INSIGHT

How entrenched is the recovery?

The global recovery remains intact.

Certainly a number of clear risks exist – a prolonged pandemic, a premature end or mismanaged policy response, and geopolitics, to isolate a few. But ANZ Research’s central expectation is none of these will be sufficient to derail the ongoing climb back towards something approaching ‘normal’ after the collapses in gross domestic product (GDP) during the first half of 2020.

The second wave of COVID-19 in many economies has resulted in movement, health and economic outcomes quite different in many aspects from the first wave. Movement restrictions, in the vast majority of cases, have been much milder than in the first wave.

New Zealand is perhaps the biggest exception to this, with restrictions tightening quite sharply in August. Even despite the more modest movement response, health outcomes in a number of economies have been superior, notably the US, to the first wave.

The number of new daily COVID-19 cases in July was about double that in April, but hospitalisations and deaths were roughly half.

Policymakers also have remained quite active. Certainly the scale of response many countries delivered through the peak of the first wave hasn’t generally been required in the second wave.

Even beyond that, the policy response in the second wave has been largely about adjusting existing policy measures rather than needing to deliver entirely new packages.

In addition, global trade appears to have largely restored the damage suffered in the first half of the year. South Korean exports, for instance, are now higher than year-ago levels, and leading indicators of mechanise trade suggest normalcy is likely to increasingly be seen elsewhere.

Reflecting this range of forces, economic activity has also shown a much more modest deterioration than many - including ANZ Research - expected as the second wave of infections picked up.

Real-time growth trackers in the US, EU, and Australia, for instance, have not retraced materially. In fact, in the US and Australia there are signs of a renewed pickup in growth even as those second waves have yet to end.

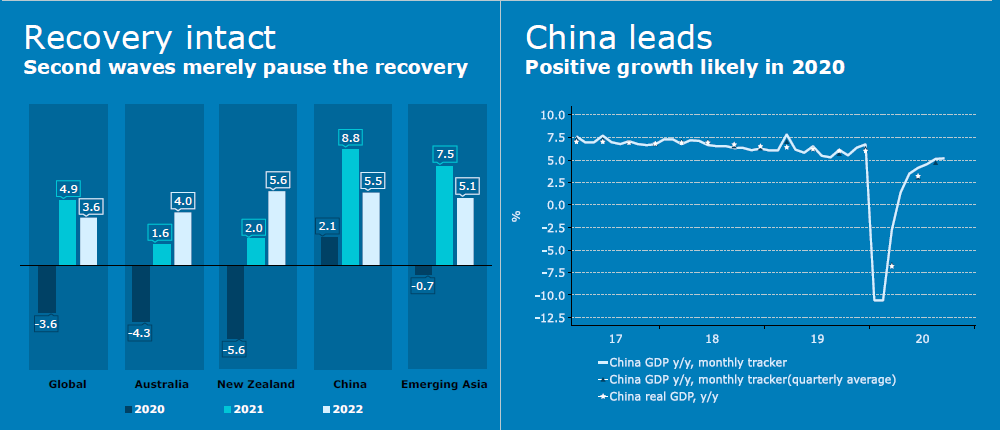

As a consequence of this range of influences, revisions to ANZ Research’s growth forecasts have almost entirely been towards improvement since its last quarterly in June; with exceptions in Malaysia and the Philippines.

This is welcome news. What hasn’t changed unfortunately is it will still take quite some time in many economies for activity to return to pre-COVID levels.

In advanced economies this is unlikely to be until 2022, while in Asia - which has generally managed this crisis more effectively - it varies between 2020 and 2022. Notably, ANZ Research still expects mainland China to record positive growth in 2020, along with Vietnam and Taiwan, the only economies in the forecast set to do so.

An important element of this outlook is the presumed path of policy. Certainly there is the risk policy missteps shake some economies off their recovery tracks. But in ANZ Research’s view that is not a reasonable central expectation.

The concern about fiscal sustainability that was a strong element of the GFC and post-GFC discourse is much less present in the current crisis. Many temporary measures have also been extended, sometimes on a number of occasions.

In fact, the discussion around alternative policy approaches (such as Modern Monetary Theory) and the continued evolution of existing policy regimes are likely to be lasting legacies of this crisis.

The US Federal Reserve has formally shifted its policy by targeting average inflation and removing low unemployment as reason to pre-emptively tighten. The second shift is particularly significant.

The coronavirus outbreak has tightened the supply side of the economy, geopolitics and trade wars are affecting supply chains, and the policy response this crisis has resulted in a large increase in global money supply.

Additionally, the weakness in commodity prices was only short-lived. ANZ Research expects many commodity prices to continue rising.

As a result, inflation surprises have not fallen this crisis the way they did in the GFC. Ongoing low inflation is the central case, but the risk profile around that central case has shifted.

The timing and specifics of COVID-19 vaccines are also becoming more relevant for the outlook. In fact one reason for a recent upward revision to ANZ Research’s China GDP forecast is the expectation China will have a vaccine available by year-end.

It seems sensible to think of a vaccine in non-binary terms, in the sense it seems unlikely a vaccine will offer complete protection against COVID-19, have no side effects, and be available to all the world’s inhabitants quickly.

But as confidence around the timing of vaccines continues to solidify, we expect significant positive impacts. Governments will be in a better position to calibrate both the scale and timing of policy responses. Businesses will also be better able to calibrate both an end to the crisis, and how much ‘living with COVID-19’ will be required even after vaccines are broadly available.

A widespread availability of vaccines is also likely to be associated with an increased focus on some of the structural shifts of the COVID-19 crisis. The pandemic has accelerated positive trends in addressing climate change, and negative trends on geopolitics. Inequality has deteriorated. And the technology sector has been a mechanism for change.

While the recovery from the worst of the COVID-19 crisis seems to be entrenched, and the timing of broadly-available vaccines is likely to continue to solidify, the post-pandemic economic landscape is likely to be materially different.

Richard Yetsenga is Chief Economist at ANZ

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.