INSIGHT

Renewable energy: fuelling Australia’s future

Australia is in the midst of a transition to renewable energy sources - namely hydro, wind and solar - and away from more carbon-intensive fuel sources amid the global shift towards net-zero emissions. The development of this industry, currently already employing 28,000 Australians, provides new investment and employment opportunities.

Energy generation from renewable sources has more than doubled in less than a decade according to data from Australia’s Department of Industry, Science, Energy and Resources.

Renewable energy accounted for over 21 per cent of total generation in the 2019 financial year compared to less than 10 per cent in the 2011 financial year. The shift to large scale renewable projects and battery storage is expected to continue as more large coal-fired generators are retired in coming years.

Additionally, the Federal government is proposing to build a new gas-fired power station in the Hunter Valley, part of an overall gas-led initiative to add additional 1000MW of dispatchable power to the national grid.

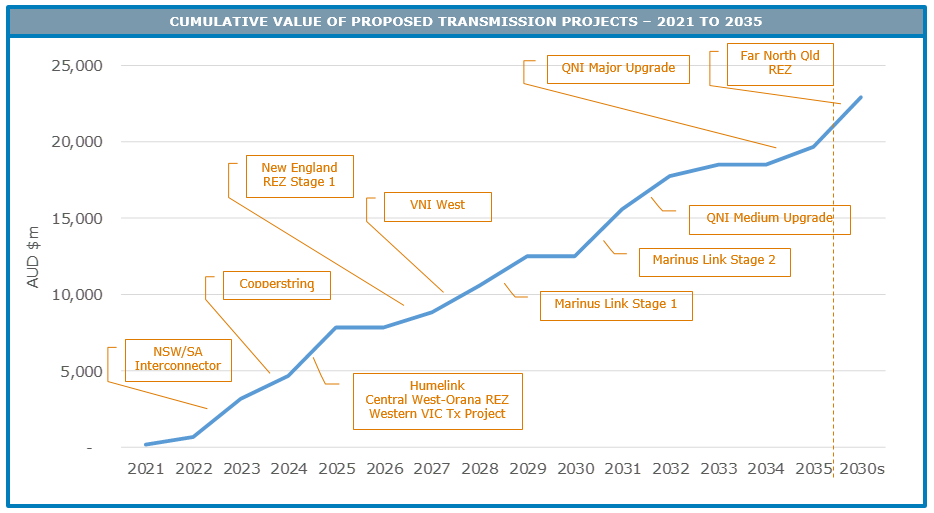

Based on expected project completion dates. List of projects above are not exhaustive. Sources: AER, AEMO 2020 ISP, ANZ Research

Grid constraints

One of the sector’s key challenges is the huge capital investment needed to upgrade capacity in the grid system. Congestion in the grid is the single biggest challenge facing new investment in large scale renewables according to the Clean Energy Council.

Congestion occurs because the grid infrastructure in locations of the best renewable-energy resources, which are often in rural areas with low electricity demand, are now being asked to absorb large electricity supply – something it was not originally built for.

These constraints in the grid have resulted in adverse changes to equity valuations in a number of renewable energy projects due to calculations in the marginal loss factor (MLF). MLF figures are a percentage of electricity the Australia Energy Market Operator (AEMO) predicts will be lost in transmission between the generator and end user.

AEMO and the Australian Energy Regulator are now planning for a significant build of new transmission infrastructure to support the energy transition. Based on AEMO’s estimates, the median value of the proposed projects that may be delivered over the next 10 to 15 years is close to the total asset value of the entire existing transmission network in the east coast.

Market reforms

Increasing amounts of renewable energy also introduces challenges to ensure security of supply to deal with the variability of the fuel source. This task is particularly complex because the rules that underpin the National Electricity Market imposes one of the highest reliability standards in the world, being an “unserved energy” target of 0.0006 per cent; that is, no matter the weather conditions or other circumstances – a tolerance level of around three minutes of unserved demand over the entire year.

The variability of renewable energy, not just in the short term but also longer seasonal trends such as El Nino and La Nina, requires the market to provide ‘firming’ energy services. These can take the form of long duration (eg. pumped hydro) and short duration (eg. chemical battery) storage as well as fast start gas peaking. They can also take the form of self-generation and storage.

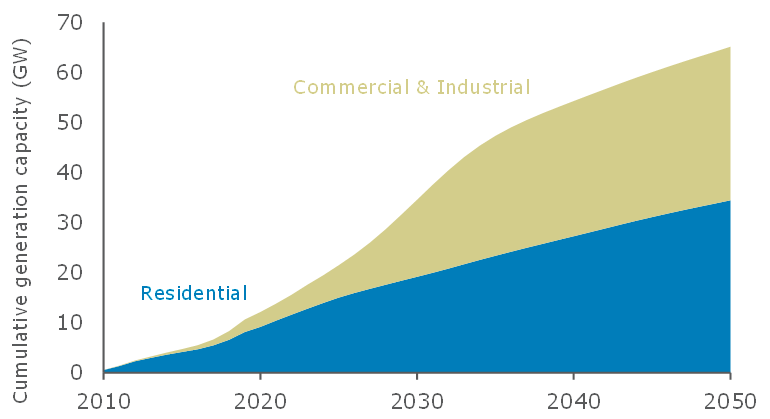

Indeed, ‘behind-the-meter’ generation, which are typically solar PV installations on domestic and commercial/industrial rooftops has been booming – there are now over 2.5 million small scale solar installations across the country, and by all accounts despite COVID-19, 2020 will have been another record-breaking year.

Source: BloombergNEF

As the cost of storage continues to fall, each household or commercial premise has the potential to become more independent, or even participate as part of a highly decentralised, but coordinated energy system.

Market reform could help ensure these changes can be managed properly, so investment in a range of technologies that support the energy system are made in a timely, cost-effective manner that fairly compensates investors and participants. Additionally, balancing the trilemma of affordability, reliability and sustainability remains the focus of the various regulatory bodies involved.

Landmark transaction

The private sector however is working to get around these challenges. CleanPeak Energy Renewable Investment recently closed a landmark financing provided solely by ANZ for the development of a portfolio of behind the meter, integrated roof-top solar and battery projects across a number of Australian states and territories.

Asset manager First Sentier Investors (formerly known as Colonial First State Global Asset Management) together with its solar project developer partner CleanPeak, offer an innovative technological alternative of embedded generation to large scale generation.

Embedded generation is the process of generating energy at a specific location, effectively mitigating the issues related to grid constraints while still providing end users with low-cost and low-carbon emission energy sources.

The portfolio is Australia’s first commercial and industrial solar scheme – targeted at factories, shopping centres and industrial precincts - to attract stand-alone limited recourse project financing and is expected to grow in the near term as more companies and landlords procure this type of renewable energy solution.

“We found that embedded networks and low emission generation are an attractive alternative to traditional utility scale centralised generation,” Gavin Kerr, Head of Transactions, Australia and New Zealand – Unlisted Infrastructure, First Sentier Investors said.

The fragmentation of the sector provides opportunities to a large fund manager such as First Sentier Investors with approximately $A230 billion of assets globally under management.

“We were looking to partner with an entity that could assist us with the development and operational aspects of building a complete service embedded generation business,” Kerr said.

Aggregating projects under a single entity provides scale, and allows First Sentier Investors to mitigate key risks through diversification and improve efficiency as the individual projects are very small when compared to utility scale renewable projects, Kerr said. Importantly, it also facilitated the involvement of ANZ as financier.

“To be successful in this sector we needed to bring together development, operational, funding, electricity market and commercial capability to be able to offer a competitive product to sophisticated buyers of energy,” he said.

David Roberts is Head of Project Advisory, Corporate Finance, Tsen Wong is Head of Energy, Institutional and Katherine O’Connor is Director, Project and Export Finance.

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.