INSIGHT

Green finance has gone mainstream

Appetite for green, social and sustainable (GSS) loan and bond issues is growing strongly across the Asia Pacific region. Amid this trend the demands of investors in terms of reporting, plus the information requested by borrowers, highlight the increasing influence – a mainstreaming, even – of environmental, social and governance (ESG) considerations within debt capital markets.

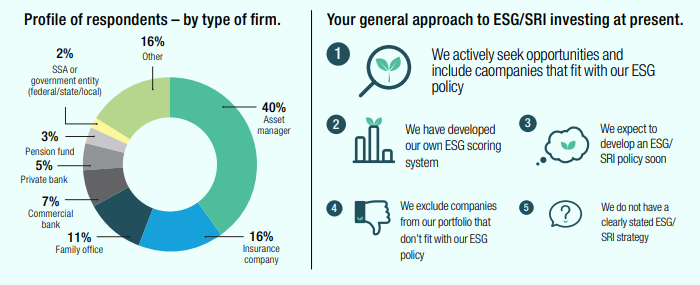

These themes and more are made clear in the third annual green and sustainable finance poll conducted by ANZ and FinanceAsia. Conducted in May, around 140 issuers and investors responded on their capabilities, strategy, preferences, requirements and plans in relation to this growing theme.

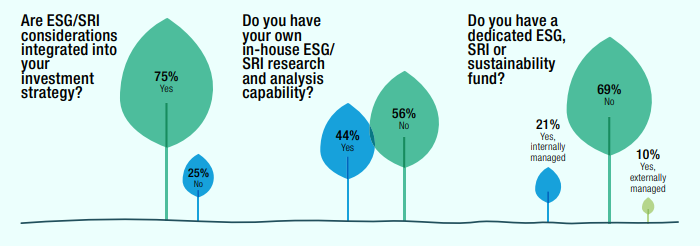

Notable findings from the survey include a wider engagement of GSS issues compared with 2019, in terms of consideration and integration into the strategy, as well as increased internal ESG scoring systems than ever before among investors, and a larger number of firms developing their own in-house research capability.

The survey shows a marked increase in the last 12 months in the focus on reporting of green loans and bonds – both in terms of proceeds and impact. It also shows growth in the issuance of GSS instruments since 2019, with a further rise in interest in issuing in the future.

Time as a factor is becoming a much greater hindrance for borrowers than in the past, while set-up costs are notably less concerning than previously, according to the survey results.

“Overall, the results of the poll show continued momentum for green bonds and loans,” Katharine Tapley, head of sustainable finance at ANZ says.

“COVID-19 has accelerated interest in ESG factors, with the longer term and bigger picture focus of investors and issuers on environmental and social issues.”

This is apparent from the thirst for information, according to Andrew Brown, director, debt capital markets at ANZ. This can be seen in investors who want transparency with the GSS loans and bonds they buy, as well as issuers seeking to understand what appeals to investors.

Seriously

This latest poll results provide little doubt about how seriously investors now take ESG. In particular, 42 per cent of those who took part say their strategy is to actively seek investment opportunities and include companies that fit with their ESG policy; in 2019, this figure was 33 per cent.

Further, only 19 per cent no longer have a clearly stated ESG or sustainability strategy, down from 34 per cent a year ago. Market trends support these figures.

Anecdotal evidence from general bond market performance, combined with ANZ’s own recent trading experience in Australia, for instance, show instruments with a GSS element are highly sought after.

“Whenever investors have sold these types of bonds, we have been able to find a buyer relatively easily,” Brown says.

While Australia and New Zealand are frontrunners in sustainable financing within Asia Pacific, meanwhile, activity in China and across South-east Asia is picking up.

“We are starting to see more internationalisation as markets in Asia increasingly align with global standards,” Stella Saris Chow, ANZ’s head of sustainable finance for its international business says.

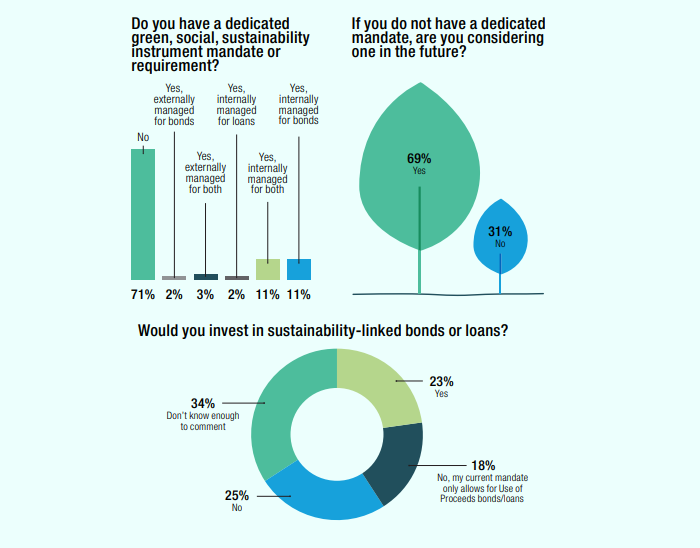

Investors across institutions are also showing growing interest in and awareness of sustainability linked bonds (SLBs). The poll shows 53 per cent of investors who responded are either directly familiar (30 per cent) with these products or have some knowledge of them but need to learn more (23 per cent).

How investors view them depends on the current state of their mandates, based on how much flexibility they have to invest in different types of sustainability linked loans (SLLs) and SLBs not just use-of-proceeds bonds.

“We expect mandates to become more flexible going forward as broader ESG mandates emerge,” Tapley says.

Spotlight

The region-wide spotlight on GSS issues is reflected in the resources being allocated to ESG. For example, 30 per cent of investors who responded to the poll say they have developed their own ESG scoring system (this was a new question to reflect the increasing focus on ESG).

Further, nearly half (44 per cent) now have their own in-house capability, up from 31 per cent in 2019. More investors than ever before have a specific ESG or sustainability fund.

Of those investors who don’t have a dedicated GSS instrument mandate, 69 per cent say they are considering one in future – higher than the 53 per cent result in 2019.

Greater demand has also brought with it more emphasis on reporting of proceeds and impact. These are now ‘necessary’ for a far higher number of investors than a year ago.

This is increasingly important to many asset managers looking to attract new investors based on the impact of their funds, explains Tessa Dann, director, sustainable finance at ANZ.

“They have strong public sustainability statements about their engagement with issuers and how they interact with companies.”

Reporting is one of several important areas for issuers to pay closer attention to in relation to investor requirements. Yet it is a double-edged sword for issuers given the need to provide more detail at the underlying asset level is time consuming, Tapley says.

Time represents one of the key hindrances for borrowers when it comes to GSS issuance, according to respondents to the survey. This reinforces the need for more resources to be directed to the GSS space.

When resolving this for reporting purposes, Tapley encourgaes detailed conversations and efforts to harmonise data.

“Issuers need to identify the metrics that are actually meaningful for investors," she says.

Investors would also appreciate this, Brown says, adding buyers of GSS debt often don’t know what information they want until they get it.

“This is an opportunity for issuers to lead disclosure rather than waiting to be told what to provide,” he says.

Solid

The foundations for issuing GSS instruments are increasingly solid. There is clear growth in issuance when comparing 2020 poll results with those from last year – while 73 per cent of borrowers hadn’t yet issued GSS instruments in the 2019 findings, 42 per cent have either issued use-of-proceeds bonds, sustainability-linked bonds or sustainability-linked loans in 2020.

More broadly, borrowers cannot underestimate the value of a comprehensive sustainability strategy for investors – with 38 per cent of them highlighting this as an important consideration. Brown suggests a more collaborative approach to tackling hurdles or negativity around the perception of GSS issuance.

Brown suggests a more collaborative approach to tackling hurdles or negativity around the perception of GSS issuance.This involves helping treasurers to develop a good working understanding of the loans and bonds available to suit their funding strategy. As a result, they can be more proactive rather than reactive.

The key is to spread the message as widely as possibly. Borrowers that have issued GSS instruments already are keen to come to market again, Brown says.This is also the case across Asia.

“Repeat issuers that have a framework typically view GSS issues as an important part of the funding mix,” Chow says.

From the 2020 FinanceAsia and ANZ poll compound broader trends driving the upward trajectory in GSS instruments and mandates. Further fuelling the appetite of investors as well as the issuance plans of existing and potential borrowers are the sustainability conversations happening more and more in boardrooms across the region.

“Very few of the better-known listed companies don’t have a detailed approach to sustainability,” Tapley says.

The impact of COVID-19 – in conjunction with the focus on climate change – might also help to address the supply conundrum for GSS-related debt, she says.

“We are witnessing a broader acceptance of sustainability, with an uptick in issuance to help finance initiatives to respond to the big picture challenges.”

This story is an edited version of a piece which appeared in FinanceAsia. To see the original report, including the full visualisations, click HERE.

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.