Insight

More needed to fill green gap: CBI

SHARON KLYNE, ASSOCIATE DIRECTOR, INSTITUTIONAL COMMUNICATIONS, ANZ | AUG 2019

A report from the Climate Bonds Initiative has called for more green investment in Australia, such as sustainable bonds, loans and other products, along with greater engagement between the private sector and government around infrastructure development to manage climate risk.

Launched in Sydney, the CBI’s Green Infrastructure Investment Opportunities 2019 report identifies a pipeline of over 350 green infrastructure projects with energy, transport, water, waste and buildings as key priority areas.

However development is hampered by an absence of a sustained national policy around carbon emissions.

“Despite some progress, sustained emissions reduction has not been effectively integrated into [Australia’s] infrastructure priorities,” the report said.

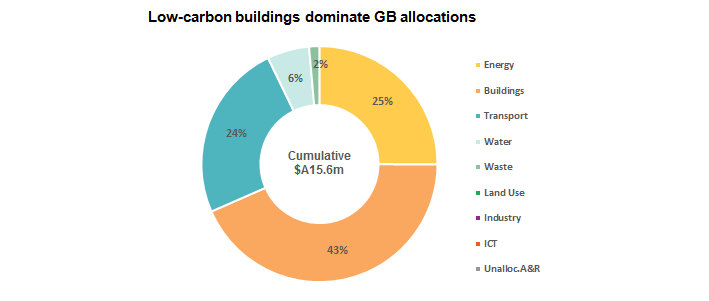

Low-carbon buildings dominate green bond allocations with a 43 per cent share, the CBI reports. Source: CBI.

_________________________________________________________________________________________________________

“Despite some progress, sustained emissions reduction has not been effectively integrated into [Australia’s] infrastructure priorities.”

-CBI

_________________________________________________________________________________________________________

Green finance

Australia has maintained its position as the third-largest green bond market in Asia Pacific with $A6.0 billion of issuance in 2018, according the CBI, nearly double the $A3.3 billion issued in 2017. Issuance in the first half of 2019 is a healthy $A3.9 billion.

However the CBI notes green issuance from listed companies is lagging - apart from banking, property and retail companies.

“The Australian and New Zealand sustainable finance market is accelerating with the emergence of loans in both green and sustainability-linked formats,” Christina Tonkin, Managing Director, Loans & Specialised Finance, ANZ said.

“This follows the growth of green bonds over the last three to four years.”

One of the key developments in 2019 is the emergence of green and sustainability linked loans. Highlights have included the $A880 million green loan for Brookfield Place Perth Tower 1 and Tower 2, the largest single asset green syndicated loan in Australia and a $A1.4 billion syndicated sustainability linked loan for Sydney Airport, the largest syndicated loan in this format in Australia, Asia Pacific and the airport sector at that time.

Sharon Klyne is Associate Director, Institutional Communications at ANZ

You can read the CBI’s press release on the latest report HERE.

RELATED INSIGHTS AND RESEARCH

insight

The future of sustainable finance, in pictures

There’s ample evidence of increasing market maturity towards green debt, according to an ANZ/FinanceAsia poll

insight

Green market broadens asset base

Sustainability takes centre stage in the second part of our expert conversation into credit markets ahead of ANZ’s conference in the Hunter Valley.

insight

The Genesis of an investment for good

Social impact financing like the G-Fund Social Investment Bond is helping parties on both sides of the investment aisle.