INSIGHT

Currency Risk Management as a Value Lever To Manage Fund Returns

Download the PDF

FOREWORD

Fund managers have been targeting developing and emerging market assets for their growth potential, providing investors with an alternative to the relative lower growth experienced in developed markets.

This is evident from the flurry of activity related to fund raising that has targeted emerging market exposures in the past five years.

Most international funds tend to use a G4 currency as the capital currency for the fund, mostly USD, while investments target non-G4 currencies, such as Asia Pacific currencies linked to the country of the underlying asset investment.

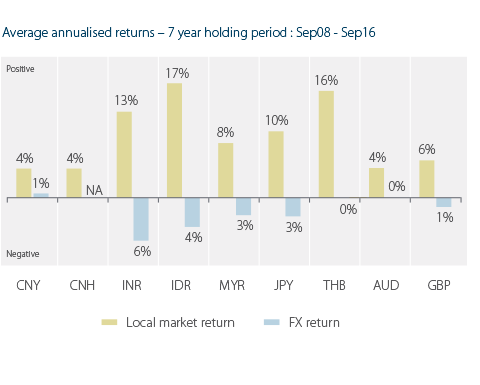

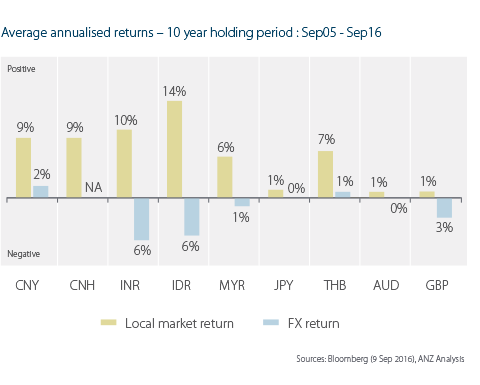

While assets in emerging markets over the past decade generally experienced double-digit annual growth based on investment periods of 7 to 10 years*, annualised foreign currency returns generally experienced single-digit depreciation.

Currency risk management under those circumstances may not to be a major focus, likely due to the comfort derived from the significantly higher local asset returns as compared to the currency depreciation.

KEY TAKEAWAYS

- In recent years, currency risk management has become more topical for investors and fund managers. This is driven by generally low or negative local asset returns across the world, combined with relatively high depreciation of foreign currencies. In such circumstances, currency returns can dominate and drive the overall return in USD.

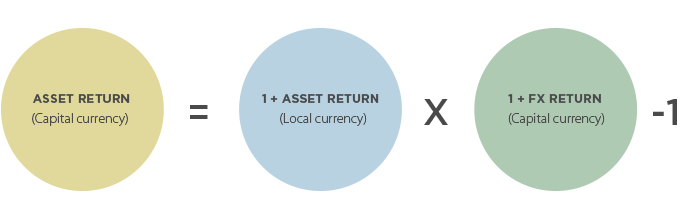

- Currency risk is a major driver of asset returns expressed in capital currency.

- It is clear that currency (FX) returns have a multiplier effect on asset returns (in capital currency terms). As such, depending on the magnitude of FX returns, currency could potentially significantly enhance or depress asset returns (in capital currency terms).

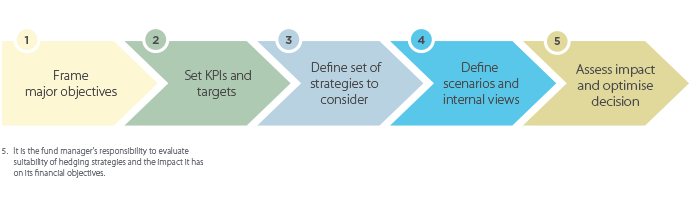

- Fund managers have an opportunity to generate value from both asset selection as well as proactive currency risk management.

- Given competitive pressures and evolution of investor expectations, some level of currency risk management capabilities could become a minimum requirement from investors going forward.

- When executing currency risk hedging transactions, it is important for fund managers to consider the hedging rationale, the uncertainty of the asset value or timing of valuations, available financial resources for transaction settlements, the creditworthiness of your counterparty as well as the fund manager’s/entity’s own credit standing.

AUTHORS

Nick Angove, Director, FX Investor Sales, Global Markets, ANZ

Mark Harding, Head of FIG South East Asia, ANZ

Robert Tsang, Director, CIS FIG, ANZ

For any comments or feedback please contact the authors at GlobalFIGInsights@anz.com

PUBLISHED NOVEMBER 2016

RELATED INSIGHTS

insight

Funds Finance in Asia: The Rise of Capital Call Facilities

The Funds market in Asia is maturing in response to the changing demand dynamics in the region.

insight

Investment Opportunities: Infrastructure Emerges As Its Own Asset Class

Infrastructure is building up the investment portfolios of Pension and Sovereign Wealth Funds.

insight

Interest Rates & Currencies: Asia Pacific Currencies in a 'Fed' Tightening Cycle

The relationship between US interest rates cycles and APAC currency performance isn't that clear cut.

*Past performance is not indicative of future performance

For a full set of relevant disclosures, please visit the link below.

These publications are published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia on its Institutional website.

If you choose to access these materials, you agree that the Website Terms of Use apply. These publications are intended as thought-leadership material. They are not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in these publications is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in these publications constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in these publications is based on information available at the time of publication. While the publications have been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of these publications or the use of information contained in these publications. ANZ does not provide any financial, investment, legal or taxation advice in connection with these publications.

If you are resident or located in the United States of America, you agree that you are not acting on behalf of a natural or individual (including yourself) “U.S. person” (as defined in Regulation S of the U.S. Securities Act of 1933, as amended) and you agree not to transmit or otherwise send any information on this website to any natural or individual person in the USA or to publications with a general circulation in the USA.

If you are resident or located in New Zealand, you are a “wholesale client” under the Financial Advisers Act 2008 (NZ), as amended.

Please confirm that the above statements are correct.