RESEARCH: CHINA’S CONSUMER

SLEEPING GIANT

Download the PDF

FOREWORD

CHINA’S CONSUMER: SLEEPING GIANT' IS ABOUT THE NEXT PHASE OF EVOLUTION FOR THE CHINESE ECONOMY. IT DESCRIBES THE TECTONIC SHIFT CURRENTLY UNDERWAY IN THE CHINESE ECONOMY AS IT MOVES FROM A GROWTH MODEL, BASED ON INVESTMENT, TO ONE BASED ON CONSUMPTION.

The shock wave from the shift in China's economy is being felt around the world. The shift has only just begun but already China is the number one market for a range of expensive luxury items. Growth in spending by China’s middle class has the potential not only to transform China’s economy, placing it on a more sustainable path for the future, but also to rebalance the global economy.

Recent volatility in China’s stock market, uncertainty about the RMB’s outlook, and downward revisions to China’s growth forecasts all appear to cast doubt on this positive vision for China’s future. However, in our view, these developments are consistent with the first painful steps towards a more open economy, which is a fundamental prerequisite for a rise in Chinese consumption.

More specifically, the Chinese government is rightly focusing on reforms to pension and medical

insurance schemes, in order to give consumers greater confidence to spend. Just as importantly, it is pressing ahead with the liberalisation of its financial system.

China’s transition to a market-oriented, open economy will not be an easy one. We see this in global market ructions today. Moreover, an economy driven by consumption will mean lower growth for China. Nevertheless, ANZ Research firmly believes it is the right course for China to chart and the world will ultimately reap the benefit in the form of a more stable global economy.

We hope you enjoy Sleeping Giant: China’s Consumer. It is our intention to spark a wide ranging debate about these issues and opportunities, given their importance to the global economy over the next 15 years and beyond.

KEY TAKEAWAYS

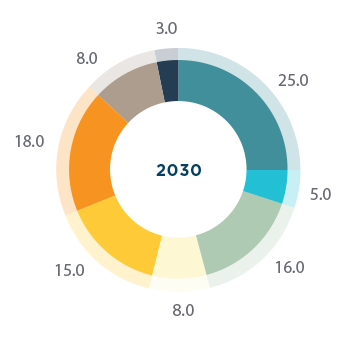

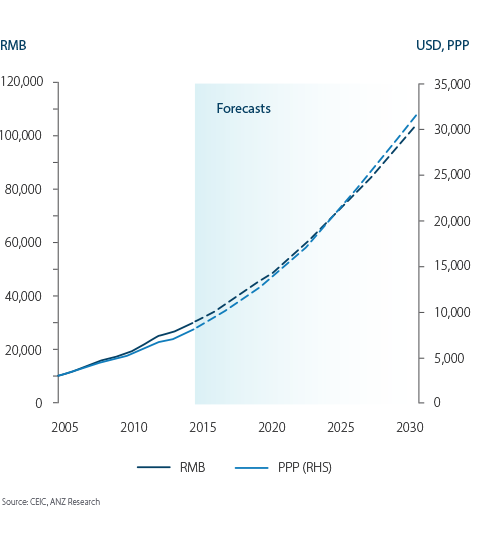

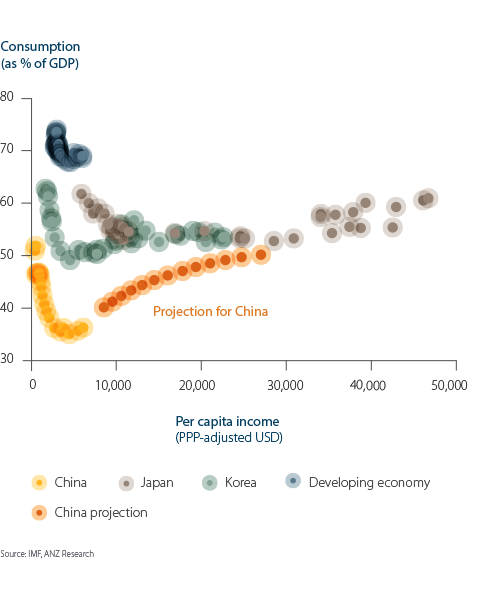

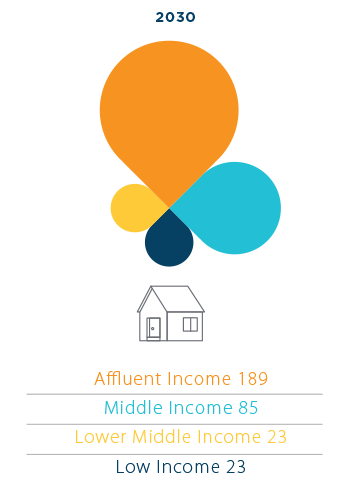

China’s private consumption is already a significant force in absolute terms, but at 38% of GDP it is still well below the rate seen in other economies. Over the next 15 years we expect China’s consumption share to rapidly approach global norms, despite a slowdown in overall GDP growth.

- The Chinese authorities are working to rebalance China’s economy by increasing consumption and reducing the reliance on investment and exports for economic growth.

- In particular, a range of reforms is being implemented to increase household incomes and lower precautionary savings. Those initiatives include widening medical insurance, pension reform, labour law amendments, and land reform – all of which should give the Chinese consumer greater confidence and capacity to spend.

- We also expect the extension of consumer credit and rapid growth in online sales to play their part in stoking private consumption.

- We believe China’s growing urban middle class will more than double its spending over the next 15 years, helping lift China’s consumption as a portion of GDP to almost 50%. By way of comparison, that means China’s consumption in 2030 would exceed GDP in the US today.[1]

- Potential risks to these projections include delays in the liberalisation of China’s financial system or delays in the implementation of the reforms mentioned above.

- Our projected increase in Chinese consumption will have significant implications for the global economy.

- On the positive side, growth in Chinese consumption and a reduction in China’s savings could help rebalance the global economy, especially if it reduces its reliance upon the US consumer as a final source of global demand.

- On the negative side, it may mean lower growth for China. In addition, fewer exports from China to the G3 will mean some Emerging Asian economies (which are currently exporting components to China for assembly) may have to develop new growth strategies.

- However, new opportunities are already arising as China’s urban middle class grows. For Australia those opportunities include education, tourism and services on the ground in China.

- As a result, we expect Australia’s exports to China will almost double to around USD175bn by 2030.

New Opportunities are Already Emerging

_____

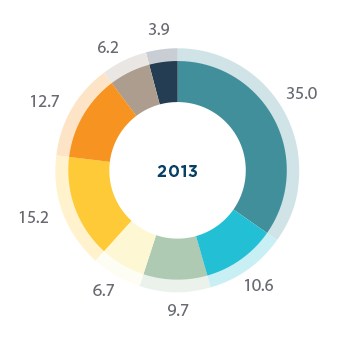

New opportunities are already arising as China’s urban middle class grows and spending habits shift away from basic necessities in favour of household items and services (see figure 3). For Australia those opportunities include education, tourism and services on the ground in China.

As a result, we expect Australia’s exports to China will almost double to around USD175bn by 2030.