INSIGHT

Why Non-Bank Financial Institutions (NBFIs) Will Need To Fuel Asia’s Growth

Download the PDF

Elodie Norman, Head of Financial Institutions Group, ANZ | Chris Raciti, Head of Loan Syndications & Specialised Finance, ANZ | Andrew Sheng, Distinguished Fellow, Asia Global Institute | Robert Tsang, Director, Client Insights & Solutions, ANZ | August, 2017

________

With banks busy searching for innovative ways to ‘survive the squeeze’ between new regulations on one side, and technological disruption on the other, non-bank financial institutions (NBFIs) are well-placed to fill the funding gap. That’s especially true in Asia, where attractive growth rates persist, but structured lending is underdeveloped compared to the West.

The hard fact remains: Asian finance is still bank-dominated, suffering from an overabundance of conservatism and an array of mismatches that act as headwinds to finance the region’s investment opportunities.

These mismatches include:

- Maturity mismatches: companies are overly dependent on short term bank loans whilst financing needs are longer term

- FX mismatches: insufficient FX reserves to meet needs from trade and capital account flows

- Debt/equity mismatches: loans dominate – there’s too much debt relative to equity due to underdevelopment of equity markets and an over-reliance on bank loans

- Governance imbalances: a silo mentality persists across Asian countries and regulatory regimes, resulting in a fragmented regulatory landscape

These mismatches mean both regional and global NBFIs – from insurers to pension funds – are now positioned to play a pivotal role in Asia’s emergence as a standalone strategic investment destination.

1. The Big Picture: Asia is Hard to Ignore

Asia’s key macroeconomic indicators paint a compelling investment opportunity that is hard to ignore.

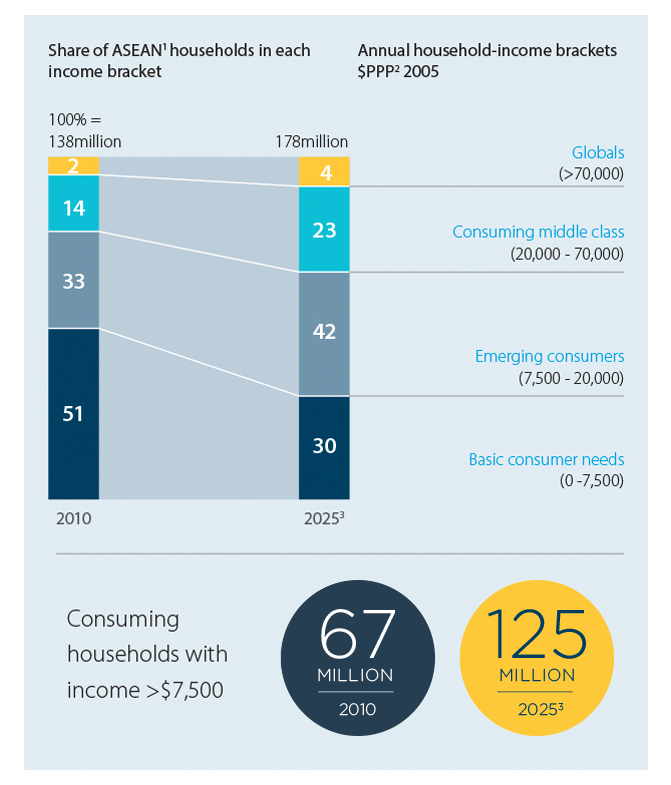

For starters, Asia ex-Japan saw GDP growth of between 5-6 percent in 2016-2017, compared to the below 2 percent range for many developed markets in the same period. In addition, disposable income and spending power is on the rise across the region: By 2025, 125 million ASEAN households are projected to attain middle-class status – with consumption rates projected to rise accordingly.

At the same time, Asia’s share in world trade is significant and growing: China’s share alone is 9.7 percent, while the whole of ASEAN is at 6.2 percent. Combined, that figure easily surpasses the US’s share of global trade at 10.8 percent.

FIGURE 1:

By 2025, 125 million ASEAN households attain middle-class

Data sources: Mckinsey Global Institute Cityscope database; McKinsey Global Institute analysis.

Source: Vinayak, Thompson & Tonby. 2014. “Understanding ASEAN: Seven Things You Need to Know” McKinsey & Company.

1 Association of Southeast Asian Nations, excludes Brunei.

2 Purchasing power parity adjusts for price differences in identical goods across countries to reflect differences in purchasing power in each country.

3 Forecast; figures may not sum, because of rounding.

2. The Nitty Gritty: Where Are the Real Opportunities for NBFIs?

From project finance to SME loans, the opportunities for NBFIs to finance Asia’s growth are abundant.

To get started on their Asia investment strategy, NBFIs should first develop their own internal risk appetite profile in order to put themselves in a position to seize the available opportunities. Importantly, they need to evaluate and decide where in the capital structure they want to be represented.

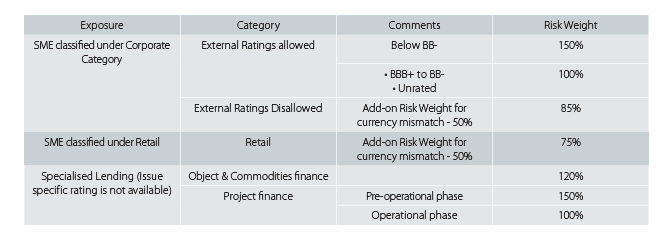

As for attractive sectors, one place to start is the areas that banks are avoiding due to the tightening regulatory environment under measures such as Basel IV. On that note, the most prominent underfinanced sectors include SMEs, specialised lending, and shipping, mining – each of which will continue to play a key role in Asia’s growth trajectory.

Also, China’s massive One Belt, One Road (OBOR) project – which by some estimates could attract cumulative investment of up to US$8 trillion – offers NBFIs a range of infrastructure-related investment opportunities across Central, West and South Asia – everything from bridges to rail links to pipelines.

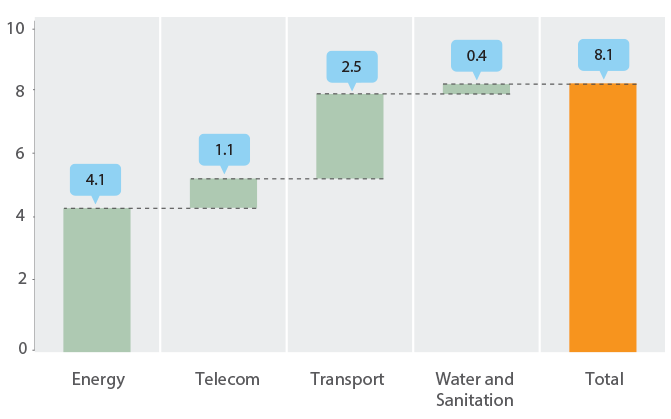

In addition to OBOR, a massive infrastructure investment gap is gripping Asia – estimated at US$8 trillion between 2010-2020 by some estimates – leaving the region in need of new road, electricity and sanitation projects.

3. Joining the Discussion on Regulation

Of course, NBFIs also face significant risks as they embark on a more aggressive Asia investment strategy.

To better navigate these potential risks, NBFIs should get involved in discussions with the region’s regulators to lobby for the framework they need to make an investment decision and help fund the region’s long-term growth potential. Knowing up front how they want to be represented in the capital structure – and what protections and structures need to be in place – will help in this regard.

Given the above factors and considerations, it is more important than ever for NBFIs to partner with banks – which are now more constrained by regulation – to originate desired credit exposures and execute strategic transactions. Only then will Asia realise its full potential as a self-sustaining investment destination.

To read a more detailed article on the same topic, please click here.

RELATED INSIGHTS AND RESEARCH

insight

Are Pan-Asian Corporates Missing the Formosa Opportunity?

In recent years, Taiwan’s ‘Formosa’ bond market – which refers to bonds issued in Taiwan but denominated in currencies other than the New Taiwan dollar – has emerged as a leading offshore fundraising destination. But are pan-Asian corporates taking advantage of the opportunity it presents?

insight

Cash Management Realities in a Basel III World

In Asia, banks are being tasked with adopting Basel III rules, which will affect how Asia’s banks treat funding such as customer deposits, especially deposits from other financial institutions. How do these impact corporate treasurers, CIOs and money managers and what lessons can be learnt from Australia?

insight

Coming soon — NPP, a Game-Changer for Australian Financial Institutions?

A guide to how Australia’s anticipated New Payments Platform will benefit banks and insurance companies.