INSIGHT

How real is Asia’s recovery?

The data are beginning to point to an economic recovery in Asia after a deep second-quarter slump driven by the COVID-19 crisis. China, being the first to overcome the pandemic, is leading the charge.

China’s recovery will be an important driver of that rebound, but so too an improvement in global trade, which is showing signs of bottoming out.

However, renewed outbreaks in some economies and rising infections in others mean the pace of Asia’s recovery remain uncertain. The economic recovery will be a bumpy and drawn out affair.

Given the depth of the downturn, it will be some time before real gross domestic product (GDP ) is back to pre-pandemic levels. And the extent and durability of the recovery is still in part dependent on continued policy support.

There is reason to believe the worst is past in terms of the hit to growth. There are signs global trade is improving, and governments are better at managing rising infections.

But there is a danger that a solvency crisis will emerge if economic activity does not recover sufficiently before support measures expire. Further policy support will be needed to sustain the recovery.

Brunt

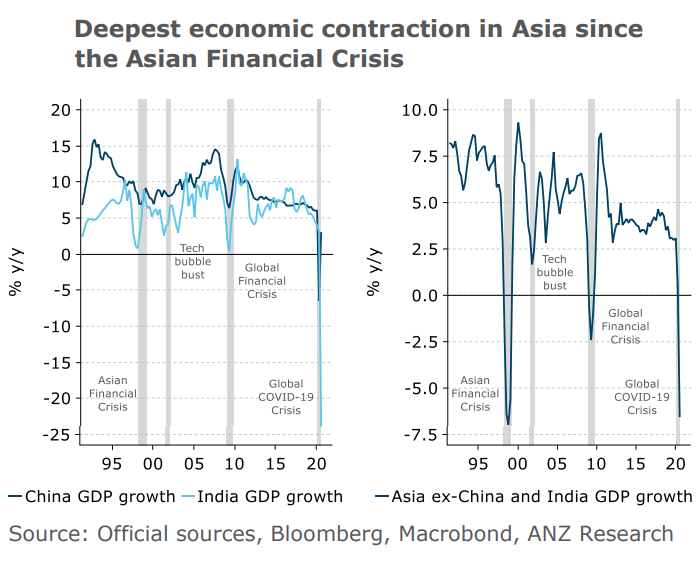

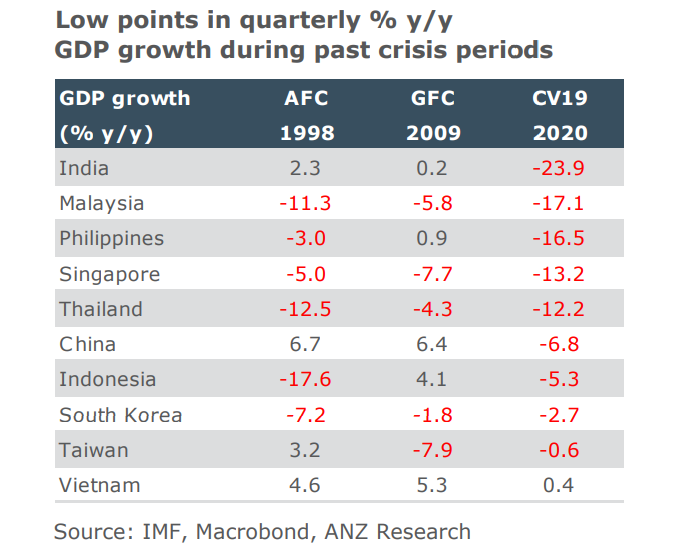

The COVID-19 pandemic plunged most Asian economies into a recession, the likes of which have not been seen since the Asian Financial Crisis more than two decades ago.

The full brunt of the economic effects were felt mostly in the second quarter, with the exception of China, which saw the biggest impact in the three months to end March as it was the first country to encounter COVID-19.

China’s second-quarter GDP managed to rebound into positive year-on-year growth, as it was also the first to contain the outbreak.

COVID-19 is first and foremost a health crisis. It turned into an economic crisis because of the unprecedented responses to contain the outbreak — a complete halt to international travel, and lockdowns that closed businesses and kept people at home.

In an integrated and globalised world, even economies that were successful in managing the outbreak without resorting to nationwide restrictions, like Vietnam, Taiwan, and Thailand, were impacted by a sharp plunge in demand from their major trading partners.

Quick action by Asian policymakers to provide both fiscal and monetary support to their economies helped to prevent an even larger contraction in activity.

In addition, the unprecedented stimulus unleashed by the US Federal Reserve by cutting the fed funds rate to the zero lower bound, as well as providing unlimited quantitative easing, and ensuring sufficient liquidity for emerging markets, played a huge role in stabilising financial markets in the region. This is why we are not facing a financial crisis.

Passed

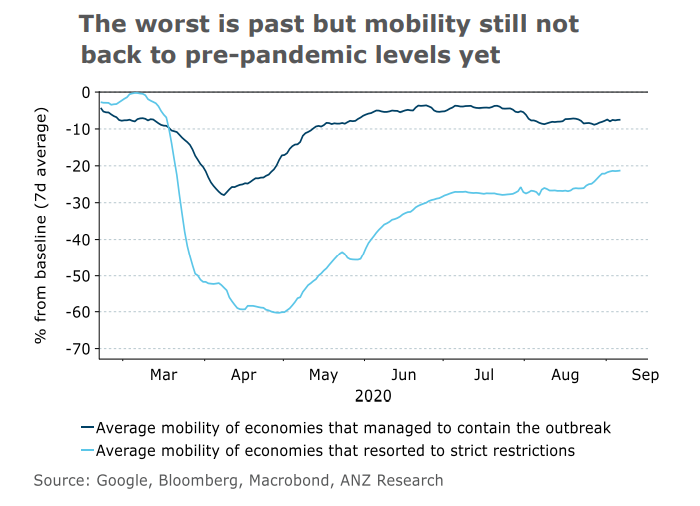

The size of the sequential contraction in second-quarter GDP was broadly in line with decreased mobility. India’s drop in GDP compared to the decline in mobility is an outlier, but this likely reflects India’s lower smartphone penetration compared to the rest of Asia.

There are signs that the worst of the economic contraction is now behind us. Strict restrictions have been eased, allowing businesses to re-open. Mobility trends have shown an improvement since late April or early May, which was the low point for activity.

This increase in mobility, even for economies that continue to see high new COVID-19 cases, should pave the way for positive sequential growth in the third quarter.

This is consistent with the latest PMI data for the region, which is pointing to a rebound in Q3 growth, at least at the aggregate level. China’s manufacturing PMI, as reported by both the official and Caixin surveys, suggests the second-quarter rebound is not an anomaly, and that there will be a further improvement in growth for the third quarter.

There is a similar message from the new orders to inventories ratio, as well as from both the official non-manufacturing and the Caixin services PMI.

It would seem that recent escalations in US-China tensions have not had much of an effect on activity. If this momentum is sustained into the final quarter of the year, China will be able to record positive GDP growth for calendar 2020 as a whole.

Khoon Goh is Head of Asia Research, ANZ

This is an edited version of an ANZ Research report. Registered clients can find the full report on ANZ Live here.

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.