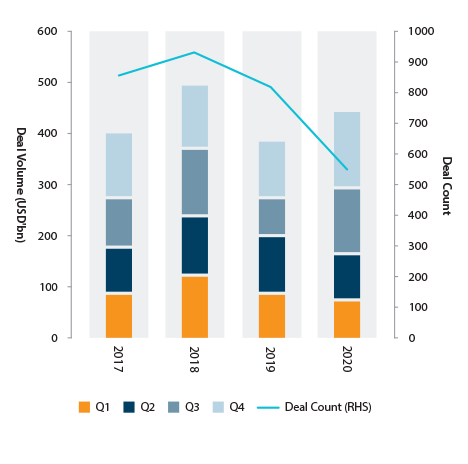

Overall M&A activity was extremely robust, increasing 11.5 per cent for the full year as deal momentum rebounded in the second half of the year, notwithstanding the significant global disruption caused by COVID-19.

_______________________________________________________________________________________________________________

• Deal flow was boosted by several mega acquisitions in China, Japan, Thailand and Indonesia as well as buoyant activity in Australia and India.

• However activity data was inflated by a number of jumbo domestic transactions in China that arose due to a more-domestic focus by the government and a re-organisation of the economy to a more market driven system.

• Trade war and geopolitical issues continue to impact China and cross border deal flows with outbound transactions plunging 48.6 per cent.

• Geopolitical issues led to lengthening regulatory approval times and the cancellation of several deals (e.g. rejection of outbound transactions from China into Australia by FIRB) as well as some MNCs exiting their China operations.

This led to buyers looking elsewhere with India providing a popular destination, particularly among technology companies and PE firms with KKR, Baring PE and Blackstone completing Indian investments in the third and fourth quarter of calendar 2020.

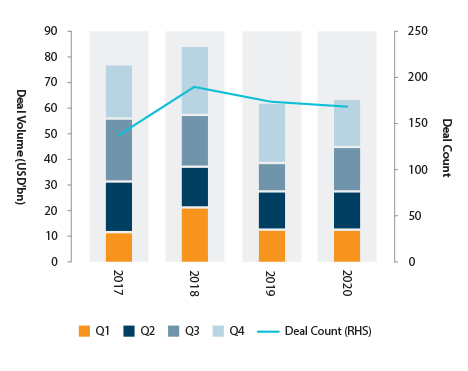

• PE backed M&A activity was remarkably resilient in 2020, despite COVID and debt markets opening and closing sporadically throughout the year, particularly in the first half.

Transaction volumes (>$US100 million) increased 2.1 per cent to $US63.8 billion year on year with deal count decreasing slightly (-3 per cent year on year).

FIGURE 1:

Overall M&A: Number and Value of Deals, APAC (ex Japan) >$US100 million

Source: Merger Market

FIGURE 2:

PE Backed M&A: Number and Value of Deals, APAC (ex Japan) >$US100 million

Source: Merger Market

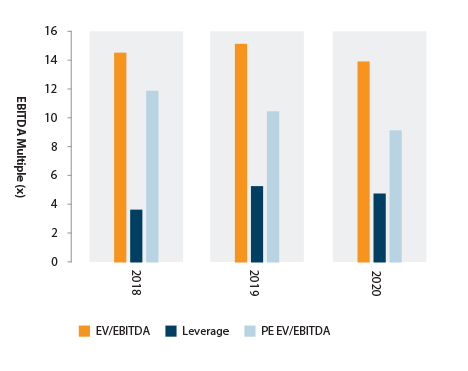

FIGURE 3:

M&A Multiples: APAC (ex Japan) >$US100 million

Source: Merger Market, Preqin, Loan Connector

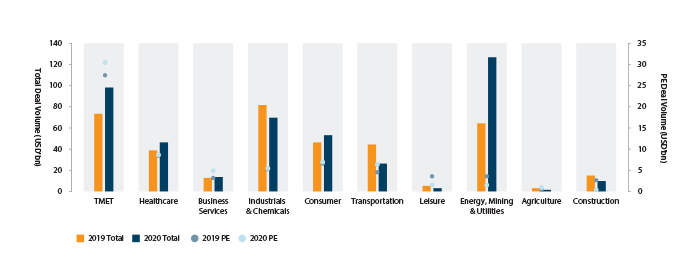

FIGURE 4:

M&A by Sector: APAC (ex Japan) >$US100 million

• M&A in the technology sector continued to be the standout sector - a trend that has remained unchanged since 2015 and is expected to continue into 2021.

Cloud technology and analytics were the top targets as companies sought to prioritise remote working capabilities and leverage data to increase efficiency and grow revenue.

Healthcare continued to remain active particularly in the midst of a global pandemic with a slight YoY increase in activity.

• Energy, mining and utilities M&A was also very active this year accounting for 31 per cent of total China and Hong Kong activity; however, the volume was skewed by a few large domestic transactions in China.

• On the consumer side, foreign supermarket operators continue to exit the region as competition intensifies with e-commerce companies continuing to grab market share and the difficulties in operating without local partners.

• However, the resilient overall market did not boost loan market volumes with the volume of M&A loans falling 14.2 per cent. This was driven by declines seen in historically strong markets such as Singapore, China and Hong Kong which

declined 30.9 per cent, 25.2 per cent and 15.5 per cent respectively against increases in Australia (+1.1 per cent year on year), Indonesia and Thailand (both +11.5 per cent year on year). LBO loans for PE firms also fell 32.4 per cent year on year.

• There were a few key factors impacting this:

- Buoyant public markets resulting in a number of M&A transactions funded via shares;

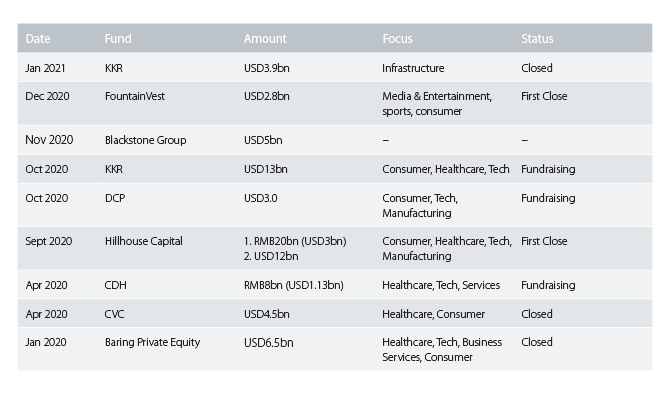

- Ongoing high number of minority deals for PE, which do not generally lend themselves to target level financing opportunities, with Hillhouse, KKR, Fountainvest and CVC particularly active;

- Some fully equity funded deals (e.g. Permira/EF) with sponsors taking a view that they can get a better deal in 2021, post Covid.

• Business uncertainty and concern regarding potential liquidity issues led to an increase in pricing in the early part of the year. While pricing in the second half gradually reduced, it remains slightly elevated over 2019 levels together with a slight contraction in leverage levels.

notable deals

MERGER AND ACQUISITION ACTIVITY IS EXPECTED TO REMAIN STRONG IN 2021 WITH AMPLE LIQUIDITY IN THE FINANCIAL SYSTEM DUE TO RECORD LOW INTEREST RATES AND A WEAKER US DOLLAR, UNDERPINNED BY INVESTOR WILLINGNESS TO PAY A PREMIUM FOR GROWTH.

_________________________________________________________________________________________

2021 OUTLOOK

_________________________________________________________________________________________

Asia Pacific M&A is expected to remain strong in 2021 given a supportive macro environment, including:

• Record low interest rates;

• USD weakness;

• Willingness of equity investors to pay for growth in a low growth environment;

• Resumption of sale processes postponed due to COVID;

• The substantial amount of liquidity in the system.

• COVID has had minimal impact on fundraising in 2020. In fact, it has probably strengthened the position of the well regarded Global and

Asia Pacific funds, a number of whom undertook notable fund raisings in 2019. These included Permira’s $US12 billion VII global buyout fund and Warburg Pincus’ $US4.2 billion China-Southeast Asia II fund. There is now an estimated $US2.8 trillion of capital committed to PE funds globally, including almost $US1trillion dedicated to buyouts.

• Significant growth opportunities will be available in the APAC region and, increasingly, investors are demanding a certain proportion of investments to be allocated to the region.

• PE firms will continue to shift away from focusing purely on buyouts towards becoming investment houses with broad offerings in alternative assets such as infrastructure, real estate, Tech, data centres covering control and minority investments.

• Environmental, social and corporate governance (ESG) will become increasingly important due to new regulations as well as demand from stakeholders who are requiring greater transparency and increased scrutiny on ESG issues.

• The trend of large conglomerates divesting local/regional divisions will continue, with Philips and Unilever coming to the market in the first half.

• India and Southeast Asia countries are expected to benefit from trade war and geopolitical tensions in China, and from companies looking to diversify their supply chains.

• Of course, risks remain including ongoing geopolitical tensions, trade wars and growing protectionism between the US and China are likely to negatively impact cross-border activity with Chinese deal making continuing to shift towards a domestic focus.

NOTABLE FUNDRAISINGS IN THE PAST 12 MONTHS

SPOTLIGHT ON: DATA CENTRES

_________________________________________________________________________________________

The global DC market has experienced consistent growth over the last few years (forecast CAGR ~10 to 28 per cent depending on region and segment) and has been one of the industries that has benefited during the COVID 19 pandemic for a number of reasons including prioritisation of remote working capabilities and an increase in in-home entertainment such as media streaming and gaming.

This builds on underlying demand driven by the rollout of 5G, increase in mobile devices and expanding internet connectivity.

• This has led to an increase in M&A and investment activity in the space as well as an acceleration in the development of new DCs primarily by established carrier-neutral third party operators but also PE fund and REIT backed entities.

Several notable transactions by PE funds in 2020 include:

- Stonepeak investing USD1bn alongside ex-Equinix executives to establish APAC DC operator Digital Edge.

- DCP Capital partnering with CITIC Private Equity to lead a $US300 million investment in Hotwon Group

- Gaw Capital closing $US1.3 billion funding for its China DC investment initiative

- Blackstone investing $US150 million in 21 Vianet

- Hillhouse investing $US400 millio in GDS

- Bain Capital’s $US540 millio NASDAQ IPO of Chindata

• In parallel, we are seeing telcos and large companies entering into sale and lease-back arrangements with third-party operators/funds/REITs to optimise balance -sheet structure and manage the large capex and ongoing maintenance requirements for DCs. As an example, in August 2020 Telstra sold its DC in Melbourne to Centuria Industria REIT for $A416.7 million with a 30-year lease back to Telstra.

CONTACTS

IMPORTANT NOTICE

Australia and New Zealand Banking Group Limited is represented in various countries.

Country specific information:

Australia and United Kingdom. This document is distributed in Australia and in the United Kingdom by Australia and New Zealand Banking Group Limited (“ANZ”). ANZ holds an Australian Financial Services licence no. 234527 and is authorised and regulated in the United Kingdom by the Financial Services Authority (“FSA”).

This document is distributed in the United Kingdom by ANZ solely for the information of its eligible counterparties and professional clients (as defined by the FSA). It is not intended for and must not be distributed to any person who would come within the FSA definition of “retail client”. Nothing here excludes or restricts any duty or liability to a customer which ANZ may have under the UK Financial Services and Markets Act 2000 or under the regulatory system as defined in the Rules of the FSA.

New Zealand. This document is distributed in New Zealand by ANZ National Bank Limited (“ANZ NZ”).

United States. This document is distributed in the United States by ANZ Securities, Inc. (“ANZ S”) (an affiliated company of ANZ), which accepts responsibility for its content. Further information on any securities referred to in this document may be obtained from ANZ S upon request. Any US person(s) receiving this document and wishing to effect transactions in any securities referred to in this document must contact ANZ S, not its affiliates.

Indonesia. This document is distributed by PT. ANZ Panin Bank (“ANZ Panin”). ANZ Panin is incorporated and licensed in Indonesia with limited liability.

Vietnam. This document is distributed in Vietnam by ANZ Bank (Vietnam) Limited (“ANZ VN”). ANZ VN Is a wholly-owned foreign bank incorporated and licensed in Vietnam.

China. No action has been taken by ANZ, ANZ NZ, ANZ S, ANZ Panin, ANZ VN or any affiliated entity which would permit a public offering of any products or services of such an entity or distribution or re-distribution of this document in the People’s Republic of China (“PRC”). Accordingly, the products and services of such entities are not being offered or sold within the PRC by means of this document or any other document. This document may not be distributed, re-distributed or published in the PRC, except under circumstances that will result in compliance with any applicable laws and regulations.

Hong Kong. This document is distributed in Hong Kong by the Hong Kong branch of ANZ, which is registered by the Hong Kong Securities and Futures Commission to conduct Type 1 (dealing in securities), Type 4 (advising on securities) and Type 6 (advising on corporate finance) regulated activities. In Hong Kong, this document may only be made available to “professional investors” in accordance with Part 1 of Schedule 1 to the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong). Please note that the contents of this document have not been reviewed by any regulatory authority in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Singapore. This document is distributed in Singapore by the Singapore branch of ANZ solely for the information of “accredited investors”, “expert investors” or (as the case may be) “institutional investors” (each term as defined in the Securities and Futures Act Cap. 289 of Singapore). ANZ is licensed in Singapore under the Banking Act Cap. 19 of Singapore and is exempted from holding a financial adviser’s licence under Section 23(1)(a) of the Financial Advisers Act Cap. 100 of Singapore. In respect of any matters arising from, or in connection with the distribution of this document in Singapore, contact the ANZ Chief Economist, Asia, with the contact details provided in this document.

Taiwan. This document is distributed in Taiwan by the Taipei branch of ANZ, which is registered as a branch of a foreign bank and holds a securities investment consulting enterprise license issued by the Taiwan Financial Supervisory Commission.

In Taiwan, this document may only be made available to ANZ customers who have requested or have consented to receive distribution of this document and who have entered into a securities investment consulting agreement with ANZ.

Information relevant to all countries:

The distribution of this document may be restricted by law in certain jurisdictions. Persons who receive this document must inform themselves about and observe all relevant restrictions.

This document is issued on the basis that it is only for the information of the particular person to whom it is provided. This document may not be reproduced, distributed or published by any recipient for any purpose. This document has been prepared for information purposes only and does not take into account the specific requirements, investment objectives or financial circumstances of any recipient. The recipient should seek independent financial, legal, tax and other relevant advice and should independently verify the accuracy of the information contained in this document.

Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, or a recommendation or advice to buy or sell or not to buy or sell any product, instrument or investment, to effect any transaction or to conclude any legal act of any kind whatsoever. If, despite the foregoing, any services or products referred to in this document are deemed to be offered in the jurisdiction in which this document is received, no such service or product is intended for nor available to persons resident in that jurisdiction if it would be contradictory to local law or regulation. Such local laws, regulations and other limitations always apply with non-exclusive jurisdiction of local courts.

From time to time ANZ, ANZ NZ, ANZ S, ANZ Panin, ANZ VN their affiliated companies, or their respective associates and employees may have an interest in or deal in, or seek to have an interest or deal in, financial products, securities or other investments, directly or indirectly the subject of this document and may receive commissions or other remuneration in relation to the sale of such financial products, securities or other investments. Such interests or dealings may directly or indirectly conflict with your interests.

ANZ, ANZ NZ ANZ S, ANZ Panin, ANZ VN or their affiliated companies may perform services for, or solicit business from, any company which is the subject of this document. If you have been referred to ANZ, ANZ NZ, ANZ S, ANZ Panin, ANZ VN or their affiliated companies by any person, that person may receive a benefit in respect of any transactions effected on your behalf, details of which will be available upon request.

The information in this document has been obtained from, and any opinions in this document are based upon, sources believed reliable. The views expressed in this document reflect the author’s personal views, including those about any securities and issuers referred to in this document. The author, however, makes no representation as to the accuracy or completeness of the information and the information should not be relied upon as such. All opinions and estimates in this document reflect the author’s judgement on the date of this document (unless otherwise specified) and are subject to change without notice. ANZ does not guarantee the performance of any of the products mentioned and ANZ, ANZ NZ, ANZ S, ANZ Panin, ANZ VN their affiliated companies, their respective directors, officers, and employees expressly disclaim any responsibility, and shall not be liable, for any loss, damage, claim, liability, proceedings, cost or expense (“Liability”) arising directly or indirectly (and whether in tort, including negligence), contract, equity or otherwise out of or in connection with the contents of and/ or any omissions from this document, or your receipt or use of it, except where a Liability is made non-excludable by legislation.

If this document has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept Liability for any errors or omissions in the contents of this document, which may arise as a result of electronic transmission.