INSIGHT

ANZ Institutional steps up for customers in FY20

ANZ has again showed its support for institutional customers through tough times with the announcement of its full-year 2020 results.

Speaking on an investor call after the announcement of the result, ANZ Chief Financial Officer Michelle Jablko said the bank had increased lending significantly in the early days of the COVID-19 pandemic.

“We supported strong demand from our Institutional customers when they needed us,” she said.

In the first half of the year, ANZ Institutional core lending rose $A16 billion as the bank supported customers in the early parts of the crisis. In the second half, core lending fell by $A17 billion, as global liquidity conditions improved and many customers paid down loans.

ANZ CEO Shayne Elliott said the institutional arm of the bank had performed well despite high levels of liquidity, low interest rates and geopolitical tension.

“As Australia’s leading international bank, we remain well positioned to assist customers as the global economy improves,” he said in a media statement.

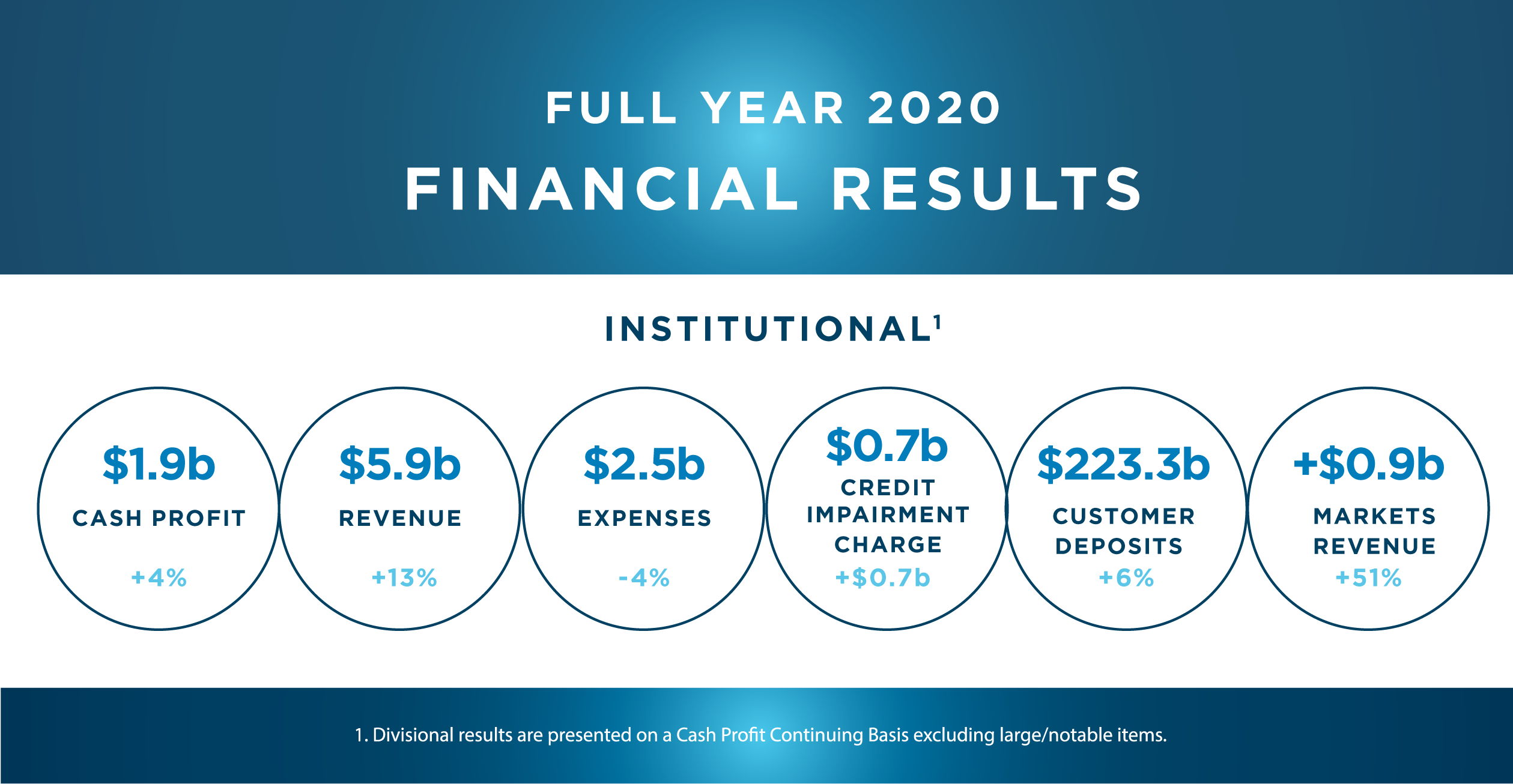

ANZ’s institutional arm posted a full-year cash profit of $A1.93 billion in, a rise of 4 per cent on the same period in 2019. The broader bank posted a full-year cash profit of $A3.76 billion.

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.