Insight

JKM & the future of the LNG market

JAMES LOWREY, DIRECTOR, REI, ANZ INSTITUTIONAL | AUGUST 2019

In 2019 Australia became the largest exporter of liquified natural gas (LNG) in the world. Growth in the market has been one of the fastest among fossil fuels, particular in Australia as the wave of local production projects built in the last six to eight years come online.

In the market’s favour is its proximity to Asia, where in conjunction with Australia’s supply growth has been the emergence of the Japan-Korean Marker (JKM) LNG benchmark, a pricing instrument published by commodity agency S&P Global Platts.

While not recognised as an official benchmark, JKM has quickly become the main pricing measure used in the Asian spot market. Launched only 10 years ago, the market was nascent for the majority of that time with little liquidity.

But as demand in Asia continued to grow, more shipments have come into the region - and prices have increasingly dislocated from the traditional benchmarks, including Brent crude. Thus sellers, buyers and traders have embraced the ‘Asian’ index.

Acceptance of the JKM marker is at a point where it "probably is" a quasi-official benchmark, gas market consultant Patrick Heather told Petroleum Economist in April – at least for now.

"Once you are established, you are established, it is very difficult to change a benchmark," he told the publication.

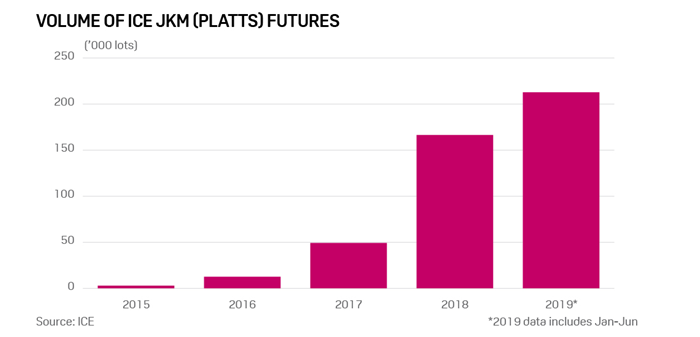

Established is perhaps underselling it. In the last two years JKM volumes for hedging have gone through the roof. In 2018 volumes increased 240 per cent year on year, from 50000 traded lots to 155,000. In February alone 30,000 lots were traded and there have been bigger months since.

At ANZ, we’re expecting that significant increase in volumes to continue. The JKM is poised to get even bigger.

_________________________________________________________________________________________________________

“At ANZ, we’re expecting that significant increase in volumes to continue. The JKM is poised to get even bigger.”

_________________________________________________________________________________________________________

On record

According to S&P Global, JKM volumes hit record levels in May before tapering off in June to a still hugely impressive 43,000 lots, the second-most active month for 2019.

On the other side of the market, prices have been falling, with S&P Global recording a decline in Asian LNG prices since the European winter due to strong supply and muted demand. The JKM spot price fell roughly 40 per cent in the first half of 2019.

Indeed, briefly in July Asian prices dipped below European prices as soaring production met the aforementioned slowing demand in Asia.

Supporters of the market say the rapid rise is relevance of the JKM indicates how the LNG derivatives market is maturing. In previous years the price of the market has been linked, as previously, to crude oil but the days of those two commodities moving in tandem are long gone.

This shift has seen an increase in spot cargoes and trading. A report from the International Group of LNG Importers said 32 per cent of total import volumes in 2018 came through spot trades, up from 27 per cent the year before.

The combination of rising demand for spot trading and traditional price disconnection has sent many parties into the arms of JKM.

Hedging with ANZ

ANZ’s grasp of the complex Asian LNG market was highlighted earlier in 2019 when the bank secured its first-ever JKM hedge trade with a large national oil company in south-east Asia.

Said company has continued to broaden its position in LNG, not only for its own requirements but also for third-party trade.

The deal came after significant work at ANZ across a number of internal teams and geographies, together with executive sponsors, to add JKM to the bank’s hedge capability in the second half of 2018.

In early 2018, we saw JKM becoming more popular among clients when pricing and hedging LNG cargos, particularly within Asia. Additionally, not many counterparties were able to offer JKM, allowing the bank to better serve existing customers in the region and also establish new hedge relationships with interested parties in Asia.

Since the trade with the large national oil company in south-east Asia, ANZ has aided another JKM hedging with one of the largest oil and gas companies in China, showing the bank is being recognised internationally for its high-quality service offering.

ANZ has progressed discussions with a number of other existing customers globally to add JKM to their hedging portfolio with the bank, and are in the process of finalising necessary approvals and documentation to capture this flow.

Focus

Australia’s resources, energy and infrastructure sectors are a key focus area of ANZ and we know how important LNG is to the industry – and broader Australian economy. We’re proud to support a lot of these projects not just with finance to build them but also as a project account bank.

There’s massive growth in the global LNG sector to come. In 2018 the number of countries importing LNG rose to 42, according to a Shell report. LNG supply is expected to grow at an annual compound rate of 4 per cent until 2035. The story JKM story has only just begun.

JKM is a still a new addition to ANZ's portfolio and while we understand it serves as one option in a diverse range of hedging opportunities for customers, having it helps open doors for some really meaningful conversations with customers.

As a bank we read the JKM trend in late 2017. Our customers are telling us they're doing JKM. They're asking us to provide it because there are not many providers on the market.

The momentum has kicked off. The market has kicked off. We’ve got JKM and we’re helping our customers win.

James Lowrey is a Director, REI at ANZ Institutional

For more information on LNG or other developments in the resources, energy and infrastructure sectors, click HERE.

RELATED INSIGHTS AND RESEARCH

insight

Grains, trade & gains

The future for Australia’s grains and oilseed sector – and the companies which trade within it - is bright.

insight

Everyone is easing: the outlook for Q3

Trade tension has been a surprising drag on growth and central banks could be called into action. Here are ANZ Research’s forecasts for the second half of 2019.

insight

Robots, productivity & the destruction of jobs

What will the tech revolution do to jobs? We still don’t know but there are some firm ideas.