Insight

In Asia, the worst is behind us

Sanjay Mathur, Chief Economist, Southeast Asia & India | January 2019

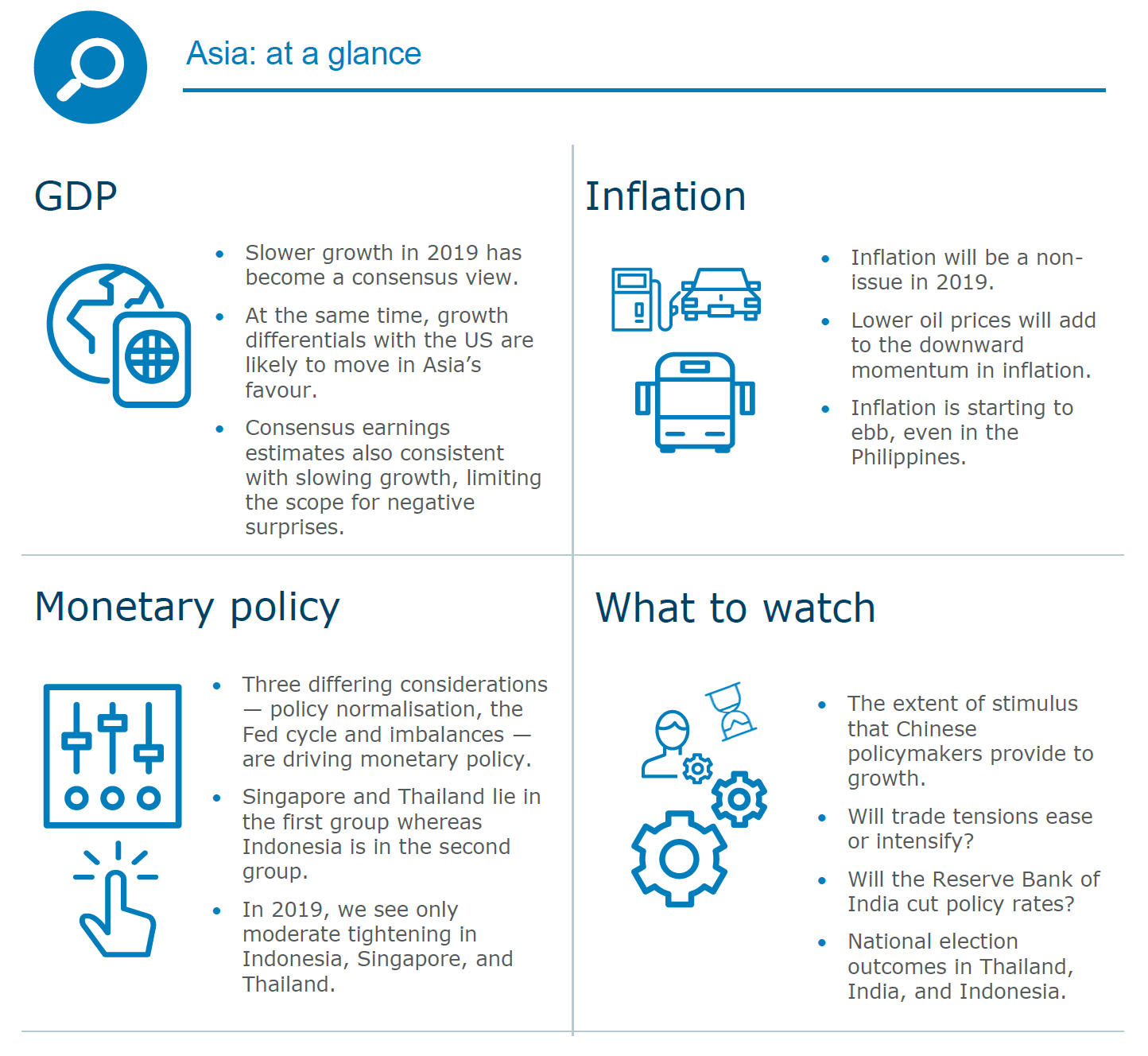

Growth will continue to slow but businesses can expect a better environment for capital flows into the Asia region in 2019.

The region’s economic activity is poised to slow further amid a maturing global trade cycle and falling demand for technology products.

Regional export growth, though volatile, has been trending weaker after peaking in early 2018. Global trade forecasts suggest further moderation in 2019.

Importantly this slower growth has been priced in and the scope for further shocks has receded.

Moreover, the worst phase of current account deterioration has now passed and central banks in most Asian economies can finally become more relaxed on monetary policy.

_________________________________________________________________________________________________________

"Importantly this slower growth has been priced in and the scope for further shocks has receded.”

Sanjay Mathur, Chief Economist, Southeast Asia & India, ANZ

_________________________________________________________________________________________________________

Grow less

Slower growth in China and tighter global liquidity are additional headwinds but as they have already played out to considerable extent their impact on Asian growth should be incremental.

Narrowing growth differentials between the US and Asia were a major source of volatility for markets in 2018. Although emanating from slower growth in the US, this will likely widen in 2019.

While accelerating growth in Asia would have been the ideal backdrop for markets, the widening still suggests a better geographical balance in portfolio flows.

Encouragingly, more recent consensus earnings forecasts have also been pared down and are directionally in sync with the anticipated course of the business cycle.

This consistency is important as it limits the scope for downside surprises and by implication portfolio flows. Earnings growth forecasts for the US continue to remain superior to those of Asia but are directionally also converging.

For most Asian economies earnings are forecast to either contract or rise by low single digits. Both developments are favourable as they reduce the scope for downside surprises.

Sanjay Mathur is Chief Economist, Southeast Asia & India at ANZ

This story is an edited version of a piece which appeared on bluenotes.

This is an edited version of an ANZ Research report. Registered clients can read the full report at ANZ Research.

You can read more about global markets HERE.

RELATED INSIGHTS AND RESEARCH

insight

Looking for Opportunity in a Geopolitical Recession

We have entered a new world order where the U.S. is no longer the global leader – and that has ramifications for not just economies, geopolitics and security but even the shape of the internet, according to Ian Bremmer, one of the world’s most highly regarded political scientists.

insight

Australian business taking a lead in ASEAN

ASEAN's growing population and affluence is attracting more Australian businesses looking for trade and investment opportunities.

insight

Institutional Term Loans taking off in Australia

Australian corporates are increasingly tapping Australia’s superannuation funds and institutional investors for longer-dated loans and to diversify their funding sources away from the bank market, paving the way for a slow evolution of a direct lending market.