INSIGHT: Clean Energy Investment

Painting Capital Markets Green

Download the PDF

FOREWORD

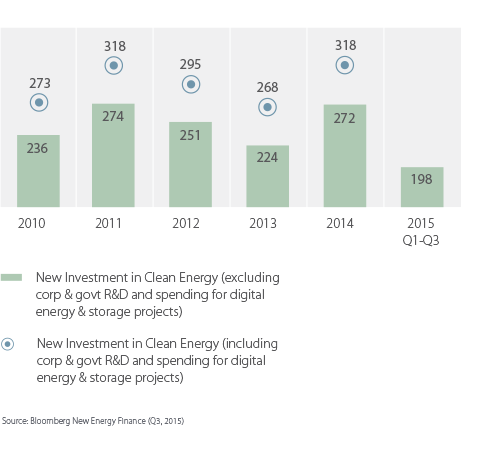

IN 2014, ROUGHLY USD318B FLOWED TO NEW CLEAN ENERGY INVESTMENT, FALLING WELL SHORT OF THE INCREMENTAL INVESTMENT NEEDS OF USD1T PER ANNUM ESTIMATED BY THE INTERNATIONAL ENERGY AGENCY. GREEN BONDS REPRESENT A NEW HOPE FOR CLEAN ENERGY INFRASTRUCTURE FUNDING AND ENCOURAGE A BROADER RANGE OF INVESTORS TO HELP PLUG THE GAP.

In December 2015, the 195 countries participating at the 2015 United Nations Climate Change Conference agreed by consensus in ‘the Paris Agreement’ to reduce emission, with the aim of keeping global warming below 2°C.

Fallout from the Global Financial Crisis (GFC), Euro Crisis and ongoing market uncertainty made it more difficult for governments to budget for infrastructure investment, green or otherwise.

Likewise, utilities stocks have been hit hard by falling equity valuations, while bank asset financing has shifted away from long-dated capital intensive infrastructure exposures.

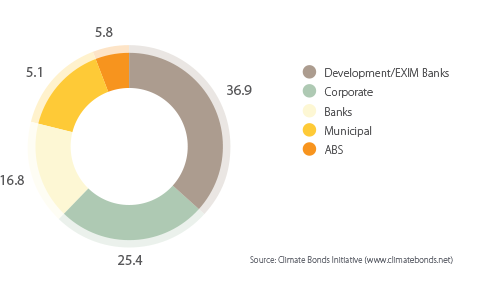

Encouraging new investors in infrastructure asset classes is key to plugging the shortfall and the new green bonds are doing just that.

Simon Ireland

Global Head, Financial Institutions Group, ANZ

KEY TAKEAWAYS

- Financial innovation is vital to encourage a broader range of investors to fill the near USD700m shortfall in clean energy investment.

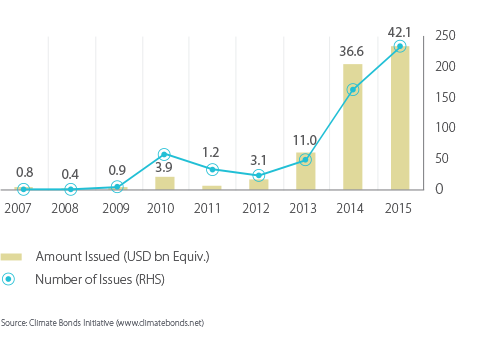

- Green bonds represent a new hope for clean energy infrastructure funding, with 5 year CAGR over 60% in this burgeoning new market.

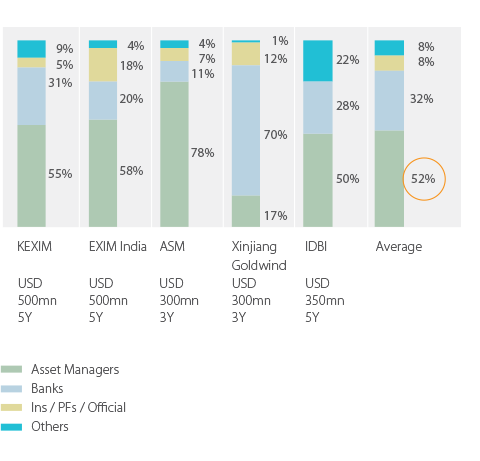

- Asset managers have been the core buyers of recent Asian green bonds.

- Initially the domain of development banks only, Green Bonds have become a staple of ANZ Debt Capital Markets discussions with commercial banks. They allow banks to sell bonds beyond their traditional investor base, and although we haven’t seen lower borrowing costs, there is certainly an increase in volume as a broader investor set participates.

- Being able to deliver into the green agenda by issuing Green Bonds has really added to reputations globally.

Debt Capital Markets, ANZ

Financial Institutions Group, ANZ

RELATED INSIGHTS

insight

Balancing Liability & Liquidity: Making Cash Available in Times of Stress

Insurers in Asia face growing pressure to optimise their collateral management.

insight

Funds Finance in Asia: The Rise of Capital Call Facilities

The Funds market in Asia is maturing in response to the changing demand dynamics in the region.

insight

Investment Opportunities: Infrastructure Emerges As Its Own Asset Class

Infrastructure is building up the investment portfolios of Pension and Sovereign Wealth Funds.