RESEARCH: Agriculture in Northern Australia

Molehill to Mountain

Download the PDF

FOREWORD

MOLEHILL TO MOUNTAIN’ ADDRESSES THE POTENTIAL DEVELOPMENT OF NORTHERN AUSTRALIA, AS WELL AS AUSTRALIA’S ROLE IN EXPANDING FOOD PRODUCTION FOR THE GROWING MIDDLE CLASSES OF ASIA. AS A STARTING POINT, WE LOOK AT WHAT ON-FARM INVESTMENT RETURNS COULD BE FOR AUSTRALIA’S LARGEST AGRICULTURAL SECTORS IF THEY EXPANDED IN THE NORTH. THIS REPORT FOCUSES ON GRAINS, OIL SEEDS AND BEEF.

For Australia, an understanding of the climate and available resources provides some initial scope as to the size of the opportunities available in Northern Australia. With water resources a key driver of new agricultural production, economists can begin to quantify the significance of any developments. Some early estimates suggest that water available for irrigation in the region could be only 15,000 gigalitres per annum, or around four times the size of Victoria’s largest man-made storage – Dartmouth Dam.

Overall, the findings in this report illustrate that the successful development of Northern Australia is not assured. Commodity price volatility is a major issue. What's more, some sectors are more likely to be winners than others, with the northern cattle industry a potential key pillar in unlocking the region for further agricultural development.

KEY TAKEAWAYS

Despite various bouts of enthusiasm over the past 100 years, the true potential of Northern Australian agriculture remains an enigma. While interest in the region first started with the early pioneers, both agricultural scientists and politicians alike have since extolled the potential for the region as the next agricultural frontier in Australia.

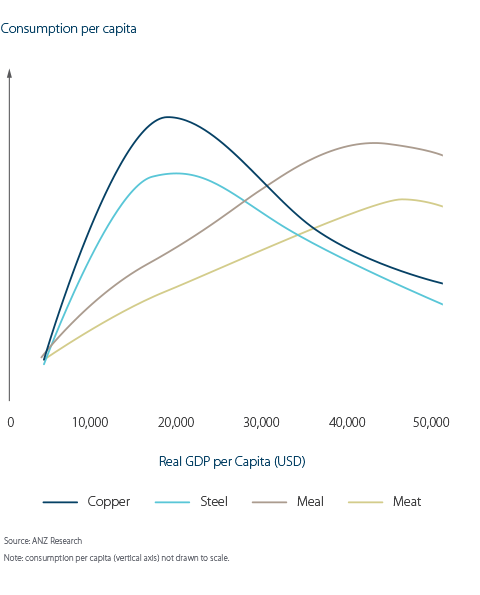

- Peak consumption in feed grain, soybeans and meat takes twice as long to occur as for steel and copper. This leaves a very long window where any investment into Northern Australian agricultural can be rewarded.

- Northern Australia has a vast tract of land available. However once the suitability of soil type, proximity to infrastructure (all-weather roads), water (proximity to a river or an underground aquifer), salinity and flooding risk is accounted for, the area shrinks considerably.

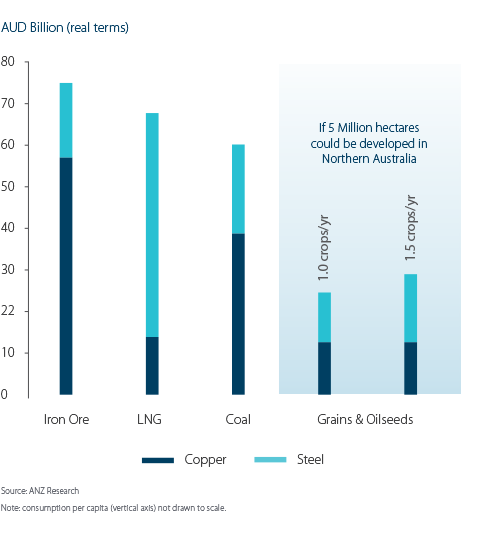

- Across the Northern Australian region, an estimated 5Ð17 million hectares of land is deemed suitable. Taking the lower bounds, the development of 5 million hectares of irrigated production would equate to an annual increase of just over 30 million tonnes of corn and soybeans or an additional AUD12bn in export revenue.

Paul Deane

Senior Agricultural Economist, ANZ

Paul’s focus is on global agricultural and soft commodity research, specialising in grains, sugar, and natural fibres. Paul has more than 10 years of experience as an economist researching Australian and global agricultural markets.

What this means for Australia and New Zealand

_____

Opportunity

Agriculture is seen as the next commodity to benefit from a rising middle class across the developing world. Much of the opportunity in growth for food will arise from the Asia region – where peak consumption (on a per capita basis) is still at least 40 years away. Australia’s north could provide one mechanism for production to expand significantly over the coming decades. Northern Australia has 120 million hectares of land available, 60% of Brazil’s Cerrado region.

Challenge

Northern Australia represents one of the more difficult soil and weather environments in the world in which to establish agriculture. However, as Brazil’s experience has proven, most of these limitations are not insurmountable, with corrective technical knowledge available if the production economics are right.

RELATED RESEARCH

research

Australia's Gas Industry: When Markets Collide

Asia's growing demand for Liquified Natural Gas (LNG) and its impact on the whole market.

research

Servicing Australia's Future

What will Australians and Australia look like in 2030?

research

China's Consumer: Sleeping Giant

There’s a tectonic shift underway in the Chinese economy.