INSIGHT

Asian Asset Management: Currency Risk Management For Asia Funds

Download the PDF

By Tim Moloney, Global Head of FX Investor Sales, ANZ | May, 2017

The third article of the ‘Signals from the Noise: Distinguishing Hype from Opportunity in Asian Asset Management’ series, produced in collaboration with FT Confidential Research.

________

WITH INVESTORS GLOBALLY HUNTING FOR YIELD, ASIA’S GROWTH POTENTIAL WILL CONTINUE TO ATTRACT CAPITAL. BUT ESPECIALLY IN AN ENVIRONMENT WHERE US MONETARY POLICY IS TIGHTENING, MANAGING CURRENCY RISK WILL BECOME AN INCREASINGLY VITAL WEAPON IN THE GLOBAL ASSET MANAGER’S ARSENAL. THE ABILITY TO MANAGE CURRENCY RISK IS LIKELY TO DIFFERENTIATE OUTPERFORMING FUNDS FROM THOSE THAT STRUGGLE IN AN INCREASINGLY CHALLENGING INVESTMENT ENVIRONMENT.

RISING ALLOCATIONS TO ASIA

Investment flows to emerging markets are subject to periodic bouts of volatility. This was highlighted again in 2016, when Donald Trump’s shock US election victory sparked an exodus from emerging market assets that brought total emerging market inflows for the year to their lowest since 2008.1 Yet given the region’s growth trajectory and persistently low yields in many Western markets, not to mention the prospect of Chinese equities being included in global benchmarks in the near future, demand for exposure to Asian assets is likely to remain robust over the medium term.

Asset managers polled for this series of articles were optimistic about inflows to Asia: the vast majority said they expected to increase allocations to Asia in the next three to five years. The reasons ranged from the region’s growth prospects and client mandates to invest in specific Asia funds, to the growing liberalisation of the investment landscape in general and China in particular.

FIGURE 1

Reasons for expected increased allocation to Asia in next 3-5yrs

A VALUE LEVER

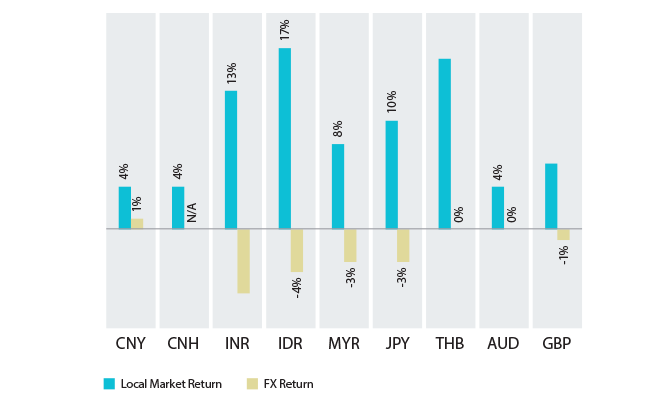

Asset managers may struggle to manage these greater Asian exposures given the added currency risk. Irrespective of the performance of local markets, the strength of the US dollar and the comparative weakness of local currencies has undercut AUM growth for many global asset managers.

For asset managers offering funds denominated in a G4 currency (US dollar, euro, sterling or yen) that are based on underlying assets valued in emerging market currencies, appreciation or depreciation can act as a multiplier and greatly affect performance.

ANZ research shows that in the past decade, while emerging market assets (using stock markets as a proxy) typically experienced doubledigit annual growth, annualised foreign currency returns typically saw single-digit depreciation. In Indonesia, to take one example, this means the average annual US dollar return over a 10-year holding period was half the return in rupiah terms.

Managing currency exposure might have been a relatively low priority while underlying assets were growing at double digits. But in recent years as growth in emerging markets has slowed considerably, it demands much more attention. This is doubly important since risk on/risk off behaviour tends to lead to a positive correlation between certain emerging market currencies and asset returns: when asset prices fall, related emerging market currencies will tend to fall at the same time.

DEVISING THE RIGHT STRATEGIES

Since hedging is a risk management tool, with associated costs, global asset managers looking to build out their Asia-focused products and services will increasingly need to consider the objectives, targets, tools and impact of managing currency risks, and the capabilities necessary to execute hedging for given Asia funds — or whether there may be demand for both hedged and unhedged versions of the same fund.

If currency hedging is appropriate, a robust strategy must take into account a number of key considerations. To start with, fund managers should evaluate whether to hedge at the portfolio level or at the individual asset level, and whether the purpose of the exercise is to hedge cashflows from the asset or debt at the asset level. These decisions will, in turn, impact the choice of hedging instruments used.

Next they will need to determine the expected asset valuation and a timeline, which should be matched to the values, tenors and timing of the hedging tools in order to deliver anticipated returns.

Naturally, fund managers should also ensure there are sufficient financial resources to settle FX hedging obligations. There is a risk that market movements in the value of the asset and the exchange rate of an emerging market currency could result in substantial shortterm cash requirements, depending on the hedging tool used for a particular transaction.

Working with highly rated counterparties to mitigate credit risk is also important, particularly with long-dated hedges. It is noteworthy that the credit profile of both counterparties affects credit limits and credit charges, which are usually incorporated into hedging transaction prices.2

In the current market context, making the assumption that returns on Asian assets will comfortably obviate the need to consider the impact of currency movements is no longer an option. Hedging will therefore be an increasingly valuable tool in managing currency risk and creating long-term value, and a source of competitive edge, for asset managers building out their Asia offerings.

FIGURE 3

Top 4 considerations in a robust EM currency hedging strategy

Source: ANZ

1. http://www.reuters.com/article/emerging-markets-iif-idUSL1N1ET10H

2. For more information, see https://institutional.anz.com/insight-and-research/Bridging-the-FX-gap-Strategies-to-Counter-EM-Currency-Risk#

RELATED INSIGHTS AND RESEARCH

insight

Asian Asset Management: China - Asia’s Future Asset Management Engine?

The opening of China’s capital markets is the biggest long-term driver of Asset Management activity in Asia.

insight

Asian Asset Management: A US$20trn Opportunity?

The Asia-Pacific Region will be crucial to the future of Asset Management, with AUM growing at nearly twice the global rate.

insight

Bridging the FX gap — Strategies to Counter EM Currency Risk

As fund managers increasingly seek emerging market assets, they must develop a robust emerging market currency hedging strategy.