Outlook 2020

Toward a single standard in trade finance

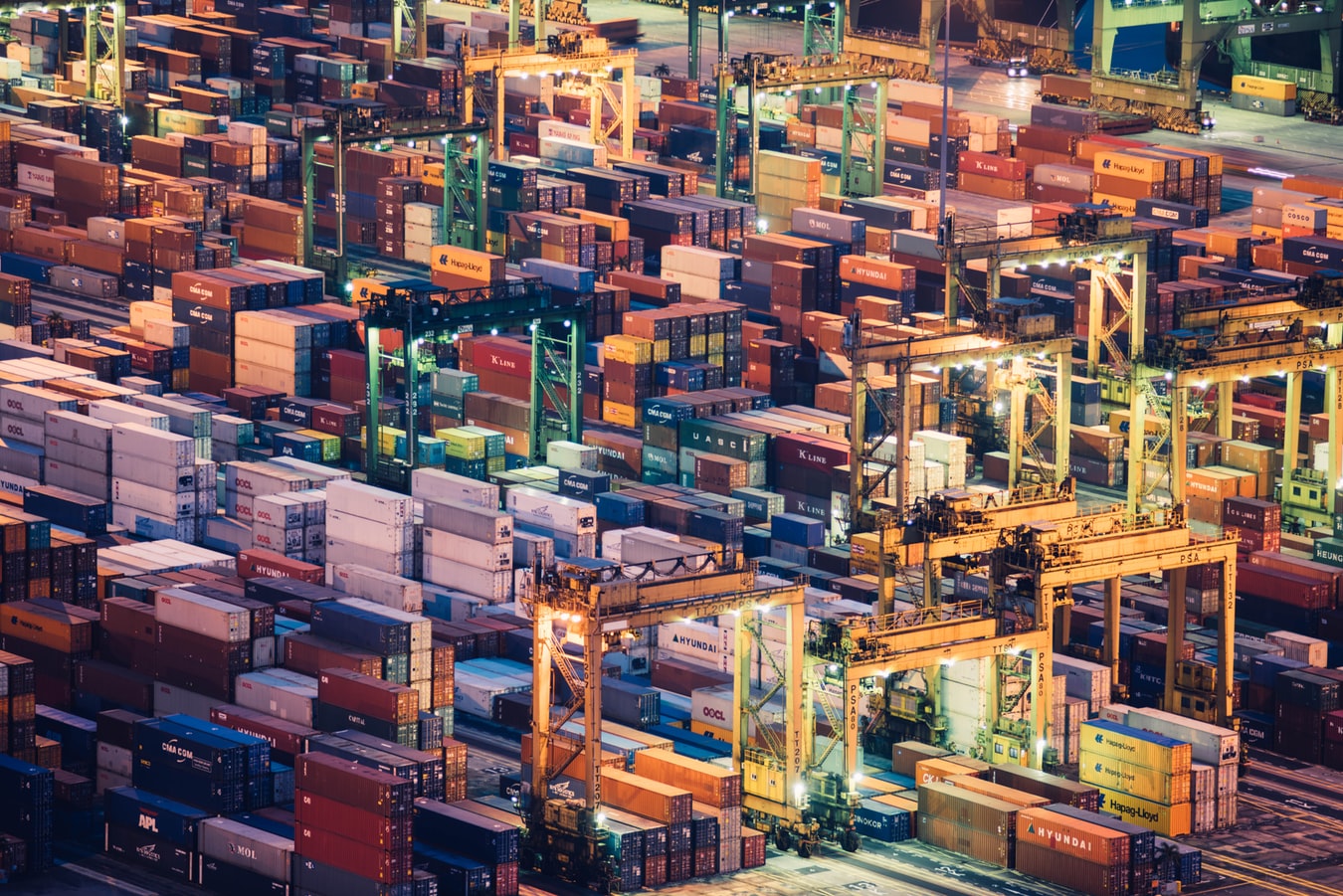

The march of progress in trade finance will continue to make life easier for treasurers in 2020.

Expect increased momentum in the trade digitisation space in the New Year, with further development in areas which saw significant progress through 2019 – including the launch of new and growth of existing bank-led platforms and private-public partnerships.

Traditional methods of international trade are highly paper-based and the physical operational capability that is required to service a trade finance proposition is a material barrier to new finance entrants. Through digitisation, there is a clear path to an ultimate goal for customers – a single, standard to connect digitally with financiers, shipping companies, suppliers and buyers.

We’re seeing this change in action with an increasing number of transactions occurring on open-account networks, streamlining information flows between financiers, various intermediaries such as shipping companies and the customer.

Expect this process to speed up in 2020, with proof of concepts are becoming a reality and moving into production mode. We’re expecting more instances of parties such as banks, corporates, shipping companies, government department moving to digitise the entire supply chain, enabling easier access to trade finance and reducing operational costs.

Outlook 2020

The New Year is upon us. The year 2020 looms as a landmark one for the global economy as trade, technological and environmental factors drive change at a scale rarely seen.

At ANZ Institutional, we aim to help our customers put themselves in the best possible position to take advantage of these forces. Our subject-matter experts have the insight to offer market-leading thought leadership in a range of complex areas from across more than 30 global markets.

We asked our experts about the key factors they see shaping markets and industry in 2020 – and the opportunities and challenges within. We’ll be sharing the responses with you over the coming weeks.

Interest

Active interest and participation from regulators and industry bodies such as the International Chamber of Commerce (ICC) will likely continue in 2020, gaining momentum as it shapes public policy.

Growth in partnerships between industry participants is also likely to be an ongoing theme in 2020. Rather than digitise on their own documents or processes, groups are banding together to ensure projects include all parts of the end-to-end supply chain, to the benefit of all parties.

Recent examples of this include Lygon, the Trade Information Network, eTradeConnect, the Networked Trade Platform (NTP) in Singapore, Marcopolo and We Trade.

The NTP and eTradeConnect are initiatives led by Singapore and Hong Kong regulators. The aim of these projects is to digitise trade data and become one-stop trade ecosystems, enabling data sharing between all trade participants such as importers, exporters, logistics providers, financial institutions and government bodies.

Lygon is an Australian platform which allows for the digitisation of bank guarantees. The platform has just concluded a successful live pilot and is preparing for commercialisation in mid-2020.

Hariramchakraborthy Janakiraman is Head of Trade Product at ANZ Institutional

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.