INSIGHT

Asian Asset Management: A US$20trn Opportunity?

Download the PDF

By Dominique Blanchard, Head of Markets Sales, ANZ | May, 2017

The first article of the ‘Signals from the Noise: Distinguishing Hype from Opportunity in Asian Asset Management’ series, produced in collaboration with FT Confidential Research

________

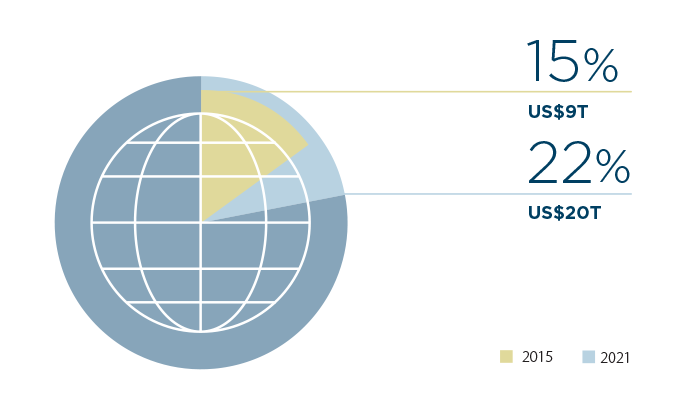

The Asia-Pacific region will be crucial to the future of asset management. Assets under management (AUM) in the region (including Japan) are projected to grow at nearly twice the global rate, more than doubling from around US$9trn in 2015 to $20trn by 2021, and expanding from 15% to around 22% of worldwide AUM.1

These growth prospects are enticing because asset managers face a testing time. Global AUM inflows have been slowing while regulatory costs have been rising. Fees are being squeezed as more investors shift to cheaper passive products, and as competition intensifies for low-cost digital asset management services.

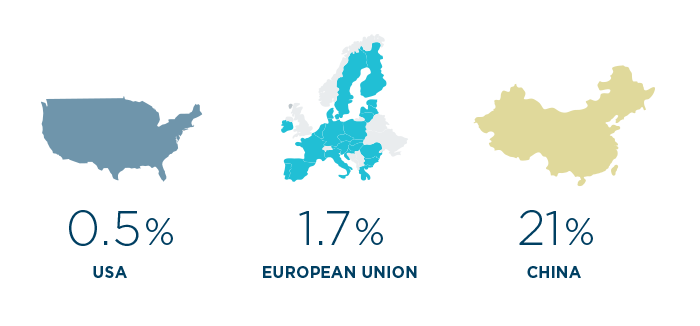

In this challenging environment Asia is a beacon of opportunity as a source of new fund inflows and business growth. The opening of China’s capital markets in particular, and the internationalisation of the renminbi (RMB), still marks an unprecedented prospect: the consultant Casey Quirk last year projected net new AUM flows from China to grow at over 20% per annum to 2021, compared to 0.5% in the US and 1.7% in continental Europe.

FIGURE 1

Asia-Pacific’s share of global AUM

Source: Casey Quirk by Deloitte

Factor in the high potential of rich and ageing markets like Japan and Australia, and the appealing demographics of South-east Asia — not to mention the region’s rising wealth, interconnectedness and technological savviness — and it is clear that Asia’s long-term potential for the asset management industry is unparalleled.

Indeed, in a straw poll of global fund managers conducted by the FT Confidential Research team and ANZ in mid-2016, three-quarters of respondents said they expected to increase their on-the-ground presence in Asia, despite concerns around regulatory restrictions, political uncertainties and the need to partner with onshore affiliates to access local markets.

Growing private wealth

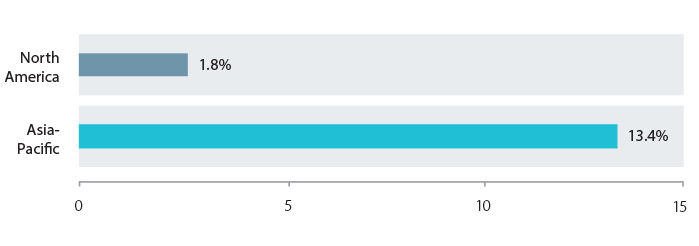

Rising private wealth is likely to account for a large share of new business in Asia. Growth in private wealth in the region has consistently outpaced North America, Europe and the Middle East, rising 13% in 2015 to US$37trn, against growth of less than 2% for North America, according to the Boston Consulting Group. The greatest prospect is clearly China, where by mid-2016 there was a supply of pent-up wealth worth an estimated Rmb146tn ($22.2tn).

Winning mandates to manage this wealth may not translate into higher profits, particularly for global asset managers competing with local private wealth managers prepared to spend more to win market share. Recent research by BCG showed pre-tax profit margins in Asia-Pacific wealth management institutions are around 21 basis points, versus around 25-26 basis points in Europe.

Nevertheless, Asian private wealth represents a compelling opportunity given much slower growth expected in net new flows from “legacy” asset owners in Asia, such as state sponsored pensions, sovereign wealth funds and Japanese retail investors. Casey Quirk predicted that local retail investors and private banks would account for 63% of the US$4trn in net new flows from rising segments in the region by 2020, whereas legacy segments would add US$1.1trn.

The slower outlook for legacy segments is partly because of the greater propensity among some asset owners to insource asset management, as well as the demographic realities facing markets like Japan and South Korea. This compares to tailwinds in rising segments generated by a massive, growing and underserved middle class in emerging Asian economies like China, as well as regulatory changes prompting greater use of money management services in savings vehicles like defined contribution pensions and life insurance.

Regulatory harmonisation is also likely to help drive demand for retail and individual asset management in Asia in the short to medium term. The rollout of regional fund passporting schemes, which allow the distribution of mutual funds and other products approved in one market in other signatory countries (discussed in more detail in a future article in this series), should help accelerate the rate at which Asian retail investors move their money out of cash, equities and bonds, as the availability of managed products widens.

Source: Casey Quirk by Deloitte

Institutional demand

Although perhaps less spectacular, rising aggregate demand for asset management services from institutions in Asia also presents a clear opportunity.

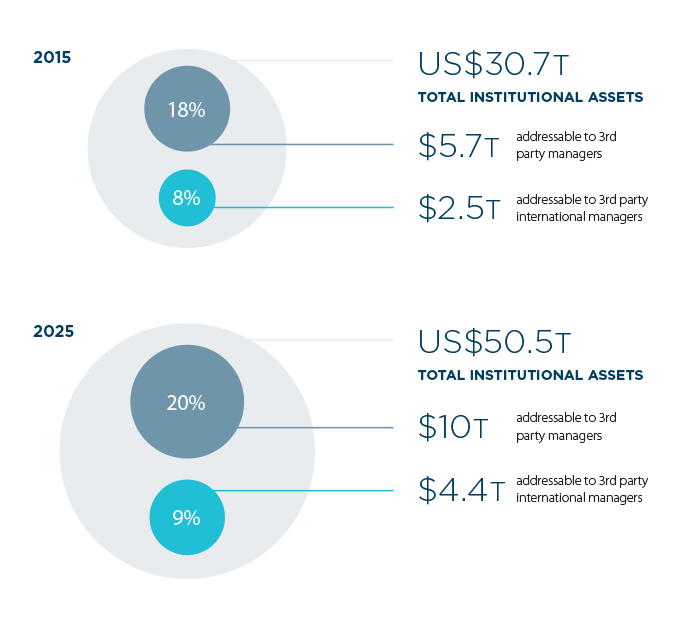

Spence Johnson, a management consultancy, predicted that the assets of sovereign wealth funds, insurance companies, pensions and other small institutional asset owners in 10 Asian markets would grow at a compound annual rate of 5.1% until 2025, to reach over US$50trn, of which US$10trn would be outsourced to third-party managers — up from US$5.7trn at the end of 2015. The consultancy estimated that just under half of this would be addressable to international asset managers.

In China, sovereign wealth funds, insurers and pension funds hold the lion’s share of AUM and are expanding rapidly. Chinese insurers, in particular, have been taking larger bets with their assets in order to match their liabilities, as more and more sell short-term wealth-management products with higher yields. As economic growth in China has slowed, and as regulators have relaxed guidelines on asset allocation, so investors such as these are getting more ambitious, opening opportunities for third-party asset managers.

Of course, efforts to move capital offshore can accelerate only as fast as China’s regulators approve quotas under the QDII programme, and these are unlikely to be expanded rapidly while concerns remain about currency volatility and capital outflows. Consequently, asset owners elsewhere in Asia, such as Japan and Taiwan, will in the short to medium term continue to be much larger exporters of capital.

In general, institutional investors are all getting more ambitious in their asset management strategies, despite often being inhibited by fiduciary and regulatory restrictions.2

The net result is that despite ups and downs in the macroeconomic cycle, the institutional demand for asset management in Asia will continue to expand. Ultimately this is likely to mean more business for international asset managers, but, as a future articles in this series will explore, they will face increasing competition from ambitious local and regional players, along with a host of other challenges, in seizing the opportunities that Asia presents.

FIGURE 3

Growth in private wealth

Source: Boston Consulting Group, “Global Wealth 2016”

FIGURE 4

Institutional assets in Asia-Pacific (US$)

Source: Spence Johnson, “Deeper Perspectives”, September 2016

1. According to 2016 projections by consultancy Casey Quirk by Deloitte

2. In Thailand, for instance, insurers are restricted from investing more than 15% of their total assets offshore or buying into hedge funds.

RELATED INSIGHTS AND RESEARCH

insight

Bridging the FX gap — Strategies to Counter EM Currency Risk

As fund managers increasingly seek emerging market assets, they must develop a robust emerging market currency hedging strategy.

insight

Currency Risk Management: A Value Lever to Manage Fund Returns

Local assets may generate positive returns, but currency risk can drag overall returns down.

insight

No TPP, no problem? Examining Asia’s trade resilience

The politics of anti-globalisation are in the ascendant. US President Donald Trump’s pledges to rip up trade deals and impose border taxes on imports appealed to many voters, as did on the other side of the Atlantic the prospect of the UK’s exit from the EU.