Insight

Is blockchain a false idol?

MARIA BELLMAS, ASSOCIATE DIRECTOR, TRADE & SUPPLY CHAIN, ANZ | MARCH 2019

We’re well past peak bitcoin. Are we approaching peak blockchain, the currency’s much-hyped underlying technology?

Blockchain has been the darling of the tech world for some time and increasingly so over the medium term, perhaps in part pushed by scorned crypto fanatics grasping for some justification of their obsession in the wake of the bitcoin collapse.

But unlike crypto, blockchain is real and tangible. Its distributed ledger technology is seemingly here to stay; the market is awash with interest in it and a large number of financial institutions – including ANZ - have begun work on projects involving it.

Research suggests by 2022 more than $US11.7 billion will be invested in blockchain solutions, with the total value of the tech to reach $US3 trillion by 2024. Yet while the blockchain hype is unquestionable, voices questioning blockchain’s maturity and effectiveness are becoming louder.

In 2018 the CEO of Spanish group BBVA, Carlos Torres, suggested there were some significant challenges ahead for a technology he called “not mature”. Like many in the market he sees value in the application of the tech "when it is mature and the regulators are ready".

The question is when – or if – that will occur.

Searching

Writing in Forbes, professor and economist Yuwa Hedrick-Wong says the collapse of bitcoin has left blockchain “an invention looking for a viable commercial application”.

“Because… applications of the blockchain technology have yet to be realised, the valuation of the technology today is therefore exactly zero,” he says.

“This does not mean that blockchain is useless. It could be the transistor of the 21st century or it could end up in the garbage heap of technological inventions that failed to find a commercial application. We will have to wait and see.”

Kai Stinchcombe in American Banker is less subtle, questioning if there is any practical use for distributed ledger tech at all.

“Everyone says the blockchain, the technology underpinning cryptocurrencies such as bitcoin, is going to change everything,” he writes. “And yet, after years of tireless effort and billions of dollars invested, nobody has actually come up with a use for the blockchain — besides currency speculation and illegal transactions.”

_________________________________________________________________________________________________________

“The voices questioning blockchain’s maturity and effectiveness are starting to get louder.”

MARIA BELLMAS, ASSOCIATE DIRECTOR, TRADE & SUPPLY CHAIN, ANZ

_________________________________________________________________________________________________________

The reality is a lot of the problems blockchain projects attempt to fix have already been solved by existing technologies. In many cases, a regular database can solve for the problem with more reliability and for much less cost than blockchain.

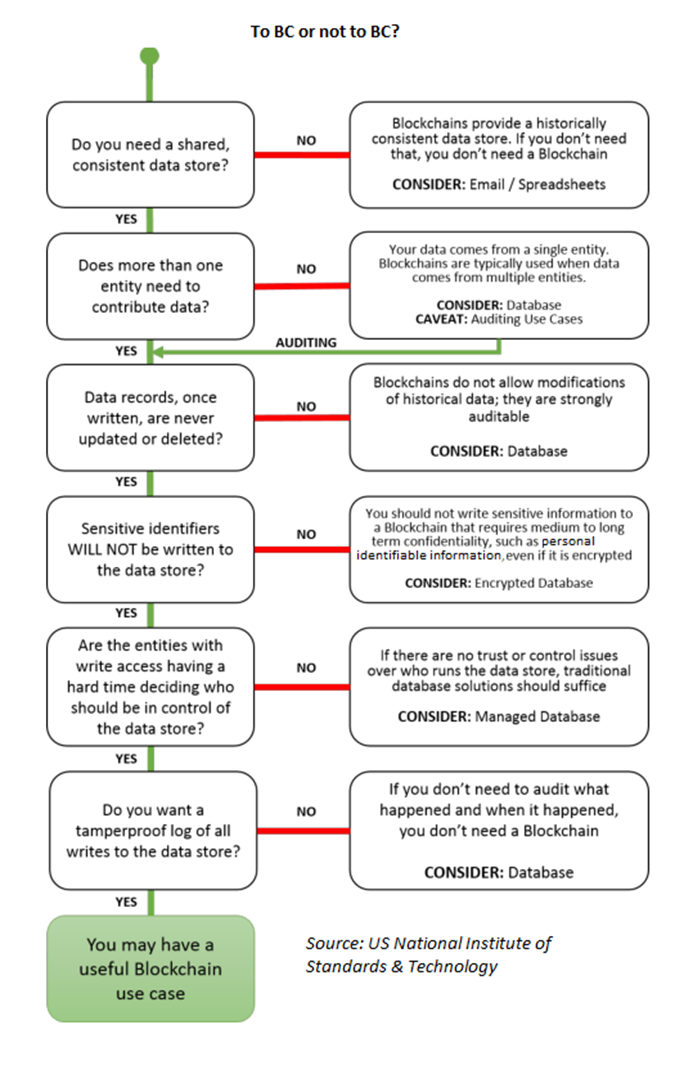

As a 2018 report from the US National Institute of Standards & Technology says, blockchain “relies on existing network, cryptographic and recordkeeping technologies but uses them in a new manner”.

Blockchain has only been available in recent times and its scalability is yet to be proven. Some databases offered by leading technology providers have been in the market for years and have a proven record of processing millions of transactions per day without failure.

Companies therefore need to do a thorough exercise to analyse the problem they are trying to fix and assess if blockchain really is the technology that best fits the solution.

When it works

Don’t peg us as philistines; blockchain is a technology with a huge number of benefits and it is particularly proving useful in the trade finance space.

ANZ is one of seven banks participating in the eTradeConnect in Hong Kong, an innovative project led by the Hong Kong Monetary Authority which makes use of blockchain technology.

eTradeConnect is “an endorsement not only of the technology but also a broad digitisation strategy within the trade finance world, which is overdue”, ANZ Banking Services Domain Lead, Nigel Dobson, says.

Another example is the digitisation of guarantees in Australia. The challenges many users of guarantees experience such as tracking, reporting and transparency of a guarantee’s status and the lack of standardisation highlight the need for a database with several non-trusting writers: banks, applicants and beneficiaries.

A blockchain, which can be relied on as the single source of truth for the existence and status of a bank guarantee, can effectively solve for the issue.

What is blockchain?

Blockchain is a system of record where each participant shares one single ledger - a source of truth maintained by all organisations and/or users. You can read bluenotes’ blockchain 101 here.

The ‘distributed ledger’ is a shared, trusted book no single body controls and everyone can access - protected with advanced technology which ensures authenticity.

As Chris Venter writes, all participants in a blockchain “must agree the ledger and transactions to be stored in it are valid before the ledger is updated.”

“Any participating node in the blockchain can review the entries. Once a transaction is written to the blockchain it is extremely difficult to erase. The ledger keeps a record of every transaction ever posted to it since it was started.”

Not every one

The truth is blockchain is not the solution for every project that needs a database. A 2018 study out of China showed despite the plethora of blockchain-related projects entering the market, 92 per cent failed – and did so in an average of just over a year.

As the US NIST report concludes, blockchain “is still new and organizations should treat blockchain technology like they would any other technological solution at their disposal--use it only in appropriate situations”.

An example of a global project not using blockchain is the recently announced Trade Information Network, a transformational trade information exchange hub based on open architecture that acts as a trusted registry of purchase order and invoice flows across the end-to-end supply chain.

The TIN, in which ANZ is a participant, tries to solve the lack-of-standardisation problem currently in global trade finance. It has the potential to be the first inclusive global multi-bank, multi-corporate network in trade finance, aiming to achieve a utility much as SWIFT does with payments.

The Network in this case acts as the trusted intermediary for the database as it is owned by the industry, operates for the industry transparently and uses open architecture and standardised connectivity.

The project assessed a blockchain solution but decided the tech was not yet ready, on the back of speed-to-market and scalability concerns - particularly around handling high volumes of transactions across more than 100 countries. The network will have the option to move to blockchain when the technology matures.

To blockchain or not?

Many companies fall into the trap of admiring the blockchain technology before admiring the problem they are trying to solve. It’s vital to understand what the end goal is and assess what the options are before starting the work on any project where blockchain is being considered.

While some projects will benefit from blockchain technology and this has a lot of potential, others do not necessarily need it and are better off using existing good old databases and technology solutions.

Maria Bellmas is Associate Director, Trade and Supply Chain Product at ANZ

RELATED INSIGHTS AND RESEARCH

insight

Data, security & value in payments

Two experts share their insights into data its changing use revolutionises businesses.

insight

Robots, productivity & the destruction of jobs

What will the tech revolution do to jobs? We still don’t know but there are some firm ideas.

insight

Institutional Term Loans taking off in Australia

Australian corporates are increasingly tapping Australia’s superannuation funds and institutional investors for longer-dated loans and to diversify their funding sources away from the bank market, paving the way for a slow evolution of a direct lending market.