INSIGHT: AUSTRALIA’S NEW PAYMENTS PLATFORM

CHANGING THE WAY BANKS AND INSURERS DO BUSINESS IN THE COUNTRY

Download the PDF

FOREWORD

IMAGINE being able to make real-time, data rich payments easily and quickly, any time, anywhere. This is the future thanks to Australia's New Payments Platform (NPP).

The introduction of NPP will deliver many benefits and future innovations to all businesses, companies and financial institutions doing business in Australia for decades to come.

The level of capability and flexibility is comparable to, or in advance of, real-time systems available elsewhere in the world.

KEY TAKEAWAYS

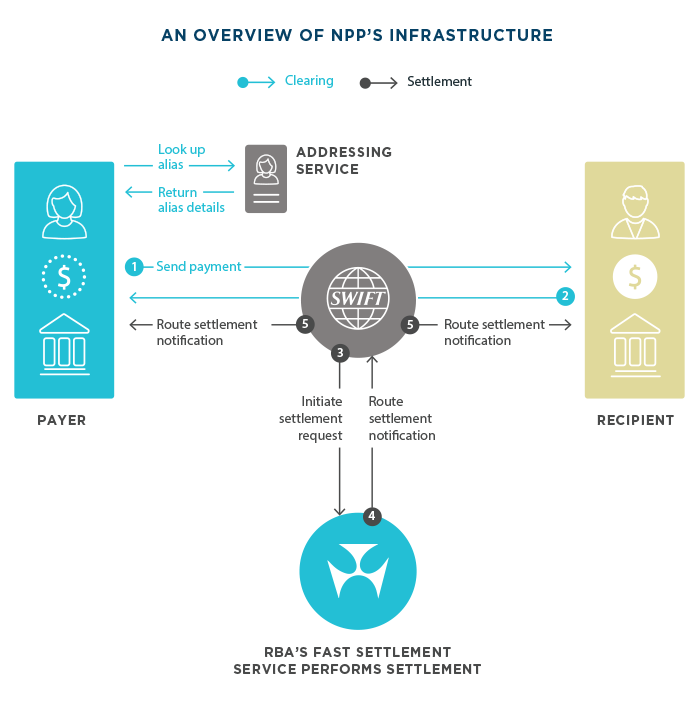

- Developed collaboratively by 13 banks or authorised deposit taking institutions (ADIs), including ANZ. NPP will provide the basic infrastructure to connect these financial institutions, and through them businesses and consumers.

- NPP provides an opportunity for consolidation of the payments landscape, removing inefficiencies and simplifying the retail and corporate customer experience. There is the opportunity to provide:

- a range of retail and wholesale payments (e.g. insurance claims, dividends, rebates and government welfare payments), and

- alternative payment options for businesses’ customers (e.g. to email addresses, mobile phones and Australian Business Numbers).

- Payments will be faster, 24x7.

- Funds will be accessible almost as soon as payment is made – even when the payer and payee have accounts at different member financial institutions.

- Support for the future development of tailored ‘overlay’ services in the new infrastructure creates a payments foundation that delivers greater value for end users.

- NPP is expected to leapfrog many existing real-time systems around the world over time.

Opportunities

_____

- For businesses with large working-capital cycles and funding exposures, NPP will allow for more effective use of funds by slowing down payments to the end of the invoice cycle.

- NPP will also improve reconciliation and payment visibility by increasing data sending capabilities.

- Businesses will get a much better understanding of the behaviours of their payers because of the ability to send more information with each payment.

- Insurance companies will be in a much better position to help customers access funds for immediate needs in the event of a natural disaster, as they can pay a portion of their claims in real-time.

- Banks and other ADIs will be able to leverage NPP to provide an improved customer communication experience, and greater customer flexibility with payment options.

- Consideration should be given to the way NPP will interact with the existing payment systems in Australia, as well as the investment and resourcing requirements to connect to it.

- Systems must be able to manage the flow of information 24/7.

- These include standardisation of file formats, authorisation of payments (including at weekends), managing cash flows outside business hours and interaction with the ‘overlay’ services to be offered.

AUTHORS

Lisa Vasic, Head of Transaction Banking, Financial Institutions, ANZ

Andrew Palmer, Head of FIG Australia, ANZ

Kevin Wong, Director, Client Insights Solutions, ANZ

For any comments or feedback please contact the authors at GlobalFIGInsights@anz.com

PUBLISHED DECEMBER 2016

RELATED INSIGHTS

insight

Transaction Banking: The Extinction of Paper Cheques

Like the dodo and the dinosaur, paper cheques are on their way out.

insight

Cybercrime: The Darker Side of Digital Disruption

A guide to transacting business safely in a digital world.

insight

ASEAN Banking: Shaping the Future

The complete banking approach for this growing market.