Insight

APAC’s biggest sustainable loan takes flight

SHARON KLYNE, ASSOCIATE DIRECTOR, INSTITUTIONAL COMMUNICATIONS, ANZ | MAY 2019

Sydney Airport has closed a $A1.4 billion ($US1 billion-equivalent) Sustainability Linked (SLL) loan, the first syndicated facility of its kind in Australia as well as the largest in Asia Pacific and the airport sector to date. The deal reinforces a growing trend among borrowers keen to align sustainability ambitions to their cost of borrowing.

The SLL approach allows a borrower to use the loan for general corporate purposes with pricing designed to incentivise ambitious but achievable improvements over an agreed set of sustainability targets over time.

“We were particularly attracted to the funding flexibility an SLL offers in incentivising improvement across the entire environmental, social and governance (ESG) spectrum, especially when compared to related products that focus on sustainability-linked investment and lack a direct link to funding costs,” Sydney Airport Group Treasurer Michael Momdjian said.

Sydney Airport, Australia’s largest airport operator, is a recognised leader in sustainability within the airport sector though a raft of programmes that aim to improve sustainability performance. These initiatives include investing in electric vehicles and supporting infrastructure, aiming to achieve carbon neutrality by 2025 and cutting carbon emissions per passenger by 50 per cent from 2010 levels by 2025.

The measures have earned Sydney Airport high ratings from sustainability rating agencies including fourth for ESG performance out of 38 in Sustainalytics’ global airports sub-industry group and seventh globally in Dow Jones Sustainability Index’s transportation and transportation infrastructure sector.

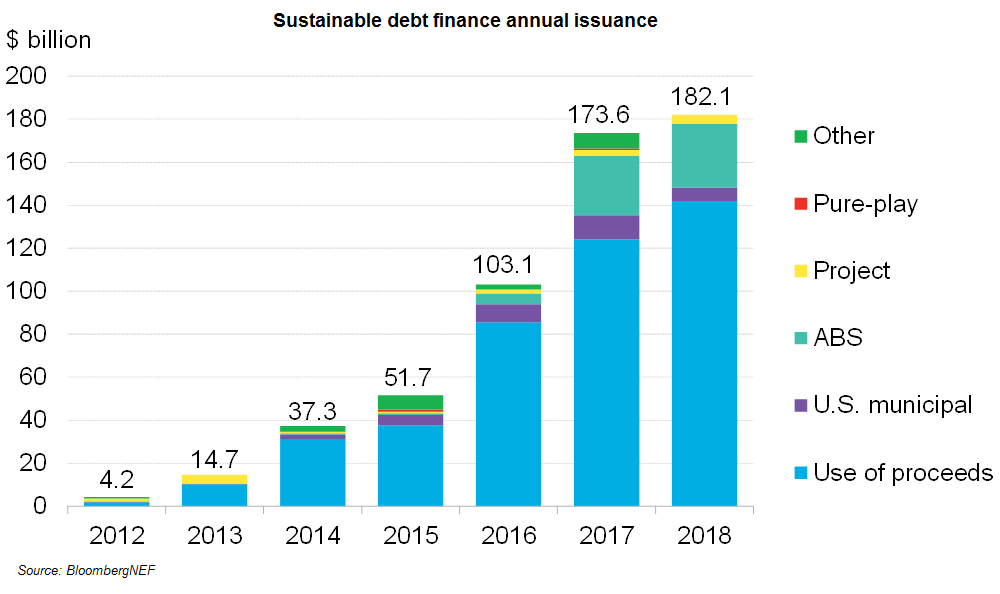

Some $US56.7 billion of SPL loans have been completed since 2017, according to data from BloombergNEF. It is the fastest-growing segment of the broader sustainable finance market.

The new loan includes a SLL feature that links pricing to Sydney Airport’s ESG performance as measured by Sustainalytics, a global leader in ESG research and ratings. ANZ and BNP Paribas were mandated lead arrangers, bookrunners and sustainability co-ordinators on the deal that attracted a total of over 10 lenders.

_________________________________________________________________________________________________________

“Banks have growing pools of funds to invest in sustainable loans and this has increased demand for loan assets such as Sydney Airport’s new facility,”

GAVIN CHAPPELL, HEAD OF LOAN SYNDICATIONS – AUSTRALIA, ANZ

_________________________________________________________________________________________________________

Deep

The deal is also the largest syndicated transaction of its kind in Asia Pacific as well as the airport sector globally, demonstrating the depth of liquidity available among banks for sustainable-linked lending.

Like many companies, banks face growing pressure from stakeholders to manage climate risk and increase their allocations to this asset class.

“Banks have growing pools of funds to invest in sustainable loans and this has increased demand for loan assets such as Sydney Airport’s new facility,” Gavin Chappell, ANZ Head of Loan Syndications Australia said.

The loan had a strong reception among banks.

“The loan was well received by lenders and the significant demand helped Sydney Airport achieve a competitive margin,” Chappell said.

Drivers

The push globally by regulators, investors, staff, customers and the community concerned about climate change is driving companies to adopt more sustainable practices.

“The transition to a zero-carbon economy is pushing investors to deploy more capital in green and sustainable investments,” Katharine Tapley, Head of Sustainable Finance at ANZ said.

“Companies who lag behind in this transition may find it more difficult to access capital in the long term.”

Sharon Klyne is an Associate Director, Institutional Communications at ANZ

RELATED INSIGHTS AND RESEARCH

insight

Sustainability: from buzzword to billions

The value of green and social bonds keeps doubling every year. Expect further growth.

insight

On sustainability, companies ‘have to change’

The changing nature of the environment – and economy – demand businesses act on sustainability, experts suggest.

insight

Green market broadens asset base

Sustainability takes centre stage in the second part of our expert conversation into credit markets ahead of ANZ’s conference in the Hunter Valley.