Insight

INFOGRAPHIC: economic outlook for 2019

Richard Yetsenga, Chief Economist, ANZ | January 2019

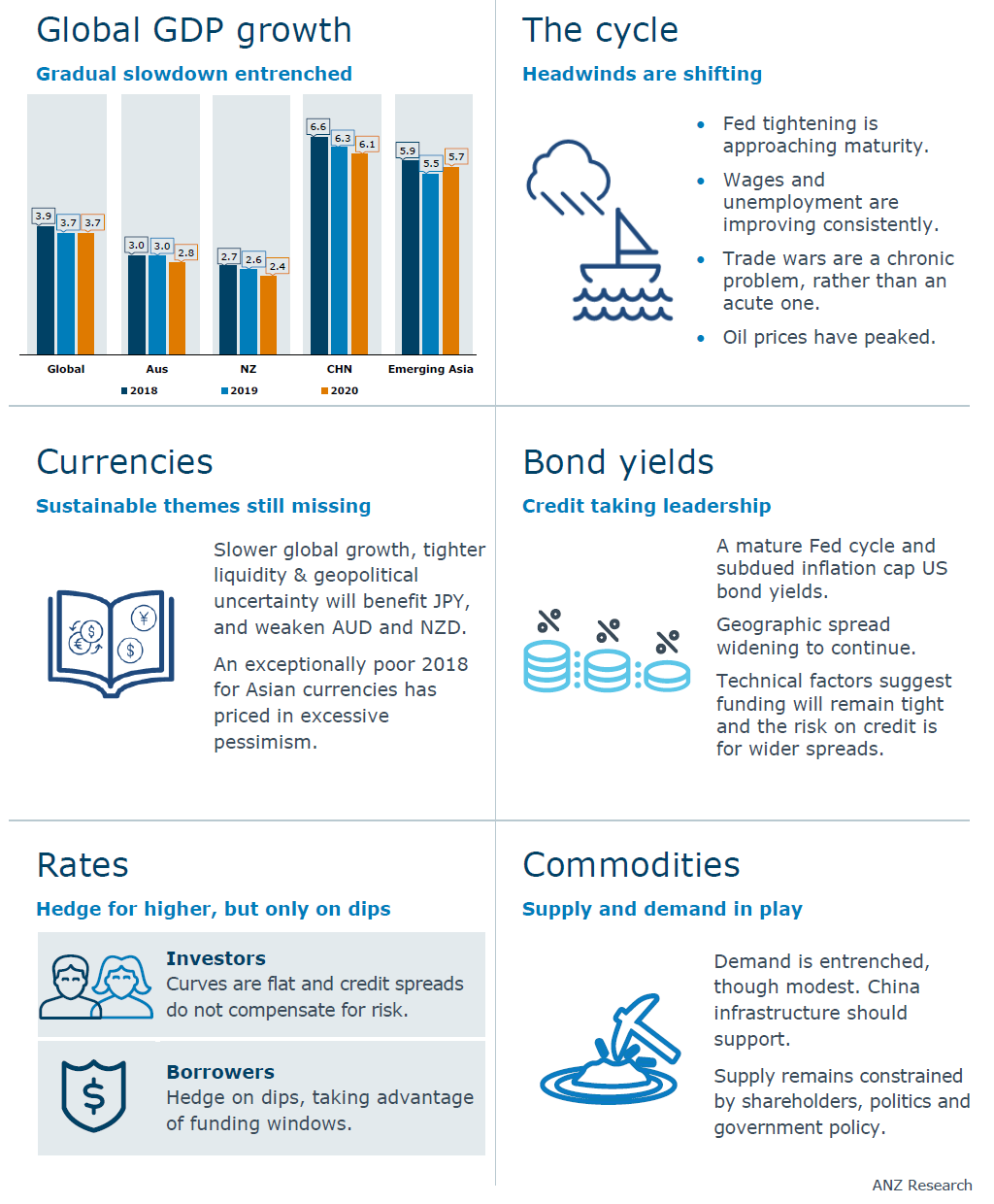

Global growth is moderating but remains resilient. Headwinds look set to persist in 2019 but the year should be less stressful all up than 2018.

Still, the effects of some of the remaining stress points are likely to be felt over much longer time frames than markets have priced.

According to ANZ Research, the slowdown from the 4.0 per cent growth peak seen in 2017 and 2018 is likely to continue into 2020, with growth of 3.7 per cent that year.

_________________________________________________________________________________________________________

"Headwinds look set to persist in 2019 but the year should be less stressful all up than 2018.”

Richard Yetsenga, Chief Economist, ANZ

_________________________________________________________________________________________________________

Major economies such as China and the US are likely to make the largest contributions to the global slowing but India and Europe will also likely weigh.

ANZ Research believes popular commentary is overplaying the short-term impact of trade wars. It just doesn’t seem probable that US tariffs on China are going to substantially weaken Chinese exports at an aggregate level.

Four things to watch in 2019

•The US Federal Reserve is on track to pause around neutral.

•Labour markets in advanced economies are giving consumers resilience.

•Trade wars are entrenched, but markets have overplayed their short-term impact.

•Data in China need to show some stabilisation to validate the early shift to stronger risk appetite.

Peaked

US growth has clearly peaked and is now slowing. This and an absence of movement on rates from the US Federal Reserve suggest that bond yields in the US are likely to remain capped, even if funding costs at the front end of the curve remain elevated.

In addition bond markets outside the US are likely to welcome the narrowing of US growth exceptionalism. Stressed non-US markets are likely to continue to normalise. With few active central banks outside the US, bond spreads against the US are likely to be more stable in 2019.

Asian currencies are likely to benefit from the improvement in risk appetite and the fall in commodity prices. Conversely, the $A and $NZ are likely to continue to be challenged because of their exposure to commodities.

Richard Yetsenga is chief economist at ANZ

This is an edited version of an ANZ Research report. Registered clients can read the full report at ANZ Research.

RELATED INSIGHTS AND RESEARCH

insight

Looking for Opportunity in a Geopolitical Recession

We have entered a new world order where the U.S. is no longer the global leader – and that has ramifications for not just economies, geopolitics and security but even the shape of the internet, according to Ian Bremmer, one of the world’s most highly regarded political scientists.

insight

Australian business taking a lead in ASEAN

ASEAN's growing population and affluence is attracting more Australian businesses looking for trade and investment opportunities.

insight

Institutional Term Loans taking off in Australia

Australian corporates are increasingly tapping Australia’s superannuation funds and institutional investors for longer-dated loans and to diversify their funding sources away from the bank market, paving the way for a slow evolution of a direct lending market.