Insight

The rise (and rise) of green loans in Australia

SHARON KLYNE, ASSOCIATE DIRECTOR, COMMUNICATIONS, INSTITUTIONAL, ANZ | FEBRUARY 2019

There are signs of an emerging green loan market in Australia as an increasing number of borrowers and lenders see the need to better align finance with a more environmentally sustainable economy.

The loan market has been slower to respond to product development opportunities than the bond market. The latter has been driven by investors pushing for greater transparency and momentum around the climate change and sustainable-development strategies of borrowers.

Green Bond issuance hit $US167 billion in 2018 according to data from the Climate Bonds Initiative (CBI) while green lending has only begun to emerge as its own class of product over the last 12 to 18 months, mainly from Europe.

But change is afoot as the financial industry faces pressure from regulators, investors and communities alike on how it manages environmental and social risks - and the need for disclosure and transparency around those risks.

“Banks themselves are under pressure,” ANZ’s Head of Sustainable Finance Katharine Tapley says.

“In terms of the kinds of risk allocation with regards to climate change and sustainability that sits in their balance sheets.”

_________________________________________________________________________________________________________

“BANKS THEMSELVES ARE UNDER PRESSURE, IN TERMS OF THE KINDS OF RISK ALLOCATION WITH REGARDS TO CLIMATE CHANGE... THAT SITS IN THEIR BALANCE SHEETS.”

KATHARINE TAPLEY,HEAD OF SUSTAINABLE FINANCE, ANZ

_________________________________________________________________________________________________________

First in market

ANZ set market precedent when it arranged and funded the first labelled Green Loan in Australia for Investa Commercial Property Fund (ICPF) in January, as well as the first ever Sustainability Performance Linked (SPL) loan in Australia for Adelaide Airport last December 2018.

The $A170 million Green Loan for ICPF is linked to the fund’s property portfolio of low-carbon-emitting buildings. The company developed a green debt framework and measured its portfolio of 15 buildings against the CBI’s Low Carbon Building Criteria carbon emission thresholds which require the portfolio to perform in the top 15 per cent in their relative city in terms of carbon intensity.

The Green Loan allows Investa to meet demands from investors concerned about climate change and show its leadership position in corporate sustainability by linking its debt funding with an emissions intensity standard.

The $A50 million seven-year SPL loan with Adelaide Airport incentivises the borrower to improve its performance against a set of environmental, social and governance targets set by third party sustainability consultant, Sustainalytics. The company gets a pricing benefit if it meets these agreed targets over time.

Adelaide Airport already has strong sustainability credentials - it was recently the top ranked airport in the world for the second year running in the 2018 Global Real Estate Sustainability Benchmark.

The loan further demonstrates its commitment to improving its sustainability performance.

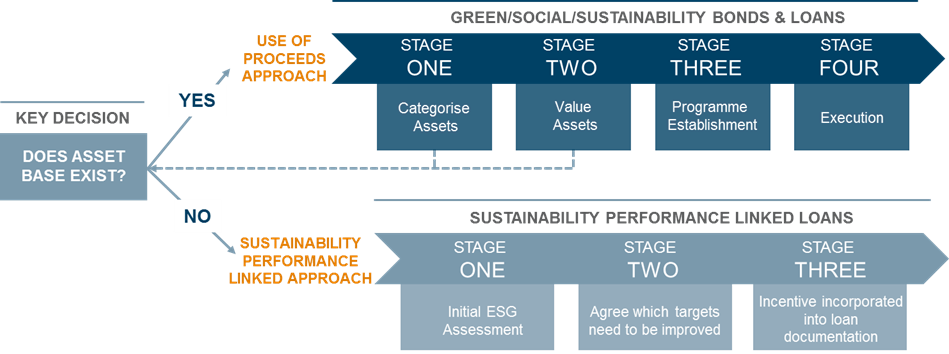

Definitive

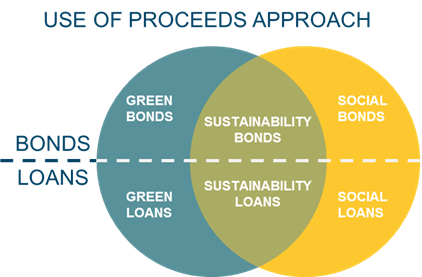

The key difference between a Green and SPL Loan is how proceeds are used. Green Loans – like Green Bonds – suit borrowers who have a definitive asset base that qualifies as ‘green’, such as renewable energy, low carbon transport projects or energy efficiency expenditures.

The SPL approach allows the borrower to use the loan for general corporate purposes, with pricing and potentially other terms, tied to improved sustainability performance over time. This style of loan suits a company motivated to link its cost of capital to its sustainability performance.

The Green or SPL Loan structures can be applied across a wide range of sectors including infrastructure, diversified industries, health, education, property, telecommunications, agribusiness and food processing and production.

ANZ expects Australian companies will become more receptive to these types of sustainable finance products as climate change and sustainable development move into the fore of their corporate strategies and risk assessment.

“We expect this style of financing to increasingly be part of the corporate landscape as customers actively engage in the transition to a low carbon and more sustainable economy”, ANZ Director, Sustainable Finance Andrew Lawson says.

Sharon Klyne is Associate Director, Communications, Institutional at ANZ

RELATED INSIGHTS AND RESEARCH

insight

Green edge: ANZ wins race for first green loan

ANZ has closed a $A170 million facility with ICPF, the first of its kind in Australia.

insight

Embrace the sustainability opportunity

Business must forget the emotion around climate change and accept the risks – and opportunities.

insight

Green finance in Aus and NZ set to grow

Green finance in Australia and New Zealand is set to grow, driven by over 400 environmentally-conscious infrastructure investment opportunities in the pipeline, according to a new report launched by the London-based not-for-profit Climate Bonds Initiative.