Insight

Aus budget 2019: more & less

CHERELLE MURPHY, SENIOR ECONOMIST, ANZ | APRIL 2019

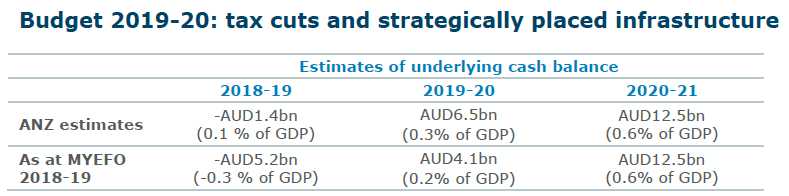

ANZ Research expects Australia’s underlying cash balance estimates will be revised upward in the April federal budget, alongside the announcement of personal income tax cuts and infrastructure spending.

Stronger-than-expected commodity prices and growth in employment have lifted tax receipts while payments are lower relative to Treasury’s expectations.

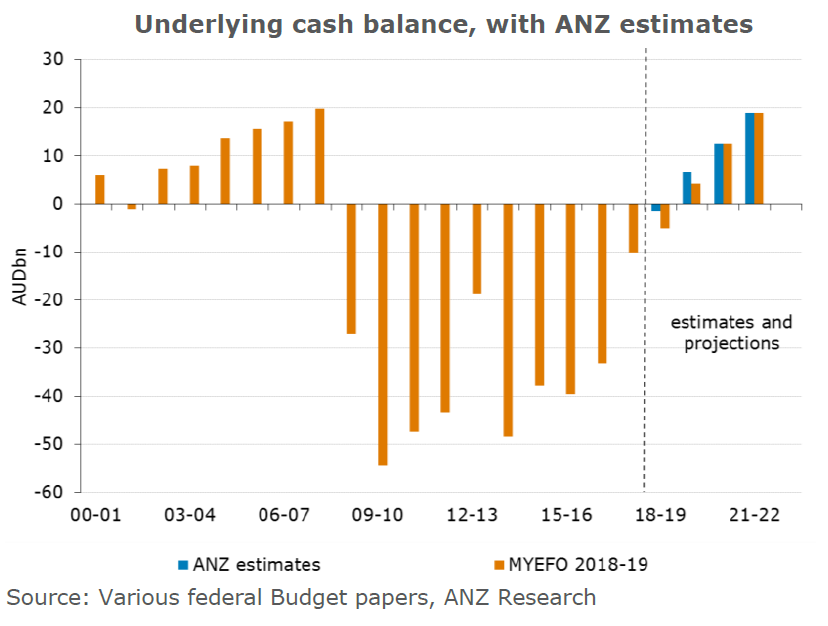

The underlying cash deficit estimate in the 2018-19 mid-year economic and fiscal outlook (MYEFO) of $A5.2 billion (-0.3 per cent of gross domestic product) for 2018-19 is likely to be smaller when the fiscal position is updated on the evening of April 2.

The estimated surpluses for 2019-20 ($A4.1 billion or 0.2 per cent of GDP) is likely to be slightly larger than what was reported in the MYEFO. The surplus projections for 2020-21 ($A12.5 billion or 0.6 per cent of GDP) and 2021-22 ($A19.0 billion or 0.9 per cent of GDP) are likely to be largely unchanged.

_________________________________________________________________________________________________________

“'Congestion-busting’ infrastructure announcements seem likely although the federal government may choose to save these for an election campaign.”

_________________________________________________________________________________________________________

Commodity prices - in particular iron ore and metallurgical coal - have been higher than what was assumed in MYEFO and the Australian dollar has depreciated modestly. That means company tax receipts are likely to be stronger.

Although Treasury upgraded its nominal GDP estimate to 4.75 per cent in the MYEFO, expect nominal year-average GDP growth to be higher still, at 5.3 per cent, lifting the revenue base for this and future years.

The Reserve Bank of Australia is likely to welcome income tax cuts, preferring this stimulus over a lower cash rate, which would not address household’s credit-supply constraints.

A bit off the top

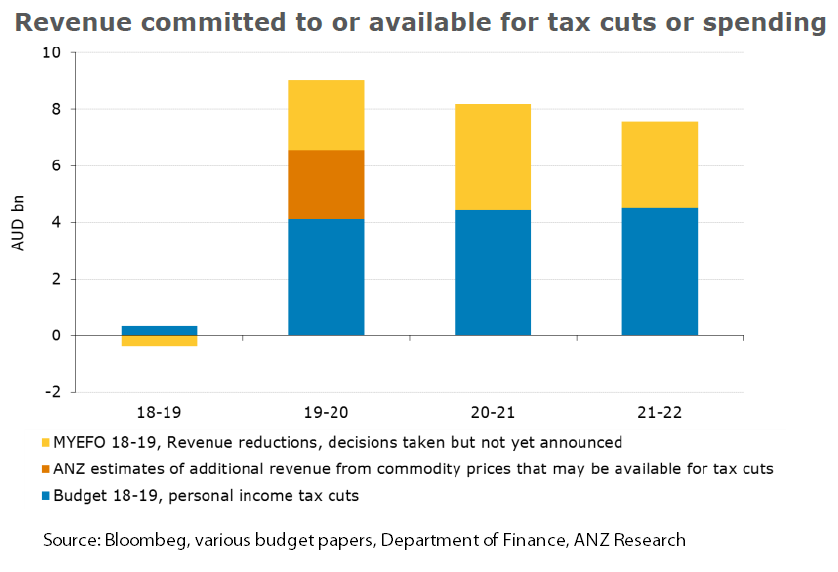

When combined with the tax cuts announced in 2018, ANZ Research expects the tax relief unveiled to be on average around $A12 a week for workers in 2019-20 and under $A2 a week for the following financial year.

Assuming 2 per cent of this is saved (the current household saving rate) the additional tax cuts would lift nominal GDP by 0.4 percentage points in 2019-20 and 0.06 percentage points in 2020-21.

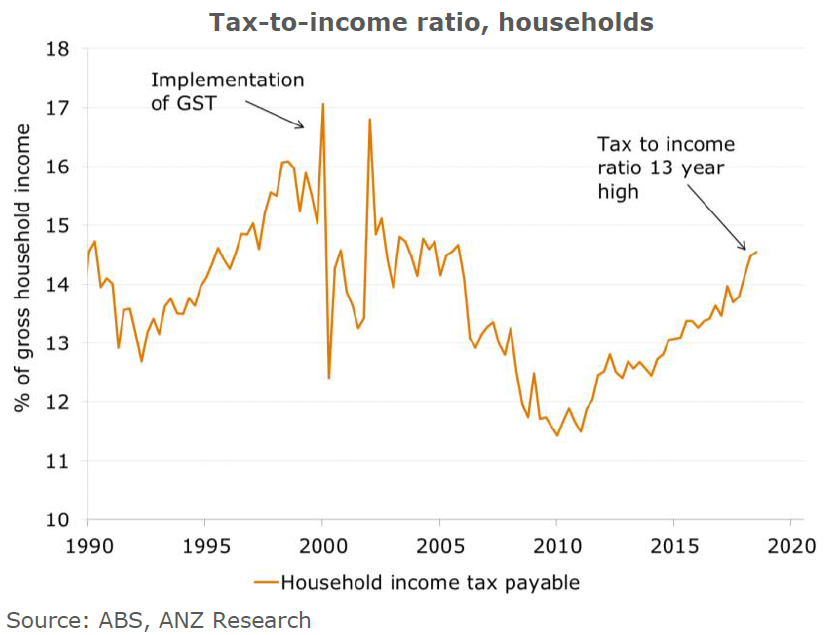

ANZ Research believes modest immediate tax cuts are appropriate given the household tax-to-income ratio has risen to a 13-year high and the consumption outlook has weakened.

Permanent tax reductions based solely on unexpected commodity price revenue bonuses may be difficult to justify, however, in ANZ Research’s view. This would erode future budgets unless future governments were willing to reverse those changes.

Modest tax cuts are arguably appropriate at the moment as household income tax is at a 13-year high of around 15 per cent of gross household income. This is not ideal given household income growth is low, household debt is high and consumer confidence is falling. Consumption forecasts are weak as a result.

As RBA Assistant Governor (Economic) Luci Ellis pointed out recently, taxes paid by households in the past year have increased by around 8 per cent, which is double the 3.5 per cent gross household income growth rate.

That has been due to bracket creep, declines in some deductions and offsets and Australian Tax Office compliance measures.

While fiscal spending when the outlook is soft can be a good buffer to slower economic growth, surpluses can cushion against shocks and long-term fiscal pressures.

The quality of spending and recipients of tax cuts also matter for the future of the economy. Surplus projections can be maintained if wasteful spending is removed and replaced with measures that encourage work, saving, investing or innovation.

‘Congestion-busting’ infrastructure announcements seem likely although the federal government may choose to save these for an election campaigning, which could start soon for a likely May 11 poll.

Infrastructure spending – whether direct, through grants to states or off balance sheet – will be worth analysing in both the budget and the election campaign.

The other one

The federal opposition’s budget reply speech is on April 4. If - as polls predict - it wins the coming election, fiscal policy is unlikely to change dramatically but personal income tax cuts would likely skew to low- and middle-income earners.

In principle, this plan could be more stimulatory for the economy than the government one. Low-income earners are likely to have a higher propensity to spend than the others.

ANZ Research does not expect fiscal changes to cause rating agencies to revise any AAA stable credit rating for Australia, regardless of the election outcome.

Cherelle Murphy is a Senior Economist at ANZ

RELATED INSIGHTS AND RESEARCH

insight

There’s nowhere to hide from political risk

Businesses can no longer ignore political risk – no matter where they are, experts suggest.

insight

The diversity dividend is obvious: Bishop

To mark IWD 2019, we share comments from the Hon Julie Bishop MP on why board diversity is paramount.

insight

China’s lesson from the trade war

China has grand plans for the future of its economy and the trade war has shone alight on what it needs.