INSIGHT: UNCLEARED OTC DERIVATIVES

MARGIN REFORMS AND IMPLICATIONS FOR COUNTERPARTIES

Download the PDF

FOREWORD

RULES FOR THE EXCHANGE OF MARGINS ON UNCLEARED DERIVATIVE TRANSACTIONS ARE HIGHLY TOPICAL ACROSS THE INDUSTRY. WITH THIS IN MIND, IT MAY BE WISE TO CONSIDER THE NEW DRAFT RULES ISSUED BY THE BASEL COMMITTEE ON BANKING SUPERVISION (BCBS) AND THE INTERNATIONAL ORGANISATION OF SECURITIES COMMISSIONS (IOSCO) TO REDUCE SYSTEMIC RISK.

In March 2015, the Basel Committee on Banking Supervision (BCBS) and International Organisation of Securities Commissions (IOSCO) finalised a framework to reduce systemic risk by establishing a consistent global standard for margining non-centrally-cleared derivatives.

The uncleared margin rules will require most financial firms, and systemically important non-financial firms subject to the rules, to exchange Initial Margin (IM) and Variation Margin (VM) when entering into uncleared OTC derivative transactions with other covered entities.

These changes will apply from around 1 March 2017 onwards for VM and from 1 September 2017 onwards for IM.*

In this insight we consider the margin requirements, credit support annex (CSA) considerations and the impact on counterparties.

KEY TAKEAWAYS

- The definitions used for determining what transactions are captured by the margin rules (i.e. covered transactions) differ between jurisdictions.

- The rules in each jurisdiction distinguish two different types of margin, Variation Margin and Initial Margin,

- When putting in place VM and IM CSAs, the relevant rules in each jurisdiction prescribe, among other things, which types of collateral are eligible, minimum transfer amounts, thresholds, frequency of margining, settlement timings and impact of FX haircuts on collateral.

- For counterparties who do not currently post margin, the new rules will have funding implications.

- Counterparties will need to put in place operational and risk management processes necessary to comply with the margin rules.

- Counterparties will be asked by ANZ to provide information confirming their regulatory status and aggregate notional amount of uncleared OTC derivatives.

- Captured counterparties may need to bilaterally negotiate new documentation with ANZ.

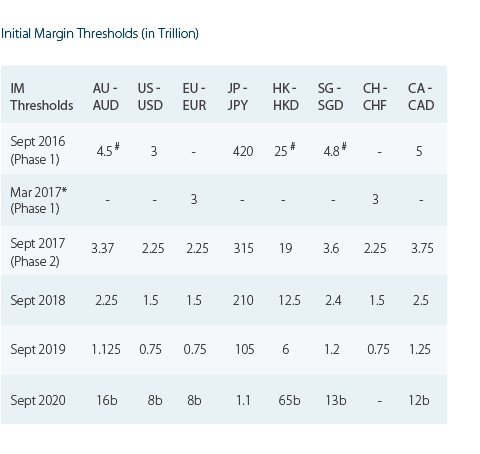

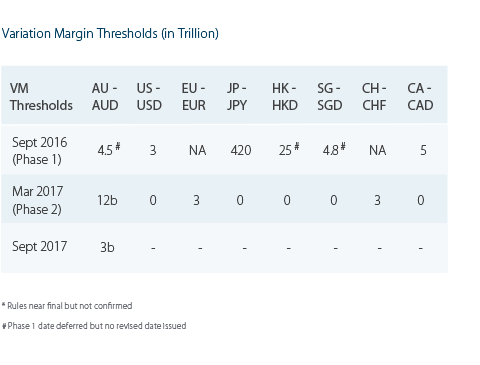

FIGURE 1

Initial Margin and Variation Margin thresholds

AUTHORS

Rohit Harjani, Rates Investor Sales, ANZ

Niamh Targett, Associate Director, Financial Institutions Group, ANZ

Robert Fievez, OTC Reform Project, ANZ

For any comments or feedback please contact the authors at GlobalFIGInsights@anz.com

PUBLISHED NOVEMBER 2016

RELATED INSIGHTS

insight

ASEAN Banking: Shaping the Future

The complete banking approach for this growing market.

insight

Australia’s New Payments Platform: Changing the Way Banks and Insurers Do Business

Imagine being able to make real-time data rich payments easily and quickly, any time, any place.

insight

Uncleared OTC Derivatives Margin Reforms: 'Life on the Margin' ― A 101 Guide

A guide to the non-centrally-cleared derivatives margin reforms.

*The US PR and CFTC rules and Japanese rules started to apply to Phase 1 entities captured under those rules from 1 September 2016 for both IM and VM. Implementation of the EU, Hong Kong, Singapore and Australian rules have recently been delayed. For most captured counterparties this may potentially mean a very slight delay for implementation of VM beyond 1 March but the IM schedule is likely to proceed as planned.

For a full set of relevant disclosures, please visit the link below.

These publications are published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia on its Institutional website.

If you choose to access these materials, you agree that the Website Terms of Use apply. These publications are intended as thought-leadership material. They are not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in these publications is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in these publications constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in these publications is based on information available at the time of publication. While the publications have been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of these publications or the use of information contained in these publications. ANZ does not provide any financial, investment, legal or taxation advice in connection with these publications.

If you are resident or located in the United States of America, you agree that you are not acting on behalf of a natural or individual (including yourself) “U.S. person” (as defined in Regulation S of the U.S. Securities Act of 1933, as amended) and you agree not to transmit or otherwise send any information on this website to any natural or individual person in the USA or to publications with a general circulation in the USA.

If you are resident or located in New Zealand, you are a “wholesale client” under the Financial Advisers Act 2008 (NZ), as amended.

Please confirm that the above statements are correct.