FINANCIAL INSTITUTIONS GROUP NEWSLETTER SEPTEMBER 2019

THE 21ST CENTURY PARADIGM OF SUSTAINABILITY

Download the PDF

_______________________________________________________________________________________________________________

IN THE PAST FIVE YEARS, SUSTAINABLE DEVELOPMENT HAS EMERGED AS A GLOBAL MEGATREND. IT HAS BEEN PROPELLED IN LARGE PART BY THE 2015 ADOPTION BY THE WORLD’S GOVERNMENTS OF THE UNITED NATIONS’ 17 SUSTAINABLE DEVELOPMENT GOALS (SDGS) AND THE PARIS AGREEMENT TO COMBAT CLIMATE CHANGE.

_______________________________________________________________________________________________________________

Meeting either will require significant funding. Take the SDGs (see box): ANZ estimates that to attain these will require ~$100 trillion. That is far more than governments can provide, and much of the capital will have to come from the private sector.

This means that the global financial system – and in particular the debt markets – has a major role to play here.

THE SDGS AND SUSTAINABLE FINANCE

The SDGs are a list of targets that countries have pledged to attain by 2030 in a range of areas - from poverty reduction to the environment, and from sanitation to building sustainable cities, to name just four.

Source: United Nations Development Programme

Sustainable finance refers to the funding of companies that actively contribute to sustainable development. The investment process typically involves reconciling economic performance with positive social or environmental impacts. Sustainable financing is that which seeks to address any of the 17 SDGs.

Its role covers two broad areas: funnelling capital towards available opportunities and taking on the risk inherent in such projects. In doing so, it relies on a broad ecosystem of players, including investors, corporations, governments and regulators, academia, financial services firms and service providers such as ratings agencies.

In tackling SDGs and climate change, this trend is also driving significant changes in environmental, social and governance (ESG) investing – as we shall see below.

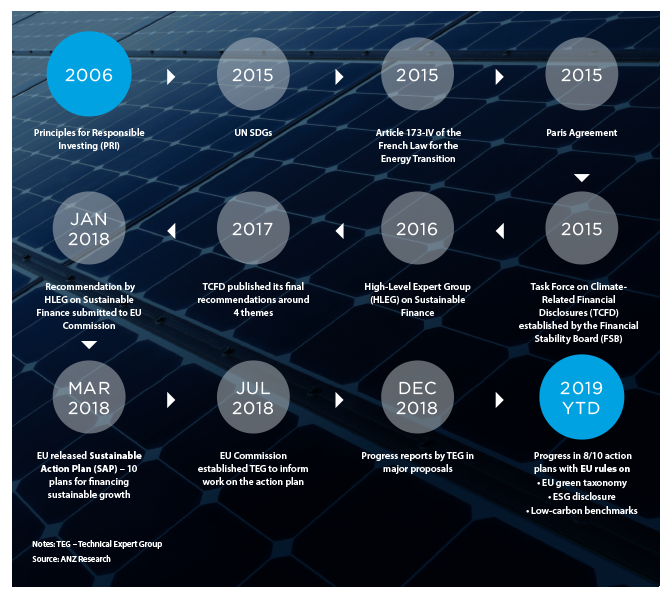

I. A REGULATORY WAVE

Nearly four years after the world’s nations signed off on the SDGs, there are sustainable finance initiatives in play in more than 501 countries.

To date, the frameworks and policies on sustainability born out of Europe are considered to be amongst the most influential in the global arena (see Figure 1).

FIGURE 1:

Key ESG Regulatory Policies and Frameworks in Europe

Most notably, the European Commission (EC)’s action plan on financing sustainable growth, adopted in 2018, is acting as a blueprint for policies development. The action plan has three key objectives:

- To reorient capital flows towards sustainable investment to ensure long-term, inclusive growth.

- To manage financial risks emanating from climate change, the depletion of resources, environmental degradation and social issues.

- To boost transparency and foster a long-term outlook in financial and economic activity.2

One of the jurisdictions that has adopted a similar blueprint approach is Australia. In 2019, the Australian Sustainable Finance Initiative was launched on the back of industry discussions, and is committing to issue a roadmap in 2020 to outline how the financial services sector can help to build a more resilient and sustainable economy in line with the SDGs and the Paris Agreement.3

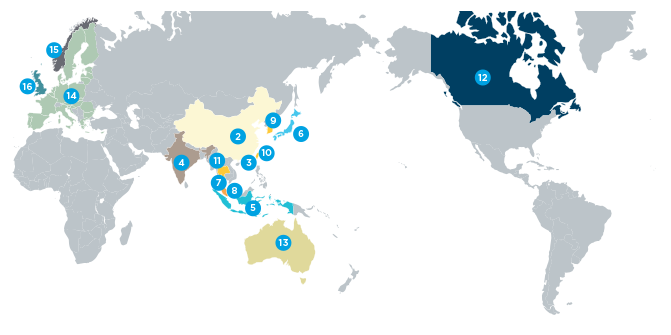

Similar work is underway in other countries including China, Japan, Canada, Norway, India, Indonesia and New Zealand. (see figure 2)

FIGURE 2:

Sustainability Initiatives Sprouting Around The World

1. GLOBAL INITIATIVES

• UN SDGs (2015)

• Paris Climate Agreement (2015)

• Task Force on Climate-related Financial Disclosures (TCFD) (2015)

• UN Principles for Responsible Investment (2006)

• UN Sustainable Stock Exchanges (SSE)

• Network for Greening the Financial System (NGFS) (2017)

• ASEAN Capital Markets Forum adopted the ASEAN Green Bonds Standards (2017)

2. MAINLAND CHINA

• NDRC’s Guideline for Establishing the Green Financial System (2016

• PBoC – Green Bonds and Green Loans incorporated into Macro-Prudential Assessment (MPA) (2017)

• TCFD Pilot project between the Chinese and UK governments (2018)

• PBoC and NDRC Green Bond guidelines (2015)

• NDRC Green Industry Guiding Catalogue (2019)

3. HONG KONG SAR

• HKMA‘s Key Measures on Sustainable Banking and Green Finance, incl. Green and Sustainable Banking, Responsible Investment, and Centre for Green Finance (CGF) (2019)

• SFC’s Strategic Framework for Green Finance (2018)

• HKSE ESG Reporting consultation (2019)

• HK Green Bond Grant Scheme (2018)

• HKQAA Green Finance Certification Scheme (2016)

4. INDIA

• SEBI issued Disclosure Requirements for Issuance and Listing of Green Debt Securities (2017)

5. INDONESIA

• Roadmap for Sustainable Finance by OJK (2014)

6. JAPAN

• METI’s The Guide for SDG Business Management (2019)

• MoE’s Green Bond Guidelines (2017) and support programmes

• METI’s Guidance for Climate Related Financial Disclosure (2018)

• TSE new platform for green and social bonds (2018)

7. MALAYSIA

• Bank Negara Malaysia issued guidance documents to encourage Islamic Banks towards sustainable finance (2018)

8. SINGAPORE

• MAS’s Sustainability Bond Grant Scheme (2019)

9. SOUTH KOREA

• National Pension Service Act requires NPS to consider ESG issues & to declare the extent to which ESG considerations are taken into account (2014, amended)

• Stewardship Code (2016)

• Green Posting System (2012)

• National Strategy for Green Growth (2009-2050)

10. TAIWAN

• Green Finance Action Plan (2017)

• Taipei Exchange Operational Directions for Green Bonds (2017, amended 2019)

• Corporate Governance Roadmap (2018-2020)

11. THAILAND

• Investment Governance Code (2017)

12. CANADA

• Expert Panel on Sustainable Finance (2018)

13. AUSTRALIA

• Sustainable Finance Initiative (2019)

• APRA launches Climate Change Financial Risk Working Group (2017)

14. EUROPEAN UNION

• Sustainable Finance Action Plan-

• Taxonomy

• EU Green Bond Standard

• Low carbon benchmarks

• Disclosure Regulation for rating agencies, investors & asset managers

• Shareholder Rights Directive II

• EU Non-Financial Reporting Directive

• Sustainable Blue Economy Finance Principles (2018)

15. NORWAY

• Roadmap for Green Competitiveness in the Financial Sector (2018)

16. UNITED KINGDOM

• Govt.’s Green Finance Strategy (2019)

• Green Finance Taskforce (2017)

• BoE/PRA climate risk stress test for UK insurers & banks (2019)

• London Stock Exchange ESG guidance (2017)

• FRC’s Stewardship code

• Carbon Budgets, committing to net zero carbon emissions by 2050 (2019)

This array of task forces, regulatory bodies and working groups is creating policies, guidelines and regulations to set frameworks and align policy signals to deliver a resilient and sustainable economy. However, it is important to note that they are addressing issues that exist in the market today.

As sustainable capital markets develop further, we expect further regulations and guidelines to address new issues, along with new rules to further steer capital markets towards activities with improved social and environmental outcomes. These new regulations, while drawing on the spirit of existing ones, will account for the nuances and complexities of their respective markets.

II. HUGE GROWTH, INVESTORS CHALLENGE, REGULATIONS CO-EVOLVE

The growing quantity of rules and regulations comes as large capital sums are being funnelled into sustainable investing.

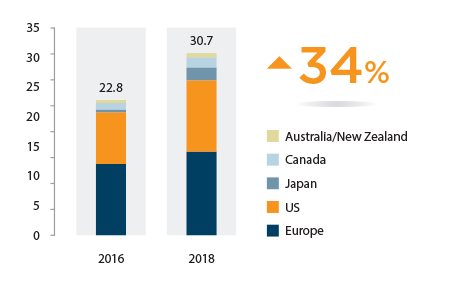

According to the Global Sustainable Investing Alliance (GSIA), investing along ESG lines in major markets4 rose 34 percent in the two years to the start of 2018 to $30.7 trillion.5

FIGURE 3:

Snapshot of global sustainable investing assets By Geography – 2016-18 (USD trillion)

That means sustainable investments now comprise onethird of the $92 trillion tracked assets under management in those markets, and make this form of investing a major force globally.6 Asia exemplifies the growing interest in ESG investing, with the region representing the most additions to the number of signatories to the UN’s Principles for Responsible Investing (PRI) in 2018.7

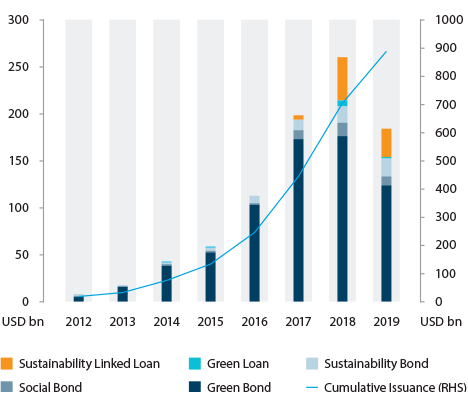

This growth has been seen on both the fixed income and the equity side. To take the former: the value of issued green bonds is expected to reach $250 billion in 2019 versus 2018’s figure of $168.5 billion.8 The issued amounts of other forms of green debt, which include sustainability-linked loans, green loans and social bonds, have also risen in recent years (see Figure 4).

FIGURE 4:

A New Green Market Sustainable debt issued by instrument type

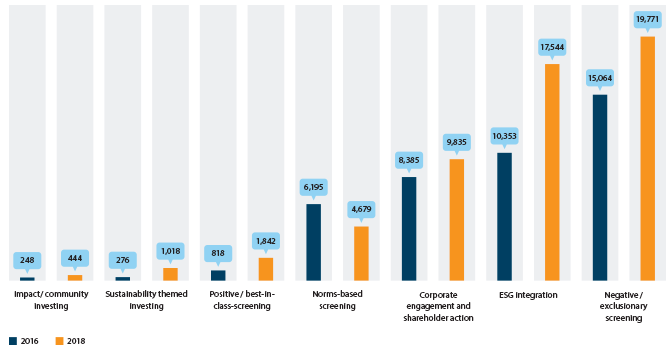

Investors are also becoming more sophisticated in their sustainable investment strategies, transitioning from negative screening to ESG integration9, as evidenced by the faster asset growth driven by ESG integration strategy (2-yr CAGR: 30.2%) than the negative screening strategy (2-yr CAGR: 14.5%) (see Figure 5). ESG Integration strategy is the incorporation of ESG factor at every stage of investment process, from research, valuation, portfolio construction, risk management, to asset allocation.

FIGURE 5:

Global Growth Of Sustainable Investing Strategies 2016-18 (USD billion)

Despite this growth in volume and sophistication, negative screening, which some investors would consider as something of the past, still constitutes the highest proportion amongst the different sustainable investment strategies as of 2018. Recent reports found that the main barriers towards the growth in ESG integration for investors were a limited understanding of ESG issues, a lack of comparable and insufficient historical data and cultural issues.10 This is why regulatory bodies (including the EC) are introducing regulations to overcome such barriers to growth. The increased requirements on the regulatory side are having an impact: we have seen a marked improvement, for instance, in ESG disclosure, and in the management of compliance in relation to SDG factors. Yet these changes aren’t solely as a result of the regulatory stick. For example, in the green, social and sustainability bond market, disclosure and transparency has been driven by the Green and Social Bond Principles managed by ICMA. These are essentially voluntary but have become the standard market practice for borrowers and intermediaries presenting robustly structured transactions to the investor market.

COMMON PRINCIPLES

This trend to develop an array of sustainability regulations across the globe has at its heart a set of general common principles or key objectives that parallel those in the EC’s Action Plan: to reorient capital flows towards a more sustainable economy; to protect the financial system from sustainability risk; and, to boost transparency and a long-term view. Admittedly, the plethora of sustainability regulations (see Figure 6) and the rapid pace at which they are being introduced can be confusing for investors. But it’s worth keeping in mind that these exist to steer capital in accordance with the key objectives outlined above, and to address existing problems in the market. It is why, despite their growing number, they all tend to address similar problems.

_______________________________________________________________________________________________________________

ADMITTEDLY, THE PLETHORA OF SUSTAINABILITY REGULATIONS AND THE RAPID PACE AT WHICH THEY ARE BEING INTRODUCED CAN BE CONFUSING FOR INVESTORS, BUT IT’S WORTH KEEPING IN MIND THAT THESE EXIST TO STEER CAPITAL IN ACCORDANCE WITH THE KEY OBJECTIVES.

_______________________________________________________________________________________________________________

FIGURE 6:

Sustainable Finance – Regulatory Themes

EXAMPLES OF PROBLEMS/ISSUES IN THE CURRENT MARKET:

- Insufficient consideration of climate & environmental risks

- Insufficient info on corporate sustainability oversight and activities

- Risk of “greenwashing” of investment products

- Underestimation of ESG factors and impact by investors

CLASSIFICATION

Commonly agreed principles and metrics to identify sustainable economic activities & investable assets

Key Framework

• EU Green Taxonomy

• ICMA’s Green Bond Principle, Social Bond Principle, Sustainability Bond Guideline

• CBI’s Climate Bond Standard

• China, Japan, ASEAN – Green Bond Catalogue, Guideline or Standard

DISCLOSURES/TRANSPARENCY

(1) Investors to disclose integration of ESG risks & opportunities;

(2) Issuers to include ESG reporting along with financial reporting

Key Framework

• EU Green Taxonomy

• ICMA’s Green Bond Principle, Social Bond Principle, Sustainability Bond Guideline

• CBI’s Climate Bond Standard

• China, Japan, ASEAN – Green Bond Catalogue, Guideline or Standard

BENCHMARKS/TARGET METRICS

Enable investors with ambitious climate-conscious strategies to orient their choice and measure performance

Key Framework

• EU Low-Carbon Benchmarks Regulation

• Task Force on Climate-related Financial Disclosures (TCFD)

ACCOUNTABILITY

Sustainability issues into account while investing and providing advice to the clients

Key Framework

- EU Sustainable Finance Disclosure Regulation

- EU - MiFID2 ESG Suitability Requirements

- UK – FRC’s Stewardship Code

GOVERNANCE AND STRATEGY

Governance around climaterelated risks and impact on businesses and strategy

Key Framework

- Task Force on Climate-related Financial Disclosures (TCFD)

- METI’s Guidance for Climate Related Financial Disclosure

- UK PRA’s Policy & Supervisory Statement on ‘Enhancing banks’ and insurers’ approaches to managing the financial risks from climate change’

Issuers and investors should be aware, however, that countries outside Europe are not simply copying the EC’s approach. Local sustainable finance initiatives and regulators must take into account their own laws, regulations and political requirements, and their own sustainable development and climate change realities. As a result, the EC’s approach is tending to be used as a basis upon which to build locally relevant roadmaps and regulations.

III. CONCLUSION

As investors shift capital into sustainable assets and away from fossil fuels, increased regulation is helping improve standards, transparency and consistency. That is beneficial for investors, lenders and for society as a whole as it opens up pathways to more diverse sources of investment. All of this should also help to narrow the multi-trillion-dollar gap that meeting the SDGs requires, and should ensure that businesses are more aware of climate risks and better equipped to do their part in managing them. Not surprisingly, issues remain. Some sustainability projects don’t deliver the ESG benefits they espouse, and the sector will require more rules to address those shortcomings.

Sustainability investing would also benefit from rules that allow comparability across jurisdictions. A third issue – on the risk side – involves resolving the gap in the insurance markets and bank markets. Yet all of these issues are likely to eventually be resolved, or at the very least improved. In the next ANZ FIG Newsletter, we will focus on how the trend is influencing financial institutions’ practices, how they can anticipate the expectations of investors and regulators, and embed sustainability into the corporate strategy. We believe that financial institutions who understand this trend of ‘sustainability as strategy’ will be able to capitalise on opportunities to grow while becoming more resilient and enduring as an organisation.

1 http://unepinquiry.org/wp-content/uploads/2019/03/Sustainable_Finance_Progress_Report_2018.pdf

2 Commission action plan on financing sustainable growth, European Commission (March 8, 2018). See: https://ec.europa.eu/info/publications/180308-action-plan-sustainable-growth_en

3 See: https://www.sustainablefinance.org.au/

4 Europe, the US, Japan, Canada, Australia and New Zealand.

5 2018 Global Sustainable Investment Review, GSIA (March 2018). See: http://www.gsi-alliance.org/wp-content/uploads/2019/06/GSIR_Review2018F.pdf

6 Ibid.

7 https://esg.theasset.com/ESG/35529/sustainable-investment-takes-off-in-asia

8 See: https://www.climatebonds.net/

9 https://www.unpri.org/download?ac=6459

10 ESG Integration in Asia-Pacific: Markets, Practices, and Data, CFA Institute and PRI (2019). See: https://www.unpri.org/download?ac=6459 and ESG Integration in Europe, The Middle East and Africa: Markets, Practices, and Data, CFA Institute and PRI (2019). See https://www.unpri.org/download?ac=6036

This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.