FINANCIAL INSTITUTIONS GROUP NEWSLETTER

SUSTAINABILITY PARADIGM 2.0: FINANCIAL INSTITUTIONS POISED FOR FRESH GROWTH PHASE

Download the PDF

_______________________________________________________________________________________________________________

UNEP FINANCE INITIATIVE’S PRINCIPLES FOR RESPONSIBLE BANKING LAUNCHED IN SEPTEMBER 2019, 13 YEARS AFTER THE LAUNCH OF THE UN-SUPPORTED PRINCIPLES FOR RESPONSIBLE INVESTMENT.

_______________________________________________________________________________________________________________

The launch of the United Nations’ Sustainable Development Goals (SDGs) and the Paris Agreement in 2015/16 have boosted global sustainability capital markets, with the emergence of environmental, social, and governance-minded (ESG) investors and related regulations (see September 2019 FIG Newsletter) having a catalytic effect. We believe financial institutions (FIs) that understand this trend will be able to capitalise on opportunities to grow while becoming more resilient as organisations.

Compared to the asset management industry, banks as intermediaries have adopted a relatively slower pace in defining their collective role, with the UNEP Finance Initiative’s Principles for Responsible Banking launched only in September 2019, 13 years after the launch of the UN-supported Principles for Responsible Investment.

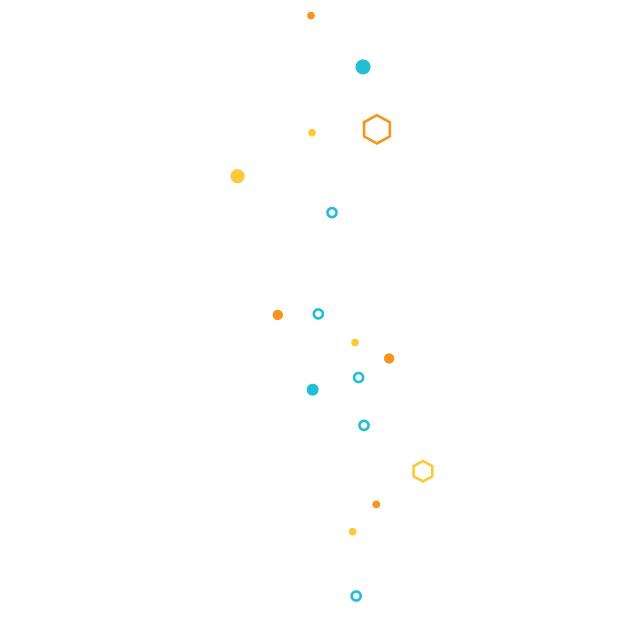

FIGURE 1:

Thirteen years of consecutive growth in AUM and signatories of the UN Principles for Responsible Investments have paved the way for the launch of the UNEP FI Principles for Responsible Banking in September 2019 with 132 banks representing more than $US47 trillion in assets.

Sources: UN PRI and UNEP FI (as of 30 Nov, 2019)

As regulated entities, banks are and have been increasingly influenced by emerging regulations in the following ways:

- directly by the actions of regulators and stock exchanges;

- indirectly through the regulations that will affect investors; and

- indirectly through the regulations that affect banks’ customers.

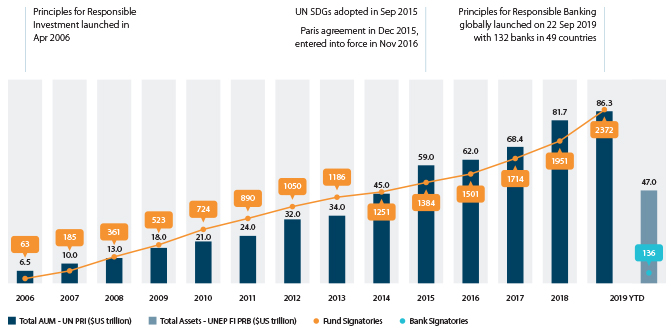

MSCI research (Figure 2) shows ESG regulations affecting investors and issuers have grown significantly since 2000.

FIGURE 2:

Number of ESG regulations affecting issuers and investors has increased since 20001

Sources: MSCI-2019-ESG-Trends-to-Watch

Forward-thinking businesses spotted the trend more than five years ago and have been reorienting to capture the trillion-dollar opportunities presented by the SDGs and the Paris Agreement.

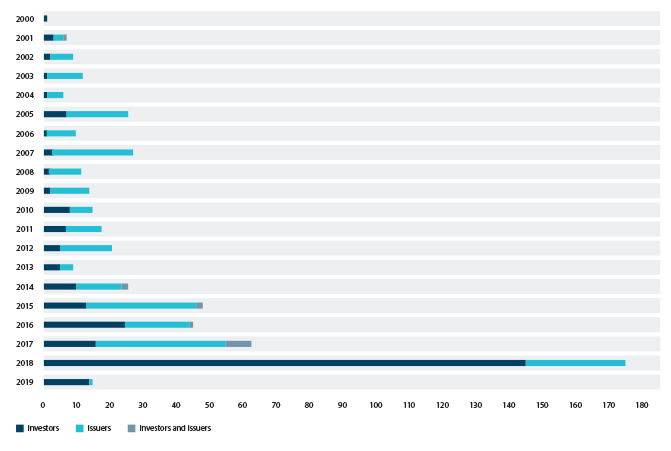

As the intermediaries of capital flows, banks have a key role in financing or arranging financing for their clients in sustainability activities or business solutions and with support from their ESG investors. These capital flows have been increasing rapidly in recent years (Figure 3).

_______________________________________________________________________________________________________________

A POSITIVE FEEDBACK LOOP HAS EMERGED WITH REGULATIONS STEERING FIs TO BECOME BETTER STEWARDS OF CAPITAL FOR SUSTAINABLE DEVELOPMENT, WHICH IN TURN INCREASES THE ACCEPTANCE OF RULES AND FOSTERS TRANSPARENCY IN THE CAPITAL MARKETS.

_______________________________________________________________________________________________________________

FIGURE 3:

Overall sustainability financing issuances by sector

Sources: Bloomberg (as of 30 Nov, 2019)

At the same time a positive feedback loop has emerged with regulations steering FIs to become better stewards of capital for sustainable development, which in turn increases the acceptance of rules and fosters transparency in the capital markets.

I. EARLY DAYS

The trend of sustainability-themed regulation coincides with the acceleration of greater volumes of green bonds, social bonds and sustainability bonds by FIs.

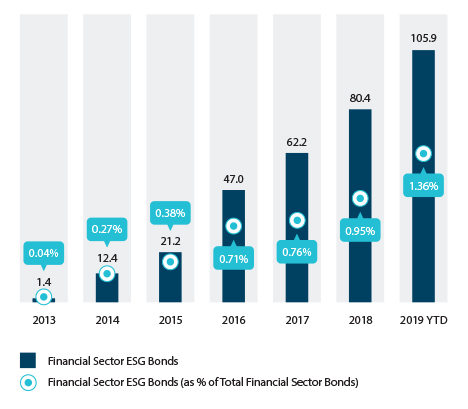

To date, however, these volumes constitute a fraction of the total FI issuance universe (see Figure 4). Additionally, in individual issuer terms, sustainability bonds typically constitute a small portion of any bank’s funding source.

FIGURE 4:

FI ESG Bonds as % of Total FI Issuances

Sources: Bloomberg (as of 30 Nov, 2019)

That raises the question: Why isn’t the sustainability bond market growing faster? One theory is global banks have been tactical rather than strategic in tapping sustainable capital markets. We disagree. The fact is this market has developed from a low base and even now isn’t at sufficient scale to constitute one of our dominant funding markets.

A number of reasons are relevant, however. On the supply side it is easier for a bank to issue its first sustainability bond because it typically has those underlying assets on its balance sheet.

Issuing the second bond, on the other hand, may require supporting new green activity by its customers, especially for smaller banks, while issuing the third could mean sending out bankers to seek new green assets or customers.

The more green, social and sustainability loans banks have on their balance sheet that meet the “use-of-proceeds” requirement, the more stock feed they have for such bonds.

Furthermore, while the “use-of-proceeds” sustainability bond format has been the focus of market development for the last few years, newer and more innovative sustainability bond structures are emerging (e.g. sustainability-linked bonds). Scaling up these developments will take time - not least because, first, they need to be recognised by corporates, factored into their strategic approach, including by setting targets and arranging financing.

Eventually they will grow the market and provide investors with more opportunities. That process will be further aided as companies increasingly value the benefits of a sustainability-oriented strategy. Indeed, a recent paper by the Economist Intelligence Unit (EIU) shows that sustainability is increasingly viewed as a way to enhance profitability.

Technology too can help, as advancements in artificial intelligence and big data analytics aid the pursuit of corporate sustainability goals. For this reason, a growing number of corporations plan to increase spending on technology, an all-round positive development, as the EIU report notes. The other reason is on the demand side: while ESG investment mandates are on the rise, the terms of such mandates are constantly evolving.

As mentioned in the previous article, the fastest-growing investment approach is ESG integration, which emphasises the issuers’ focus on sustainability – as opposed to an issuance’s (i.e. where the issuance has a green label).

While dedicated green bond funds have not moved as fast as some market participants would like, there is a much larger and growing global pool of funds coalescing around a broader SDG focus – healthcare, education and smart cities, for instance. That holds great promise and will often align to a bank’s lending growth plan.

It’s also true channelling capital to the sustainability economy will work optimally when sustainability bonds are priced tighter than regular bonds. This will take time to evolve – but will eventually happen as the market matures and brings lower volatility and greater liquidity for these bonds.

For more information, please visit ANZ Insto & EIU partnership site: institutional.anz.com/tailored-with-technology

II. SHIFTING FOCUS TO ISSUER’S SUSTAINABILITY

As the bond market evolves, investors are looking more closely at how the issuer behaves, thereby improving the issuer’s focus on sustainability and, in turn, creating for themselves a more viable, long-term investment.

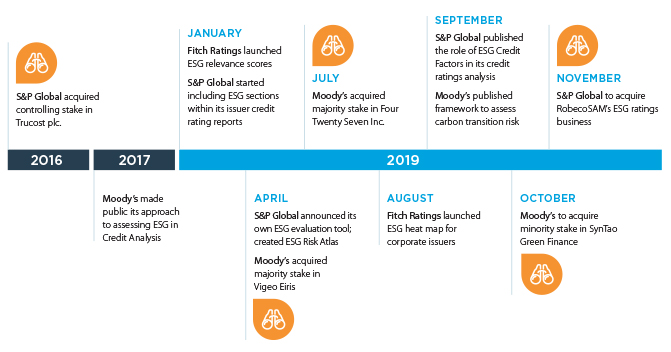

Credit rating agencies, recognising investors’ need for greater transparency and clarity on ESG factors, have committed to enhance systematic and transparent consideration of ESG in the assessment of creditworthiness (see Figure 5). Such approaches are applied across all rated issuers, as opposed to just green-labelled bonds.

In the long term, we believe a market more focussed on sustainability outcomes will morph into the mainstream.

There are signs this shift is already underway: take the recent fires in California, for example, which saw three power utility companies pre-emptively cut power to roughly one million customers.

According to Moody’s, the events illustrate how environmental and social risks are linked to the credit quality of the utility companies. The rating agency, which downgraded PG&E through six rating actions from A2 in March 2018 to eventually D and a rating withdrawal in January 2019 citing the company’s liabilities linked to wildfires, warned the consequences of climate change meant California would experience more fire-prone conditions.

As a result, utilities would see their electricity and distribution systems become more vulnerable, and face a heightened risk of large reconstruction costs.

As the market grows and becomes more focused on sustainability outcomes, the “use-of-proceeds” factor will become just one more point of consideration within the overall framework aimed at measuring the outcome of a sustainable strategy. It will also mean the general positioning of the borrower becomes the key focus. Until then, the pace of growth of sustainability bond issuances by banks will hinge on their support of such “use-of-proceeds” instruments.

FIGURE 5:

Credit rating agencies have been increasing investment in ESG related resources since 2016

III. INVESTOR-DRIVEN IMPACT

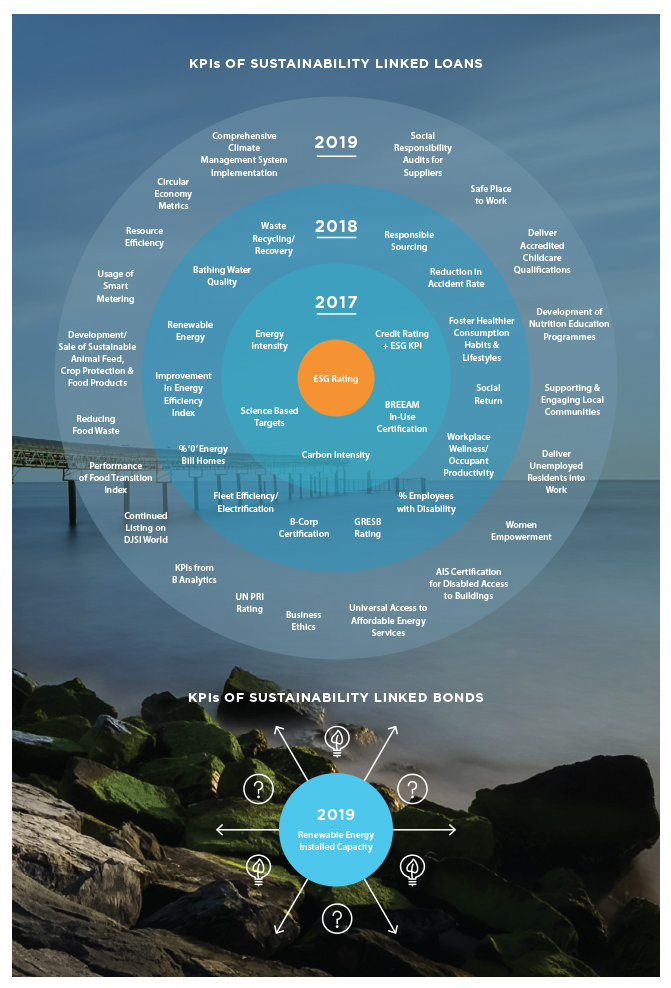

The sustainable bond market is evolving in interesting ways. Take the sustainability-linked financing market in Europe, for instance, where the loan margin or bond coupon is linked to specific sustainability-related key performance indicators (KPIs), and the proceeds of which can be used for general corporate purposes rather than for specific green or social asset categories.

In September 2019, ENEL, an Italian energy company, raised $US1.5 billion through a five-year sustainability linked-bond, whose coupon is designed to increase by 25 basis points if ENEL does not achieve a percentage of installed renewable generation capacity equal to or greater than 55 per cent of total consolidated installed capacity by December 2021. The figure stood at 45.9 per cent as of June 2019.

The bond was reported to have been priced 20 basis points tighter than an issuance without a sustainability feature. Such measures help sustainability-linked bonds to build and strengthen the market for outcome-focused instruments.

FIGURE 6:

The sustainability-linked bond market is set to draw reference from the recent rapid bloom of innovative structures in the sustainability linked loan market.

“From an issuer’s perspective, the observable benefits of bonds, based on “use-of-proceeds”, have primarily derived from increased diversification and primary market liquidity which in turn may result in an economic upside. Sustainability-linked bonds offer a new economic proposition linking to sustainability outcomes that are more direct for both issuers and investors,” said KJ Kim, Head of Asia DCM.

This is a sign of how the green and sustainability bond market is pushing into new areas. It also shows how investor interest can help drive banks into a greater stewardship role.

Investors are increasingly keen to engage on sustainability issues, especially in Europe, where there is detailed knowledge of this asset class.

They are also more sophisticated and rigorous in how they evaluate the sustainability of issuances and of the issuer. These investors are exercising much greater scrutiny and paying greater attention to “use-of-proceeds” and traceability, with detailed questions about why an issuer is raising a sustainability bond and what the issuer’s strategy is.

Post-issuance reporting is now compulsory, with more green investors asking how the proceeds are used, while the progress and impact of the projects require external verification.

This has prompted organisations, as the EIU report notes, to create dashboards to help track and make public a company’s record in meeting its sustainability targets and objectives.

INVESTORS SEEKING TO SUPPORT BUSINESS TRANSFORMATION

Issuing green bonds can help firms to better meet their strategic goals as seen in the case of vehicle leasing companies, which are using green bond issuance proceeds to help their existing fleet meet net-zero emissions or purchase green vehicles.

Such developments tie in with our view that increasing numbers of responsible and impact investors want more sustainable issuances that support business transformations that meet, for instance, the below 2°C Paris goal or solve sustainability challenges. Additionally, they want scale, familiarity and consistency, with greater depth in the market.

Innovations are key to broadening opportunities for investors. One exciting area is transition bonds: these types of bonds can serve to encourage companies in sectors such as fossil fuels, palm oil and meat production to begin transitioning from carbon-intensive or ‘brown’ production methods to less brown and, eventually, to ‘green’ over the long-term. At the same time, it’s crucial these bonds be properly structured in order to avoid the possibility of greenwashing.

In a positive development for investors, and society as a whole, companies are now taking a lead role in addressing sustainability goals and including increasing investments in technological innovation as the realisation grows there is a market opportunity in being sustainable.

According to the EIU report, more than a third (39 per cent) of executives surveyed in the financial services industry describe corporate sustainability initiatives as being “very significant”. The proportion of corporate leaders who hold this view is even higher in other industries.

_______________________________________________________________________________________________________________

INNOVATIONS ARE KEY TO BROADENING OPPORTUNITIES FOR INVESTORS SEEKING TO SUPPORT BUSINESS TRANSFORMATION AND NET POSITIVE IMPACT.

_______________________________________________________________________________________________________________

IV. THE ROAD AHEAD

As we have outlined above, there are several reasons why sustainable bond issuances represent just a fraction of overall FI issuances.

What is clear, though, is this market will keep growing, and that banks that position themselves for this sustainable future will shape the market.

As noted in the first article in this two-part series, some estimate that attaining the goals of the SDGs alone will cost about $US100 trillion. And much of this capital must come from the private sector.

On the supply side, we can expect banks’ asset portfolios to constitute greater proportions of green and sustainability-linked assets as they increasingly align their business strategies to the SDGs, the Paris Agreement, and national and regional frameworks. This will support more “use-of-proceeds” based bonds.

At the same time, as banks help finance clients’ efforts at business transformation and maximising their net positive impact on ESG issues, it will aid the development of the market for sustainability-linked bonds issuances.

On the demand side, growth in volume and new strategic themes of ESG credit funds will benefit investors with greater diversification, while liquidity-driven pricing will incentivise banks to tap sustainability bonds for their funding and regulatory capital purposes.

As supply of and demand for FI sustainability bond issuances evolve, they are also supporting the emergence of new taskforces and regulatory bodies, and in turn influencing the evolution of regulations, explored in the first article of this two-part series.

Yet another force driving these changes is the growing consumer demand for ethical conduct from companies they buy from – whether those be fund management firms, clothing brands or technology companies.

This trend is set to become more pronounced as wealth is transferred to sustainability-conscious millennials who will drive the ESG investment mandate and provide greater motivation to ensure sustainability investments deliver “additionality”.

All of the above will lead to a greater proliferation of sustainability lending and capital markets activity, which can be supported by FI sustainability issuances. Our view [see box] is that in the coming years the Asia-Pacific region and the world broadly can expect a stronger regulatory push and the creation of a more integrated framework of standards that bring about a paradigm shift in ESG and the widespread adoption of sustainability products.

- More ESG standards and definitions that will help to create a level playing field; in doing so this will further drive demand for sustainable finance.

- More government influence through a combination of hard regulatory push and soft encouragement for greater use of sustainability products.

- Increased integration of ESG factors into ratings analyses and decisions by ratings agencies.

- A new role for FIs to broaden understanding that climate change is exposing financial institutions and the financial system more broadly to risks that – if not addressed - will rise over time. Also, banks are being asked to integrate this into their risk models.

- A growing trend of banks integrating broader ESG factors (beyond climate) into their credit process.

- Increased demand for transition financing, a category that is potentially more impactful in helping traditionally ‘brown’ sectors to eventually become ‘green’, or ‘greener’.

- Higher frequency of engagement with issuers.

- Increased sophistication in how issuers approach sustainability financing. This will see issuances in more sectors and in more formats.

_______________________________________________________________________________________________________________

ALL OF THE ABOVE WILL LEAD TO A GREATER PROLIFERATION OF SUSTAINABILITY LENDING AND CAPITAL MARKETS ACTIVITY, WHICH CAN BE SUPPORTED BY FI SUSTAINABILITY ISSUANCES. WHAT IS CLEAR, IS THIS MARKET WILL KEEP GROWING, AND THAT BANKS THAT POSITION THEMSELVES FOR THIS SUSTAINABLE FUTURE WILL SHAPE THE MARKET.

_______________________________________________________________________________________________________________

1 https://www.msci.com/documents/10199/239004/MSCI-2019-ESG-Trends-to-Watch.pdf

Contacts

SIMON IRELAND, MD, Global Head of Financial Institutions Group, ANZ, Simon.Ireland@anz.com

KATHARINE TAPLEY, Head of Sustainable Finance, Katharine.Tapley@anz.com

STELLA SARIS, Head of Sustainable Finance, International, Stella.Saris@anz.com

KANG JAE KIM, Head of Asia DCM, KangJae.Kim@anz.com

BEN WALKER, Head of Sustainable Development, Ben.Walker@anz.com

SHEILA IP, Client Insights and Solutions, Sheila.Ip@anz.com

ACKNOWLEDGEMENT:

We’d like to thank Scott Gifford, Head of Debt Investor Relations, and Jack Ang, Head of Syndicate, Asia, for contributing their expertise and valuable insights for this article.

This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.