Insight

China’s lesson from the trade war

DR RAYMOND YEUNG | CHIEF ECONOMIST, GREATER CHINA, ANZ

The below story is an edited version of a presentation given by Yeung as part of ANZ’s Economic Outlook Series 2019. Click HERE for more information.

The impact of the ongoing trade dispute between the United States and China highlights the importance, for the latter, of hastening its structural reforms.

Currently enduring an economic slowdown which is structural, not cyclical, China aims to transform itself into a high-value added and technological driven economy, decamping from property driven growth cycle.

A country endowed with valuable assets (be they natural resources or corporate headquarters) supports its currency outlook. The yuan will appreciate only if China can move up to the value added chain.

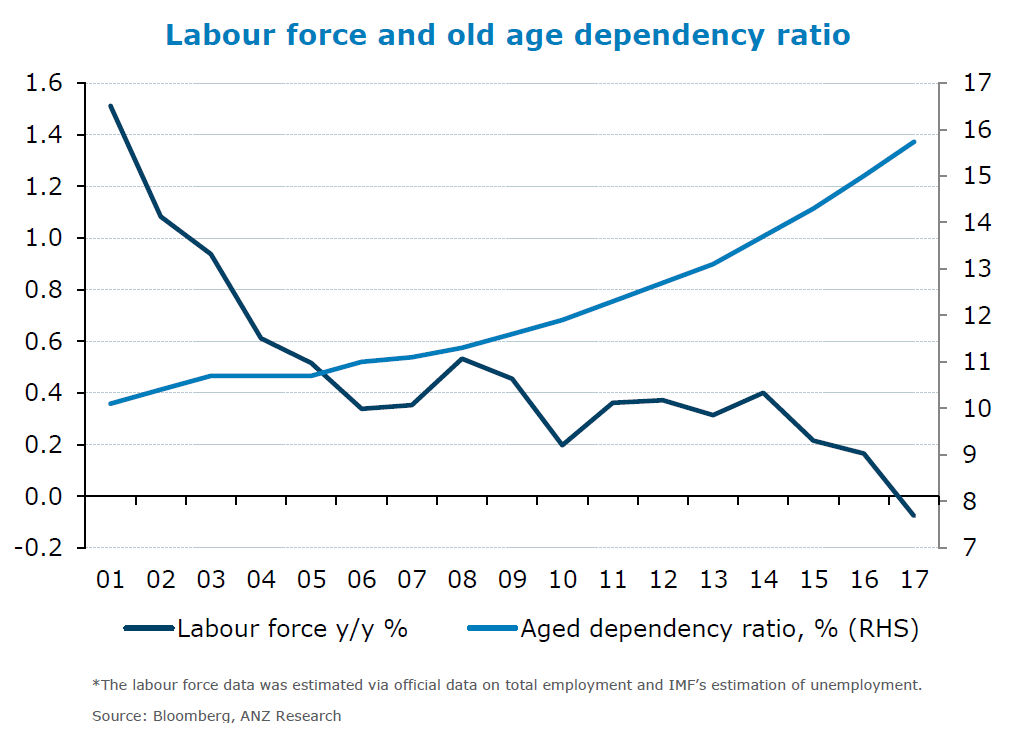

The reality is the Chinese economy is increasingly constrained by its factor of inputs. Its growth potential is shrinking unless we see a substantial improvement in productivity per unit of input.

Productivity improvement is the key to sustainable growth in China. A shrinking labour supply encourages investment in human capital.

_________________________________________________________________________________________________________

“Currently enduring an economic slowdown which is STRUCTURAL, not cyclicaL, China aims to transform itself.”

_________________________________________________________________________________________________________

Innovation and technology improvement is critical. The Chinese policymakers know this, so do their US counterparts. This makes Made in China 2025 under the spot light in the current trade tension.

Manageable

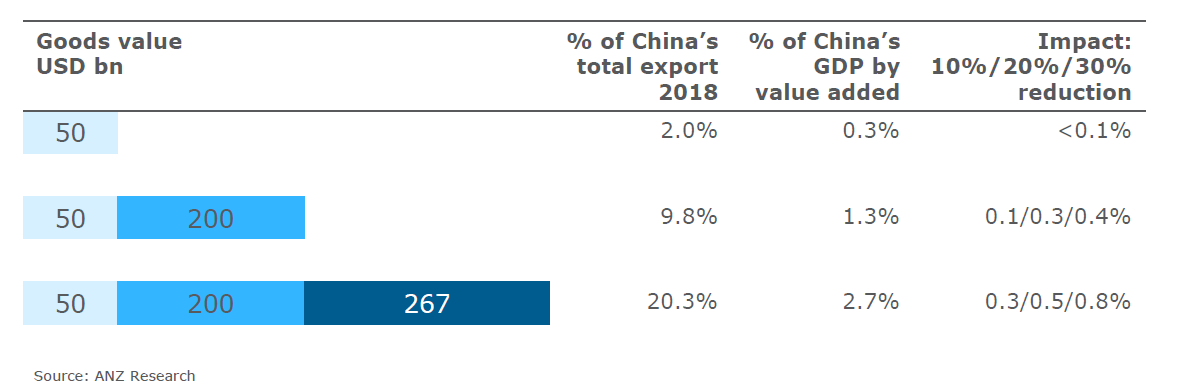

The impact of import tariffs on China’s gross domestic product is manageable. China’s exports are likely price inelastic so a 25 per cent increase in price may result in a 20 per cent decline in export value.

In our base-case scenario, the full package would cost 0.5 per cent of China’s GDP. This can be regarded as the long-term direct impact.

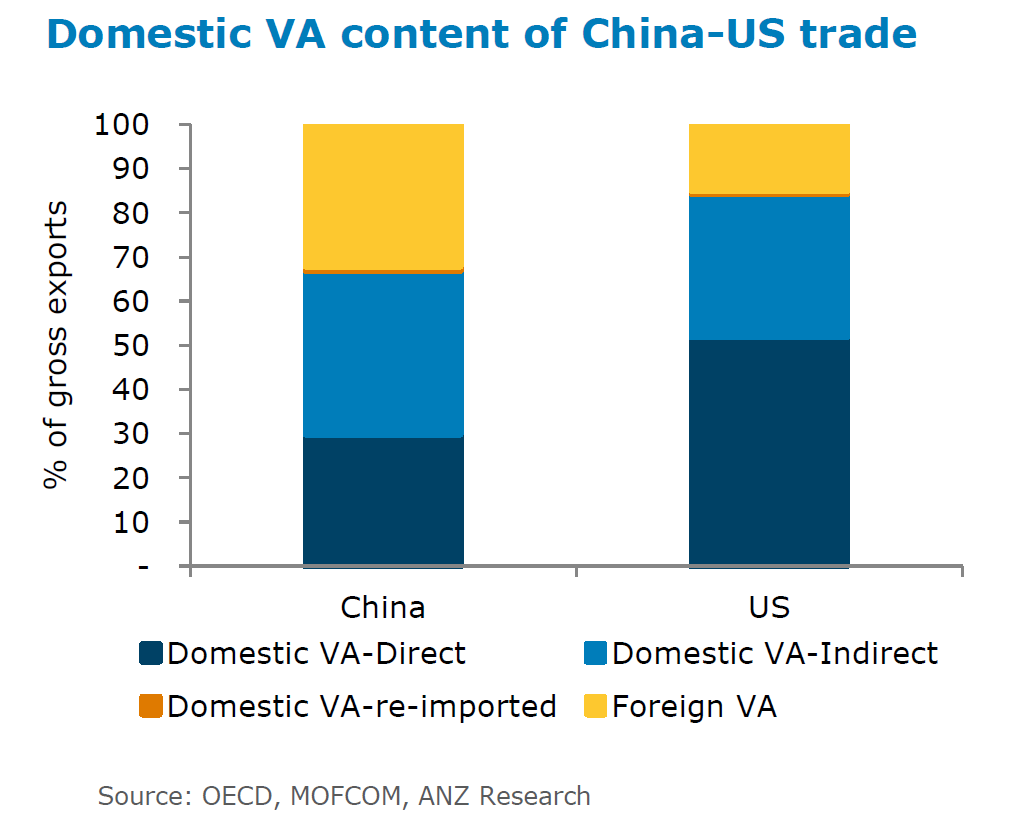

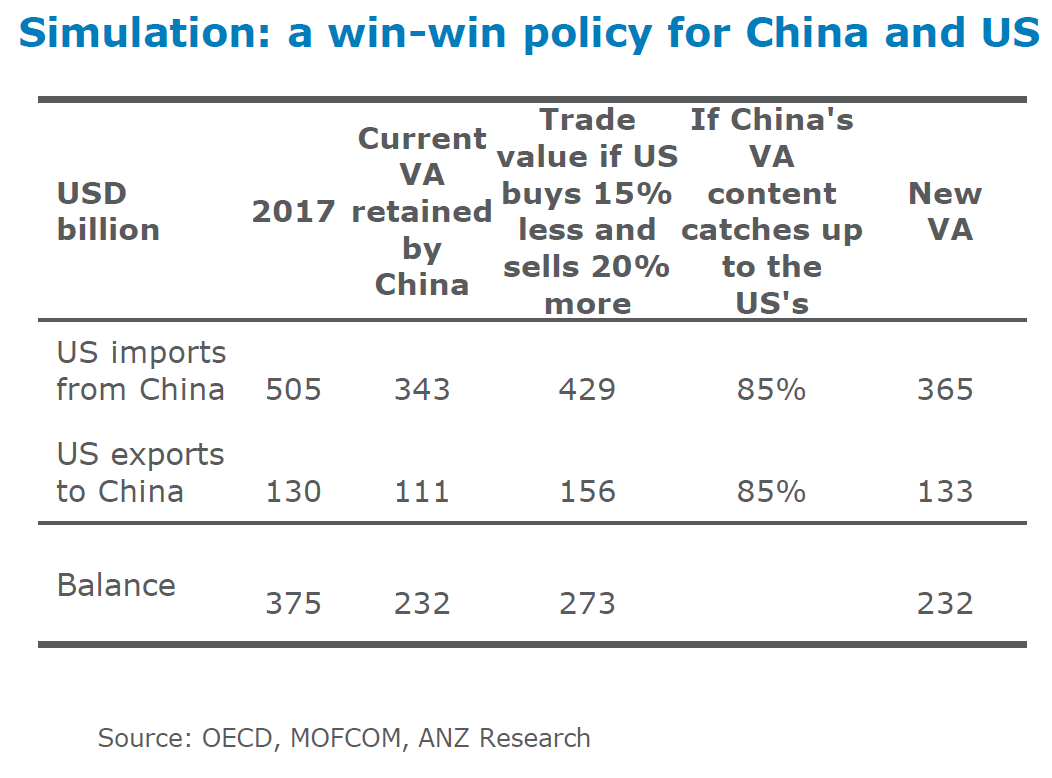

Economic value add, not the trade surplus, is where the battlefield is. Both the US and China know this.

Service

Financial data of listed Chinese companies suggest strong growth across industry. In 2018, six out of 11 categories of service firms have registered double-digit revenue growth. The GDP of the service industry has moved in tandem. Profit margins also reflect the high value added by the industry.

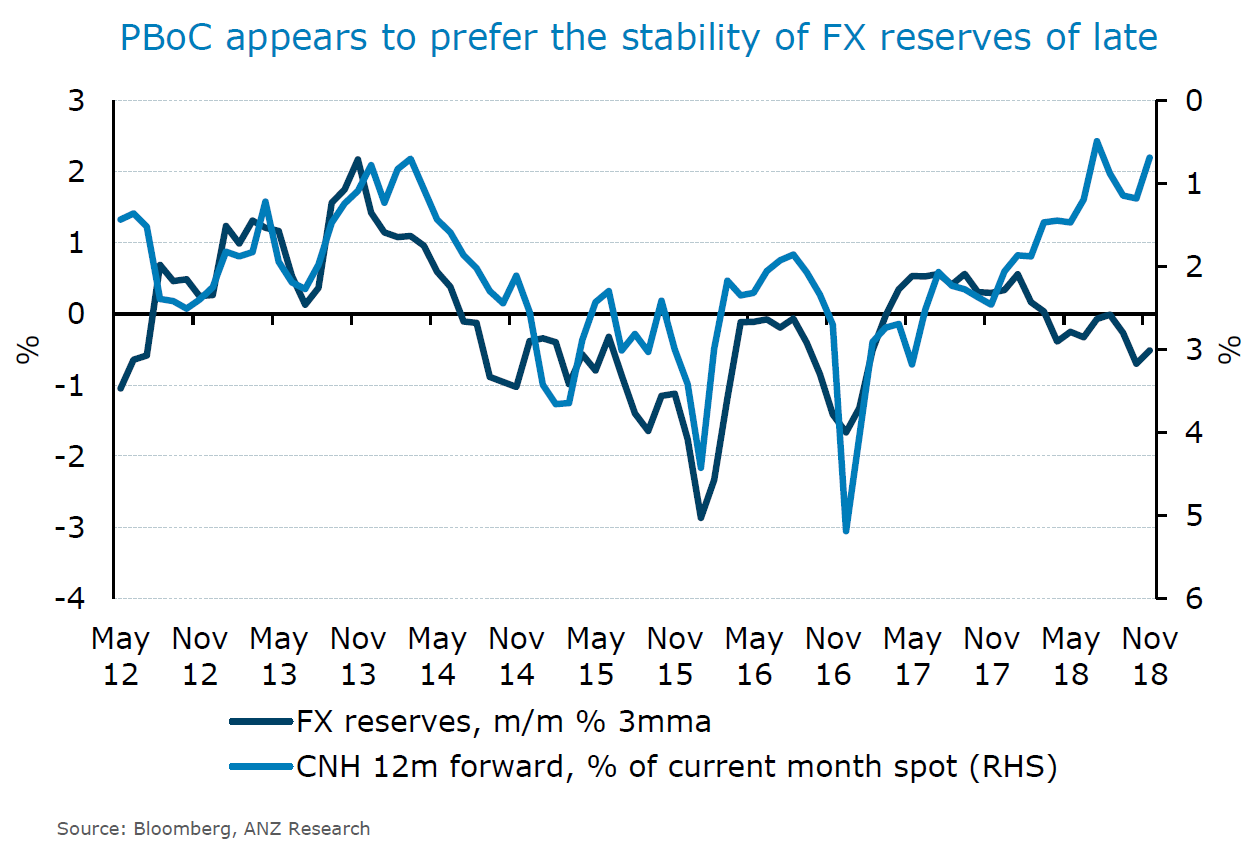

China’s high foreign reserve will help maintain currency stability for now. For emerging markets, deep foreign reserves are the cornerstone of currency stability. China will still manage cross-border flows tightly in order to preserve its level of foreign reserve.

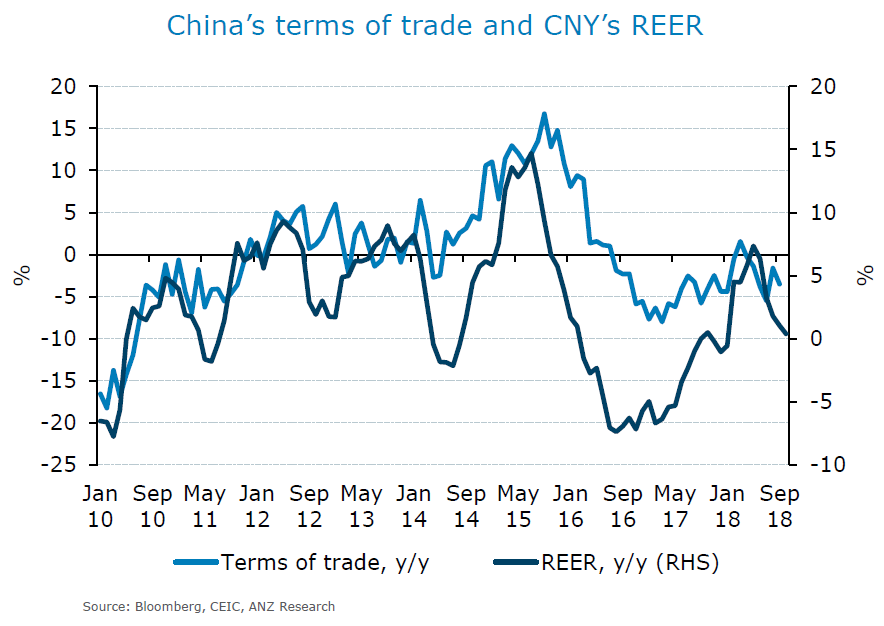

Ultimately though a country’s terms of trade determines the fair value of its currency. Economic theory suggests terms of trade are a key determinant of fair value. Empirically this applies to China, too.

Dr Raymond Yeung is Chief Economist, Greater China at ANZ

This story is an edited version of a presentation given by Yeung as part of ANZ’s Economic Outlook Series 2019. Click HERE for more information.

RELATED INSIGHTS AND RESEARCH

insight

Looking for Opportunity in a Geopolitical Recession

We have entered a new world order where the U.S. is no longer the global leader – and that has ramifications for not just economies, geopolitics and security but even the shape of the internet, according to Ian Bremmer, one of the world’s most highly regarded political scientists.

insight

Is Asia heading toward a trade recession?

China manufacturing is as weak as it has been for years. How will the rest of Asia hold up?

insight

Q&A: Bishop on trade, uncertainty & taming China

MP and former Australian foreign minister chats to ANZ’s Farhan Faruqui about the importance of strong leadership in times of global upheaval.