INSIGHT: ASEAN Banking

Shaping The Future

Download the PDF

FOREWORD

THE ASSOCIATION OF SOUTHEAST ASIAN NATIONS (ASEAN) IS PRIMED FOR THE BENEFITS OF GREATER BANKING INTEGRATION. NOW IT IS UP TO BANKS TO CHOOSE THEIR COURSE FOR NAVIGATING THE EMERGING TRENDS IN THIS FAST PACED REGION.

In this paper, we characterise the approaches of regional, network and partnership banks across developing ASEAN sub-regions: the High Income Economies; the Mid Manufacturing Competitors; and the Mekong Frontier.

We then share our observations of three long-term trends that may not be immediately apparent to banks outside the region:

- The growing importance of the Mekong frontier to multinational corporations (MNCs);

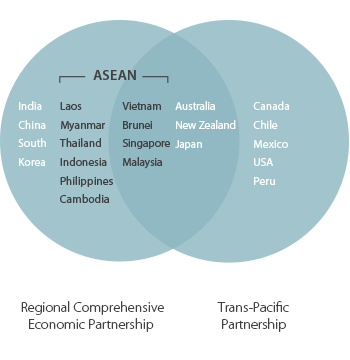

- The proliferation of bilateral trade agreements across ASEAN nations and key trading countries; and

- The de-dollarisation and rise of intra-ASEAN direct foreign currency pairs.

ANZ is a strong believer in the ASEAN bloc and while we expect to see increasing competition in cash management, hedging products, trade and services, it is an exciting time to operate in the region and take part in the dynamic growth story.

There is no one-size-fits-all approach to ensure success of a bank in ASEAN, but banks that stay mindful of local changes and adapt their position will be better placed to capture the many opportunities ASEAN promises.

KEY TAKEAWAYS

Despite various bouts of enthusiasm over the past 100 years, the true potential of Northern Australian agriculture remains an enigma. While interest in the region first started with the early pioneers, both agricultural scientists and politicians alike have since extolled the potential for the region as the next agricultural frontier in Australia.

- ASEAN1 is capturing the world’s attention as a key manufacturing hub and emerging engine of growth.

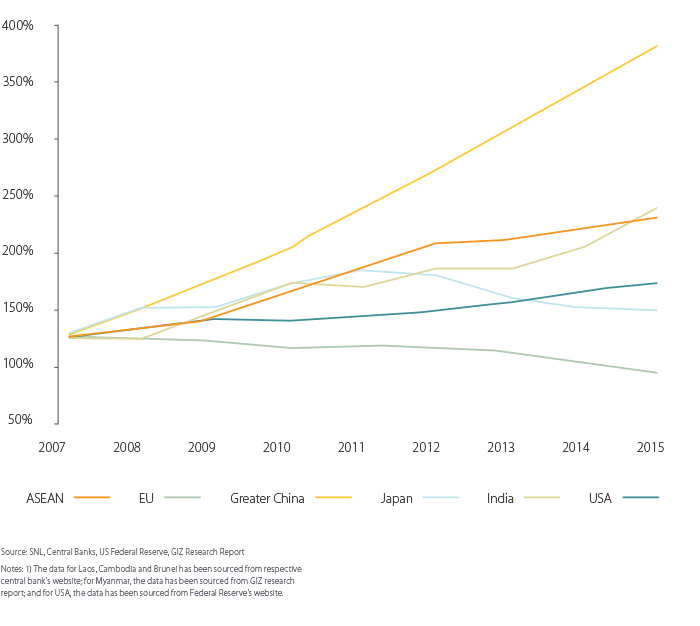

- The region’s commitment to free trade and progressive integration is spurring much of the investment surge evidenced in the last 5 years.

- While banking prospects are bright, operational challenges abound too and there is no singular consensus as to which banks will emerge as winners and losers in the region.

- Three banking approaches have emerged to capture the opportunities – namely Regional Banks, Network Banks and Partnership Banks.

- Three sub-regions are rising in line with ASEAN trade and financial integration: the high income economies (Singapore, Brunei and Malaysia); the mid manufacturing competitors (Thailand, Vietnam, Indonesia and the Philippines); and the Mekong frontier (Myanmar, Cambodia and Laos).

- There are three long-term trends that may not be immediately apparent to banks outside the region: the growing importance of the Mekong frontier to multinational corporations (MNCs); the proliferation of bilateral trade agreements across ASEAN nations and key trading countries; and the de-dollarisation and rise of intra-ASEAN direct foreign currency pairs.

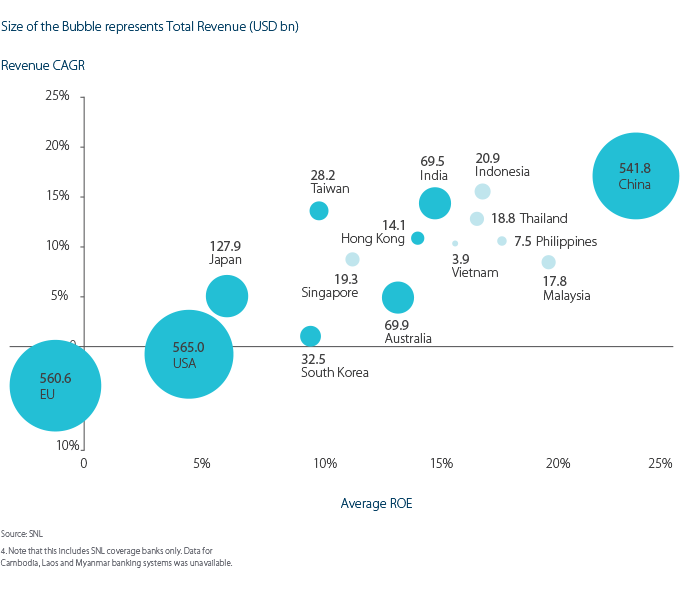

FOR MANY HIGH-GROWTH ASEAN MARKETS, DOMESTICALLY FOCUSED BANKS CAN ACHIEVE HIGHER RETURNS RE-INVESTING ORGANIC GROWTH PROCEEDS IN THE HOME MARKET...

RELATED INSIGHTS

insight

Transaction Banking: The Extinction of Paper Cheques

Like the dodo and the dinosaur, paper cheques are on their way out.

insight

Cybercrime: The Darker Side of Digital Disruption

A guide to transacting business safely in a digital world.

insight

Australia’s New Payments Platform: Changing the Way Banks and Insurers Do Business

Imagine being able to make real-time data rich payments easily and quickly, any time, any place.