INSIGHT

Digging Deep: Mining the Next Big Data Frontier

Download the PDF

Aaron Ross, Global Head of Resources, Energy & Infrastructure, ANZ |

Jonathan Bloch, Head of Strategic Banking, Resources, Energy & Infrastructure, ANZ | September, 2017

________

The future of the natural resources industry is increasingly looking like science fiction: very soon resources firms big and small will be able to quickly locate value deep in the earth thanks to lightning-fast, algorithm-based analysis of electromagnetic data

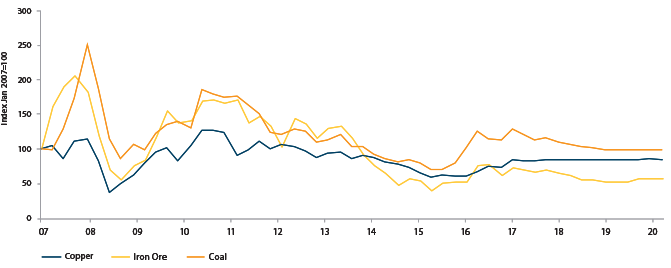

To be sure, leveraging big data and artificial intelligence will be increasingly necessary for natural resources companies in an era where much is outside their control, including tighter margins, price fluctuations, slowing China demand for some commodities and a rise in geopolitical instability.

Moving into 2018 and beyond, energy giants and diversified miners will have to apply big data beyond the production process to both the exploration and marketing phases of their operations if they want to remain competitive.

Although the full impact won’t be felt for years, early results from mining companies show this turn to technology will drive not only efficiencies and profits, but also build resilience in an era of less predictable commodity prices.

Some resources firms have been slow to embrace new technologies, hampered by a fear of change. And yet, others are coming around to the potential of big data and the dividends it can deliver from more agile client servicing, and competitive advantage arising out of predicative analytics. After all, the fortunes of tech giants like Google and Facebook are based on extracting value from big data and using that data to better target their client bases.

When the next commodities shakeout comes, it is tech savvy resources firms who will be best placed to weather it. Those who fail to embrace technology may fall behind the competition and potentially put themselves out of business for good.

1. Improvements in asset utilisation will continue

Cloud-based storage, the Internet of Things (IoT), and artificial intelligence will be the main areas of data application in the natural resources sector over the next decade.

In fact, the growing number of applications for big data is so significant that a number of CEOs from major natural resources companies have cited leveraging data as their main priority in making further operational gains and optimising use of assets.

Case in point: In 2015, Australian oil and gas producer Woodside set up a team to harvest and interpret the masses of data generated by its operations in order to improve efficiency, safety and profits at its LNG operation in northwest Australia. One aspect of the firm’s technological push is an artificial intelligence system that is learning to augment the site-based LNG operations control, allowing Woodside to optimise daily plant performance. This combined effort has been key to Woodside reporting world class LNG plant availability at close to 99.8 percent.

Other companies are using big data analysis to review real time data feeds to both optimise maintenance scheduling and predict future plant and equipment breakdown – a metric known as ‘Time To Failure,’ or TTF. The result of these big data implementations is that resources firms can significantly enhance operational productivity, reduce unit operating costs and potentially reduce sustaining capital intensity.

And then there are robots. Many diversified miners are using robot trucks or driverless long-distance railway systems – programmed according to big data-based inputs – to automate parts of the production process, achieving labour and cost savings.

Woodside is currently working with NASA as part of its Robonaut program to develop robot functionality – innovations that can be applied to robots working in the extreme conditions of Woodside’s onshore and offshore processing facilities. This physical functionality can be enhanced by real time big data analysis and fed directly into the robot operating systems, assisting in all onsite problem solving.

2. The next frontier: Applying data to the exploration and marketing phases

In recent years, many natural resources giants have aggregated data to identify the quickest, safest, and most cost-effective ways to discover and extract minerals from the earth and pre-empt major hazard and risk events.

Some resources firms can now pinpoint which day in the year was their most productive, as well as manage the performance on a daily basis to try and outperform their top productivity level. As one of our clients put it: “We use data to ensure we play our best game everyday.”

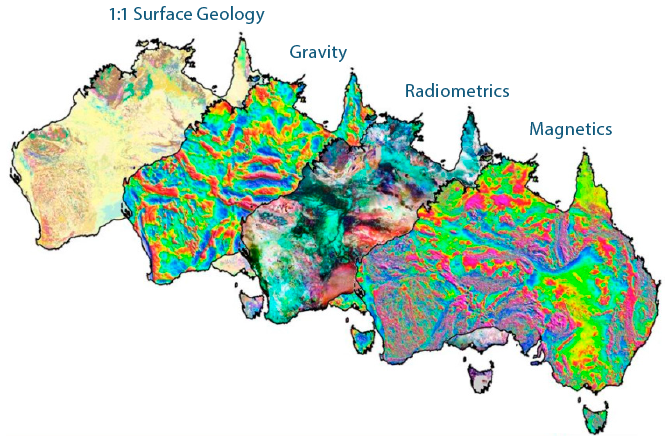

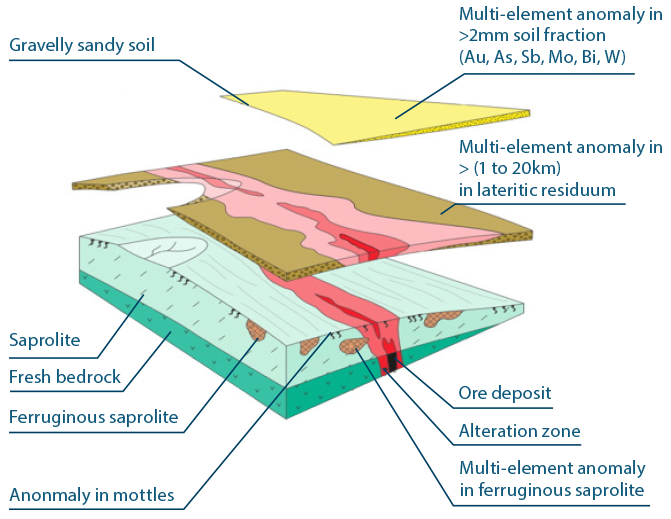

Looking into the near future, resources companies will also apply big data analysis to the exploration phase. When scientists and engineers search for undiscovered deposits, they have to acquire, process and interpret massive data sets, including geological, geophysical and geochemical information derived from the targeted exploration area. The stakes are high: in order to find the proverbial needle in the haystack, natural resources firms need to rely on largely visual interpretations of these processed and complex data sets to decide if they will allocate scarce risk capital.

Developments in artificial intelligence will soon be able to summarise innumerable layers of data in mere seconds with a very low margin of error – augmenting human talent and intuition in ways that were previously unimaginable.

On the other side of the value chain, the marketing of resources is another area ripe for big data applications. Soon, resources firms will be able to better focus their marketing efforts and more efficiently identify the most appropriate customers, based on data-driven analyses of the exact chemical and physical properties of the commodities they are selling.

3. Making data analysis part of the corporate DNA

What can natural resources companies do to take these crucial next steps in the area of big data application?

The first thing to do is to ensure that chief data engineers participate in the formulation of business development plans at the most senior level, and also play a major role in strategic management decisions.

Natural resources firms have to foster company-wide awareness of data rather than simply pay lip service to trends in technology. They have to actively nurture a pro-data culture and establish management systems that allow cutting-edge data management to blossom inside their companies.

Enhanced management of both digital and language-based reported data will form the foundation for more efficient assessment and reconciliation of what mineral deposit multi-data finger prints look like. For example, in the case of Woodside it has created and trained a cognitive assistant (avatar) called Willow which is able to engage with different Woodside specialists to assist with real time problem solving. Willow is able to assess and access millions of current and past data files to support the users’ requests.

The second task is to work with data-driven external partners who can help realise new gains from big data, as excessive insularity can trap a company in a state of arrested development.

On that note, over the next few years ANZ and other innovative banks will become as data driven as their clients in the natural resources sector. The most forward-looking banks will increasingly have their own data sets around capital flows and risk management, and will co-mingle those sets with data from clients to add value in decision support, particularly in regards to financing.

By virtue of their scale, trust and multiple touch-points across the value chain, leading banks will be able to offer:

1) Data sharing as a service – safe and scalable environments for co-mingling of datasets across partners and customers; and

2) Machine learning as a service – extend services from their own data science teams to work with natural resources companies in building their data capabilities to deliver real time predictive modelling in areas such as asset, risk and capital management.

Moving forward, leading natural resources companies need to work with banks that provide bespoke – rather than generic – dashboards around capital risk and liquidity management, so that big data will become part of the DNA of interpretation across their entire business cycle, from exploration to marketing. Otherwise they risk falling behind the development curve, and losing to the more tech savvy competition.

FEATURED ARTICLES

insight

Why Non-Bank Financial Institutions (NBFIs) Will Need To Fuel Asia’s Growth

Non-bank financial institutions (NBFIs) are well-placed to fill the Asia funding gap.

case study

Commodities Risk Management: Commodities Trading, Debt Reduction and Bespoke Solutions

Supporting producers through the commodity cycle.

case study

FX Risk Management: Unique Business Requirements and Non-Traditional Currency Pairs

Having the ability to set up and deal in non-traditional currency pairings makes all the difference.