RESEARCH: AUSTRALIA’S GAS INDUSTRY

WHEN MARKETS COLLIDE

Download the PDF

FOREWORD

AUSTRALIA'S GAS INDUSTRY: WHEN MARKETS COLLIDE' FOCUSES PRIMARILY ON AUSTRALIA’S DOMESTIC GAS MARKET. IT ALSO EXPLORES ASIA’S GROWING DEMAND FOR LIQUEFIED NATURAL GAS (LNG) AND THE IMPACT OF THAT GROWTH ON THE LNG MARKET AS A WHOLE.

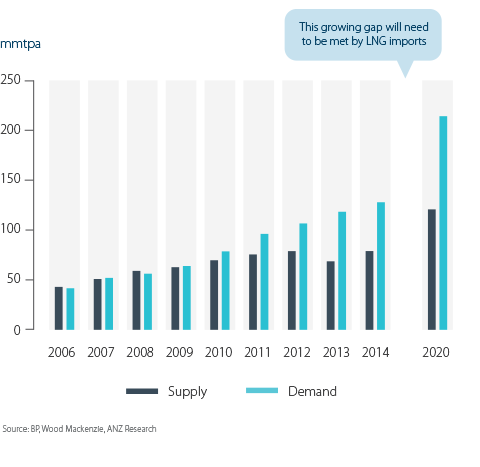

Asia will be the main driver of demand growth for LNG over the next five years. In fact the top five importers of LNG are now all based in Asia, which is a dramatic change from just 10 years ago.

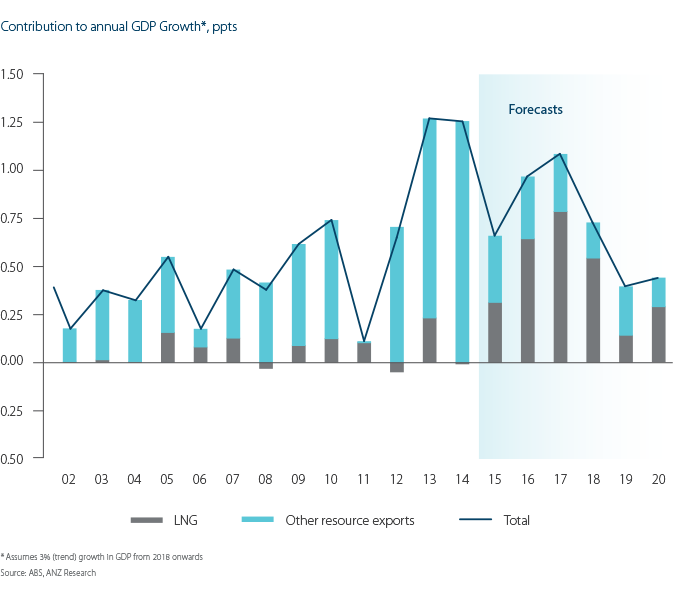

The Australian domestic market is also going through a series of unprecedented changes. After a strong run-up in investment, Australia’s LNG projects are now set to export record volumes of LNG to the world. By 2016, ANZ expects LNG to have taken over from iron ore as the key driver of Australian exports.

However, the export volumes to which Australia’s LNG projects have committed will most likely place pressure on domestic gas supplies, especially on the east coast, which in turn should push Australian domestic gas prices higher.

Consumers of gas at wholesale and retail levels will all be affected by these changes, particularly those industries that rely heavily on natural gas as feedstock, from grocery producers through to steel manufacturers.

In terms of energy sources to watch, we believe LNG is not only a ‘game changer’ for Australia but will also be one of the fuels of the future, used throughout the world by countries searching for cleaner energy alternatives.

KEY TAKEAWAYS

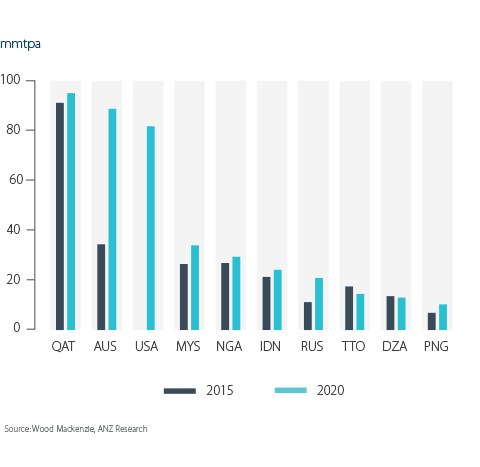

Australia’s LNG export volumes will rise rapidly over the next few years as the extra capacity created by the LNG investment boom comes on-stream. By 2018 Australia will rival Qatar as the largest exporter of LNG in the world.

- The long term global outlook for LNG is strong. We expect international prices to increase over the next five years due largely to the rise of Asia, where clean energy demand and overall increases in energy consumption are outstripping supply.

- As a result, Australia’s LNG exports could more than triple over the next five years (overtaking iron ore as the key export driver), substantially lifting Australia’s GDP growth and playing a decisive role in restoring Australia’s trade balance to positive territory.

- However, the growth of Australia’s LNG export industry will strain domestic supply, which in turn will lead to substantial price increases for Australian industry and households over the next two years.

- While wholesale prices could nearly double on the east coast between now and 2017, not all of that price increase will flow onto households. We expect retail prices to rise by approximately one-third on the east coast.

- A range of Australian manufacturers will be impacted by the increase in the gas price, especially in the chemicals and metals industries, where natural gas use is heavy and the capacity to pass on price increases is limited.

- In the absence of mitigation strategies, Australia’s heaviest gas-consuming companies could see their aggregate profitability drop by a fifth and their return on equity halved.

Daniel Hynes

Senior Commodity Strategist, ANZ

Daniel is a member of ANZ’s Commodity Research team. He brings with him considerable experience in commodity markets, including research and trading from around the globe. He provides valuable commodity trading ideas and strategic research on the bulk metal, oil, precious metal, and energy markets.

Impact on Business

_____

Those Australian manufacturers that are the heaviest users of natural gas, and cannot pass cost increases onto their customers due to international competition, will be hardest hit by the forecast gas price increases. We expect the following sectors to be most affected: food, beverage and grocery manufacturers; wood, pulp and paper manufacturers; iron and steel product manufacturing; non-ferrous metals manufacturing and chemical products manufacturing.

If Australia’s major gas-consuming companies take no action to mitigate the cost impact of our base case for prices, within five years aggregate profitability across these companies could decline 19%, return on equity could halve, and total debt to EBITDA leverage could rise by 31%.

RELATED RESEARCH

research

Servicing Australia's Future

What will Australians and Australia look like in 2030?

research

China's Consumer: Sleeping Giant

There’s a tectonic shift underway in the Chinese economy.

research

Agriculture in Northern Australia: Molehill to Mountain

Expanding food production in Australia for the growing middle classes of Asia.