RESEARCH: ASEAN

THE NEXT HORIZON

Download the PDF

FOREWORD

SOUTHEAST ASIA WILL EVENTUALLY BE AS IMPORTANT TO AUSTRALIA AND NEW ZEALAND AS CHINA IS TODAY. THE ASEAN BLOC HAS ENORMOUS POTENTIAL, AS BOTH A MANUFACTURING HUB AND A SOURCE OF CONSUMPTION FOR THE WORLD. A LARGE, YOUTHFUL WORKFORCE AND STRATEGIC LOCATION ARE JUST SOME OF ASEAN’S MANY ADVANTAGES, WHICH SHOULD DRAW MORE COMPANIES TO ESTABLISH PRODUCTION BASES IN THE REGION.

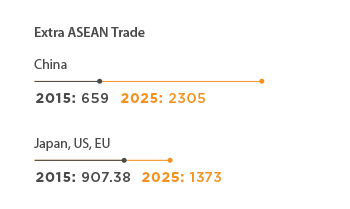

The ASEAN Economic Community (AEC) will help ASEAN realise its potential by removing barriers to trade and investment. While the AEC’s goal of creating a single market and production platform across ASEAN may not be reached this year, due to inadequate infrastructure and other impediments, ultimately we expect the process of economic integration to create economies of scale and lift intra-regional trade. By 2025, we project trade within ASEAN will exceed USD1trn in value.

The ANZ Research In-Depth series aims to provide an informed voice in the all-important conversation about Asia’s future and its growing influence on the world.

ASEAN: The Next Horizon is the fourth instalment in the series. This paper looks at ASEAN’s journey towards an integrated economic community and the opportunity that ASEAN presents for Australia and New Zealand.

KEY TAKEAWAYS

Over the next ten years, ASEAN has the potential to become one the world’s key manufacturing hubs and an emerging source of consumption for the world.

- Demographics – a large body of potential workers between 20 and 40 years of age.

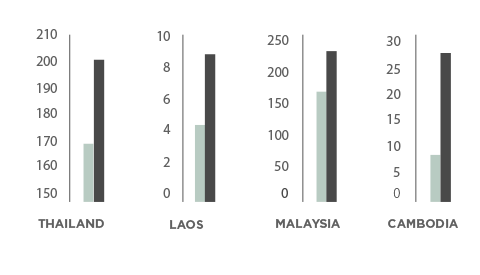

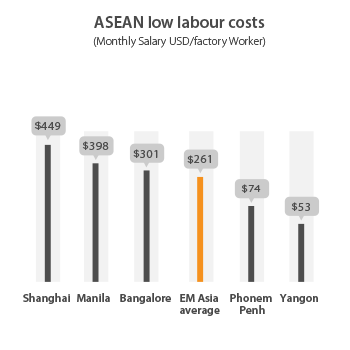

- Comparatively lower wages, especially around the Mekong.

- Production synergies – the strengths of the ASEAN member countries are often complementary.

- The growth of the middle class in ASEAN will drive a significant increase in domestic consumption. As a share of ASEAN GDP, we expect consumption to account for 75% of GDP in 2025, up from 62% in 2010.

- Scope for productivity improvement – initiatives such as the ASEAN Economic Community should create economies of scale across the bloc.

- Geography – strategically positioned at the junction of the Indian and Pacific Oceans, and sitting squarely between China and India, ASEAN is uniquely placed to benefit from growing trade in the region.

Opportunities for Australia and New Zealand

_____

Australia and New Zealand (the Antipodes) stand to gain from ASEAN’s rise, particularly in relation to commodity exports, tourism and education. The trade and investment corridor between the Antipodes and ASEAN could exceed USD230bn by 2025.

Strong demand growth, rising standards of living and a sizeable infrastructure deficit in the ASEAN region all present the following opportunities for businesses and consumers in the Antipodes:

- Exports: An expanding middle class in ASEAN will increase demand for food, tourism, education, energy and hard commodities, not all of which will be satisfied within the region.

- ‘On the ground’ opportunities: Antipodean businesses may establish operations (or expand existing operations) in ASEAN to benefit from its growth and low costs of production. Some of the profits from those operations will accrue as income flows to Australia and New Zealand.

- Imports: Increasingly, the Antipodes are importing low cost goods from ASEAN. We expect this trend to intensify as ASEAN becomes the new low cost manufacturer in the region. This could extend the current run of cheap goods for consumers by another two or even three decades.

ASEAN: THE NEXT HORIZON

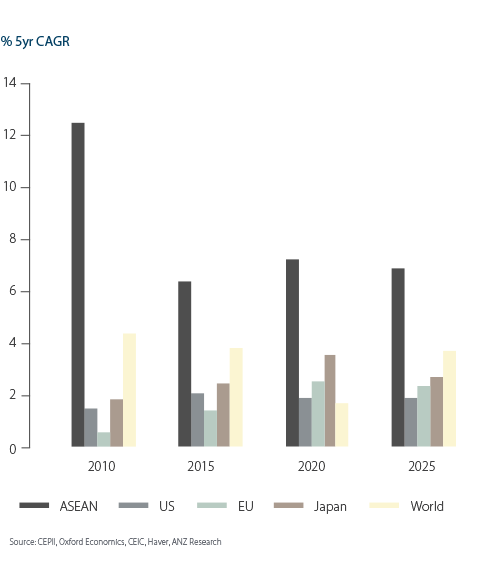

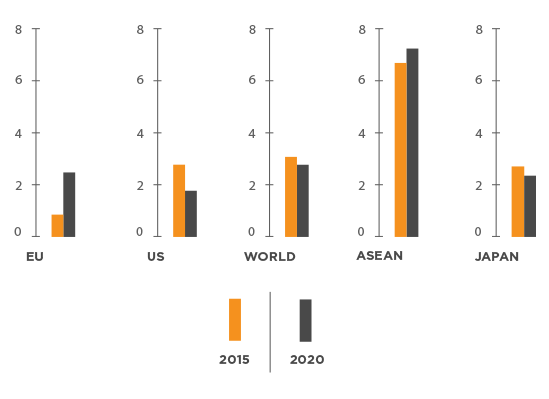

ASEAN’S Nominal GDP Growth Projections

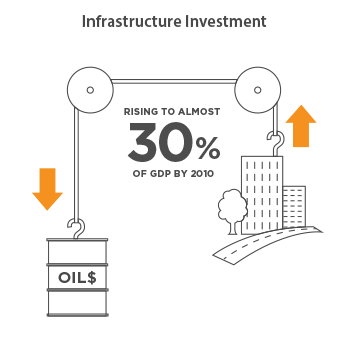

Infrastructure gap to close

The structural decline in oil prices allow economies such as Malaysia and Indonesia to unwind fuel subsidies and free up between 2.5-3% of GDP for infrastructure spending. For the ASEAN-5 economies, we expect investment to rise by 11.7%-pt (ppt) of GDP to almost 30% in 2020 from the recent trough in 1999.