INSIGHT: Interest Rates & Currencies

Asia Pacific Currencies in a 'Fed' Tightening Cycle

Download the PDF

FOREWORD

ANALYSIS SUGGESTS THE RELATIONSHIP BETWEEN U.S. INTEREST RATE CYCLES AND APAC CURRENCY PERFORMANCE IS NOT AS CLEAR AS COMMONLY BELIEVED. HERE WE LOOK AT WHY.

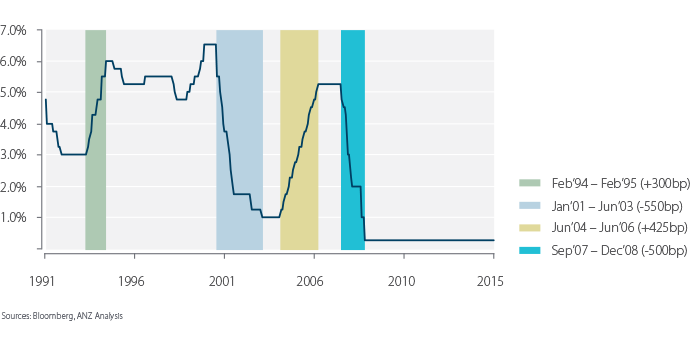

In December 2015, the United States Federal Reserve (the ‘Fed’) raised interest rates 25 basis points, marking the first time in nine years the central bank has hiked rates. The move was well telegraphed and anticipated by ANZ Research to test a “buy the rumour, sell the fact” pattern around major currencies against the USD.

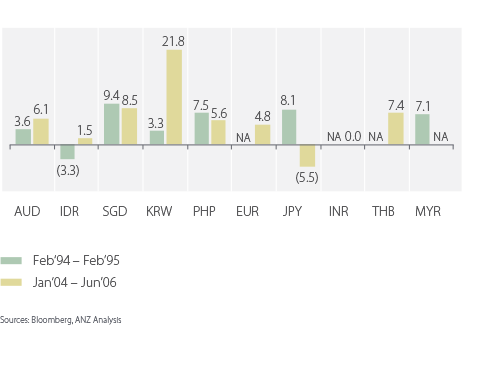

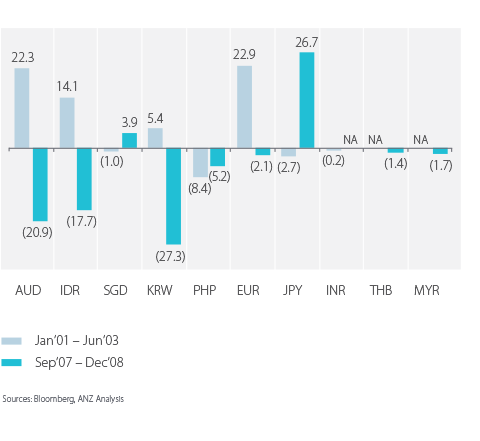

They found that, looking at past Fed tightening cycles, major currencies tend to weaken against USD heading into the start of a Fed hiking cycle, but rebound following the first rate increase. However, the pattern is more varied against a basket of Asian currencies.

Simon Ireland

Global Head, Financial Institutions Group, ANZ

KEY TAKEAWAYS

- In the two most recent prolonged rate hiking cycles, many currencies actually strengthened against the USD. However, results during the two easing cycles were fairly mixed, with no clear trend.

- Currency movements are driven by many factors besides Fed policy or interest rate differentials. Since markets are forward-looking, it could be the case that the expected USD appreciation has largely taken place before the Fed began raising rates.

- ANZ Financial Institutions Group have had a number of FX hedging conversations with investor clients in APAC, particularly China and Indonesia, where currency fluctuations can have material impacts on returns as well as loan to value (LTV) covenants on USD denominated bank facilities.

Global Markets, ANZ

Financial Institutions Group, ANZ

RELATED INSIGHTS

insight

Clean Energy Investment: Painting Capital Markets Green

Green Bonds are encouraging a broader range of investors to plug the shortfall in Clean Energy investment.

insight

Balancing Liability & Liquidity: Making Cash Available in Times of Stress

Insurers in Asia face growing pressure to optimise their collateral management.

insight

Funds Finance in Asia: The Rise of Capital Call Facilities

The Funds market in Asia is maturing in response to the changing demand dynamics in the region.