INSIGHT

The end of OPEC+?

The OPEC+ alliance looks dead after the loose organisation of oil-producing nations failed to reach an agreement with Russia on further production cuts. OPEC’s take-it-or-leave-it ultimatum of an output cut of 1.5 million barrels per day was rejected by Russia at its March meeting in Vienna.

Not only did the parties fail to reach agreement on further cuts to production, they failed to extend the current production cut agreement which expires at the end of March. That agreement has been in place since December 2016, and managed keep the market relatively balanced through a tumultuous period in the oil market.

Markets have not been kind in response. The question is how long prices will remain at these levels. Unless OPEC can resurrect some sort of production agreement between themselves, a long period of low oil prices looms as a likely scenario.

High likelihood

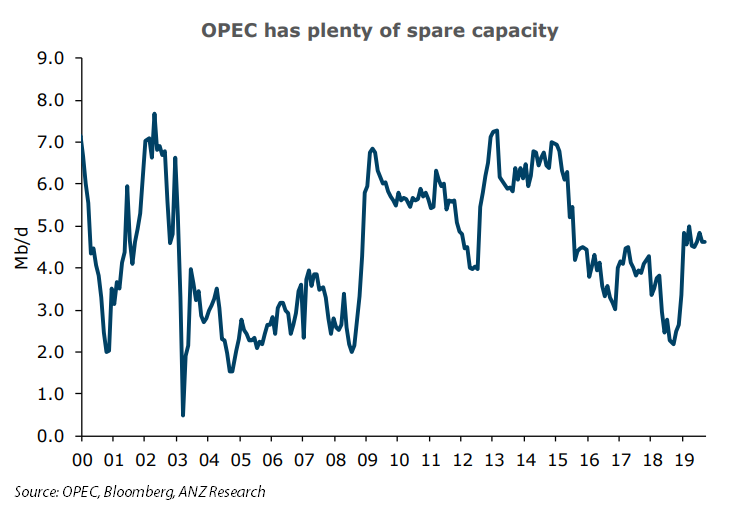

ANZ Research now sees the likelihood of production rising from OPEC+ members relatively high, even before the agreement officially expires.

If a deal is not reached in the coming weeks, output could rise above 10 million barrels per day in April, ANZ Research believes.

Russia stands out as the most likely to ramp up in the short term. Some of the smaller OPEC producers are also expected to raise output.

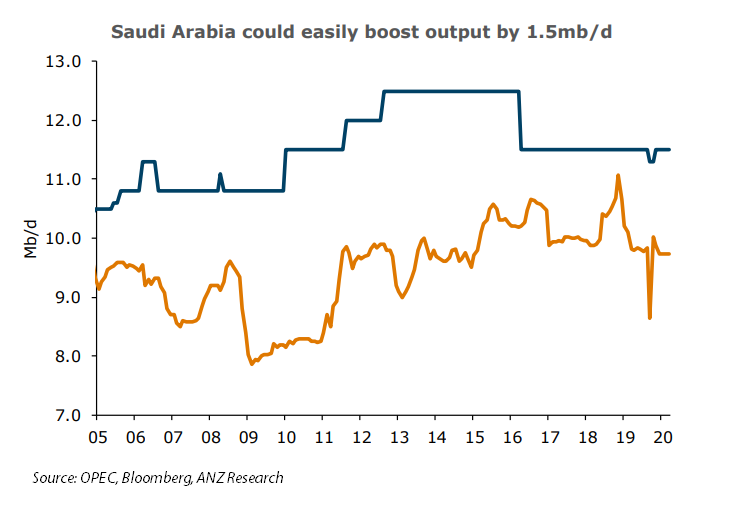

Saudi Arabia remains the wildcard. It had warned it wouldn’t cut production without Russia but now appears willing to endure low prices for the foreseeable future.

The Kingdom has 1.5 million barrels per day of spare capacity. Saudi officials have already warned they can raise output to over 12 million barrels per day if required.

Contagion

The development comes amid weakening demand as COVID-19 hits industrial activity around the world. The transportation sector has been ravaged by travel restrictions imposed by various governments.

ANZ Research expects the hit to oil demand in the first half of 2020 will be approximately 1.6 million barrels per day as the impact of COVID-19 spreads. This will clearly worsen if OPEC production rises quickly.

Daniel Hynes is a Senior Commodity Strategist and Soni Kumari is a Commodity Strategist at ANZ

This story originally appeared as an ANZ Research report. Click HERE to read the original note.

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.