INSIGHT: Balancing Liability & Liquidity

Making Cash Available In Times Of Stress

Download the PDF

FOREWORD

WHILE INSURERS WITHIN THE ASIA PACIFIC REGION ARE GENERALLY CONSIDERED FLUSH WITH LIQUIDITY, THERE IS GROWING PRESSURE TO OPTIMISE COLLATERAL MANAGEMENT. OUR ANZ FINANCIAL INSTITUTIONS GROUP AND GLOBAL MARKETS HAVE FIELDED QUESTIONS FROM A NUMBER OF INSURERS ABOUT GLOBAL BANK REGULATION AND THE IMPLICATIONS OF A SHIFT TO CENTRAL CLEARING.

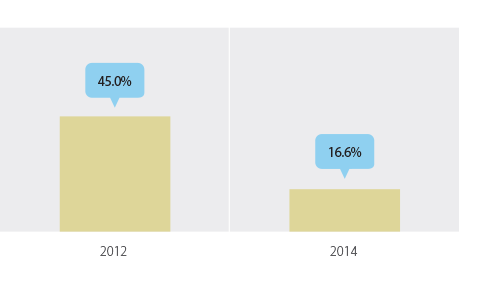

Recent signs of deterioration in market depth and resiliency across sovereign markets in Asia Pacific have driven a growing number of regulators to enforce, or encourage, insurers to quantitatively consider the collateral requirements they would face in a variety of market shocks.

Whether insurers run models on market shocks, or incorporate liquidity risks into their general risk management framework, the availability and cost of repo market access in crises are key considerations. Key bank beneficiaries of a flight to quality will have the greatest propensity to make cash available to relationship clients in times of stress.

KEY TAKEAWAYS

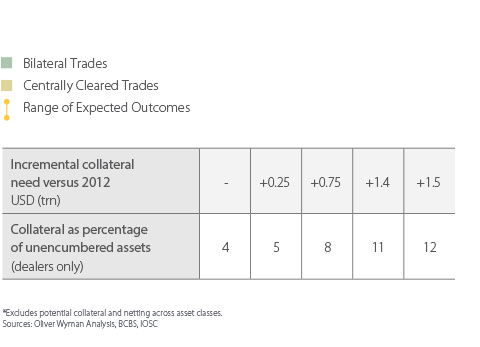

- Liquidity assumptions are being tested. Post the US Treasuries flash crash on 15 October 2014, the question of whether a market is liquid or illiquid is not as clear cut.

- Liability driven investment and solvency considerations may conflict as regulatory requests mean insurers with liquid assets in term tradeable securities will need to access the repo market.

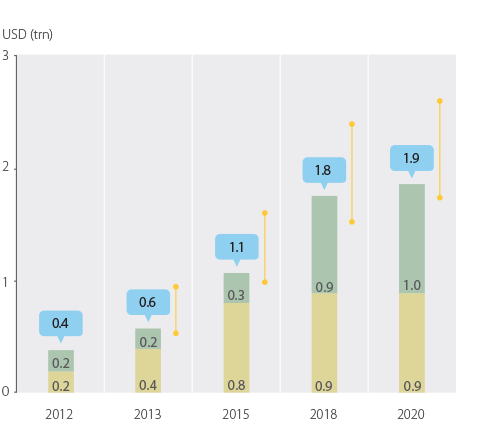

- Rising interest rates will intensify collateral needs and raise questions of repo market accessibility.

- The pricing of repo markets is another concern as the Basel III’s leverage requirement on banks kicks in from 2018.

- Term repo with the right bank counterparty can provide both liquidity and long-end exposure.

Head of Collateral Optimisation & Repo Trading Global Markets, ANZ

Head, Funds & Insurance, Hong Kong Financial Institutions Group, ANZ

RELATED INSIGHTS

insight

Funds Finance in Asia: The Rise of Capital Call Facilities

The Funds market in Asia is maturing in response to the changing demand dynamics in the region.

insight

Investment Opportunities: Infrastructure Emerges As Its Own Asset Class

Infrastructure is building up the investment portfolios of Pension and Sovereign Wealth Funds.

insight

Interest Rates & Currencies: Asia Pacific Currencies in a 'Fed' Tightening Cycle

The relationship between US interest rates cycles and APAC currency performance isn't that clear cut.