INSIGHT

Are Pan-Asian Corporates Missing the Formosa Opportunity?

Download the PDF

Kang Jae Kim, Head of FIG Debt Capital Markets, Asia Pacific, ANZ | Tina Li, Head of Markets Sales, ANZ Taiwan | Alan Roch, Head of Debt Syndicate, ANZ, Asia Pacific | Eric Stanley, Head of Financial Institutions, ANZ Taiwan | June, 2017

________

In recent years, Taiwan’s ‘Formosa’ bond market—which refers to bonds issued in Taiwan but denominated in currencies other than the New Taiwan dollar—has emerged as a leading offshore fundraising destination. But are pan-Asian corporates taking advantage of the opportunity it presents?

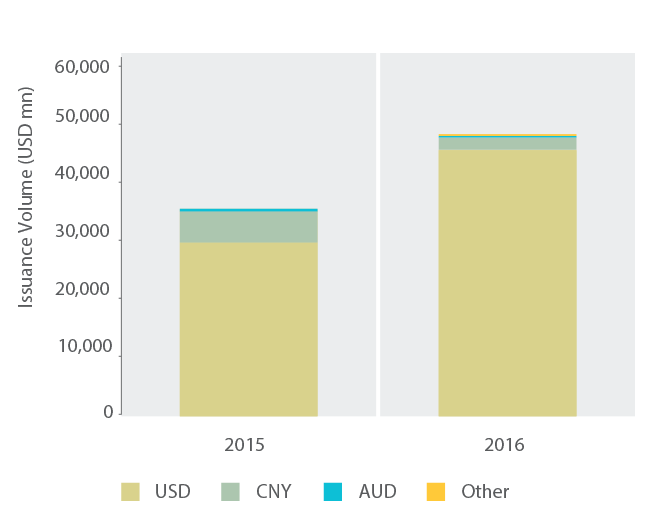

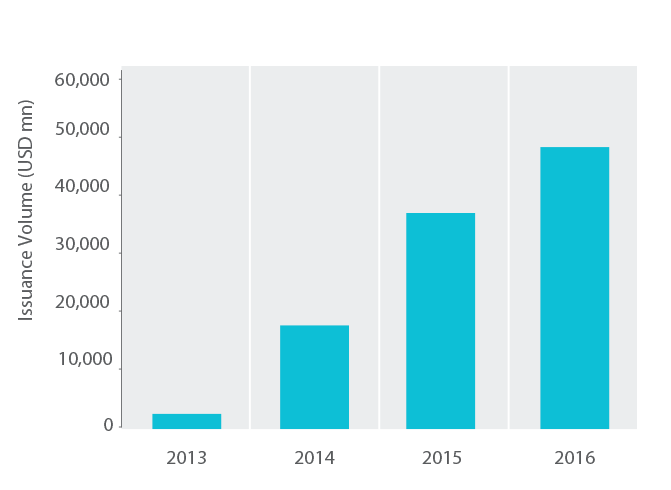

Interestingly, the data reveals it’s mostly European, North American and Australian banks, as well as North American multinationals, seizing the opportunity in this roughly US$80 billion market. Many regional corporations, such as Asian banks, have also issued Formosa bonds in China’s currency, the renminbi (RMB). For the year to date March 2017, issuance of Formosa bonds has surged more than 80 percent to US$17 billion, according to Dealogic and the Wall Street Journal.

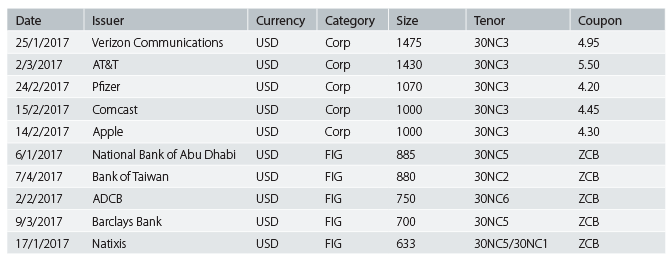

Case in point: in January Verizon Communications issued a US$1.475 billion 30-year non-call three bond at 4.95 percent, according to Reuters. In March, AT&T issued a US$1.43 billion 30-year bond with a 5.5 percent coupon. Technology titan Apple and biopharmaceutical leader Pfizer have issued Formosa debt of US$1 billion-plus each this year.

This data points to pan-Asian corporates and non-bank financial institutions missing out on the Formosa opportunity, which is supported by a stable and transparent regulatory regime, deep pools of liquidity, and investment grade assets: the bonds must be rated BBB (Standard & Poor’s), Baa2 (Moody’s) or higher.

Formosa bonds appeal to the island’s life insurers such as Cathay and Fubon, many of whom are hungry for foreign currency debt as they aim for higher yields and to fund their liabilities over a long time horizon. Issuance has spiked since 2014, when Taiwan’s Financial Services Commission designated Formosa bonds domestic debt, effectively exempting them from a rule that capped ownership of debt issued by foreign companies at 45 percent of a domestic firm’s portfolio.

Now the writing is on the proverbial wall: should pan-Asian borrowers wait too long to issue Formosa bonds, issuers may miss liquidity windows and an opportunity to tap into an attractive source of funds from Taiwan’s sophisticated investor base.

A rapidly evolving market

Before seizing the Formosa opportunity, pan-Asian fundraisers should also be aware that recent regulatory changes are altering the market’s dynamics, especially in regards to short-dated call options.

In the Formosa market, the most common tenor is 30 years, although many bonds historically came with call options as short as three years, much to the benefit of the issuer, who could call in the debt and refinance should rates start to fall.

In coming weeks, Taiwan’s Financial Supervisory Commission is expected to enact a rule that forbids companies from issuing bonds with call options shorter than five years. The purpose of the change is to help insurers better match assets and liabilities, foster more market stability and lower risks to insurers and other investors, who will face the fallout if rates creep lower and borrowers decide to call in a bond early.

On the other side of the equation, there is good news for foreign financial institutions, which are now permitted to issue subordinated debt up to the same value of outstanding senior Formosa bonds in the market, according to Reuters. As such, the market offers another source of regulatory capital for financial institutions seeking greater diversity in their prudential capital base.

Arriving too late to the party?

Also encouraging for first-time pan-Asia issuers is that Taiwan’s life insurers – who serve a market with more than US$620 billion in portfolio investments – are hungry for a greater diversity of issuers and risk/reward scenarios as they grow weary of lower-yielding sovereign bonds.

But if pan-Asian issuers wait too long to explore the Formosa market, Taiwan’s relatively concentrated investor base might already be inundated with options. In such an environment latecomers will inevitably lose pricing power, whilst investors will have the luxury to be pickier and might even charge a premium to invest in the bonds.

At the same time, Taiwan’s investors may start to look for other opportunities with lower risk and potentially higher yields, such as in the US market if rates keep rising on the back of Fed hikes. According to Pimco, as of the end of 2016 investors would have been able to build a portfolio of diversified US investment-grade corporate bonds with a potential yield above 4 percent, compared to Formosa bonds with similar risks averaging yields of over 4.50 percent.

Seizing the day

Despite ongoing regulatory changes and the market’s relatively small size, Formosa bonds will likely remain one of Asia’s most compelling opportunities, offering multinational and regional corporates the ability to issue offshore debt in their own currency and borrow at rates similar to those in their home market.

Given Taiwan’s stable regulatory regime, educated investor base, and ample pools of liquidity, pan-Asian corporates would be well served to explore the market before the secret is truly out and the market has evolved to the point where the appetite for new issuers is not as strong as it is today.

FIGURE 3

Top 10 corporate Formosa bonds, 2017

RELATED INSIGHTS AND RESEARCH

insight

Cash Management Realities in a Basel III World

In Asia, banks are being tasked with adopting Basel III rules, which will affect how Asia’s banks treat funding such as customer deposits, especially deposits from other financial institutions. How do these impact corporate treasurers, CIOs and money managers and what lessons can be learnt from Australia?

insight

Coming soon — NPP, a Game-Changer for Australian Financial Institutions?

A guide to how Australia’s anticipated New Payments Platform will benefit banks and insurance companies.

insight

Uncleared OTC Derivatives: Margin Reforms and Implications For Counterparties

Banking regulators are moving to reduce the systemic risk associated with OTC derivatives.