Insight

The future of sustainable finance, in pictures

As the appetite for green bonds grows in Asia, focus is shifting to the potential development of a thriving market in sustainable bank loans, according to the results of a June poll.

The poll conducted by ANZ and FinanceAsia surveyed more than 120 investors and issuers on their attitudes towards green finance and asked them to outline their future plans. It is the second time the poll has been conducted, covering 13 countries across the region.

The results show an overall boost in green-financing volumes, an increase in the number of discrete mandates being established by asset owners, and a growing interest in green and sustainable bank loans.

“The market is rapidly moving towards greater awareness and product sophistication, and the newfound interest in green loans is a sign of just how far green financing has come,” Katharine Tapley, Head of Sustainable Finance at ANZ, said of the poll results.

“In the early days, investors were more focused on the specifics of the issuance but now they are looking closely at the issuers themselves. They want to see issuers have a strong story to tell about their transition to a neutral carbon footprint and a program to make it happen.”

_________________________________________________________________________________________________________

“The newfound interest in green loans is a sign of just how far green financing has come.”

Katharine Tapley, Head of Sustainable Finance, ANZ

_________________________________________________________________________________________________________

Tapley said market momentum is partly fuelled by regulatory changes in Europe, which then feeds into other marketplaces.

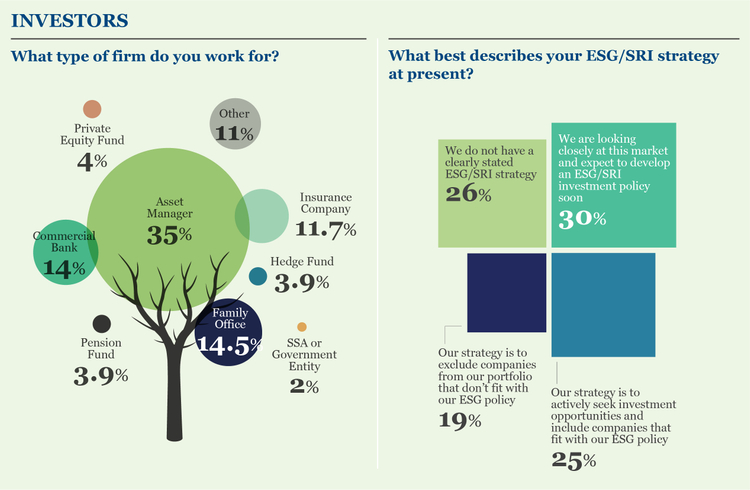

“New rules in the EU require investors to make mandatory disclosures around the climate change risks in their portfolios,” she said. “This has really sharpened investors’ focus to actively exclude companies that don’t fit with their ESG policies.”

This trend is borne out in the poll results, with 19 per cent of investors reporting they actively exclude investments on the grounds of poor ESG metrics, compared to 10 per cent of participants from 2018.

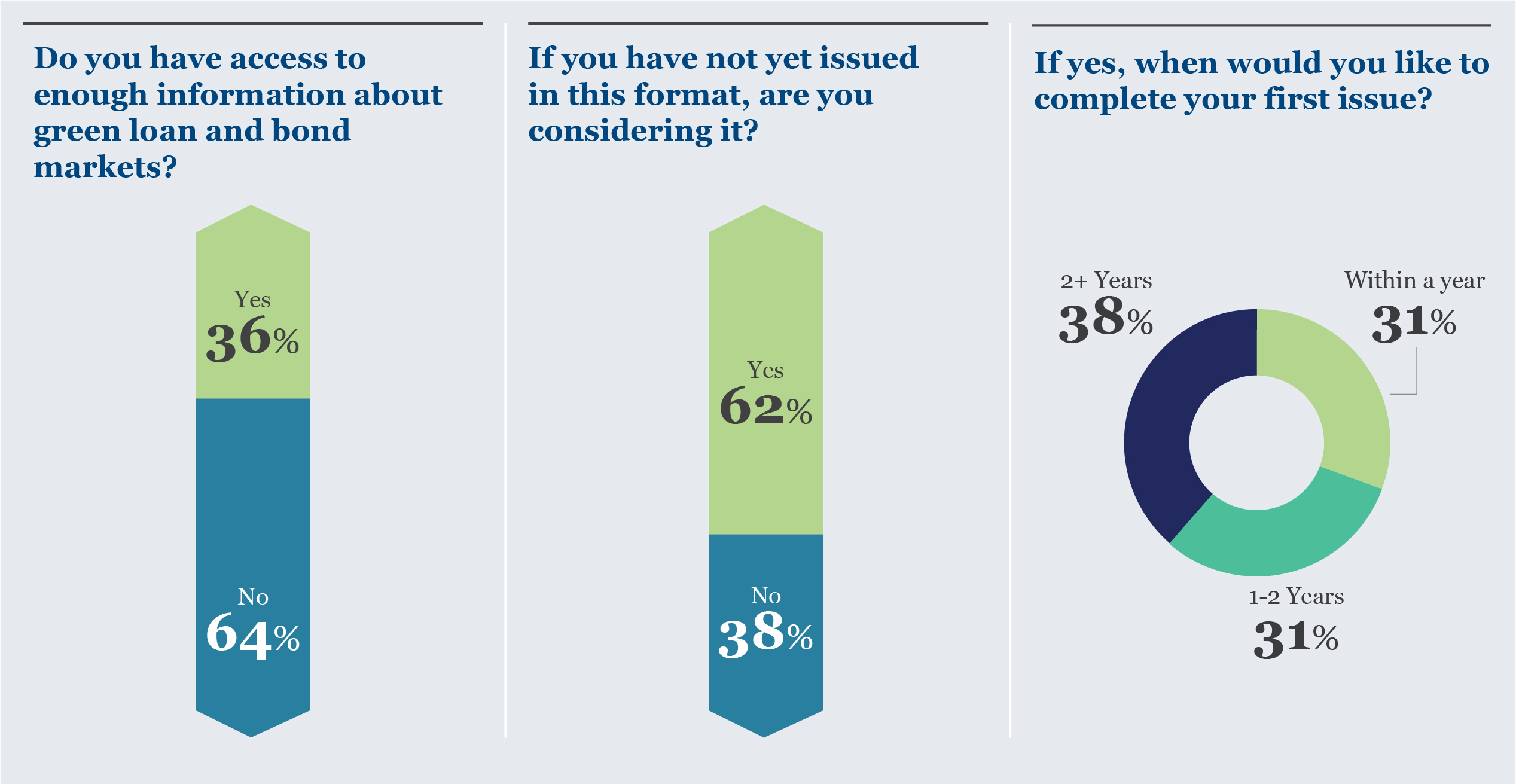

The results also show a year-on-year uptick in the number of investors expecting to develop an ESG/SRI investment policy in the short-term (30 per cent in 2019 versus 12.5 per cent in 2018) and an increase in those considering buying their first green or sustainable bond within the next two years (53 per cent in 2019 versus 40 per cent in 2018).

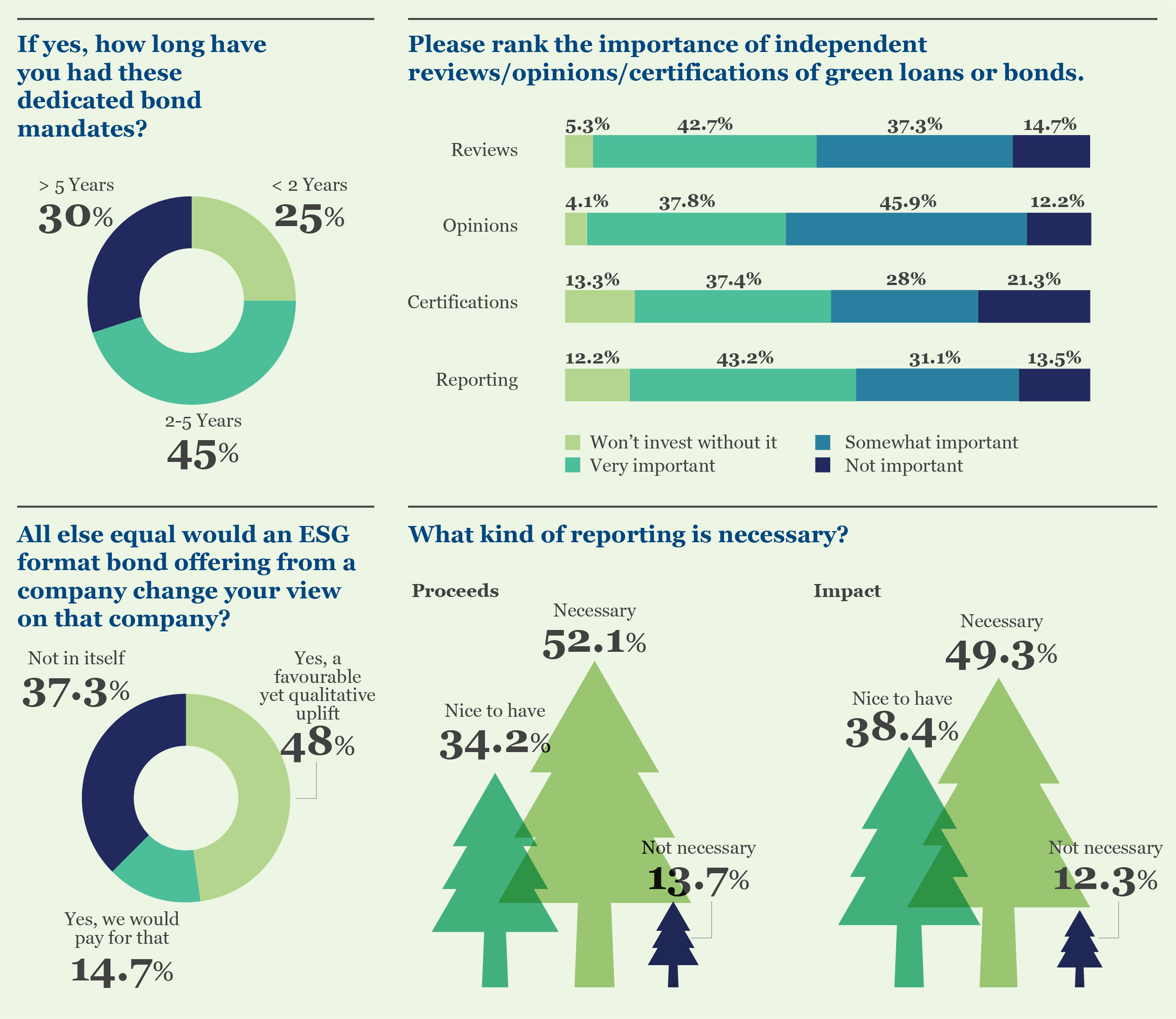

Further evidence the market is maturing is in the number of poll respondents who have softened their requirements around the need for independent certification of sustainable bonds.

In 2018 31.7 per cent of investors said they wouldn’t invest in a bond unless it had independent certification and 19.5 per cent wouldn’t invest without reporting. This year those figures have dropped to 13.3 per cent and 12.3 per cent respectively.

“Independent reports and certifications are still important to investors but they are no longer a determining factor,” Tapley said.

“It also reflects the growing number of investors who are developing their own in-house ESG/SRI research and analysis capabilities.”

Price

The 2019 poll asked investors whether the issuance of an ESG bond would change their view on a company. Nearly half of all respondents said it would result in a favourable uplift and 14 per cent said they would pay for the uplift.

“While most investors won’t admit to paying a premium for green issuance, we are certainly seeing benefits coming through in the form of heavy over-subscription rates and tighter sales processes,” Tapley said.

“As the market evolves it is becoming harder for us to say there are no pricing benefits for issuing in this format.”

Tapley points to the experience of Woolworths as an example of how pricing tension is generated during the bookbuilding process. The Australian supermarket chain issued a debut $A400 million green bond in April through joint lead managers ANZ, Citi and JP Morgan.

The proceeds will finance a portfolio of low-carbon supermarket assets, as well as energy efficiency projects such as lighting and air conditioning upgrades, and the group’s solar energy installations.

The final book closed with more than $A2 billion in orders from 90 investors, mostly from the domestic market. Nearly all of these were dedicated green investors.

Paul White, Head of Debt Capital Markets, Australia and New Zealand at ANZ said while Woolworths’ primary deal priced 10 to 15 basis points tighter than initial guidance, the biggest uplift came in the secondary market.

“The bonds priced at 120 basis points over the semi-quarterly asset swap curve and quickly traded in by 30bps,” he said.

Smaller overall deal sizes and larger individual tickets are driving secondary demand, White said.

In Asia

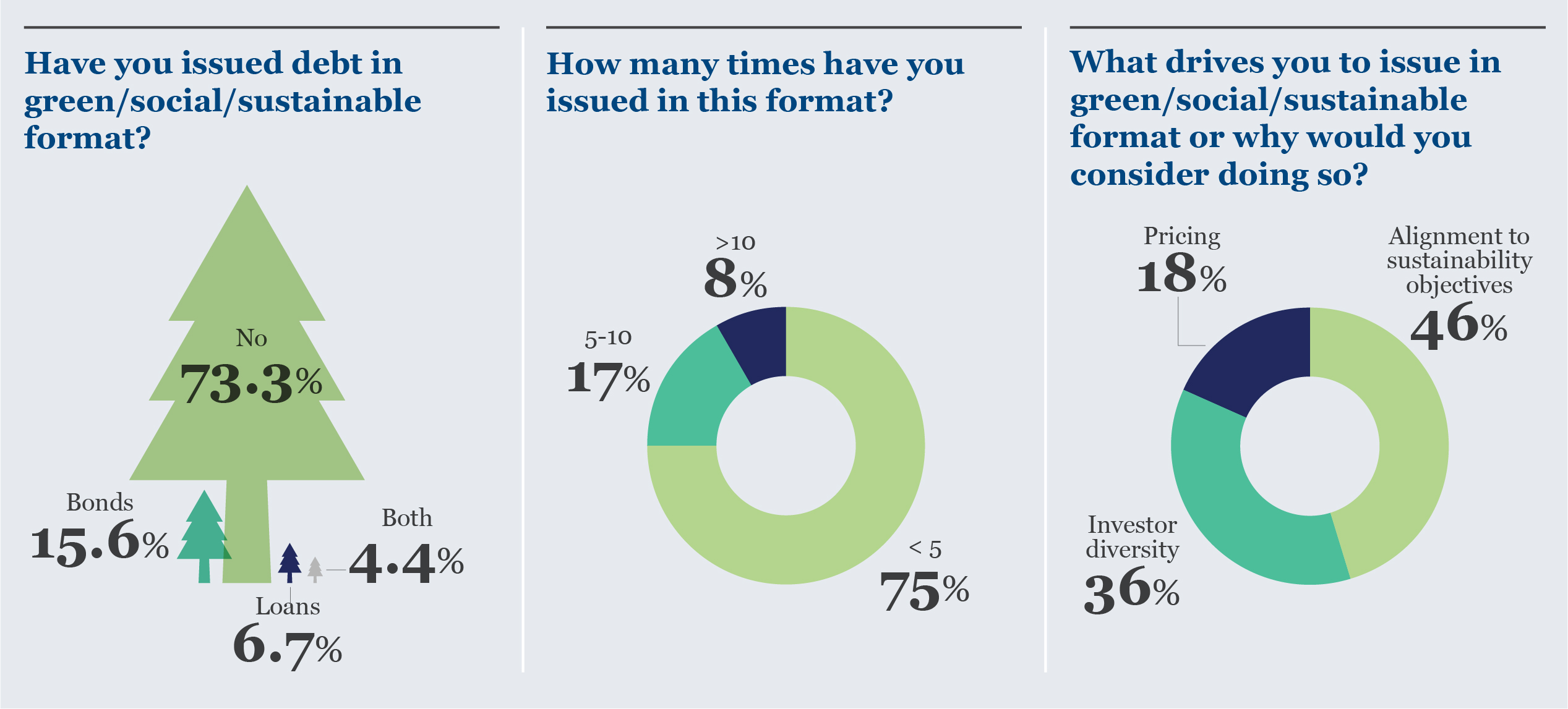

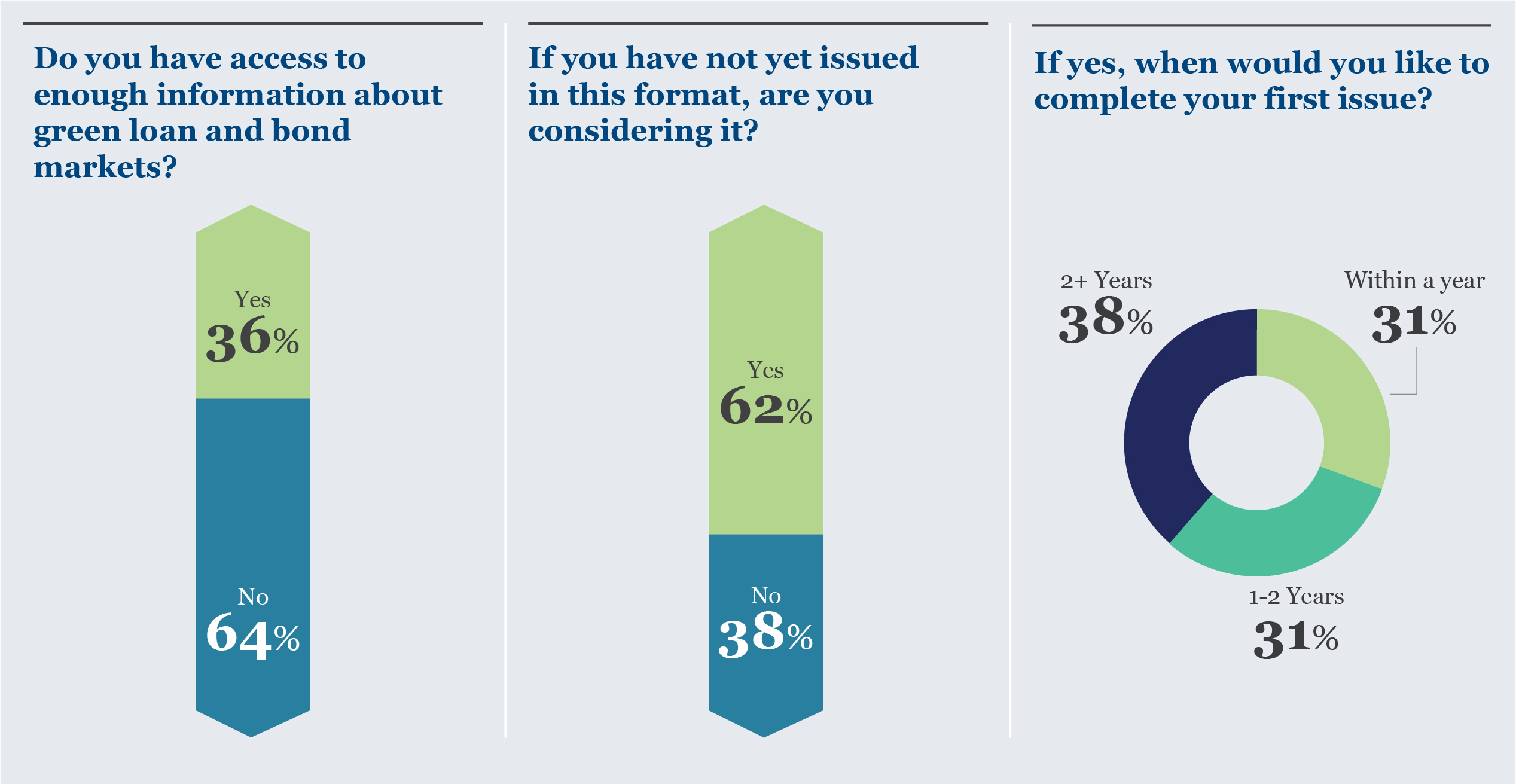

The poll results show over the past 12 months Asia-based companies have sharpened their awareness around green financing. In fact, a whopping 62 per cent of companies which haven’t yet issued in green or sustainable format are now considering it, compared with 44 per cent in 2018.

These businesses are driven to issue by a wish to improve investor diversity and meet their sustainability objectives.

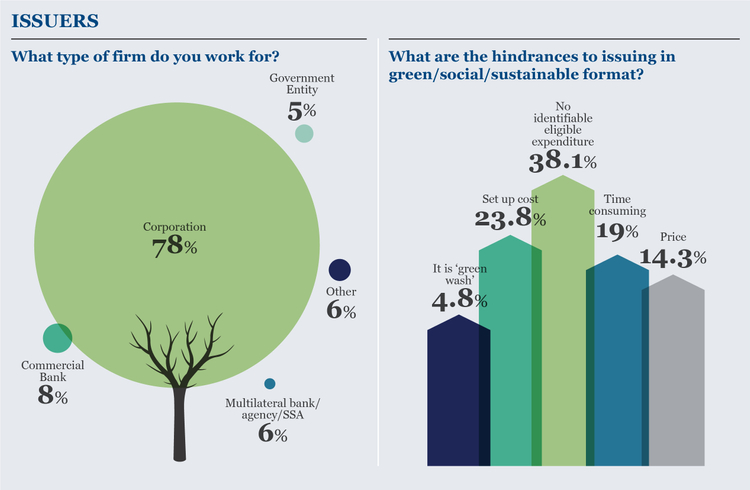

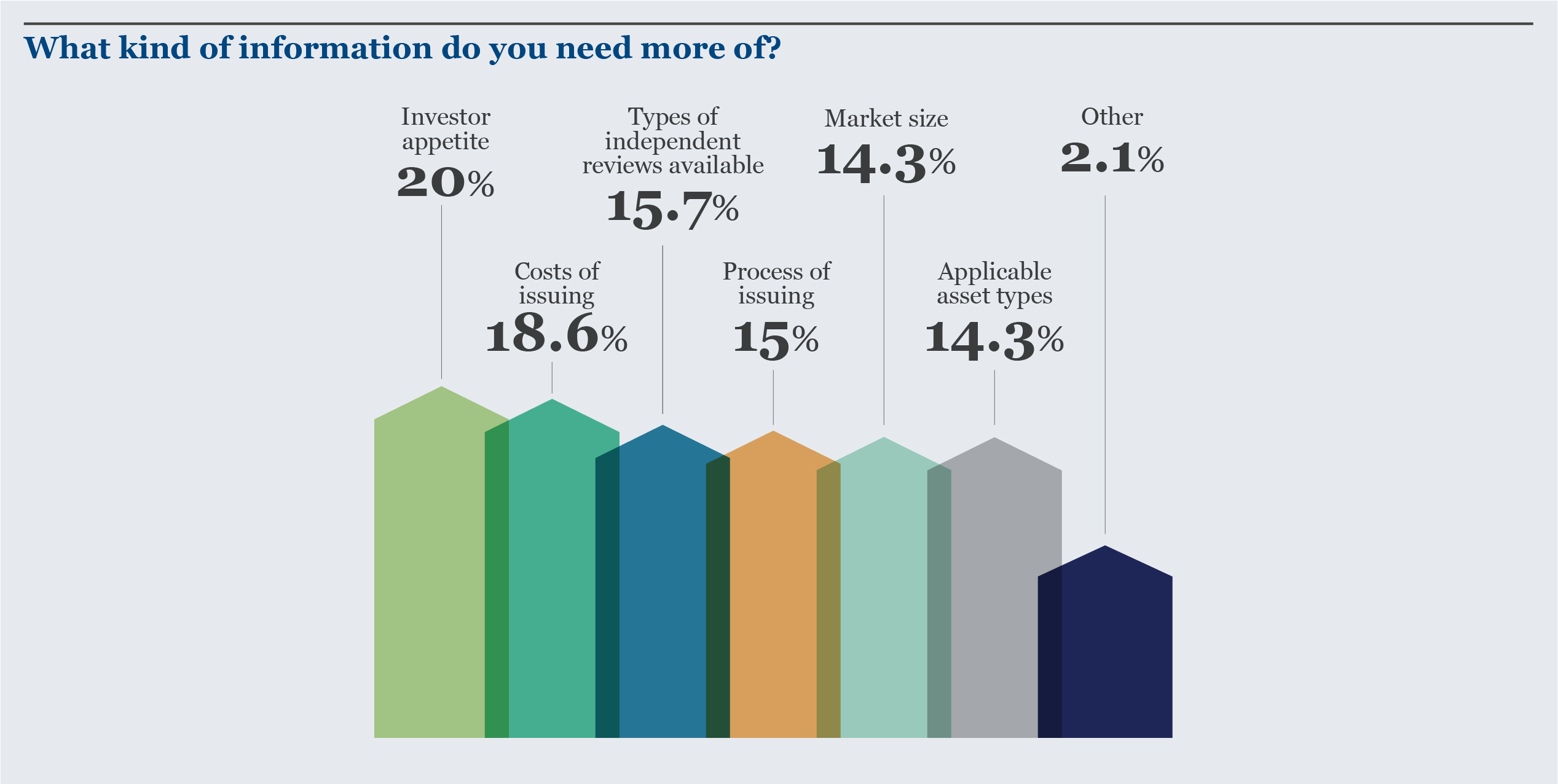

Issuers say some obstacles remain - one of the biggest being an inability to identify a sizeable pool of suitable green assets. Thirty eight per cent of respondents listed this as their number one obstacle. Another 23.8 per cent listed ‘set-up costs’ as a hurdle while another 19 per cent mentioned the extended timelines of such deals.

Jimmy Choi, Head of Debt Capital Markets, Global at ANZ, acknowledges some Asia-based issuers can struggle to find enough discreet assets to fold into a green-bond programme.

“The bond markets have a set of unspoken minimum benchmarks for issuance and investors won’t do the due diligence on a bond under about $A300 million,” Choi said.

“This puts pressure on issuers to find enough discrete assets and then put those proceeds to use. Ultimately issuers have to weigh up whether it is worth the time and expenditure to issue a bond.”

Choi is hopeful the creation of an active green and sustainable loan market in Asia will give smaller companies – or those at the beginning of the transition process – a viable alternative.

Loan market

Gavin Chappell, who heads ANZ’s Syndications in Australia, said the closing of a $A1.4 billion sustainability linked loan (SLL) for Sydney Airport in June is likely to mark the beginning of a wave of interest in this product.

To date the SLL market has been largely driven out of Europe with close to $A60 billion in loans completed since 2017, according to Bloomberg Energy Finance data. But momentum is growing in Asia and the US with a number of recent transactions highlighting companies’ transitions to a low-carbon economy.

Unlike a green loan which is usually issued to fund a sustainable project such as a renewable energy plant, a SSL can be used for general corporate purposes. It is structured as a revolver and linked to a borrower’s ability to achieve certain sustainability targets.

Borrowers are benchmarked based on their current ESG performance and given incentives to improve that performance over time. In the case of Sydney Airport, the benchmarks were set by independent certifier Sustainalytics.

Chappell said the Sydney Airport loan was syndicated to a group of over 10 lenders.

“Since it closed we have had a strong flow of reverse enquiries from banks wanting to learn about the deal,” he said.

“A lot of banks now have targets for growing the ESG side of their balance sheets and SSLs will help them to achieve these ratios. We expect volumes in sustainable loans to swell significantly in the next three years.”

This story originally appeared on financeasia.com

RELATED INSIGHTS AND RESEARCH

insight

Q&A: sustainability, bonds & the wall

For some countries in the Asia Pacific there really is no choice: sustainability bonds have a huge role to play in the future, experts tell IFR Asia.

insight

The Genesis of an investment for good

Social impact financing like the G-Fund Social Investment Bond is helping parties on both sides of the investment aisle.

insight

Go low: supporting the drive to a net-zero emissions economy

ANZ is helping our customers adapt to the transition to a low-carbon economy.