Insight

HONG KONG EMERGING AS GLOBAL BOND HUB

ANSHUL SIDHER, HEAD OF TRADING AND MARKETS ASIA, ANZ | APRIL 2019

________

HONG KONG IS CEMENTING ITS POSITION AS A GLOBAL CAPITAL MARKETS HUB AMID RISING CHINESE BOND ISSUANCE AND INVESTORS’ GROWING APPETITE FOR US DOLLAR BONDS.

China will lean heavily on Hong Kong as a conduit to global investors as the country looks to fund its emerging current account deficit as well as unprecedented regulatory bond issuance requirements.

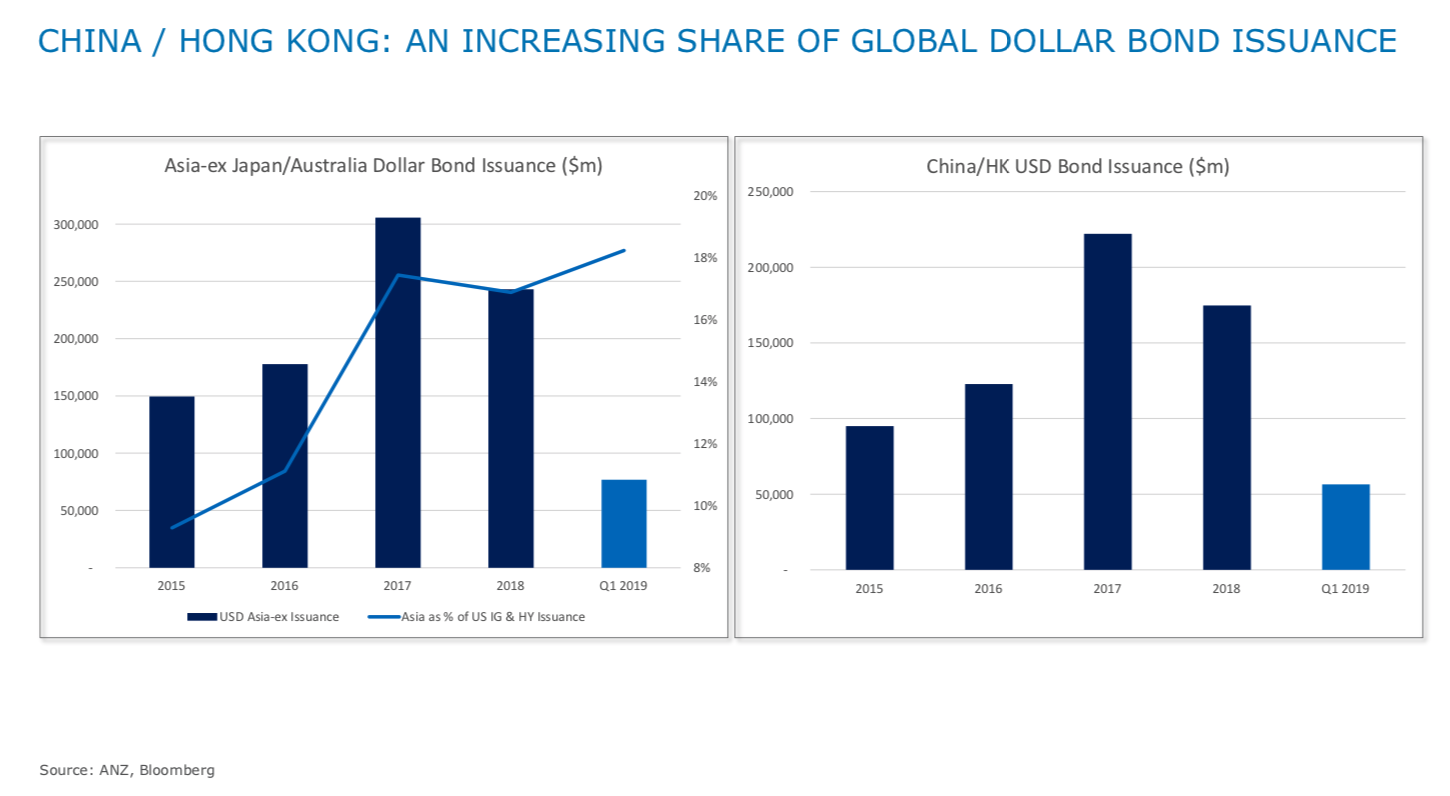

In 2018, China and Hong Kong bond issuers accounted for $US175 billion of US dollar bond volume in Asia excluding Japan and Australia, a 72 per cent share of the $US243 billion-strong market. The Hong Kong-centred US dollar Asia bond market offers a broad and diversified universe across corporates, state-owned entities and sovereigns with 69 per cent rated investment grade, 13 per centnon rated, and 18 per cent high yield rated.

In addition to the US dollar market, global issuers and investors can tap alternate pools of liquidity such as the Hong Kong dollar bond market and the Dim Sum bond market which are bonds issued outside China but denominated in Renminbi.

The pipeline is looking strong, as it will include issuance from Chinese and Hong Kong banks who need to raise up to $US800 billion in Total Loss Absorbing Capacity (TLAC) bonds to fulfil regulatory requirements to shore up their balance sheets and prevent a repeat of the Global Financial Crisis. These banks will have to tap most global bond markets including Hong Kong to raise such a significant volume of new capital.

Green financing push

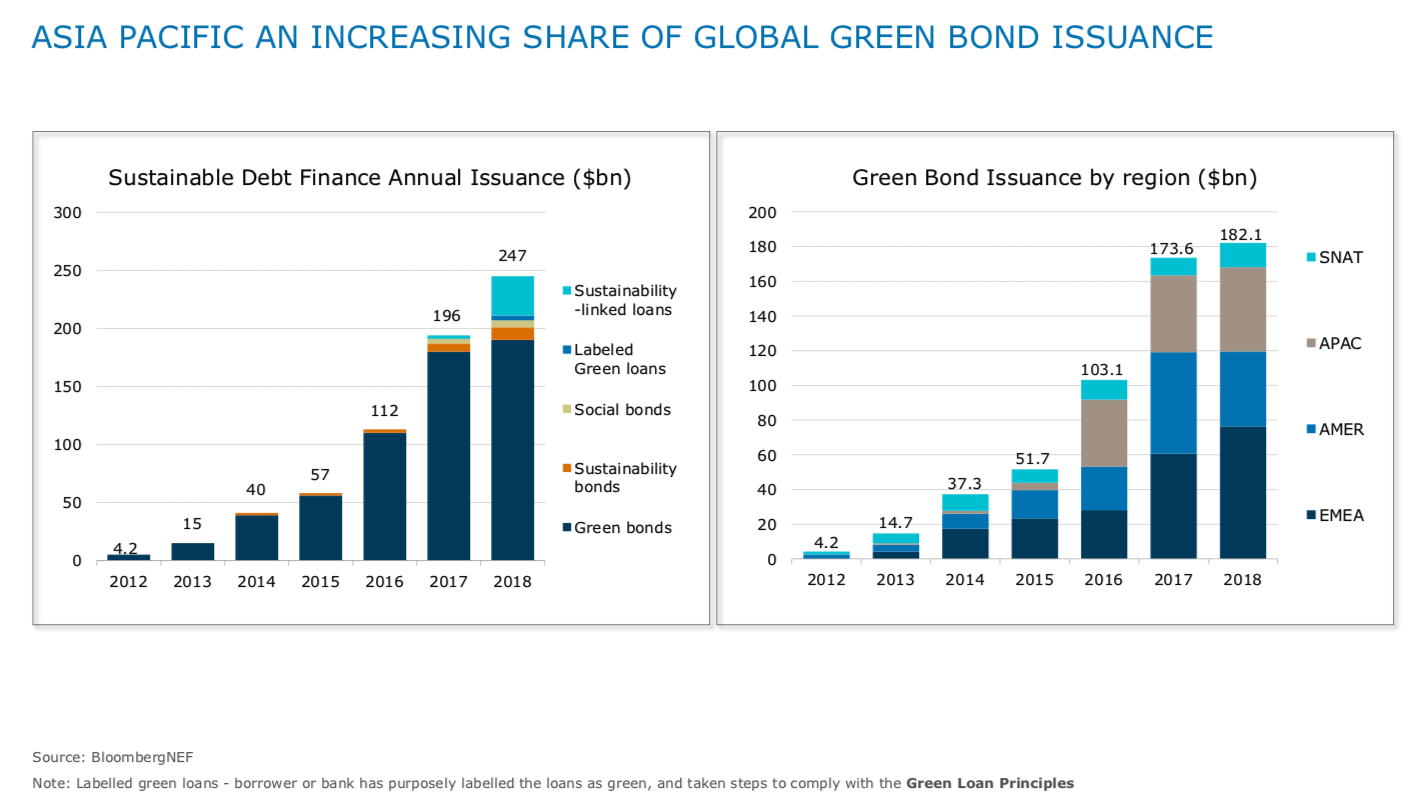

The Hong Kong government’s initiative to develop a green financial system to cultivate green loans and bonds as well as green development funds will further anchor Hong Kong's position as a global bond centre.

_________________________________________________________________________________________________________

“CHINA’S TRANSITION TO A LOWER-CARBON ECONOMY AND THE DEVELOPMENT OF GLOBAL MARKET STANDARDS IN ENVIRONMENTAL, SOCIAL & GOVERNANCE INVESTMENTS WILL BE ANOTHER KEY PLANK TO Hong Kong’S POSITION AS A GLOBAL BOND CENTRE.”

ANSHUL SIDHER, HEAD OF TRADING AND MARKETS ASIA, ANZ

_________________________________________________________________________________________________________

The Hong Kong Monetary Authority has established a $HK100 billion green bond programme, the world’s largest sovereign green bond programme, which will help attract more Chinese and international issuers and investors to the city.

So China’s transition to a lower-carbon economy and the development of global market standards in Environmental, Social & Governance (ESG) investments will be another key plank to Hong Kong’s position as a global bond centre.

Improving credit analysis

International rating agencies Fitch Ratings, Moody’s and S&P have been taking concrete steps to improve their research, analysis and access to the issuers in China as bond defaults are slowly rising.

The three rating agencies have applied to the regulator to operate independent entities in China with S&P going further to secure approval to rate domestic bonds. These developments are all key towards greater credit differentiation in both the onshore and offshore bond markets.

Hong Kong is uniquely positioned for both Asian investment dollars diversifying to global bond markets such as Australia and the US, as well as for global investors raising their weightings to China and Asian fixed income markets.

Anshul Sidher is Head of Trading and Markets Asia at ANZ

This is an edited version of comments made at the 6th Annual RMB Fixed Income & Currency Conference in Hong Kong on April 2, organised by stock market and futures operator HKEX

RELATED INSIGHTS AND RESEARCH

insight

Looking for Opportunity in a Geopolitical Recession

We have entered a new world order where the U.S. is no longer the global leader – and that has ramifications for not just economies, geopolitics and security but even the shape of the internet, according to Ian Bremmer, one of the world’s most highly regarded political scientists.

insight

Australian business taking a lead in ASEAN

ASEAN's growing population and affluence is attracting more Australian businesses looking for trade and investment opportunities.

insight

Institutional Term Loans taking off in Australia

Australian corporates are increasingly tapping Australia’s superannuation funds and institutional investors for longer-dated loans and to diversify their funding sources away from the bank market, paving the way for a slow evolution of a direct lending market.