INSIGHT: Funds Finance In Asia

The Rise of Capital Call Facilities

Download the PDF

FOREWORD

THE FUNDS MARKET IN ASIA IS MATURING FAST. THIS INSIGHT LOOKS AT THE EVOLUTION OF FUNDS FINANCE IN ASIA AND THE CHANGING DEMAND DYNAMICS OF THE REGION.

Initially, capital call facilities were offered as relationship deals for real estate funds when key Asian fund sponsors began diversifying away from traditional equity stocks and bonds in 2008.

Since then ANZ’s Global Funds and Insurance team have structured a broad range of financing solutions for funds in Asia and other regions. These include specialty funds and sponsors, including infrastructure, private debt and other specialty private equity funds.

The funds market in Asia is maturing fast and we are now working with a number of Asian-based funds to support their intra-Asian and global investment strategies.

KEY TAKEAWAYS

The evolution of financing facilities used by Asian funds is reflective of several factors:

- Asian investors are more exposed to the sophisticated funds finance markets of North America and Europe via the fund’s general partners (GPs).

- GPs take longer to find suitable assets and need to be quicker, in the face of competition, when opportunities present.

- In the wake of the GFC, funds families are implementing measures to improve fund performance and reduce liquidity risks.

- Alternatives are being sought to carrying a low yielding liquidity portfolio.

- Funds finance is seen as a cheaper alternative to asset or company level finance to enhance investment.

Demand dynamics are changing in the Asian market:

- Long-term macro trends of urbanisation, industrialisation and the rising middle income class are attracting investor attention.

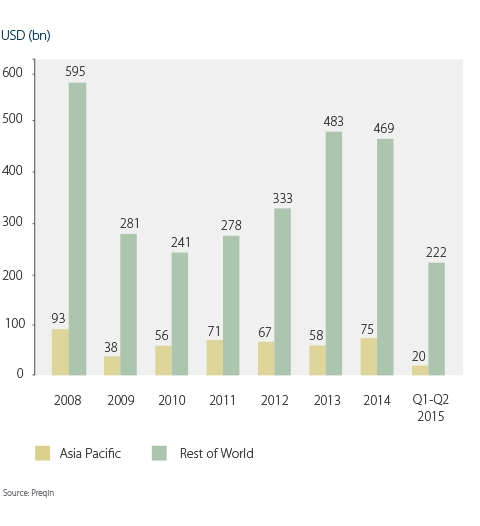

- Total fundraising for Asia-focused funds has dropped off since 2011. For example, China-focused fundraising dropped to a five-year low in 2014 of $20b through 49 fund closures.

- Asia remains a source of fundraising for global private equity funds.

- While much of Asia Pacific investors’ allocation is directed intra-regionally, increasingly the investment mandates are expanding to reduce concentration risks and access the world’s highest yielding investments.

Commercial Property Funds, Asia

Financial Institutions Group, ANZ

Director, Funds

Financial Institutions Group, ANZ

RELATED INSIGHTS

insight

Investment Opportunities: Infrastructure Emerges As Its Own Asset Class

Infrastructure is building up the investment portfolios of Pension and Sovereign Wealth Funds.

insight

Interest Rates & Currencies: Asia Pacific Currencies in a 'Fed' Tightening Cycle

The relationship between US interest rates cycles and APAC currency performance isn't that clear cut.

insight

Clean Energy Investment: Painting Capital Markets Green

Green Bonds are encouraging a broader range of investors to plug the shortfall in Clean Energy investment.