INSIGHT: Investment Opportunities

Infrastructure Emerges As Its Own Asset Class

Download the PDF

FOREWORD

INFRASTRUCTURE IS EMERGING AS A STRONG ASSET CLASS IN ITS OWN RIGHT, SEPARATE TO REAL ESTATE OR PRIVATE EQUITY ALLOCATIONS. IT IS BUILDING THE PORTFOLIOS OF INVESTORS AS WELL AS FUND MANAGERS OF PENSION AND SOVEREIGN WEALTH FUNDS.

Infrastructure as an asset class is well suited to public pension funds and sovereign wealth funds (SWFs), many of which blend investment choices with government initiatives around development. These investors:

- Have an ability to deploy large volumes of capital at a time.

- Have no long-term liabilities or unexpected redemptions to manage

- Can afford to be more patient, because they are unencumbered by regulatory restrictions on investment choices.

Australia and other developed countries have become a destination for funds such as these, especially where major government infrastructure projects are underway.

KEY TAKEAWAYS

- Opportunities for the infrastructure asset class is great, but investors and fund managers must:

- Remain mindful of uncertainty regarding the timing and the scale of the impending financing task.

- Have a sufficiently broad and flexible investment mandate.

- Possess an ability to self-manage liquidity over a long-term investment horizon.

- In the last decade the investor base in Australia has diversified to include investors from funds in the Middle East and Asia. This is partly due to privatization of state-owned infrastructure, a rise of major resource projects during that time, and strong infrastructure demand from both domestic and foreign investors.

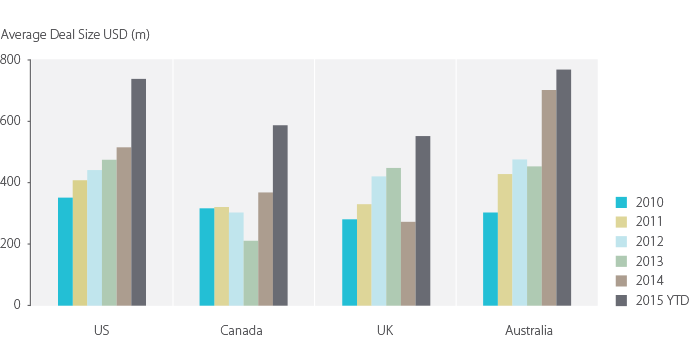

- In Australia, 40% and 57% of deals in 2014 and 2015YTD respectively were completed for AUD1b or more. Comparatively, the proportion of deals occurring for AUD1b or more in the proceeding four years was an average of 20%.

Paul Orton

Global Head of Project & Export Finance

Global Loans & Advisory, ANZ

Global Head of Project & Export Finance

Global Loans & Advisory, ANZ

Rennie Siow

Head of Funds & Insurance, Singapore

Financial Institutions Group, ANZ

Head of Funds & Insurance, Singapore

Financial Institutions Group, ANZ

RELATED INSIGHTS

insight

Balancing Liability & Liquidity: Making Cash Available in Times of Stress

Insurers in Asia face growing pressure to optimise their collateral management.

insight

Interest Rates & Currencies: Asia Pacific Currencies in a 'Fed' Tightening Cycle

The relationship between US interest rates cycles and APAC currency performance isn't that clear cut.

insight

Clean Energy Investment: Painting Capital Markets Green

Green Bonds are encouraging a broader range of investors to plug the shortfall in Clean Energy investment.