Insight

China-US trade tensions raise key questions for future Asia growth

Sharon Klyne, Associate Director, Institutional Communications | August 2018

________

Heightened trade tensions between the United States and its major trading partners is causing significant uncertainty and volatility in global markets, as investors assess the growing risks of a global trade war.

Heightened trade tensions between the United States and its major trading partners is causing significant uncertainty and volatility in global markets, as investors assess the growing risks of a global trade war.

This uncertainty is showing no signs of abating just yet. China recently proposed tariffs on US$60 billion worth of US imports in response to the Trump administration’s plans to impose 25% tariffs on US$200 billion of Chinese imports.

According to ANZ’s chief economist Richard Yetsenga, the trade issue raises important structural questions about the future sources of growth in Asia due to the potential for significant disruption to supply chains.

“One of the key drivers for Asia’s success in the last couple of decades has been fragmentation of global supply chains as businesses are increasingly sourcing product from the most efficient places in the world,” he said.

“Trade friction and tariffs start to push wedges into that seamless global supply chain story and that potentially challenges one of the key pillars of the emergence of the Asian economy.”

Pivot to China

Indeed, in its July economic outlook the International Monetary Fund warned tariff increases by the United States and retaliatory measures by trading partners could derail economic recovery and depress growth in the medium term. It estimates global growth could fall by 0.5% or US$430 billion by 2020.

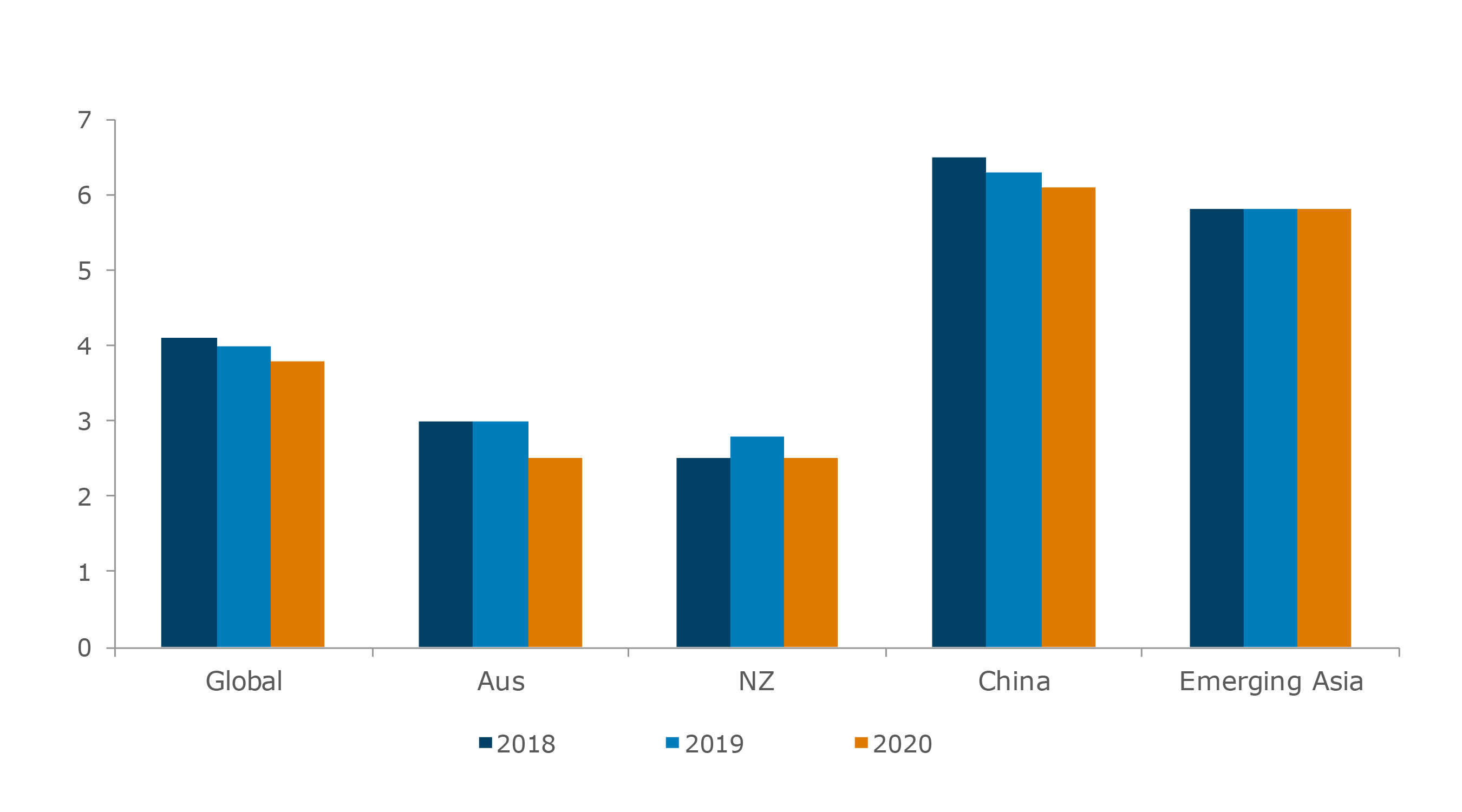

There are already signs of a gradual slowdown in the global economy with growth expected to hit 4.1% this year, then dropping to 4% in 2019 and 3.8% in 2020, according to ANZ’s forecasts.

However, the increased trade protectionism also comes at a time of China’s growing assertiveness as an economic and political power. Its “Belt and Road Initiative” promotes deepening economic and financial ties between Asia, Africa and Europe, with billions of dollars in infrastructure investment.

The policy is certainly paying off, according to political risk consultant Eurasia Group’s report titled Top Risks 2018, as governments across Asia, Africa, the Middle East and even Latin America are pivoting more toward China.

“No country today has developed as effective a global trade and investment strategy as Beijing,” said Ian Bremmer, President of the Eurasia Group in the report. ”China is writing cheques and creating a global architecture while others are thinking locally or laterally.”

South East Asia - watching with interest

Other key South East Asian countries such as Singapore, Malaysia, Indonesia, Vietnam and the Philippines are watching the situation with interest, given trade wars and any impediments will limit economic growth in the region.

In a Bluenotes interview last year, Goh Chok Tong, currently Emeritus Senior Minister of Singapore and the city state’s second Prime Minister, stressed the importance of Singapore expanding trade ties and offshore investments in the current environment.

“We cannot enlarge the domestic economy but we can enlarge the national economy – meaning Singapore investing outside Singapore,” he said. “That is part of our economy – our investments in China, US, Middle East.”

_________________________________________________________________________________________________________

“One of the key drivers for Asia’s success in the last couple of decades has been fragmentation of global supply chains as businesses are increasingly sourcing product from the most efficient places in the world”

richard yetsenga

_________________________________________________________________________________________________________

Investors are trying to work out whether the current market condition is a short term effect of the Trump Administration. However ANZ’s Yetsenga warns against such wishful thinking. “I think there is a bit of a myth that if Trump disappears in the next election it all will be OK.” he said. “I think the reality is that there are a range of drivers here including technology.”

“Technology has become an issue of national security for many countries and so you would expect, at the very least, that trade in technology will become increasingly more restricted.”

Looking ahead, the key will be for Asia’s economies to undertake the significant structural reform needed to meet these challenges to the global world order, according to ANZ’s Yetsenga.

“Whether it’s through monetary policy to stimulate growth, or demographics, or trade, countries increasingly need to look elsewhere. They need to look to their own armoury to drive growth. And structural reform is the main weapon there,” he said.

RELATED INSIGHTS AND RESEARCH

research

Japan's Demographic Alchemy

Japan has laid out a roadmap for dealing with an ageing population that a growing list of other countries will increasingly have an interest in. We all have a stake in Japan’s demographic alchemy succeeding.

research

ANZ Research Quarterly

The ANZ Research Quarterly navigates a global cycle where the risks seem to be rising, rather than diminishing.

research

Tech Eclipses China

China’s rise was epochal but much of the impact was narrowly confined and has broadened only recently. Technology is challenging us much more fundamentally than China’s economic ascent, confronting many of the ideas we see as foundational. Technology is genuinely disruptive.