INSIGHT

Green finance grows (and grows and grows)

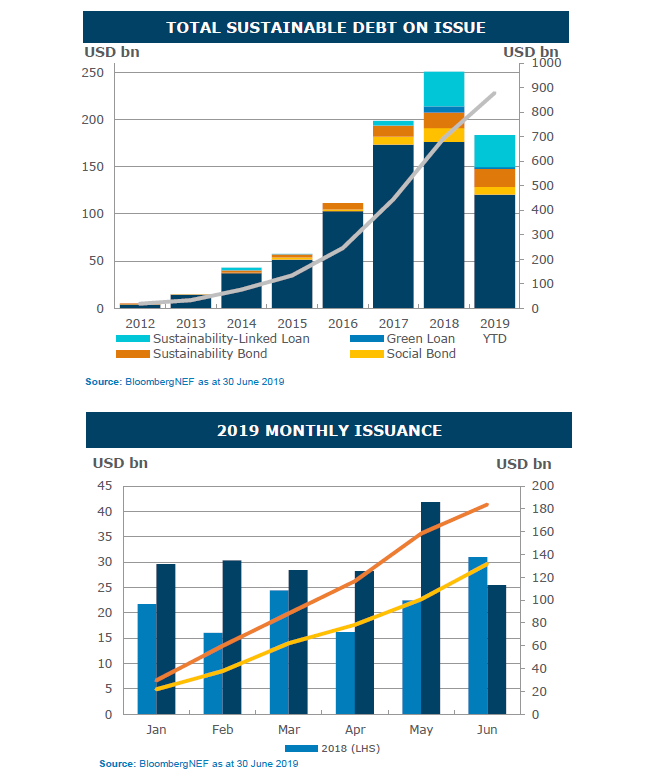

The year 2019 was another massive period for sustainable debt as investors continued to focus on incorporating environmental, social and governance (ESG) goals into their investment processes, and broader global sustainable finance developments encourage further market growth.

Green bonds continued to dominate sustainable debt issuance. Global issuance of green bonds to June 30 totalled over $US12 billion. Sustainability linked loans are the fastest-growing sustainable finance product. By the end of September, issuance (~$US34 billion) has already almost surpassed the whole of 2018.

Transition bonds could be the next major market development. AXA Investment Managers published guidelines for transition bonds, specifically for carbon-intensive companies who want to become greener.

Sustainability Bonds are expected to feature more prominently in 2020 as investors and issuers increasingly utilise the UN Sustainable Development Goals (UNSDGs) as a basis for reporting impact. Both issuers and investors are adopting policies and strategies linked to the UNSDGs and this trend is expected to continue.

Social bonds continue to feature in the market though to a lesser extent. The National Housing Finance and Investment Corporation (NHFIC) issued their first $A315 million social bond in March for social and affordable housing. The transaction was heavily oversubscribed with the final order book over $A1.3 billion.

Regulators globally continue to reinforce the need to disclose climate change risks, including the Australia Prudential Regulation Authority, the Australian Securities and Investment Commission and the Reserve Bank of Australia.

The Task Force on Climate-related Financial Disclosures recommendations have gained significant momentum and attention and continue to be referenced as the preferred reporting framework for climate change risks. Various jurisdictions focus on the development of the sustainable finance market through government and/or industry led initiatives.

The Australian Sustainable Finance Initiative (ASFI) has established working groups which will guide the development of the Australian Sustainable Finance Roadmap. ANZ is proudly part of the ASFI steering committee and is co-chairing the Technical Working Group on Mobilising Capital.

Mainstream

Results from a poll conducted by ANZ and Finance Asia in June 2019 showed ESG investing is becoming more mainstream and the sustainable finance market is accelerating in the Asia Pacific region.

Of the investors surveyed 74 per cent either already have ESG/socially responsible investment policy or are expecting to develop one in the short term. Forty eight per cent said an ESG format bond offering would favourably change their view of a company and 15 per cent said they would pay for it.

“Sustainability linked loans are the fastest growing sustainable finance product.”

Under a sustainability linked loan (SLL) structure a company’s cost of capital is explicitly tied to its third party-verified sustainability performance – i.e. the margin on a loan is directly linked to the borrower’s performance against pre-agreed sustainability target(s).

Proceeds can be used for general corporate purposes (i.e. not tied to a specific green or social asset), so the SLL may be suitable for companies that would not traditionally have access to the green bond/loan market due to lack of ownership of ‘green’ assets.

SLLs are relevant for companies with a determination to improve their sustainability performance and align their cost of capital with that performance.

It is important the parties agree to sustainability target/s that are ambitious, to incentivise material improvement in sustainability performance. Pre-agreed targets must be carefully aligned with the borrower’s sustainability strategy.

Where companies have very broad sustainability ambitions, a material improvement in their ESG rating, provided by an independent third party rating agency, may be an appropriate target.

The Asia Pacific Loan Market Association recently released ‘SLL Principles’ as guidance for lenders and borrowers. These principles underpin market integrity and consistency.

Emergence

The majority of SLL transactions completed to date have been in Europe, with a handful completed more recently in Asia and in the US.

SLLs are new to the Australian market. The first SLL was a bilateral facility provided to Adelaide Airport by ANZ in December 2018. The first syndicated SLL to launch in Australia was provided to Sydney Airport in May.

ANZ has committed to fund and facilitate at least $A15 billion in low carbon and sustainable solutions by October 2020 with $A14.5 billion already committed as at March 31. ANZ has played a key role in developing the green, social and sustainability bond and loan markets across Australia, New Zealand and Asia.

ANZ has arranged over $A16 billion (equivalent) of green, social and sustainability bonds and loans across Australia, New Zealand and Asia in $A, $NZ, $US, CNH and Euro for a broad range of corporate and frequent issuers. ANZ also has strong experience as an Issuer of both green and sustainability bonds.

At the same time, the loan market has gained momentum and ANZ has arranged $A3.3 billion equivalent of green loans and sustainability linked loans.

In 2018, ANZ was awarded Finance Asia’s Best Sustainable Finance House Australian Achievement Awards 2018, reflecting our position as clear leader in the sustainable finance sector in Australia. The bank is a green bond principles member and a climate bonds initiative partner. It also participates in the Loan Market Association's green loans committee.

This is an edited version of a story that appeared in the Infrastructure Partnership Australia Yearbook 2019.

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.