ANZ FIG CONVERSATIONS THAT MATTER - LIFE AFTER LIBOR BEYOND 2021

NAVIGATING THE COMPLEXITIES OF REPLACING THE LIBOR BENCHMARK

Download the PDF

_______________________________________________________________________________________________________________

IT APPEARS THE IMMINENT DEMISE OF THE LONDON INTERBANK OFFERED RATE, COMMONLY KNOWN AS LIBOR, IS PUSHING FINANCIAL MARKET PARTICIPANTS AND CORPORATE EXECUTIVES INTO TWO DISTINCT CAMPS: THOSE OPTING TO PLAN-AND-LEAD THE DISRUPTION AND THOSE TAKING A WAIT-AND-SEE APPROACH.

_______________________________________________________________________________________________________________

Shifting away from the lending benchmark is unquestionably a massive task – LIBOR underpins more than USD400 trillion worth of contracts for loans, bonds, derivatives, among other instruments.1 Finding another suitable rate and then rewriting thousands of existing contracts will require major restructuring and legal assistance. Moreover, the fallout from this switch is likely to extend well beyond day-to-day operations and could impact business strategies, due to accounting treatments, reporting valuation methods, and Fund Transfer Pricing impacts.

In order to limit the uncertainties, risks and related costs, it is vital to proactively plan for an orderly transition and constantly question the processes in motion. What scenarios need to be considered after the 2021 deadline passes? Can tangible steps be taken early on to minimise vulnerabilities? And how do the alternative rates stack up, especially as repo volatility is impacting one of the major new rates, the SOFR? Those were some of the issues that our guest speakers and audience members delved into at our latest “Conversations That Matter” event - held in Hong Kong and Singapore - on preparing for the end of what is often called “the most important number in the world”.2

APPROACHING THE EXPIRATION DATE

LIBOR, a measure of the borrowing costs between banks for unsecured short-term loans, has formed the foundation of millions of financial contracts worldwide for decades now. But despite the rate’s ubiquity, doubts had surfaced in recent years about its integrity and value.

A 2014 study by the Financial Stability Board (FSB), which reviewed the reliability and robustness of interbank benchmarks, recommended the development of alternative nearly risk-free rates (RFRs) and proposed ways for financial markets to adopt them instead.3

Meanwhile, efforts by the UK’s regulatory body, the Financial Conduct Authority (FCA), to reform LIBOR led to the conclusion that the benchmark was potentially “unsustainable” and “undesirable” in the long run. In 2017, the FCA said it would not compel banks to submit their LIBOR quotes after December 2021, effectively giving it an expiration date.4

Those announcements spurred regulators in several jurisdictions, including the US, Switzerland and Japan, to advance their own domestic RFRs to gradually replace LIBOR. However, the sheer scale of the undertaking at hand, given LIBOR’s pervasiveness in the fabric of global markets, is proving to be daunting and difficult.

As Matthieu Sachot, a director at management consultancy Chappuis Halder & Co., told our Hong Kong audience, the volume of assets in the firing line is significant.

“You have to consider your loans, your debt securities, your equity securities. You have to account for your liabilities and then account for the indirect impact to your P&L, for example,” he said, adding off-balance sheet items such as credit facilities, swaps, futures, options and collateral to the list.

Kush Handa, Head of Balance Sheet Trading North East Asia for ANZ, also outlined the challenges ahead. “It’s an incredible amount of work because we have an incredible amount of exposure across a variety of asset and liability classes. I think the most amount of work, obviously, is looking at contracts,” he said.

Regarding contracts, there are concerns that legacy covenants do not sufficiently deal with the prospect of changes in the underlying benchmark, and that the interim provisions would need to be addressed urgently in a post- LIBOR era.

“The contracts have some kind of fallback regime which, to a greater or lesser degree, does give comfort as to what rates would be applied in the situation where LIBOR is either not available or is not appropriate,” explained Fiona Cumming, a partner at law firm Allen & Overy. “But they are typically temporary measures and they are not designed to be used on a going-forward basis.”

For instance, all floating rate instruments would suddenly turn into fixed rate ones from January 2022 because the rate would remain stuck at last LIBOR quote calculated on 31 December 2021.

According to Cumming, such cases place a real emphasis on trust and fairness as the financial institutions involved would be obliged to clearly communicate the risks to their clients to avoid any disputes.

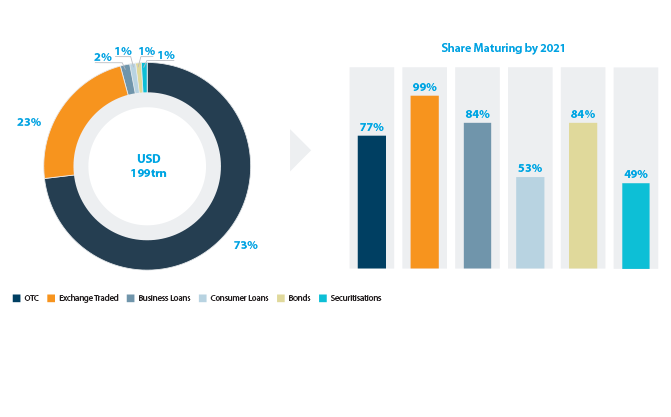

FIGURE 1:

Estimated USD LIBOR based contracts and share maturing by end 2021

Source: The Alternative Reference Rates Committee (ARRC) Second Report, March 2018.

Notes: Data are gross notional exposures as of year-end 2016. Estimated maturities based on historical pre-payment rates. The percentages in the chart may not add up to exactly 100% due to rounding off.

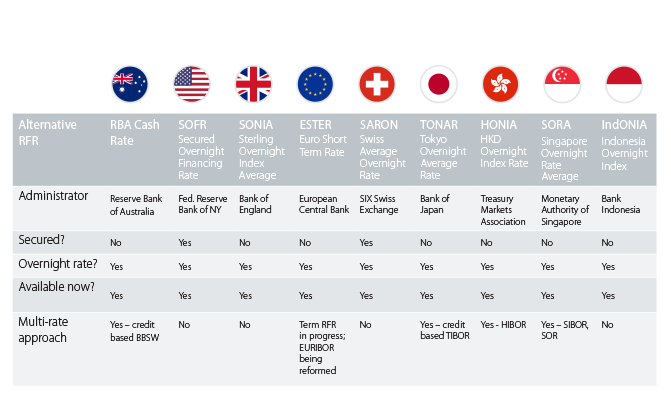

FIGURE 2:

Alternative Risk Free Rates (RFRs) in selected currencies

Source: Reserve Bank of Australia, Fed Reserve Bank of NY, Bank of England, European Central Bank, SIX Exchange, Bank of Japan, Treasury Markets Association, Monetary Authority of Singapore,Bank Indonesia

CHALLENGES TO RFR MIGRATION

As regulators call ‘last orders’ on LIBOR,5 they have each selected their successor to the benchmark. Sterling Overnight Index Average (SONIA) is the Bank of England’s pick, while the US Federal Reserve has chosen the Repo-based Secured Overnight Financing Rate (SOFR).

But for market participants and stakeholders, the substitution is far from simple due to the fundamental differences in the characteristics of the rates. Most notably, SONIA and SOFR are overnight rates based on actual transaction data, therefore incorporating them requires substantial credit and term adjustments.

“Right now, if you’re looking at replacing LIBOR, and most of the banks are in this boat, you’re going to have to make do with something that doesn’t address what LIBOR was able to achieve, for all its faults,” explained Handa. “At this point, we don’t have anything with a term or credit component to it, so something as simple as a cross-currency swap is going to be very complicated.”

Cumming agreed that the backward-looking nature of RFRs had dimmed the appetite for them in certain spaces. “From a loan market perspective, we like forward-looking, we like fixed-term, and we like to have the credit element built into that as well,” she noted. “There’s a lot of debate about how we’re going to turn an RFR into something that’s more forward-looking. But at the moment there’s certainly no market consensus on how that’s going to be done.”

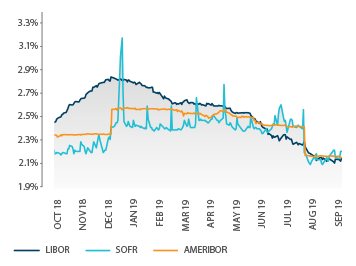

FIGURE 3:

LIBOR and potential replacement rates

Source: Bloomberg

Although the New York Fed argues that SOFR is much more resilient and transparent than LIBOR,6 many lenders and borrowers say they will not migrate to it until a robust forward-looking version is brought to the table. Consequently, the relatively low levels of SOFR-linked issuance means not enough liquidity has been developed in the market and, according to our expert panellists, this is problematic given the status of the US dollar as the world’s reserve currency.

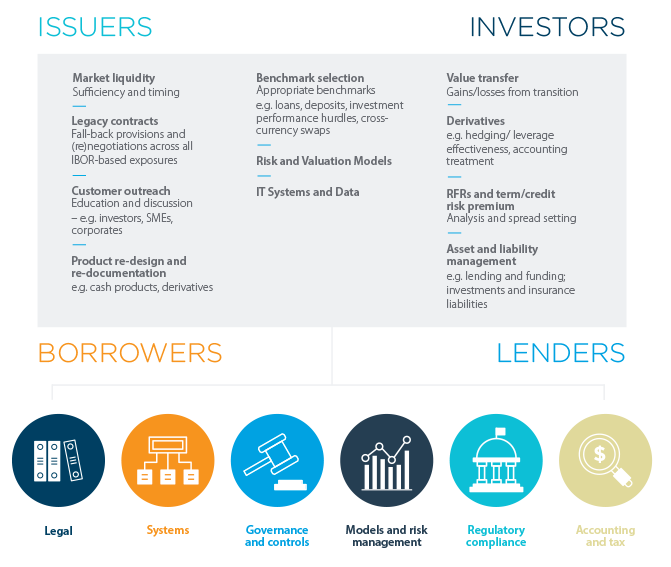

FIGURE 4:

Transition considerations for financial institutions

ESTABLISHING A ROADMAP FOR CHANGE

The lack of clarity on LIBOR alternatives is certainly clouding the horizon for the financial services industry and their customers. As a result, several firms and banks are continuing to issue LIBOR-based contracts in the hopes that the deadline will be flexible - or even disappear.

Indeed, the voluntary aspect of the transition has created a grey area where the market approach is leaning towards wait-and-see. “If an authority comes out and says we’re going to stop LIBOR on this date, I think that would be the watershed moment for everybody because we’re dancing around this topic,” said Handa.

Nevertheless, our event speakers shared the view that the discontinuation of LIBOR was an eventual probability, so it is imperative to formulate a roadmap and avoid being caught off guard. Their checklist includes examining exposure to LIBOR and non-LIBOR products, preparing transition and contingency plans, updating risk and operational systems, and weighing up a combination of RFRs.

“Stress test your models, stress test your curves. You have to stress test your day-to-day operations and dispute management,” advised Sachot.

_______________________________________________________________________________________________________________

IF WE’RE NOT ALL INVOLVED IN THE CONVERSATION THEN WE CAN’T INFLUENCE THE OUTCOME

_______________________________________________________________________________________________________________

“If we’re not all involved in the conversation then we can’t influence the outcome,” added Cumming, highlighting that being engaged in discussions and consultations are crucial steps in successfully navigating the complexities of replacing LIBOR.

As the transition timeline gets closer, many work-streams under various regulatory bodies, trade associations, and service providers will be picking up speed and it is imperative for market participants to fine-tune their transition plans accordingly and keep engaging relevant stakeholders. ANZ organized conferences on this topic in Australia and Asia to share key learnings and recommends that companies consider taking a pro-active approach in terms of engaging your clients and counterparts, and take the lead in planning and developing solutions to ensure you manage the potential outcomes that could affect you in a post LIBOR world.

1. BIS Quarterly review, March 2019, “Beyond LIBOR: a primer on the new reference rates”. https://www.bis.org/publ/qtrpdf/r_qt1903e.pdf

2. https://news.bloombergtax.com/financial-accounting/libors-looming-endleaves-hedgers-lenders-in-a-bind

3. https://www.fsb.org/2014/07/r_140722/

4. https://www.fca.org.uk/news/speeches/the-future-of-libor

5. https://www.bankofengland.co.uk/events/2019/june/last-orders-calling-time-on-libor

6. https://www.newyorkfed.org/arrc/sofr-transition

Contacts

Annabel Squier, Head of Financial Institutions, North Asia, ANZ, Annabel.Squier@anz.com

Robert Tsang, Director, Client Insights & Solutions, FIG, ANZ, Robert.Tsang@anz.com

Matthieu Sachot, Director, Chappuis Halder & Co, msachot@chappuishalder.com

John Corrin, Head of Loans Syndications, ANZ, John.Corrin@anz.com

Samson Yip, Head of Investor and Solution Sales, ANZ, Samson.Yip@anz.com

This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.