FINANCIAL INSTITUTIONS GROUP NEWSLETTER

Retraining the Social Lens to Build an Inclusive and Sustainable Post-Pandemic Economy

Download the PDF

_______________________________________________________________________________________________________________

WHILST SOCIAL AND SUSTAINABILITY BONDS HAVE BEEN A KEY FEATURE OF SUSTAINABLE DEBT CAPITAL MARKETS IN RECENT YEARS, THE GLOBAL SPREAD OF COVID-19 HAS ACCELERATED DEMAND FOR THESE INSTRUMENTS, WHICH OFFER AN EFFECTIVE MEANS TO DIRECT CAPITAL TOWARDS MITIGATING THE HEALTH AND SOCIO-ECONOMIC IMPACTS OF THE PANDEMIC.

_______________________________________________________________________________________________________________

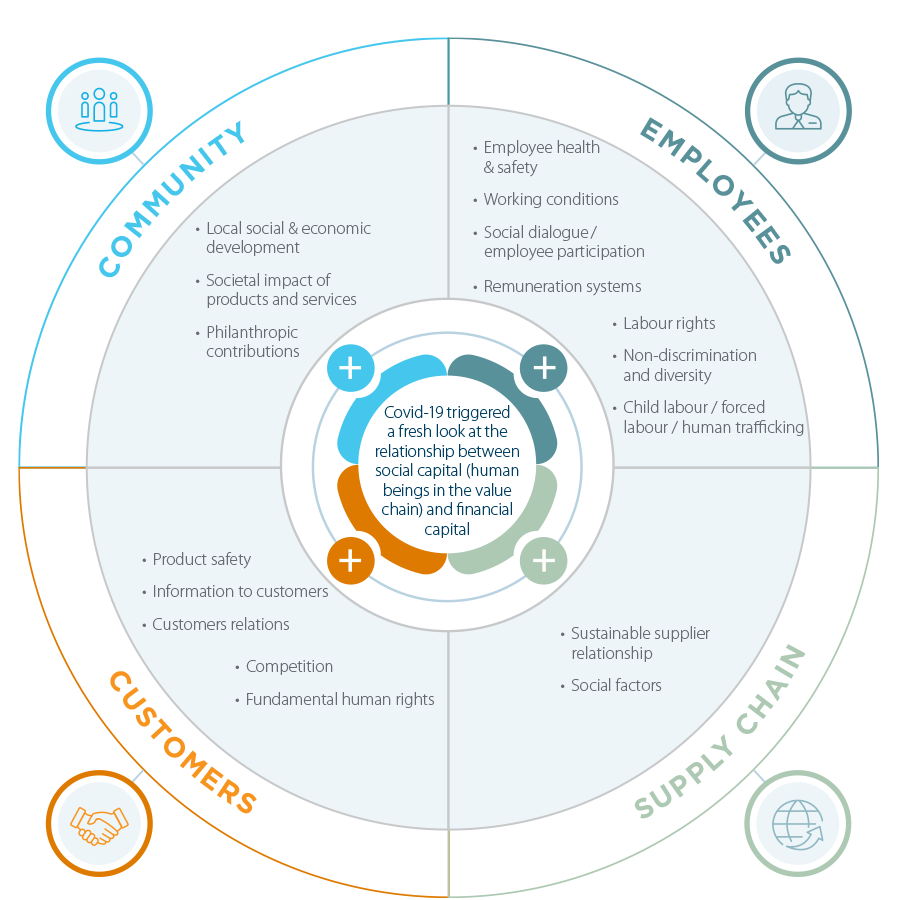

The outbreak has shone a spotlight on the material inequalities and disparities in social and economic factors worldwide. And, for corporates, banks and investors alike, it has become increasingly clear that a lack of social capital, be it employees, customers, or suppliers, can have a significant financial impact. This, in turn, has bolstered the argument for safeguarding and strengthening the world’s social fabric in order to build resilience into the global economy.

As governments quarantined their citizens and central banks rolled out record levels of fiscal and monetary relief, private companies and financial institutions joined the ranks of multilateral agencies to raise funds to repair the damage inflicted by the coronavirus on public health, the global economy and society at large. By June end, social bond issuances had already totaled USD 37.9 billion surpassing the USD 18.5 billion in issuances witnessed during all of 20191.

Now, as governments around the world lift lockdowns and look for ways to resurrect their economies, there is a growing recognition of the importance of human capital and a fresh urgency to filter our vision of the future with a social lens – to build back better and create a healthy, sustainable economy that is more equal in all respects than the one that existed before the advent of COVID-19. Various sustainable financing products, including social bonds, can help achieve this.

AN OPPORTUNITY FORGED BY CRISIS

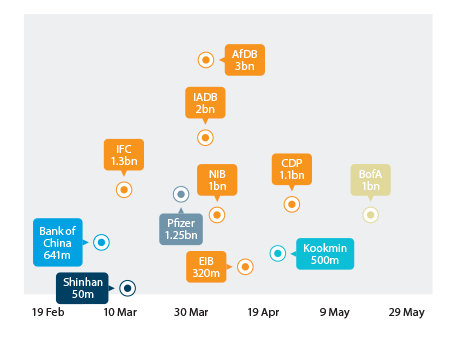

Image 1: Major COVID-themed Social / Sustainability Bond Issuances (USD)

Historically, social bond issuances have been driven by national and supranational public sectors, who continue to lead this part of the market. However, interest from commercial banks and private entities is growing (Image 1). At the same time, investors have been receptive – as demonstrated by the oversubscription of many issuances – indicating the market’s perception of social bonds as an effective instrument in helping to urgently tackle the outbreak’s economic and societal impact, and assist in the subsequent recovery process.

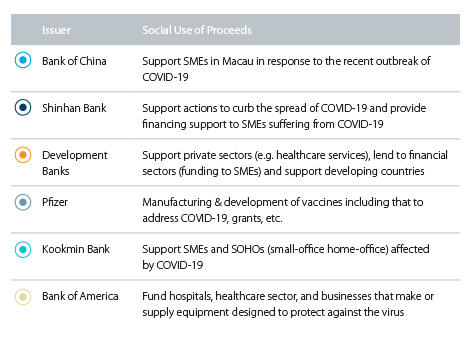

It’s not hard to see why social bonds are gaining market share now. They come with a specific focus: to raise funds for projects that directly address a social issue affecting a target population, and are tied to an aim to achieve measurable positive outcomes. The use of proceeds (UoP) categories that social bonds address (Image 2) – including enhancing access to essential services and employment generation – are particularly well suited to tackle some of the key challenges the world is now facing. Additionally, the target populations that the proceeds from social bond issuances seek to serve are, in many cases, the same that have borne the brunt of the lockdown and its attendant slowdown and related social ills.

Image 2: ICMA Social Bond Principles – Use of Proceeds Categories

In recognition of this trend and the increase in social bond issuances, the International Capital Market Association (ICMA)2 has issued guidance on how to direct funds to combat the outbreak, emphasising the applicability of the existing Social Bond Principles (SBP) in addressing the pandemic, and highlighting the scope to target a broad population with a COVID-19 themed social bond. Whilst social bonds have traditionally been required to focus on a target/vulnerable population(s), the sheer scale and breadth of the spread of the novel coronavirus has enabled the impact of social bonds to be directed towards the public at large.

ICMA’s guidance provides issuers with an opportunity to leverage the COVID-19 theme to customise social bonds in a format that best fits their business strategies and funding needs. This is helping to expand the impact, as demonstrated by the growing number of issuances aimed at enhancing healthcare infrastructure and other pandemic-related objectives, including addressing its economic impact by saving existing jobs and creating new ones.

Financial institutions and corporations with an established Sustainable Finance Framework and readily identifiable assets in their portfolios or focus areas aligned to social bond UoP are well positioned to quickly come to the market to raise funds under this format. For other entities, the pandemic has shown that it’s vital to shift strategies to include a sharper ESG lens and ensure their business strategy is resilient to both climate and social risks.

The development of a comprehensive sustainability strategy takes time, and even where this is established, if future sustainable finance issuance is contemplated, it is important to build a framework aligned with the principles outlined by the ICMA in order to be better positioned to issue a sustainable product when desired.

REDIRECTING CAPITAL TO AREAS WHERE IT’S NEEDED MOST

COVID-19 has reinforced the importance of the human component in global supply chains. The simple fact is, business is suffering because employees are unhealthy and customers don’t feel safe. Remote working and contactless transactions only go so far – business also needs to care about people’s wellbeing. And that means going beyond simply protecting any social license to operate.

_______________________________________________________________________________________________________________

BUILDING A RELIABLE REPOSITORY OF SOCIAL CAPITAL WILL REAP REWARDS IN THE FORM OF HIGHER LONG-TERM SUSTAINABLE FINANCIAL RETURNS.

_______________________________________________________________________________________________________________

The United Nations’ 17 Sustainable Development Goals (SDGs) – which include promoting good health, tackling inequality, creating gainful job opportunities, and reducing poverty and hunger – are interconnected and broadly linked to social bond UoP. Yet social and sustainability bonds account for less than 16% of the total sustainable bonds market3, largely due to the availability of UoP – the funding requirement by nature has been much lower than the universe of projects that can be classified as green, and the associated costs of those projects. This hurdle is compounded by the complications of defining exactly what constitutes a social project or cause.

Further, the difficulty in measuring the impact of a social bond has been an enduring issue. For instance, while the impact of a green bond used to build a renewable energy farm is easily calculated, say by the amount of clean energy generated, it is harder to monitor, report on and assess the social impact of certain initiatives. Yet progress is being made on this front with ICMA releasing a set of guidelines and recommendations, as well as clear definitions of outputs and outcomes, to aid the impact reporting process for social bonds4. The Global Impact Investing Network’s IRIS+ system also provides an excellent framework for measuring the impact of social-themed UoP5.

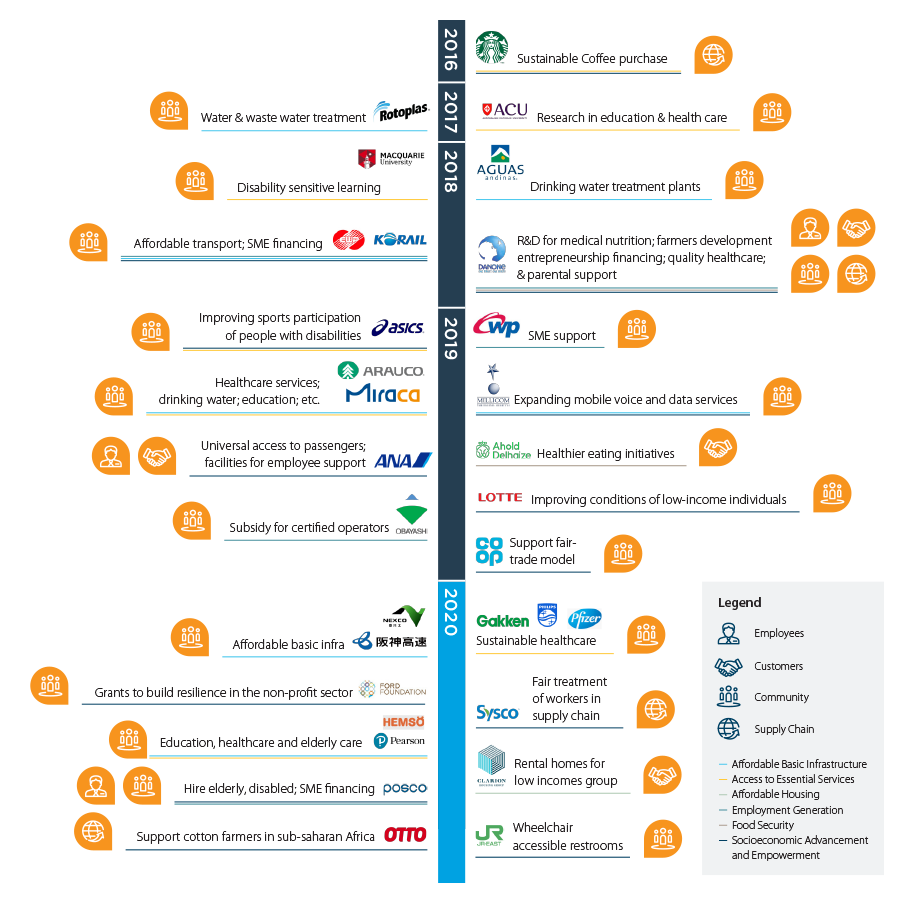

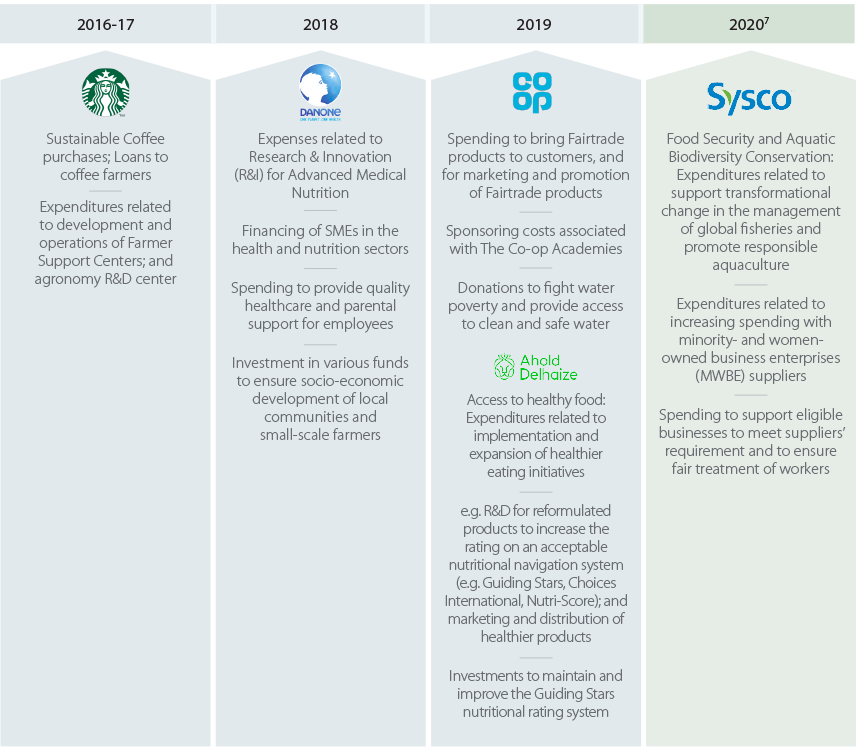

It’s also crucial to recognise how much social oriented UoP have evolved in a short period of time and the significant opportunities they offer for sustainable and inclusive growth (see Infographic 2). A key approach for maximising the use of social and sustainability bonds involves thinking broadly about their applications and beyond the current pandemic and the near term.

RECOGNITION OF THE PURPOSE OF SOCIAL UOP: FROM THE NICHE TO THE MAJORITY OF MARKET PARTICIPANTS

Infographic 26: Social Use of Proceeds Precedents

BUILDING BACK BETTER

The pandemic has raised the alarm on the levels of social inequality prevalent in specific demographics and countries around the world. We predict this will catalyse social bond issuance and we expect to see increased issuance well into 2021 as the recovery gathers speed.

Over the medium to long term, we can expect the focus to shift from addressing immediate healthcare concerns to deploying social bonds that can address other societal issues, building affordable housing and basic infrastructure, financing small and mid-sized enterprises, and overall socioeconomic advancement and empowerment, to improve the well-being and quality of life of human beings – who are the most important assets of all.

Banks have the opportunity to work together to aid businesses and society at large employ a social lens to the recovery efforts and ensure the world that is rebuilt is a better version in all respects than before (See Case Study below). Educating clients and other stakeholders in the various ways social bonds can be harnessed, and upholding industry best practices (including clearly defining UoP so that investors can readily recognise their social and financial value) are a major part of this process. The sum of these actions will help enhance transparency and maintain the overall credibility of social bonds. Most importantly, there is a need for banks and other financial institutions to continue to ingrain social and sustainable goals into their corporate strategy.

BANKS PLAY A CRUCIAL ROLE

Banks also have a crucial role to play in helping businesses and society at large employ a social lens to the recovery efforts and ensuring the world that is rebuilt is a better version in all respects than before.

CASE STUDY: FOOD, BEVERAGE AND AGRIBUSINESS (FBA) SECTOR

Take the food, beverage and agribusiness (FBA) industry, for example. The role banks play in encouraging the sector to adopt sustainable business practices can be illustrated by ANZ’s three-part strategy. This involves partnering with stakeholders to acknowledge the importance of human capital across the farm-to-fork supply chain; aiding socially conscious businesses, including by reducing capital carrying requirements; and, promoting the use of technology to track the impact of these measures and enhance their effectiveness.

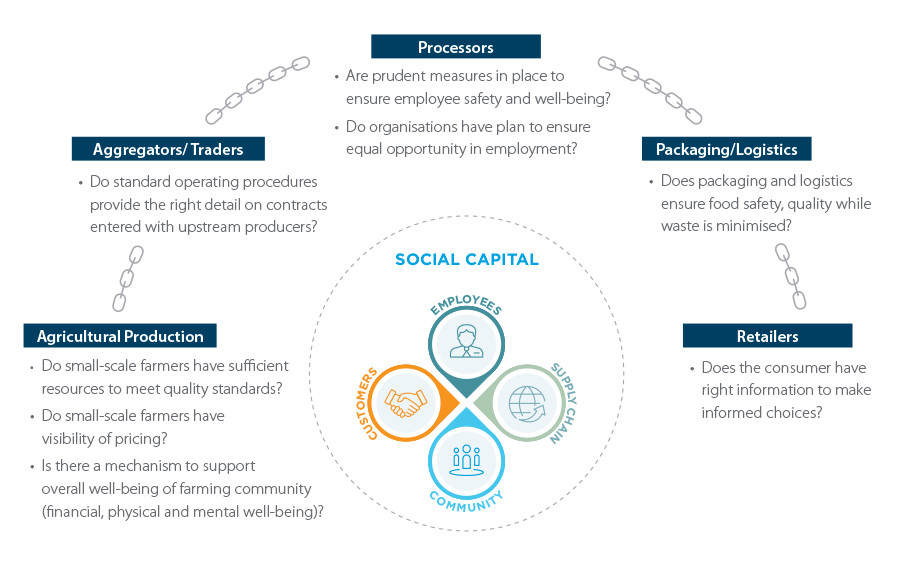

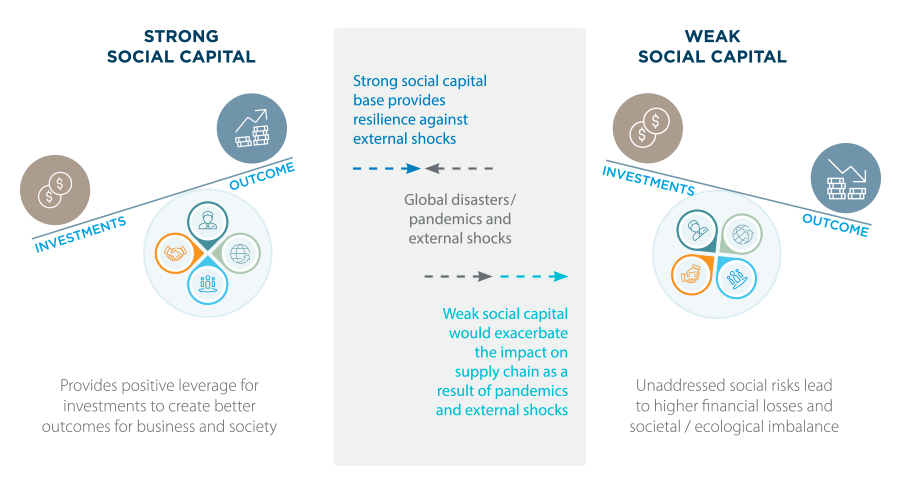

SOCIAL CAPITAL DRIVING SUPPLY CHAIN EFFICIENCY

STRONG SOCIAL CAPITAL BASE MAXIMISES INVESTMENT EFFICIENCY

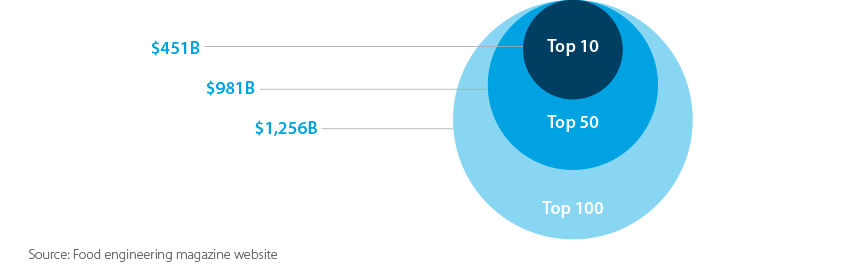

A DROP IN THE OCEAN

Despite rising volumes and innovative structures, these Social bond issuances are just a drop in the ocean. Far less than 1% of Top 10 FBA Co sales is currently invested to tackle Social issues.

Top 100 FBA companies food sales (USD)

Evolution of social use-of-proceeds issuances in FBA sector

_______________________________________________________________________________________________________________

BANKS CAN PROVIDE THE CAPITAL DIRECTLY OR INDIRECTLY (ACTING AS INTERMEDIARIES FOR CORPORATES), REQUIRED TO BE FUNNELLED TO ADDRESS THE SOCIAL VULNERABILITIES.

_______________________________________________________________________________________________________________

CONTACTS

ACKNOWLEDGEMENT:

We’d like to thank Jack Ang (Head of Syndicate, Asia) for contributing his expertise and valuable insights for this article.

1. Bloomberg NEF data, as at 22nd June 2020

2. https://www.icmagroup.org/green-social-and-sustainability-bonds/social-bond-principles-sbp/

3. Total Social & Sustainability Bonds – Bloomberg NEF data, as of 22nd June 2020

6. The list of precedents is not exhaustive; and UoP data belongs to Corporate issuances excluding FIs and Government issuances. Sources: UoP data is from Bloomberg as of June 30, 2020

7. As of June 2020; Source: Bloomberg

This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.