NEWS

ANZ’s SDG bonds: a positive impact

ANZ’s latest SDG Bonds Impact Report which is available to professional investors shows how investor capital can be positively utilised to help alleviate some of the world’s most pressing challenges.

“The impact of ANZ’s Sustainable Development Goals Bonds highlights how investors can drive positive environmental and social outcomes,” Adrian Went, ANZ Group Treasurer said.

ANZ has four outstanding Sustainable Development Goals (SDG) Bonds totalling $A-equivalent 5.2 billion issued to professional investors. The bank issued its second and third SDG bonds in 2020 financial year, including the first in the Australian dollar bond market, followed by a fourth in January 2021.

The bank’s $A SDG Bond was issued as Tier 2 Capital, providing a unique opportunity for investors and gaining market recognition. The landmark transaction was awarded best $A Financial Institution Bond deal of the Year by Australian debt capital markets news provider KangaNews as well as Best Sustainable Finance Deal 2020 by trade finance publication FinanceAsia.

ANZ was also named 2020 Australian Bank Issuer of the Year and Australian Sustainability Issuer of the Year by KangaNews and Sustainability Issuer of the Year by FinanceAsia.

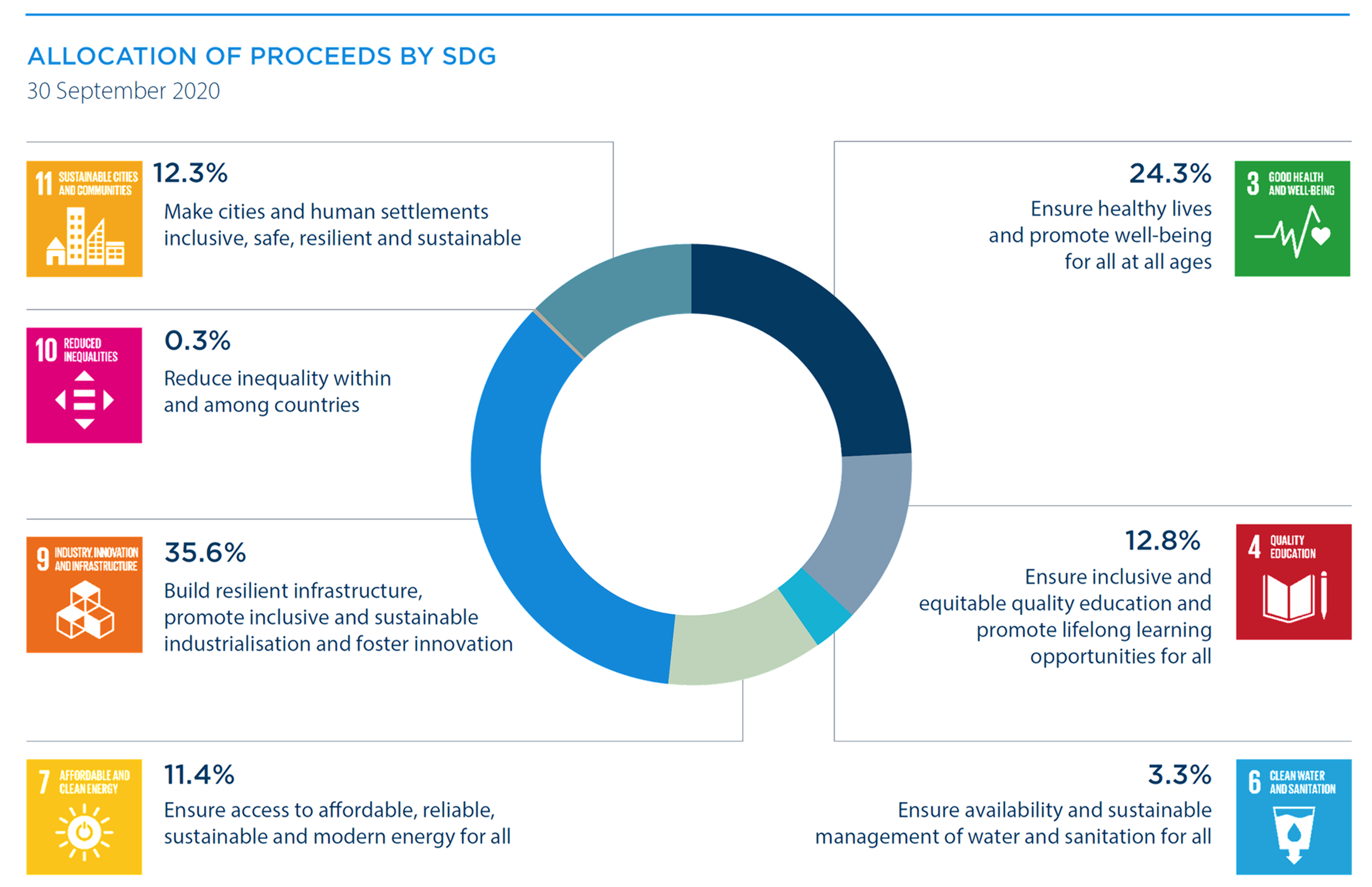

ANZ’s SDG Bonds Impact Report shows the top three project categories to which bond proceeds were allocated as of September 30 were green buildings (35.6 per cent), essential services including hospitals and aged care (24.3 per cent) and education (12.8 per cent), linking to SDG 9, 3 and 4 respectively.

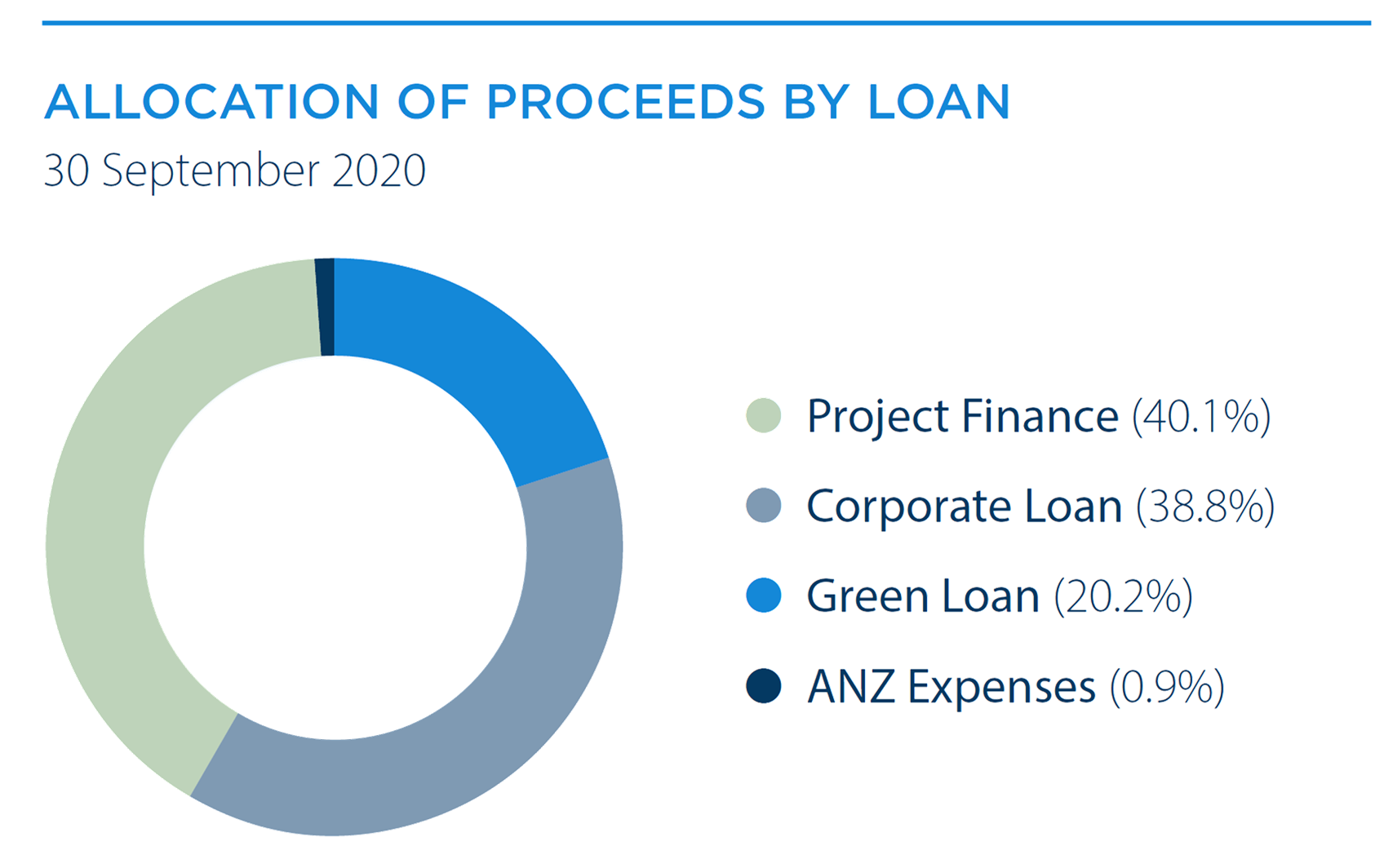

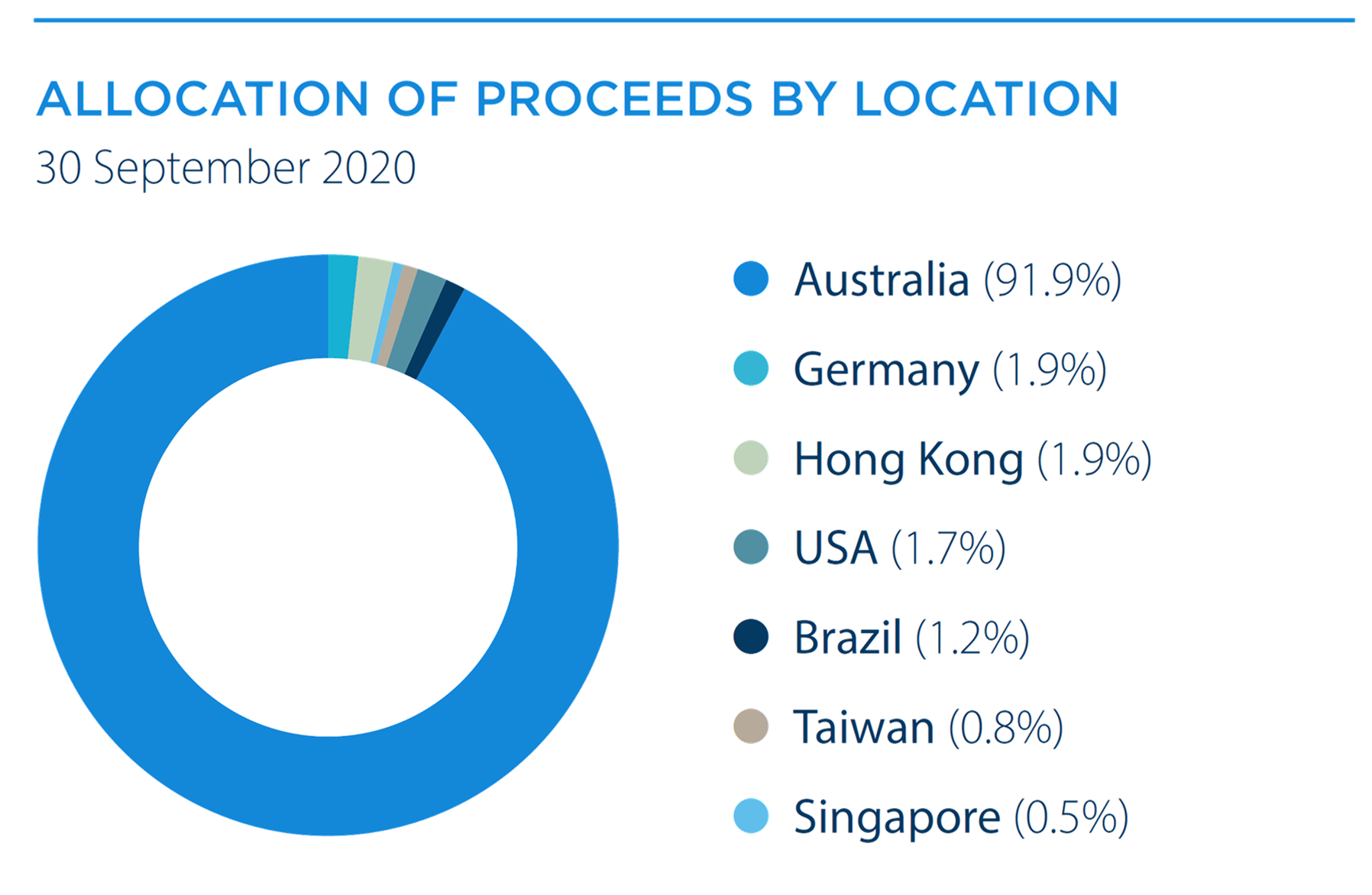

With regard to location, 91.9 per cent of proceeds were allocated to the bank’s lending in Australia, followed by Germany (1.9 per cent) and Hong Kong (1.9 per cent). In addition, project finance loans accounted for 40.1 per cent of bond proceeds, followed by corporate loans (38.8 per cent) and labelled green loans (20.2 per cent).

The United Nations Sustainable Development Goals comprise 17 goals and 169 targets aimed at solving the world’s most pressing challenges including ending global poverty, protecting the planet and ensuring human rights by 2030.

ANZ expanded the list of eligible SDGs from nine to 11 in August 2020 comprising good health and wellbeing, quality education, clean water and sanitation, affordable and clean energy, decent work and economic growth, industry, innovation and infrastructure, reduced inequalities, sustainable cities and communities, responsible consumption and production, climate action, and life on land.

“ANZ’s SDG Bonds demonstrate a clear link between our funding and capital needs, and our purpose which is to shape a world where people and communities thrive,” Katharine Tapley, Head of Sustainable Finance, ANZ said.

“Our purpose is a key consideration for the type of loans we extend to our customers which in turn drives our own issuance in this format.”.

Sharon Klyne is an Associate Director, Communications at ANZ Institutional

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.